Manufacturers are navigating an environment of constant disruption, from tariff uncertainty and supply chain issues to geopolitical instability and labor shortages to technological leaps and evolving customer demands.

Reactive strategies based on temporary conditions run the risk of losing market share and failing to meet customer expectations. Sustainable success requires proactive, long-term strategic planning focused on attractive markets.

Today, finding new sources of growth is no longer about simply scaling operations.

It's about integrating internal analyses while monitoring and understanding external market dynamics. This balanced perspective empowers leaders to make decisions with confidence - even as uncertainties continue to challenge the industry.

The Manufacturing Growth Imperative

The Time to Act is Now

It’s not hyperbole to say that the manufacturing industry is transforming at unprecedented speed.

The sector faces significant challenges that demand bold strategic responses rather than safe tactical adjustments.

This transformation is taking place during a time of massive disruption:

- Supply chain vulnerabilities exposed by global disruptions

- Workforce shortages amid shifting skill requirements

- Digital transformation pressures and Industry 4.0 adoption

- Rising customer expectations for customization and service

- Increasing global competition and market volatility

- Environmental sustainability demands and regulatory changes

In such a turbulent environment, manufacturers can no longer rely on incremental improvements to drive growth. Instead, they need a strategic framework that allows them to systematically, properly evaluate opportunities and make informed decisions about where and how to grow.

Manufacturing companies have access to a wealth of internal data - from customer reports to margin analyses, to R&D performance to production and supply chain metrics. At the same time, external data such as consumer trends, competitive moves, geopolitical shifts, and emerging technologies provide invaluable context.

Executives who can blend these two dimensions are uniquely positioned to craft strategies that are both resilient and adaptive.

The Dual-Lens Growth Framework

Inside-Out and Outside-In Analysis

Achieving sustainable growth requires evaluating opportunities through two complementary perspectives that work together to identify the most promising routes for expansion where companies have a “right to win”.

| Critical Factors | |

| Inside Out | Outside In |

Core Competencies

| Market Dynamics

|

Resource Availability

| Competitive Landscape

|

Organizational Alignment

| Environmental Factors

|

Strategic Evaluation

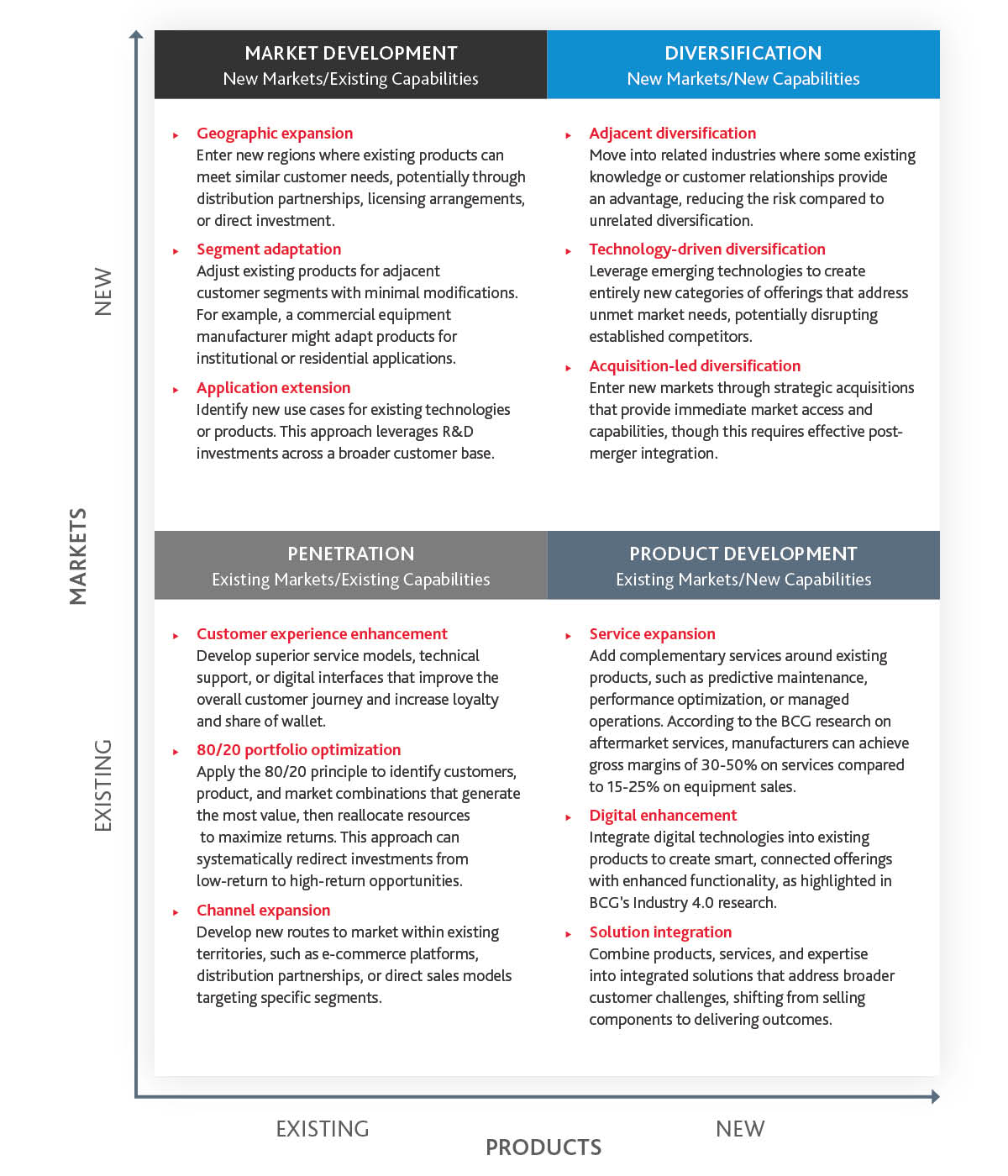

The Ansoff Strategic Growth Matrix

After conducting outside-in and inside-out analyses, we can apply a framework to simplify complex decisions and provide a structured method to evaluate risks and rewards.

A modified Ansoff Matrix is a powerful tool to visualize the most promising growth opportunities. This framework divides growth strategies into four quadrants, each addressing different combinations of internal capabilities and external market opportunities.

From Analysis to Action

Four Growth Acceleration Levers

Irrespective of what quadrant in the Ansoff matrix a manufacturing company may decide it wants to play, it has four levers at it’s disposal to accelerate their growth strategy:

Build

Develop new assets, products, or capabilities internally.

This works best when the organization already possesses adjacent expertise or when the capability is considered strategically critical to own.

- Maintains strategic control over the development process and intellectual property

- Ensures tight alignment with existing systems and business processes

- Builds organizational knowledge and expertise that can be applied in future

- Requires investment in talent, technology, and organizational development

- Preserves cultural alignment and strategic control

Buy

Acquire new assets, products, or capabilities.

Acquisition strategies accelerate market entry by providing immediate access to established products, customer relationships, and operational capabilities.

- Reduces time-to-market compared to internal development

- Provides access to proven technologies, products, or business models

- Brings in talent and expertise that might be difficult to develop internally

- Access to established customer relationships

- Requires effective integration to realize synergies

Partner

Form strategic alliances or joint ventures.

Partnerships allow manufacturers to access complementary capabilities without full ownership, sharing both risks and potential rewards.

- Reduces capital requirements compared to building or buying

- Combines complementary strengths of multiple organizations

- Provides flexibility to adapt or exit as market conditions change

- Creates potential for ecosystem advantages through network effects

- Shares risk and resource requirements

- Maintains flexibility while accessing new opportunities

Invest

Create market demand or accelerate development.

Strategic investments in technologies, startups, or ecosystem initiatives can create option value and influence market development.

- Provides early insights into emerging technologies or business models

- Creates potential for outsized returns if investments succeed

- Builds relationships that could lead to future partnerships or acquisitions

- Builds market presence and influence

- Can lock competitors out of critical innovations

The Path Forward

Executing a Growth Strategy

The integration of internal analyses with external insights—and the application of frameworks like the Ansoff Matrix—provide manufacturing leaders with the

roadmap to sustainable growth. By continuously challenging the status quo, engaging with emerging market signals, and investing in transformational technologies, manufacturers can drive innovation, secure market share, and mitigate future risks.

Forward-looking executives should focus on:

- Data Integration - Invest in robust data analytics platforms that merge internal performance metrics with external market intelligence.

- Strategic Flexibility - Use frameworks to stress test strategic choices and adjust priorities as market conditions evolve.

- Collaboration & Alliances - Establish strategic partnerships that provide access to technological innovations and new consumer segments.

- Cultural Shift - Promote an internal culture of continuous improvement and experimentation to stay ahead in a competitive marketplace.

Structured Approach & Roadmap

Successful implementation of manufacturing growth strategies requires a structured approach that balances immediate action with long-term transformation.

Phase 1

Assess and Strategize / 0-6 months

- Conduct comprehensive inside-out and outside-in analysis

Systematically evaluate market opportunities and organizational capabilities using the frameworks outlined earlier. Include revenue/margin analyses, customer research, competitive intelligence, technology assessment, and internal capability audits. - Segment and pressure test end market capacity

Conduct internal analysis to assess segmenting business units aligned to end users and markets, root out complexity, and pressure test hypothesis. Ensure adequate end market demand and identify new market opportunities. - Identify strategic growth opportunities

Apply the Growth Matrix to prioritize opportunities based on market attractiveness and organizational fit. Develop specific business cases for the most promising opportunities, including resource requirements, timeline, and expected returns. - Align leadership and stakeholders

Build consensus around the strategic direction through structured engagement of executive leadership, board members, and key stakeholders. Establish clear governance and KPI monitoring. - Define your “North Star”

Develop a compelling vision for the organization that inspires and aligns. Articulate how the growth strategy will create value for customers, employees, and shareholders.

Phase 2

Pilot and Scale / 6-18 months

- Test strategic initiatives

Implement limited-scope pilots for key growth initiatives to validate assumptions, refine approaches, and demonstrate value. Pilots should be structured as learning experiments with clear success criteria. - Validate technology investments

Evaluate technology solutions through proof-of-concept projects that demonstrate functionality and value without requiring enterprise-wide deployment. Use these projects to build internal capabilities. - Refine based on market feedback

Actively solicit customer and market feedback on pilot initiatives, using this input to refine value propositions, offering design, and go-to-market approaches before scaling. - Scale successful initiatives

Once pilots demonstrate success, develop detailed scaling plans that address organizational requirements, process changes, technology infrastructure, and change management needs.

Phase 3

Optimize and Innovate / 18-36 months

- Enhance operational efficiency

Apply continuous improvement methodologies to optimize the performance of new growth initiatives. Use data analytics to identify bottlenecks, inefficiencies, and improvement opportunities. - Leverage data and analytics

Develop more sophisticated data capabilities to refine market targeting, customer segmentation, and offering optimization. Implement closed-loop feedback systems that enable continuous learning and adaptation. - Explore emerging technologies

Monitor technological developments and conduct targeted experiments with promising technologies that could enable new growth opportunities or enhance existing initiatives. - Build ecosystem partnerships

Develop strategic relationships with technology providers, channel partners, and complementary solution providers to accelerate innovation and market access.

Phase 4

Sustain and Lead / 36+ months

- Embed growth mindset

Develop organizational systems and processes that continuously identify and pursue growth opportunities. Include incentive structures, performance management systems, and resource allocation. - Maintain competitive advantage

Invest in capabilities that preserve differentiation as markets evolve and competitors respond. This might include continued R&D investment, talent development, or strategic acquisitions. - Adapt with agility

Establish mechanisms for sensing market changes and rapidly adjusting strategies in response. This requires both market intelligence systems and organizational flexibility. - Shape industry standards

Take a leadership role in influencing industry standards, regulations, and ecosystem development to create favorable conditions for continued growth.

Let BDO Turn Disruption into Opportunity

The most successful manufacturers will be those that maintain a long-term strategic perspective while building the agility to respond to short-term market shifts. Success hinges on continuously assessing the interplay between internal capabilities and the dynamic external landscape. Manufacturers can not only weather disruption but also capitalize on the opportunities it presents, building a robust engine for sustainable growth and competitive advantage.

Through decades of industry experience and the practical application of rigorous strategic analysis, BDO helps manufacturers transform disruption into opportunity, achieving sustainable growth in an increasingly complex global landscape.

Our management consulting professionals can help your company design a strategic growth plan that leverages your core strengths to build resilience and expand your competitive advantage. Our team has worked with more than 100 manufacturers on profitable growth strategy. We have delivered a 10X ROI to these companies and on average they have seen a 44% increase in EBITDA in year one. By helping you achieve the right balance of organic and inorganic growth opportunities, our knowledgeable teams can help you makethe right investments and lean into your unique sources of competitive advantage.

If considering a transaction, our professionals can help you navigate the full transaction process, from due diligence to post-transaction integration.

The time to design your future growth strategy is now. BDO is here to help you build it.