Nonprofit Standard Newsletter - Winter 2018

Table of Contents

- Impact of Wayfair Supreme Court Decision on Nonprofit Organizations

- TE/GE's Program Letter Provides Projects and Priorities for 2019

- Does Your Information Governance Program Look Like An Abandoned Fairground?

- Is Running a Nonprofit with a For-Profit Vision the New Normal?

- Funding Innovation in the Nonprofit Sector

- Release of 2018 Draft Form 990-T and Instructions

- How to Address Generational Workforce Challenges

- Nonprofit & Education Webinar Series

- BDO Professionals in the News

Impact of Wayfair Supreme Court Decision on Nonprofit Organizations

By Katherine Gauntt

Sales tax is imposed upon retail sales of tangible personal property and taxable services in 45 states and the District of Columbia. Each state determines the circumstances under which a sales tax is imposed on the purchaser.

Purchases by nonprofit organizations are exempt in most of the states, if the tangible personal property or taxable services are used or consumed exclusively for the purposes for which the organization was established. The states usually require each legal entity to register as a nonprofit entity with the state to receive state tax-exempt status. Upon state authorization, the entity can provide a state-approved exemption certificate to its vendors in order to purchase goods and services without paying sales tax.

While nonprofit organizations can make purchases free of sales tax, their sales of goods and taxable services are usually taxable. One could argue that these sales ultimately benefit the organizations’ nonprofit activities but most states do not extend the nonprofit exemption. Many organizations selling promotional goods on their websites are registered in their home state but rarely are registered in multiple states to collect sales tax. Usually they have no “physical presence” in states beyond their home state and did not have to collect the sales tax. However, everything changed on June 21, 2018 when the U.S. Supreme Court held in South Dakota v. Wayfair[1] that states can require a retailer to collect and remit sales tax even if the retailer lacks an in-state physical presence.

History of the Wayfair Case

Effective May 1, 2016, South Dakota passed a law requiring remote sellers to remit sales tax on all taxable sales if the seller’s gross revenue from the sale of products or taxable services delivered into South Dakota exceeded $100,000 or 200 or more separate transactions. Wayfair, Inc., Overstock.com, Inc. and Newegg Inc. refused to comply on the basis that they had no physical presence in South Dakota and, therefore, were not obligated to collect the sales tax. South Dakota filed a declaratory judgment action in state court. The case was fast-tracked through the South Dakota lower courts. Ultimately, the South Dakota Supreme Court, compelled by the 1992 U.S. Supreme Court decision in Quill,[2] found in favor of the Wayfair, Inc. et al. The U.S. Supreme Court in Quill affirmed that “substantial nexus” under the U.S. Constitution’s Commerce Clause required a business to have a physical presence within a state before the state could impose tax or a tax collection obligation.

Nonetheless, the ultimate goal was a U.S. Supreme Court challenge to overturn Quill. On Jan. 12, 2018, the U.S. Supreme Court granted South Dakota’s petition for a Writ of Certiorari with respect to the Wayfair case. Oral argument was heard on April 17, 2018. And on June 21, 2018 the U.S. Supreme Court overruled Quill and the physical presence standard.[3] The Court then ruled that South Dakota’s sales tax economic nexus statute was constitutional and “substantial nexus” under the Commerce Clause. In anticipation of the ruling, many states already had laws on the books which were designed to go into effect if the ruling was favorable. As of Oct. 15, 2018, 35 states have passed some form of economic nexus standard for sales tax purposes.

Wayfair Impact and Action Items for Nonprofits

All industries are likely to see an impact from the Wayfair decision, but industries selling goods and taxable services remotely over the internet at retail have the greatest exposure. Nonprofits carry the same burdens as for-profit e-commerce sellers for taxable goods and services, if their sales reach the economic thresholds established by the states. (For the latest information on thresholds by state go to: https://www.bdo.com/wayfair.) When it comes to Wayfair, it’s also important to keep in mind that all states aren’t equal. The following are areas that nonprofit organizations should review to mitigate their risk of overpaying or under-collecting the sales tax.

Administration

Most states require nonprofits to register with the state departments of revenue if they are eligible for a sales tax exemption on purchases. In addition, once the economic thresholds are reached, the nonprofit must register as a vendor with the state since its sales will likely be treated the same as for-profit vendors. Again, each state is different regarding its nonprofit tax registration requirements.

Purchases

As a result of Wayfair, more sellers will be required to collect sales tax. Many of these sellers either “assume” everything they sell to nonprofits is exempt from tax or default all sales to taxable without consideration for nonprofit status. Either way, nonprofits must be proactive in informing their vendors when to charge them sales tax or they could end up overpaying sales tax on purchases or underpaying and creating a use tax assessment if they are audited. Each vendor’s sales should be reviewed to ensure that, if no sales tax is charged, the sale qualifies for the nonprofit exemption (i.e., the purchase benefits the organization’s nonprofit activities). It is important to establish an exemption certificate policy to ensure that only those vendors selling qualified goods and services are given an exemption certificate. Providing an exemption certificate to a vendor shifts the liability for the tax to the nonprofit even if it is provided in error. Areas where sales to nonprofits are generally taxable include sales of food, lodging, certain types of software and supplies such as uniforms, furniture and fixtures or any other type of sale unrelated to the purpose for which nonprofit status was granted by the state.

Sales

Nonprofits should examine their sales volumes in each state and compare it to the economic nexus thresholds established by each state. In general, measurement should be done at a legal entity level if there is more than one legal entity doing business in the state (although some states may combine sales of affiliated legal entities.) For tangible products, the state where sales occur is determined by the delivery address. However certain nonprofits, especially in healthcare, sell tangible goods, digital products (e.g., e-books) and services. In addition, some are part of an organization of affiliated companies consisting of nonprofit and for-profit entities. Nonprofits should consider the following when developing an action plan for determining nexus and potentially charging sales tax:

1. Where are the tangible goods, digital products and services sold?

2. Do the sales reach the threshold for economic nexus?

3. If yes, what are the necessary actions needed for complying?

- Registration – Nonprofits should register as a vendor in each tax jurisdiction.

- Taxability of Products Sold – A determination of the tax status of each product sold should be made.

- Exemption Certificate Procedures – If products are sold to other nonprofits, a process to collect exemption certificates should be established.

- Billing Sales Tax – A process must be established to charge the correct sales tax on an invoice. To do so, the nonprofit must utilize the most current sales tax rates to charge its customers.

- Reporting – Depending on volumes, sales tax reporting can be in-house or outsourced through third parties. Most states have portals where tax returns can be filed by keying in the data manually if the nonprofit has established economic nexus in only a few states.

4. In addition, nonprofits should consider their internal operational capabilities:

- Accounting – Do you have Sales Tax Liability Accounts set up that can undergo reconciliation and audits?

- Technology – Do you have the functionality in your billing system to charge the correct tax on taxable sales?

- Resources – Do you have enough resources in-house to administer exemption certificates and tax reporting?

- Document Retention – Most states require retention of all invoices, work papers, tax returns and other supporting documentation to support the taxes reported.

Conclusion

Wayfair has impacted every organization in the country in one form or another. Not all nonprofits sell goods and services, but they may see an uptick in the costs of the things they buy as a result. Those that do sell, must perform their own due diligence and incur the costs of compliance just like any other company dealing with the complexities of 46 different state tax jurisdictions with 46 different sets of rules. The rules are still evolving but one thing is certain: Unless Congress acts to change the economic nexus standards established by the Wayfair case, every entity, including nonprofit entities, that buys or sells will incur extra costs in its attempt to comply with current law.

Return to Table of Contents

TE/GE's Program Letter Provides Projects and Priorities for 2019

By Marc R. Berger, CPA, JD, LLM

The IRS Tax Exempt and Government Entities (TE/GE) division released its Fiscal Year 2019 Program Letter on Oct. 3, 2018. The Program Letter outlines its projects and priorities for fiscal year 2019 for tax-exempt organizations, employee plans, Indian tribal governments, and tax-exempt bonds. This article focuses on those projects and priorities relating to tax‑exempt organizations.

The TE/GE division will continue to refine its compliance strategy approach, which is designed to ensure that its examination programs are focused on the highest priority compliance areas to promote efficient tax administration. In this regard, TE/GE collaborates with its IRS business partners and various other groups and agencies, including the Advisory Committee on Tax Exempt and Government Entities, the U.S. Department of Labor, the Municipal Securities Rulemaking Board, and the Securities and Exchange Commission. TE/GE will continue to use advance data and data analytics to drive decisions about identifying and addressing high-risk areas of noncompliance.

The Tax Cuts and Jobs Act (TCJA) will remain a priority in fiscal year 2019. TE/GE has completed numerous form revisions, as well as guidance and training, and it anticipates more developments in these areas going forward. It plans on initiating additional education efforts in FY 2019 along with TCJA-related compliance strategies.

For the first time this decade, TE/GE is onboarding a significant number of new hires, and is cross-training employees to allow flexibility in directing resources to shifting needs. The increase in employees signals a potential increase in examination and enforcement action.

The bulk of the Program Letter focuses on six areas of its compliance program in an effort to become more effective and efficient. These six areas are:

Compliance Strategies

Compliance strategies are issues approved by TE/GE’s Compliance Governance Board (Board) to identify, prioritize and allocate resources within the TE/GE taxpayer base. Using a web-based portal, TE/GE employees submit suggestions for consideration by the Board. Once approved, these issues are considered priority work. Strategies approved to date include:

- Tax-exempt social clubs under Internal Revenue Code (IRC) Section 501(c)(7) – The focus will be on investment income, non-member income, and non-filers of Form 990-T, Exempt Organization Business Income Tax Return.

- Non-Exempt Charitable Trusts under IRC Section

- 4947(a)(1) – The focus will be on organizations under-reporting income and over-reporting charitable contributions.

- Tax-exempt organizations that were previously for-profit – The focus will be on organizations formerly operated as for-profit entities prior to their conversion to IRC Section 501(c)(3) organizations.

- Self-dealing by private foundations – The focus will be on organizations with loans to disqualified persons.

- Early retirement incentive plans – Determining whether federal, state or local governmental entities that provide cash (and other) options to employees as an incentive for early retirement have applied proper tax treatment to these benefits.

- Forms W-2/1099 matches – Comparing payments reported on Form 1099-Misc., Miscellaneous Income, with wages reported on Form W-2.

- Notice CP 2100 (backup withholding) – Determining whether mismatched and/or missing taxpayer identification numbers on Form 1099 indicate a failure to comply with backup withholding requirements.

- Worker classification – Determining whether misclassified workers result in incorrectly treating employees as independent contractors.

Data-Driven Approaches

Data-driven approaches use data, models and queries to select work based on quantitative criteria, which allows TE/GE to allocate resources that focus on issues that have the greatest impact. TE/GE integrates data into its processes and procedures, using return data and historical information to identify the highest risk areas of noncompliance.

With respect to models, this includes continuing to improve compliance models based on Forms 990, 990-EZ, and 990-PF, as well as testing the newly developed model for Form 5227 (Split Interest Trust Information return). In addition, identifying returns containing the highest risk of employment tax noncompliance will be a priority.

Referrals, Claims and Other Casework

Referrals allege noncompliance by a TE/GE entity and are received from internal and external sources. The public can submit a specialized exempt organization referral on Form 13909 (Tax-Exempt Organization Complaint). With respect to referrals, TE/GE will continue to pursue referrals received from all sources alleging noncompliance.

Claims are requests for refunds or credits of overpayments of amounts already assessed and paid, and can include tax, penalties and interest. TE/GE will continue to address claims requests, including high-dollar complex employment tax claims filed by federal, state and local governments.

Other casework includes examining entities that filed and received exemption using Form 1023-EZ, focusing on (1) filers who are ineligible to file Form 1023-EZ, (2) filers who donate to (or pay expenses for) individuals, and (3) filers operating bingo and other gaming activities.

Compliance Contacts

Compliance units are employed to address potential noncompliance, primarily using correspondence contacts known as “compliance checks” and “soft letters”.

A compliance check is correspondence with organizations to inquire about an item on a filed return; to determine if specific reporting requirements have been met; or to determine whether an organization’s activities are consistent with its stated tax-exempt purpose. A compliance check is not an examination.

A soft letter is correspondence with organizations that provides notification of changes in tax-exempt law or compliance issues. A response to these letters is generally not expected.

TE/GE will continue to inform taxpayers via compliance checks and soft letters, in particular in the area of adhering to recordkeeping and information reporting requirements, including:

- Combined Annual Wage Reporting – Focusing on tax-exempt employers that had discrepancies between Form W-2 and either Form 941 or Form 944.

- Financial Assistance Policy – Whether tax-exempt hospitals are complying with IRC Section 501(r)(4).

- Form 990-T Non-filers – Looking for IRC Section 501(c)(7) organizations that reported investment income on Form 990 but did not file Form 990-T.

- Supporting Organizations – Entities that state that they are supporting organizations but have filed Form 990-N, which is not allowed.

Determinations

TE/GE expects a continued increase in determination applications and will concentrate on identifying new strategies for reducing a filing burden and case processing time. The exempt organizations group expects to hire 40 new revenue agents to process determination applications to help offset application increases and workforce attrition.

Voluntary Compliance and Other Technical Programs

This area is focused primarily in the employee plans group of TE/GE, and enables a plan sponsor, at any time before audit, to pay a fee and receive IRS approval for correction of plan failures.

Management of exempt organizations should evaluate the potential implications of the areas identified in the Program Letter on their organizations and consult with their tax advisors.

For more information, contact Marc Berger, national director, Nonprofit Tax Services at [email protected].

Return to Table of Contents

Does Your Information Governance Program Look Like An Abandoned Fairground?

By Alex VanVeldhuisen, IGP

“Our Information Governance program looks like an abandoned fairground in my mind … each old ’ride’ representing a technology, software or server with data and information we no longer use, need, can find or know what to do with.” Quote from a Manager at a Public Utility

BACKGROUND

ARMA International defines Information Governance (IG) as a strategic, cross-disciplinary framework composed of standards, processes, roles and metrics that hold organizations and individuals accountable for the proper handling of information assets. Using a combination of views about information governance, BDO defines it as the ability to integrate people, process, technology and data into a framework that is cross-functional throughout the enterprise. This model allows for the development of an enterprise information governance program that aligns business functions and the use of data practices with their technological, business, security, privacy and legal needs.

INTRODUCTION

The “abandoned fairground” metaphor is a great visual. Imagine an old roller coaster being the legacy CRM program that was replaced by Salesforce. The ferris wheel was your old accounting software package now in the cloud. Your on-premises Windows server infrastructure was the spider ride, which is now hosted in the cloud via Office 365 and MS Azure. These rides were the best when they were new, but now they lie dormant with no one actively using them. However, leaving them in place unattended incurs costs and presents risk.

One can compare this metaphor to the lack of resources an organization has to mitigate its records management functions, which is part of the foundation of a sound enterprise Information Governance program. Long considered a line item on an organization’s balance sheet and a back-office function typically delegated to the Facilities or Information Technology (IT) departments, the cost and management of the program has long been considered a necessary evil—and, not a value add for the organization. However, with the software tools and processes that are now available, many organizations are realizing they can clean up their IG program with all its Redundant-Obsolete-Trivial (ROT) data and bring it into compliance in a timely and cost-effective manner. Organizations are also seeing that these mitigation efforts will drive increased productivity and business process transformation, which as a result, often improves regulatory compliance, reduction in costs and organizational risk, along with increased profitability.

WHAT DOES AN ORGANIZATION'S ENTERPRISE LANDSCAPE LOOK LIKE?

Understanding what legacy systems your organization has and what it’s costing the organization to maintain them is the first step in an Information Governance assessment. To properly “map” out the enterprise landscape, both current and legacy systems containing data must be identified and tracked. Once systems have been identified, the organizations should implement steps that include:

- Understanding who has access to the data or information and how it is used throughout the enterprise

- Identifying dormant data and information

- Identifying any additional data and information repositories that are outdated and outside the organization’s records retention schedule

WHY IS IT IMPORTANT TO HAVE A STRONG IG PROGRAM?

Aside from the normal regulatory reporting requirements that nonprofit organizations must comply with, nonprofits that are collecting or managing data on residents in the European Union ("EU") are now subject to the recently implemented General Data Protection Regulation (GDPR). The specific requirements within the regulation mandate that organizations have a firm understanding of the Personal Data, (similar to what the U.S. refers to as Personal Identifiable Information, or PII) they possess and control. Additionally, the organization must have documented processes in place to be able to provide any individual who is a resident of the EU a summary of what specific Personal Data is being maintained by the organization along with the mechanism(s) to delete their Personal Data, if they so request.

Examples of Personal Data a nonprofit might possess would be email addresses or newsletter mailing information the marketing department may be using to communicate to donors, subscribers or interested parties. According to Article 5 of the GDPR regulation, this information should not be maintained after the point in time in which the need/reason for processing it no longer exists. Once that point in time is identified, the Personal Data should be removed from the enterprise systems, including downstream systems, in a secure and timely manner.

Additionally, according to the Information Commissioner’s Office based in the UK (www.ico.org.uk), nonprofits can be considered both “data controllers” and “data processors.” There are several ways in which a nonprofit is then subject to GDPR:

- As an employer processing data of volunteers, employees or trustees

- As a campaign or fundraising organizer

- As a provider of services to beneficiaries

The GDPR provides the following eight rights for individuals:

- The right to be informed about the collection and use of personal data

- The right of access to their personal data and supplementary information

- The right to rectification of inaccurate personal data or completion of incomplete data

- The right to erasure of personal data

- The right to restrict processing that allows an organization to store data but not use it

- The right to data portability, which allows individuals to safely and securely obtain and reuse their own data for their own purposes

- The right to object to processing based on legitimate interests, direct marketing and for purposes of research

- Rights in relation to automated decision-making and profiling

What makes IG so challenging for most organizations is that it is as much about organizational structures as it is about data. Most organizations, including nonprofits, work in what the IG profession refers to as silos. Each of these silos is represented by various departments, locations and service lines who are all currently responsible for their own data and records with little or no thought as to how their individual programs or governance efforts may impact the organization as a whole.

Unlike mature enterprise information governance programs, these organizational and information silos result in increased liability and costs to the organization while also increasing the cost of managing and maintaining current and legacy systems. This is the exact opposite of what a mature IG program is designed to accomplish, which is the reduction of your data footprint (data minimization) through the elimination of ROT data. Improving processes and controls will result in reducing the organizational risk profile while increasing efficiencies and controls over your data.

Due to the implications, the recent passing and implementation in May 2018 of the GDPR as mentioned earlier, and the passing of the California Consumer Protection Act (CaCPA) which takes effect Jan. 1, 2020 (which may have up to a six-month look back), nonprofits cannot continue to do business without prioritizing how to secure and manage their sensitive donor and organizational information.

CAN CREATING A STRONG INFORMATION GOVERNANCE PROGRAM CREATE STRONG ROI?

The simple answer is “Yes!” Every organization is unique, and every organization has its own strategic business goals, so it is difficult to quantify a return on investment (ROI) without specific information. However, what a strong IG program supports and shows results in, is better control and security of your information and an improved ability to leverage that information to make more informed decisions. Another result that may occur is improved efficiencies that generate better outcomes. In a nonprofit this could result in the ability to better understand who, and how, donors and volunteers are engaging with the organization. Clean, accurate, available and meaningful data will allow the organization to look to the past to guide the future.

What are some examples of benefits that are a direct result of improved IG programs?

- A reduced risk profile for the organization

- Improved outcomes of regulatory audits

- Minimization of the data footprint which results in lower costs to store, maintain and dispose of data in all its forms

- More productive employees in their daily activities by making the data and information they need available in a safe, secure and timely manner

- Better decision making by having data that is more accurate, available and trustworthy

HOW DO YOU START TO PREPARE TO MAKE CHANGES?

Existing corporate culture and changes within that culture pose difficult challenges specific to bringing an organization into compliance and building an effective IG program. The first and most important step to is to get executive sponsorship and involvement of all stakeholders to support the success of an IG program. Developing and nurturing a culture of compliance does not happen immediately. Organizations should implement programs where employees are asked and encouraged to change habits and business processes so they understand the benefits to the organization as a whole. Additionally, seeing how these changes will impact each of their specific jobs and responsibilities will result in saving the organization money and prevent exposing the organization to unnecessary risk.

DON’T LET PERFECTION GET IN THE WAY OF PROGRESS

One of the justifications organizations use to stall change is that the proposed new processes are not perfect. No IG program will ever be perfect. The variables involved in any organization, particularly those that are larger, make it difficult to create a program that’s perfect. What is needed is to create an ongoing and iterative IG program that has:

- Executive sponsorship and ongoing support

- Deep and continued stakeholder involvement

- Is audited and evaluated on a regular basis

- Is nimble enough to make changes in a timely manner to address new regulatory requirements, business changes and personnel turnover

An IG program that does this will create and support a culture of compliance in an organization and lead to efficiencies across a variety of areas including records management, e-discovery, information security and reporting.

GET HELP AND PARTICIPATION FROM THESE AREAS

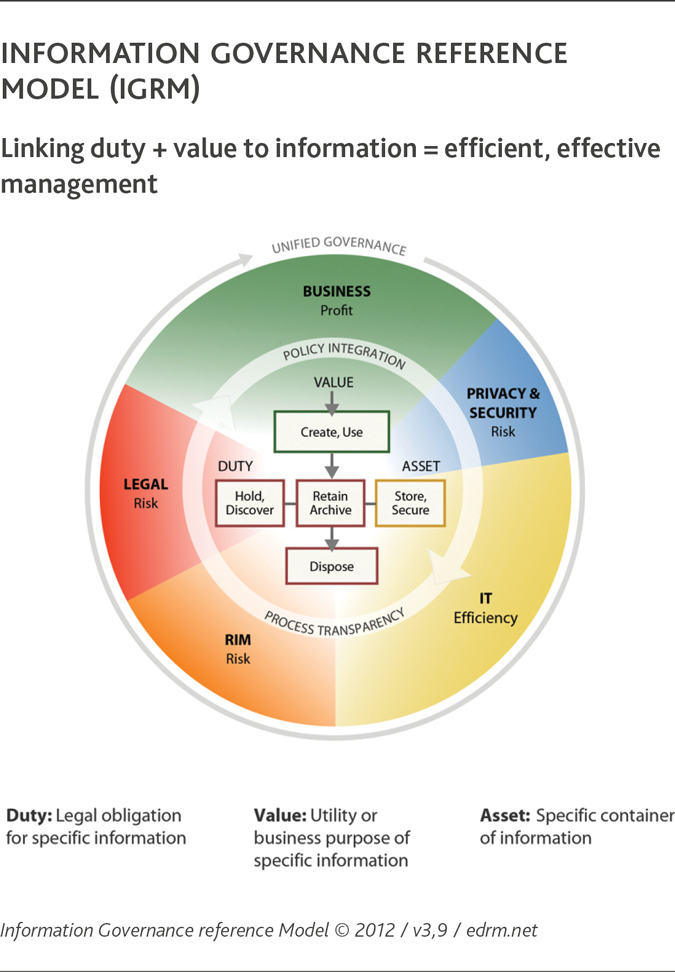

The creation of an IG program takes some planning and is the responsibility of multiple people within the organization. The creation of a strong IG program will require input, knowledge and expertise in at least five areas of the organization. As shown in the Information Governance Reference Model (IGRM), these areas need to work collaboratively to create a strong and successful IG program. Start by fostering positive relationships across the business lines that include the security, IT, RIM and legal teams. Discuss the priorities each group has and the responsibilities they currently oversee. Finding synergies can develop partnerships to achieve shared goals. Ultimately, including these stakeholders will allow the organization to identify areas that need attention and a strong well-rounded IG can accelerate.

CONCLUSION

A strong Information Governance program is possible to accomplish. Understanding where the organization is maintaining data benefits the organization as the organization will reap the rewards of a properly managed program. Engaging key stakeholders throughout your organization is the most important activity and step an organization can take to get started. The benefits that result from creating a strong IG program will support efficiencies and reduce risk profile. And most importantly, a well thought out IG program will create a culture that functions every day. As with our fairground metaphor, to make sure your data is accounted for and maintained is synonymous with ensuring the fairground is not abandoned, but maintained, so all rides, new and old are safe and fun, and a place where everyone wants to go!

For more information, contact Alex VanVeldhuisen, manager, TBTS Governance and Risk Compliance, at [email protected].

Return to Table of Contents

Is Running a Nonprofit with a For-Profit Vision the New Normal?

By Adam B. Cole, CPA

Alleviating homelessness. Providing healthcare. Advancing educational and economic opportunities.

While nonprofit organizations may have a social purpose, they are, by definition, businesses that need to focus on profitability to further their mission. Like their for-profit brethren, they must have sound governance and financial practices, including a way to measure outcomes and return on investment (ROI), that can support their growth and help them maximize funding, mitigate risks and better serve their constituents. Without strategic operational investments, nonprofits risk failing to build up the foundation they need for sustainable success.

Read More on the Nonprofit Standard Blog

For more information, contact Adam Cole, partner, at [email protected].

Return to Table of Contents

Funding Innovation in the Nonprofit Sector

By Andrea Wilson

What is a safe and cost-effective way to transport vaccines to children in developing countries? Many life-saving vaccines and antiretrovirals need to be stored in specific temperatures and conditions difficult to accommodate during long periods in transit. One international nongovernmental organization (NGO) discovered drones equipped with climate-controlled technology offered a solution.

Read More on the Nonprofit Standard Blog

For more information, contact Andrea Wilson, managing partner, Nonprofit & Education Advisory Services, at [email protected].

Return to Table of Contents

Release of 2018 Draft Form 990-T and Instructions

By Jake Cook, CPA

The 2018 Internal Revenue Service draft Form 990-T and Instructions were released in October 2018. Due to the tax reform provisions in the Tax Cuts and Jobs Act of 2017, the form and instructions include several necessary revisions.

The significant modifications include:

- Calculation of UBTI (unrelated business taxable income) separately for each business activity (UBTI silos) under Internal Revenue Code (IRC) Section 512(a)(6)

- Treatment of fringe benefits including qualified transportation and qualified parking under IRC Section 512(a)(7)

- Changes to the net operating losses as a result of the amendment to IRC Section 172

- Corporate tax rate change to 21%

- Elimination of the alternative minimum tax (AMT) for corporations.

A summary of these significant provisions follows below.

UBTI Silos – IRC Section 512(a)(6)

Organizations with more than one unrelated business activity are now required to compute UBTI separately for each activity, and a loss from one activity cannot reduce income from another activity. Net operating losses (NOL) will be tracked separately for each activity. The instructions explain that an organization with more than one unrelated trade or business may allocate any charitable deduction among the activities using any reasonable method.

The new Schedule M on Form 990-T should be completed for each unrelated trade or business. The organization will then report the sum of the UBTI on each Schedule M on Line 32 of Form 990-T. To the extent there is a UBTI loss reported on a Schedule M, it cannot be used to offset income on another Schedule M. Rather, this loss will become a NOL available only for future income within the same type of trade or business.

Disallowed Fringe Benefits – IRC Section 512(a)(7)

Under IRC Section 274(a)(4) no deduction shall be allowed for the expense of any qualified transportation fringe, defined in IRC Section 132(f), provided to an employee of the organization. The Form 990-T was modified to include an addition to the total unrelated trade or business income for the amounts paid for disallowed fringe benefits. This addition is before the pre-Jan. 1, 2018 NOL deduction as well as the $1,000 specific deduction; thus, both are available to be used against the disallowed fringe benefits amount recognized as UBTI. With the new limitation of UBTI losses generated for tax years starting after Dec. 31, 2017, these future losses will not be able to be utilized against UBTI from disallowed fringe benefits. The instructions also make it clear that if the only UBTI the organization has is from disallowed fringe benefits, the organization must still file the 990-T if the UBTI is greater than $1,000.

Net Operating Losses – IRC Section 172

Net operating losses generated in tax years ending after 2017 can no longer be carried back two years. Net operating losses can be carried forward indefinitely, however they can only reduce taxable income up to 80 percent.

Corporate Tax Rate Change – Flat 21 Percent

The corporate tax rate was modified from a variable rate based on income to a flat 21 percent rate. Due to the lowest tax bracket starting at 15 percent previously, tax-exempt organizations with UBTI less than approximately $90,000 will actually pay a higher tax with the new 21 percent tax rate.

Repeal of Corporate AMT

There is no longer a corporate level minimum tax and an organization with an AMT credit carryover can treat a portion of the carryover as refundable using Form 8827.

Additional Modifications that may impact Form 990-T as a result of tax reform, with respective form numbers:

- Base erosion minimum tax – Form 8991

- Business interest expense limitation – Form 8990

- Excess business loss limitations for noncorporate taxpayers – Form 461

- Global Intangible Low-Taxed Income (GILTI) – Form 8992

- Foreign-Derived Intangible Income (FDII) – Form 8993

- Deferred foreign income inclusion under Section 965(e) – Form 965

Further guidance from the IRS on implementation of the tax law changes is still pending. Stay tuned for future updates.

For more information, contact Jake Cook, nonprofit tax managing director, at [email protected].

Return to Table of Contents

How to Address Generational Workforce Challenges

By Donna Bernardi Paul, SPHR, SHRM-SCP

Are differences in work and communication style in the workplace among the different generations the cause of leadership/supervisory challenges or is it something else?

There have been a plethora of articles, seminars, webinars and discussions around millennials in the workplace and the challenges of managing and working with them due to their different work style.

When we talk about the importance of differences in the workplace, sometimes we forget about one of the most prominent dimensions—age. There are three main generations in our workforce currently, and we are on the brink of adding a fourth. Understanding how to relate to each is critical to successfully keeping them motivated and engaged in their work.

The Baby Boomers: Born between the end of World War II and the early 1960s. Also known as the “Me Generation.” They grew up with television. Mothers were typically home waiting for their children to come home from school, and children were allowed outside of their homes unsupervised. Their relationships with their parents, teachers and others in authority were somewhat contentious.

Boomers came into the workforce in droves. They were the first “workaholics.” Their frame of reference at work was to spend as much time as possible working, sacrificing time with families, so that good things would come to them. Motivating them at work is typically done via the “carrot and stick” approach.

Generation “X”: Born between the early 1960s and the early 1980s. Also known as the “Latchkey Kids” or the “Sandwich Generation” because they are sandwiched between the huge baby boomer and millennial groups. They grew up in an era when more mothers entered the workforce and children came home from school to an empty home. They fended for themselves. They were instructed not to answer the door to anyone they didn’t know. As a result, they became independent and skeptical. They entered the workforce with the frame of reference they needed to have multiple careers so that they didn’t put all their eggs in one basket. They didn’t want to experience the disappointments of prior generations. They tend to be entrepreneurial and individualistic. Managing them at work became more complicated due to their supercilious attitude and resentment towards the boomers and millennials.

Many feel that they do not have career paths because the boomers aren’t leaving and the millennials are leapfrogging over them.

Generation “Y” (millennials): Born between the early 1980s and the early 2000s. Also known as “Echo Boomers.” They represent the largest generation in the workforce and its members generally have high levels of self-esteem. They are highly educated and technologically savvy. Their preferred communication style is text messaging. Their relationships with their parents tend to be that of friends or peers because their parents typically have moved away from the authoritarian style in which they were raised. As a result, they have grown up in an era where their lives are programmed and organized from birth, which doesn’t prepare them to cope with disappointment or help them to make decisions on their own. For example, their nurseries were monitored via the baby monitor. Their parents organized their social activities via “play dates” vs. allowing them to go outside unsupervised. Moreover, parents of millennials have instilled within their children entitlement attitudes vis-à-vis “everyone is right” and “everyone gets a trophy.” Many parents become advocates for their children with schools, their friends and even their workplaces. As a result, this generation has expectations that may not be realistic. They’ve entered the workplace with the expectation that they can work whenever and however works best for them. Managers from prior generations tend to have trouble supervising this group, even though they were probably the same parents who raised them, because this generation’s virtual style of working is very different from what older generations are used to.

Generation “Z”: Born between early 2000s to the present. This generation is extremely technologically savvy. Many had iPads as toddlers. They are now in high school and college.

Perhaps the upshot to all of this is that it doesn’t matter to which generation a person belongs since all workers tend to want the same things:

- Good bosses

- Career paths

- Recognition

If you think back on all the jobs you’ve ever had and all the bosses you’ve ever had, which boss would you choose as your favorite and why? Now, give yourself a rating against your favorite boss in order to determine where you would like to develop your supervisory skills. After all, how do people become bosses? Do they go to school to learn how to be a great boss? Not usually. Typically, they do something well from a technical perspective and then they are promoted out of what they do well and placed into a job (managing others) that they may not be familiar with, and for which they get no training. With proper training of its managers and supervisors, organizations have a better chance to have skilled employees who care and are productive regardless of which generation they fall in because people join companies—they quit bosses.

Return to Table of Contents

Nonprofit & Education Webinar Series

The BDO Institute for Nonprofit ExcellenceSM provides a complimentary educational series that is designed specifically for busy professionals in nonprofit and educational institutions.

Our 2018 BDO KNOWLEDGE Nonprofit and Education Webinar Series will keep you abreast of trends, timely topics and challenges that are impacting the nonprofit environment and provide you with key takeaways relevant for busy professionals working in and with nonprofit and education organizations. We invite you to take part in this program with members of your organization, including board members.

Stay tuned to the Nonprofit Standard blog or refer to www.bdo.com/resource-centers/institute-for-nonprofit-excellence for further details and registration information.

1/23/2019 | 1:00 – 2:30 PM ET

Nonprofit Benchmarking, a CFO’s Perspective

1.5 CPE hour

BDO Professionals in the News

BDO professionals are regularly asked to speak at various conferences due to their recognized experience in the industry. You can hear BDO professionals speak at these upcoming events:

February

-

Dick Larkin will be speaking on the topic “Financial Indicators for Nonprofit Organizations” for the Greater Washington Society of CPAs at its Nonprofit Section meeting on Feb. 26 in Washington, D.C.

March

-

Larkin is also presenting a session entitled, “Not-for-Profit Accounting Update,” at the Washington Non-Profit Legal & Tax Conference on March 28 in Washington, D.C.

SHARE