Insurance M&A Insights: Market Opportunities for Buyers and Sellers

By Imran Makda and Jonathan Roberts

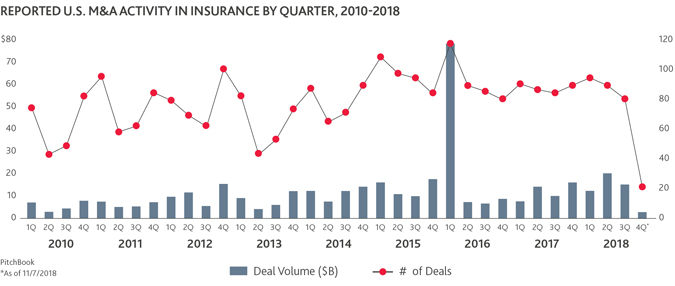

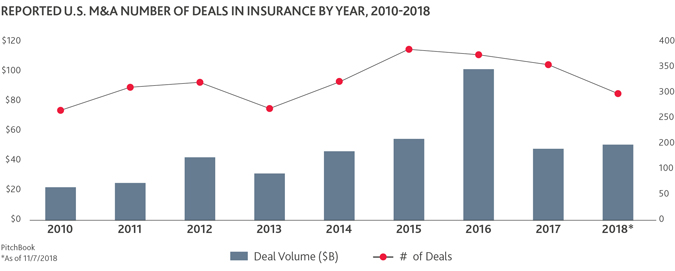

The insurance industry saw a spike in M&A activity in 2016, with deal volume reaching a peak of more than $100 billion in the U.S., almost double that of the year prior according to PitchBook data.1

While the market hasn’t nearly reached that level again, the industry has seen continued growth in M&A deal volume from 2017 through 2018—a trend the market is likely to continue in the year ahead, with opportunities for both buyers and sellers amid insurance industry evolutions.

A wide range of ongoing economic factors have contributed to a steady rise in insurance deal volume and suggest a sustained level of deal activity for the year ahead—from new and emerging business models to record levels of dry powder for private equity, and from advancements in Insurtech to a focus on specialty insurers. In the U.S. specifically, the transformation of healthcare to a value-based care system is impacting all industries that touch the health ecosystem, including insurers.

With so many dynamics in play in the already-consolidating insurance industry, buyers and sellers have individual definitions of value, whether that means broadening capabilities or divesting non-core business assets and units. Savvy insurers, agents and brokers can take steps now to understand the M&A opportunities the market presents and how to best prepare to take advantage of them.

Megadeals Fuel Insurance M&A & PE Trends in 2018

The industry experienced a swell in deal volume, with $20.08 billion in the U.S. in Q2 2018 alone—the highest quarterly rate since the industry peak of $77.97 billion in Q1 2016 and all quarters prior to that through 2010, according to PitchBook data. To add, S&P Global Market Intelligence notes that the first nine months of the year saw $39.1 billion in aggregate transaction value, making 2018 the most active year for insurance M&A since 2015.2

Much of the insurance industry deal volume in 2018 can be attributed to megadeals. Overall, the number of deals has been on a steady decline in the U.S. since 2015, falling from 379 deals to 367 in 2016, 345 in 2017 and just 281 in 2018, as of November, according to PitchBook. Thus, recent surges in deal volume point to megadeals as the main drivers of activity. While megadeals were largely absent from the insurance industry in 2017, says Insurance Business, continued trends around consolidation in the reinsurance and property & casualty (P&C) markets and restructurings of core business units and specialty offerings have fueled a resurgence in these larger transactions.3 For example, AIG purchased reinsurer Validus Holdings for $5.56 billion in January, and AXA acquired XL Group for $15.3 billion in March—the biggest deal of the year so far.4

These two deals highlight an industry-wide focus on specialty offerings in both consolidation and divestitures. Validus Holdings adds specialty insurance products covering cargo, energy, marine and even political violence, among others, to AIG’s general, life and retirement insurance products; XL Group (now AXA XL) adds P&C and specialty risk services to AXA’s traditional lineup of life insurance, retirement and investment products. Combined with numerous smaller deals—such as AIG’s later procurement of Glatfelter Insurance Group, The Hartford Group’s purchase of The Navigators Group and Marsh’s deal with Jardine Lloyd Thompson Group to create March-JLT Specialty—the emphasis on specialist acquisitions is clear.

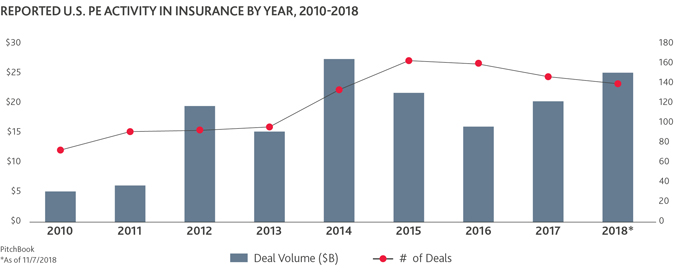

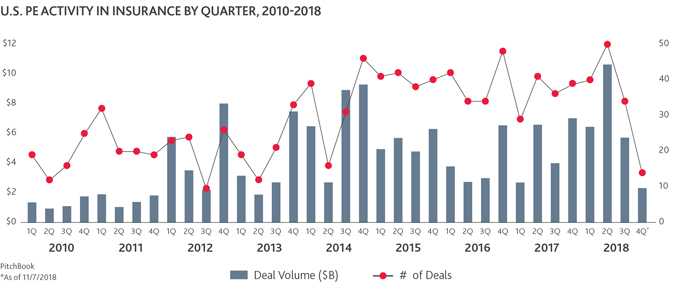

Simultaneously, due to a highly-competitive market, some insurers are looking to quickly divest the specialty lines that are not core to their businesses to improve results, finds Willis Towers Watson and Mergermarket, which has led to increased PE interest. It should come as little surprise, then, that PE in the insurance industry has reached $24.83 billion as of November—just $3 billion shy of peak deal volumes in 2014—according to PitchBook data. In line with overall M&A trends, the total number of PE deals has decreased year-over-year since 2015; however, deal volume has shown consistent growth, with a 26 percent increase in deal volume from 2016 to 2017 and a 24 percent increase from 2017 to 2018, so far. In fact, Q2 2018 saw both the highest quarterly PE deal volume and number of PE deals in the insurance industry in the past eight years, with 50 deals valued at a total of $10.51 billion.

Specialists & Tech Drive Continued M&A Volume in the Year Ahead

While deal-making headwinds are possible due to global geopolitical uncertainties—such as Brexit, current relations between the U.S. and China, and the possible slowdown of the global and U.S. economy —the outlook for the insurance industry remains positive for the year ahead. The appetite for insurance deals is likely to remain strong, given a continuation of economic and industry dynamics that compel buyers and sellers to consider how specialties fit within their business models and consolidate or divest accordingly to remain competitive.

One prospective specialty area of focus in 2019 is Insurtech. Facing competition from both large technology giants like Google and small-but-ambitious startups, insurers and brokerages are giving greater consideration to their technology investments and making non-traditional deals with complimentary businesses—take, for example, Zurich Insurance Group’s stake in Coverwallet, which provides technology that makes it easier for businesses to buy insurance online.

The focus on technology investments rings particularly true for the P&C sector, where insurers are often impacted by consumers’ digital experience expectations created by brands outside of the industry, like Amazon, Netflix and Uber, according to Property Casualty 360.5

Regardless of the type or size of the deal, successful insurance M&A requires careful consideration of unique risks, as well as deep analysis of proprietary data assets that can help guide smarter business decisions, while maintaining compliance with accounting and regulatory reporting requirements.

Navigating the Complexities of Insurance M&A

With the potential for increased regulation and rapid technology changes in the insurance industry, the M&A landscape is increasingly complex, requiring proactive and regular reviews of decision processes, risk mitigation strategies and capital preservation.

One such complexity is federal tax reform—tax year 2018 will be the first to see the impacts of the Tax Cuts and Jobs Act (TCJA). Many insurers have already implemented changes to adapt to the TCJA’s modifications to net operating losses, standards for tax reporting for life settlement transactions, tax reserve rules for P&C carriers and other federal and international industry tax standards. However, with an active deal market in front of them, potential buyers and sellers should further consider how tax reform could alter their M&A opportunities and use the upcoming tax season as a chance for a deep financial review. Visit our Tax Reform FAQ for Insurers for details on how TCJA will impact insurers in the 2018 tax season.

Additionally, middle market insurance buyers and sellers should consider whether Reps & Warranties (R&W) insurance could help improve transaction execution through added risk management. Generally, R&W policies cover the insured from risks and exposures that were not known at the time of the policy and deal. Quickly becoming a must-have component of M&A transaction processes, R&W can be purchased by either the buyer or seller and, ultimately, helps accelerate deal transactions, while shifting risks to the insurer by providing coverage for indemnification obligations resulting from breaches, such as lack of compliance with regulation or reliance on the seller’s representations about financial statements. Learn how R&W insurance works with our guide, How Deal Insurance Improves M&A Transaction Execution.

Keep in mind that R&W insurance is not a substitute for due diligence! Exclusions from R&W coverage—for example, issues that would be discovered during the appraisal process—require insurers to take a holistic approach to deal transactions, performing financial and tax due diligence for all potential deals. Those that do will be best-positioned to retain as much value as possible in the complex insurance M&A environment.

For more accounting, tax and M&A insights on the insurance industry, visit BDO’s Insurance Practice site.

Imran Makda is a Partner and leader of BDO’s Insurance practice. He can be reached at [email protected].

Jonathan Roberts is a Director in BDO’s Transaction Advisory Services. He can be reached at [email protected].

1 See data tables provided by PitchBook, updated as of 11/7/2018.

2 Insurance M&A deal value expected to increase by 150% in 2018, S&P Global Market Intelligence, October 9, 2018

3 Is 2018 the year of big-ticket M&A deals?, Insurance Business, April 23, 2018

4 2018 M&A Update, Willis Towers Watson and Mergermarket, October 31, 2018

5 5 trends influencing P&C insurance purchases, Property Casualty 360, June 19, 2018

SHARE