As organizations expand organically or conduct strategic transactions or acquisitions, their state tax liabilities are likely to increase. State tax restructuring can be key to reducing state tax liabilities. Many companies are unaware of the restructuring options available and the opportunities they offer. State income tax restructuring can help organizations improve state tax efficiency and reach business objectives. By understanding the types of restructuring opportunities available, tax leaders can help their organizations become more state tax efficient.

When Should a Company Consider State Tax Restructuring?

State tax restructuring involves evaluating an organization’s state tax profile and identifying ways to change its operational, financial, or legal entity structure to help improve tax efficiency.

While every organization’s situation is unique, the most common business profiles considered for restructuring include:

- Organizations paying significant taxes in separate filing states;

- Organizations that pay large amounts of state income taxes and have considerable foreign operations;

- Organizations planning strategic transactions; and

- Organizations with substantial franchise tax liabilities.

Organizations Paying Significant Taxes in Separate Filing States

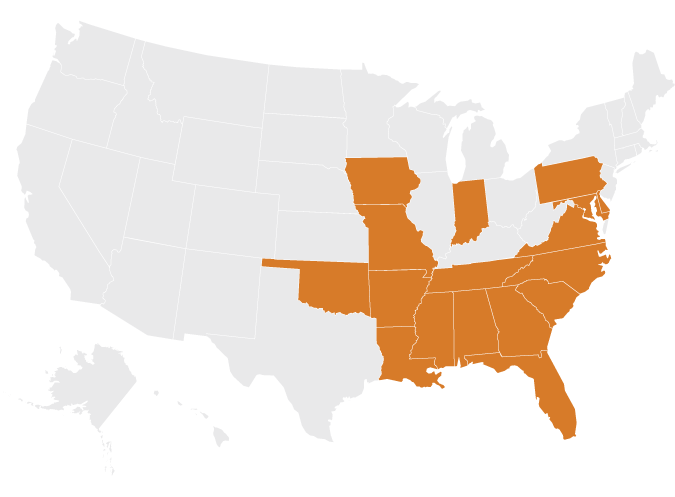

There are opportunities to restructure to help reduce state tax liabilities — particularly for organizations that have significant state tax liabilities in separate filing states. Separate filing states impose tax on each corporation with nexus in the state, while mandatory combined filing states assess tax on the combined income of affiliates operating as a unitary business group. The orange states in the map below are separate filing states.

Separate Filing States

Map indicates U.S. separate filing states based on information available as of May 27, 2025: Alabama, Arkansas, Delaware, Florida, Georgia, Iowa, Indiana, Louisiana, Maryland, Mississippi, Missouri, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, and Virginia.

Organizations can leverage different filing methodologies across states and set up legal structures for tax planning purposes. For example, affiliated groups that have entities filing in separate and combined filing states can restructure their operations to report more income in combined filing states and less income in separate filing states, provided the restructuring is properly implemented and any intercompany dealings are well documented, at arm’s length, and consistent with applicable state tax laws. Reporting more income in combined filing states may reduce state tax liabilities in separate filing states while having minimal to no impact in combined filing states.

Organizations That Pay a Significant Amount in State Income Taxes and Have Significant Foreign Operations

Organizations that have foreign operations or plan to expand internationally can sometimes leverage their international presence to save state taxes. For instance, numerous unitary combined states exclude foreign corporate affiliates or “80/20 corporations” (that is, a corporation with more than 80% of its payroll, property, and/or sales outside the U.S.) from the combined group. Companies with foreign operations may be able to restructure their operations to minimize their state income tax liabilities but with minimal to no impact to their foreign tax liabilities. As with any planning, the restructuring must be properly implemented and documented to achieve state tax savings.

Organizations Planning a Strategic Transaction

Corporate and pass-through entities might also consider restructuring their businesses to help prepare for a major transaction or liquidity event. For instance, pass-through entities such as partnerships or S corporations can properly plan and restructure in anticipation of major transactions to help minimize the transactions’ state tax burdens on their owners.

Organizations Paying Significant Franchise Taxes

There are planning and restructuring opportunities for companies that pay substantial state franchise taxes based on their assets or net worth. Companies might also be able to use planning strategies to reduce their franchise tax bases or conduct business in alternative structures that can reduce their franchise tax liabilities. At times, the restructuring strategies that help minimize state franchise taxes may also serve to minimize state income taxes.

Using Intercompany Transactions for State Tax Efficiency

Intercompany transactions can help organizations reduce their state tax liabilities. However, to withstand audit scrutiny, transfer pricing studies must be performed to ensure intercompany transactions are conducted at arm’s length and consistently with applicable federal and state tax laws. Companies should consider restructuring strategies that incorporate intercompany transactions to mitigate state tax costs. However, it is critical that all intercompany transactions comply with federal and state transfer pricing rules, have legitimate business purposes, and are properly documented.

What Is the Process for State Tax Restructuring?

Restructuring an organization for tax efficiency purposes can be time and resource intensive, involving numerous internal and external advisors, including financial, legal, and tax professionals. Restructurings typically are executed in four phases: strategic assessment, design, implementation, and maintenance.

Phase 1: Strategic Assessment

- Review the organization’s business data and information, including operations, financial data, income projections, and tax position.

- Develop various structural options, outlining associated business implications and the potential state tax impact and savings of each structure.

- Present a summary of findings to management and key stakeholders to evaluate the various restructuring options.

Phase 2: Design

- Conduct a comprehensive evaluation of the restructuring options to determine the most efficient structure.

- Assess the business and tax considerations of the various structures.

- Determine the restructuring option that will be pursued and develop an implementation workplan and execution timeline.

Phase 3: Implementation

- Manage and facilitate execution of the workplan, including legal, accounting, operations, human resources, payroll, tax, and other affected areas.

- Conduct weekly meetings to assess progress, identify issues, and determine resolutions.

- Work with accounting teams on system modifications to establish separate books and records for the new entities.

- Perform transfer pricing studies and comparables research to identify arm’s-length price and prepare the transfer pricing report.

- Prepare all business and tax registrations for the new entities.

Phase 4: Maintenance

- Perform a review to determine if procedures, policies, accounting, and other affected areas are operating as intended.

As state tax authorities increase their scrutiny of complex tax structures, it’s critical for entities to maintain strong supporting documentation that defends any new structure’s business purpose. Organizations should maintain documentation that demonstrates transactions were conducted according to federal and state transfer pricing rules and at arm’s length. Separate balance sheets, income statements, board meeting minutes, and proper accounting of intercompany transactions are necessary for compliance.

Pursuing a Restructuring Strategy

While restructuring may seem daunting, it can significantly help strengthen your state tax posture and enhance state tax efficiency.

For organizations considering restructuring to mitigate state income tax liabilities, adhering to compliance and legal standards is critical. Working with experienced advisors who have knowledge of state income tax, sales and use tax, transfer pricing, federal tax, and employment tax, can help companies navigate the complexities of state tax restructuring and develop strategies that align with their long-term objectives.