2015 Retail Compass Survey of CFOs

Retailers Offer Bright 2015 Outlook Rife with M&A Activity

Right as retailers rounded out 2014 with strong sales performance and the longest holiday shopping season on record, we surveyed 100 retail chief financial officers (CFOs) for our annual Retail Compass Survey of CFOs. What did we find?

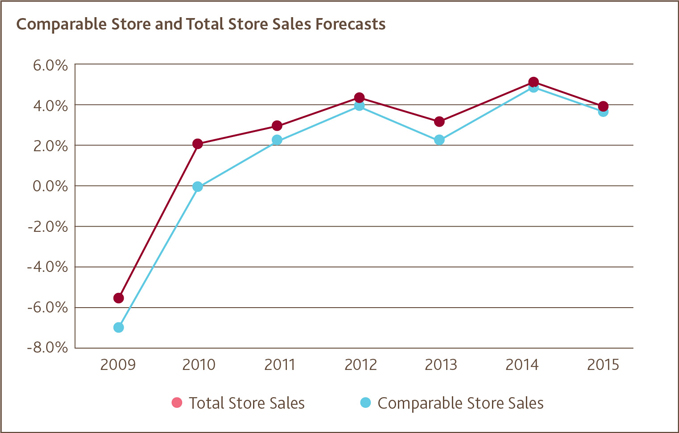

When it comes to the state of the consumer and the industry overall, retail CFOs forecast a sunny but aggressive 2015. While U.S. sales declined in December, January and February, longer-term indicators help maintain a healthy outlook for the year ahead, both for consumers and for the retail industry as a whole. With promising job gains and relative financial market stability over the last six months, consumer confidence has climbed to pre-recession levels, which helped push retailers to solid 2014 year-end sales growth of 3.5 percent, according to the National Retail Federation (NRF). Looking ahead, retailers are hopeful that warmer weather will help rebuild sales momentum as we move into the spring and summer months; overall, they project a 3.9 percent increase in total sales and a 3.7 percent increase in comparable store sales, nearly in line with the NRF’s 4.1 percent growth projection for 2015.

To capture these expected gains, retailers will continue to battle for consumers’ dollars in today’s highly competitive and increasingly digital landscape. But to unlock opportunities in the year ahead, more retailers are looking to M&A as a way to strategically accelerate growth, and CFOs predict that record deal flow will shake up the industry in 2015.

Consumer Confidence Surges as Unemployment Concerns Fall

Behind retailers’ upbeat sales growth projections are upward-trending consumer confidence levels that consistently rose in Q4 and reached 2007 levels in January, according to the Conference Board. February confidence declined slightly, but March levels rebounded, and a majority of retailers (54 percent) expect confidence levels will continue to improve in 2015, despite a number of issues that could disrupt gains.

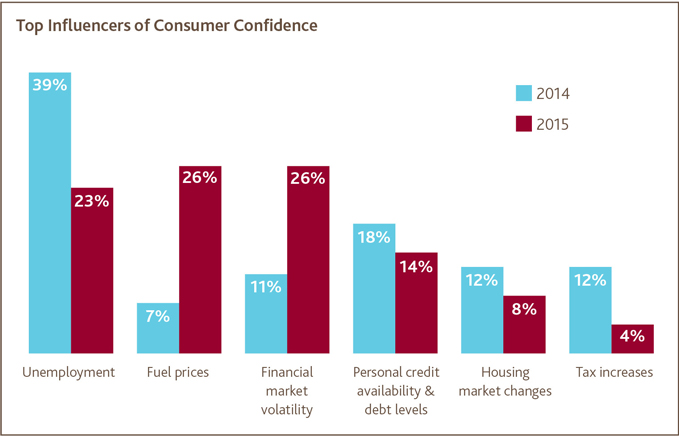

Chief among these concerns is financial market volatility, which roughly one-in-four CFOs (26 percent) note as a potential impediment to confidence. The stock market saw a shaky start to 2015, due in part to an uncertain geopolitical climate and ongoing declines in fuel prices, which have dropped by more than 50 percent year-over-year throughout Q1. Not surprisingly, another 26 percent of retailers expect fuel prices to notably impact confidence levels, compared to just seven percent in 2014. While these rock bottom pump prices could help buoy consumers’ discretionary spending in the year ahead, their impact to date appears limited. Weaker winter sales and recent growth in saving rates instead suggest that consumers have been putting aside this cash into savings accounts and using it to pay down debt. Meanwhile, with slow but promising job market gains in the second half of 2014 and impressive January and February jobs reports, only 23 percent of retailers cite unemployment as the top factor impacting consumer confidence this year—the lowest amount in the survey’s nine-year history.

“Steadily improving business and labor market conditions helped deliver a strong end to 2014, and as consumer confidence and unemployment are now at pre-recession levels, retail CFOs are upbeat about 2015 performance,” says Doug Hart, partner in the Consumer Business practice at BDO. “This momentum has already carried into the New Year, buoyed by ongoing recovery in the housing market and a record decline in fuel prices. As they look ahead to what are typically the slower spring months, retailers are hoping these positive signals carry through to the second half.”

Competition to Spur Aggressive Deal Activity

On the heels of 2014’s heavy deal flow, CFOs once again remain bullish about retail M&A, with 59 percent expecting the number of industry deals to increase in the year ahead—the most optimistic projection in the survey’s history. Already in Q1, talk of a potential merger involving Staples and Office Depot, as well as a possible buyout of Rite Aid by Walgreens, have hinted at the ongoing consolidation across the industry.

Competitive considerations will likely drive much of this activity, as a majority of CFOs (56 percent) say strategic buyers will be most acquisitive, and 16 percent say M&A is the growth tactic they are most heavily focused on for 2015, up notably from just three percent in 2014. More specifically, CFOs say strategic buyers will be primarily targeting market share (cited by 43 percent) and increased geographic coverage (cited by 24 percent, up from just eight percent in 2014). Another 16 percent say increased revenue and profitability will be the top driver of strategic deals, 12 percent say technology assets and intellectual property, and six percent point to increased distribution channels. In terms of where M&A will take place, 73 percent of CFOs expect it will primarily occur in the United States and 15 percent expect Asia to see the most activity. Survey respondents also expect buyers will pay an average EBITDA multiple of 5.2, up from 2014’s projected multiple of 4.2.

“Behind the uptick in retail deal flow is one simple truth,” says Ted Vaughan, partner in the Consumer Business practice at BDO. “Many traditional brick-and-mortar retailers have fewer opportunities for growth, and are turning to M&A to gain market share through consolidation or enter new markets to extend their brand and reach. On the other hand, we’re seeing more and more online-only retailers eyeing floor space to demo products and engage with consumers, and acquisitions can be an effective way to do so.”

Competition and Consolidation Round out Retailers’ Top Concerns

Cutthroat competition continues to pressure retailers on a number of fronts, and a plurality of CFOs (37 percent) note both competition and consolidation as their top concern for 2015. On one hand, the increased focus on M&A as a key growth strategy is causing more retailers to look over their shoulders as they scramble to secure greater market share. Meanwhile, with modest sales growth on their radars, some retailers will also be vying for qualified workers to support both brick-and-mortar and e-commerce operations. Nearly six-in-ten (59 percent) plan to maintain their 2014 employment numbers, but one-in-three retailers will increase their rosters in the year ahead, and a majority (59 percent) will increase their compensation levels to attract and retain key employees.

Retailers Eye Digital Investments to Nab Online Sales Growth

Last year was yet another record-breaker for U.S. online sales, as the Commerce Department estimated a whopping $304.9 billion of goods purchased via digital channels. On the heels of this growth, retail CFOs expect consumers’ appetite for online buying to continue its strong upward trajectory in 2015. This year, nearly four out of five (78 percent) retail CFOs anticipate their online sales to grow. Overall, they forecast an impressive 9.9 percent boost to e-commerce sales in 2015.

To reach more consumers across digital platforms, a plurality (37 percent) of CFOs say their primary growth tactic for 2015 is expanding their e-commerce and mobile offerings. In a similar vein, when asked where CFOs plan to spend the most capital this year, 22 percent point to e-commerce and mobile channels. Mobile commerce is growing at nearly three times the rate of overall e-commerce, according to PayPal and Ipsos, and to keep pace, CFOs are investing heavily to enhance each touchpoint on their customers’ path to purchase. For those with mobile platforms, 68 percent plan to increase their investment in mobile technologies in 2015, a leap from the 40 percent who planned to do so last year.

“Consumers crave speed, selection and the convenience of shopping anywhere and anytime at the touch of a button,” says Natalie Kotlyar, partner in the Consumer Business practice at BDO. “But investing in online and mobile systems is a difficult balancing act. Staying competitive requires retailers to deliver a seamless, engaging experience across channels, while at the same time investing to protect their consumers from the growing threat of cyber attacks.”

With more digital growth on their radar, retailers are committed to both strengthening and securing their platforms, and a plurality (28 percent) of CFOs anticipate investing the most capital into their IT systems and technology this year. Despite a decline in the overall number of cyber attacks against retailers in 2014, according to IBM, the year was still dominated by headlines of high-profile data breaches impacting major players, including Home Depot, Michaels and Supervalu. As retailers look to bolster their cybersecurity to avoid such scenarios, the number of CFOs noting protection of customer data as their top concern increased from 12 percent in 2014 to 20 percent this year.

It therefore comes as little surprise that more than half (56 percent) of CFOs have increased their spending on cybersecurity in the last 12 months. Among these retailers, 89 percent have begun using new software security tools and 81 percent have created a security breach response plan. At the same time, 40 percent have hired an external security consultant and 11 percent have brought in a Chief Security Officer.

“We’re seeing more retailers realizing the need for proactive measures when it comes to managing their cybersecurity risks,” says Karen Schuler, Managing Director at BDO Consulting, leading the firm’s Forensic Technology Services practice in Washington, D.C. “Investing more capital into software, response planning and key personnel not only boosts organizations’ incident responsiveness. It also gains trust among shareholders and customers. Ultimately, proactive investments save organizations money over time, as they help mitigate risks from the outset and enable companies to more efficiently respond when a breach does occur.”

Retail IPOs Expected to Hold

This past year saw 16 retail and consumer IPOs, down slightly from 2013 levels, according to Renaissance Capital. Still, retail IPOs were among 2014’s top performers, and following strong returns from the IPO of PE-backed Michaels in 2014, there are positive signs for specialty retailers and PE-backed companies that are considering going public.

Looking ahead, two-thirds of retail CFOs expect the number of retail and consumer products IPOs to stay about the same as 2014 levels, while 20 percent forecast an increase. These projections fall in line with BDO’s recent IPO Outlook Survey, which found that a plurality of investment bankers (45 percent) expect the number of retail and consumer products IPOs to remain flat this year, while 26 percent forecast an increase. CFOs say strength of brand (cited by 37 percent) and the strength of the U.S. economy and stock market (cited by 31 percent) will be the top factors driving a company’s ability to go public this year.

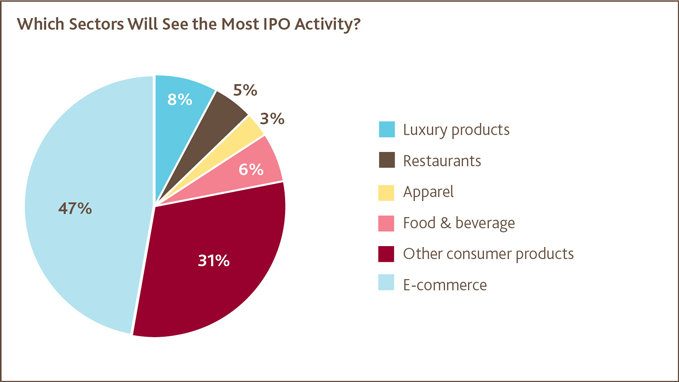

When asked which sectors are likely to see the most IPOs in 2015, nearly half of CFOs (47 percent) point to e-commerce, and 31 percent say other consumer products. Surprisingly, only five percent of CFOs expect restaurants to see the most IPOs this year, despite the success and returns from fast-casual concepts Zoe’s Kitchen and The Habit Restaurants’ offerings in 2014. Shake Shack’s January IPO gave the company a valuation of $1.6 billion after the first day of trading, according to Nation’s Restaurant News.

“Recent restaurant industry IPO debuts like Shake Shack and El Pollo Loco have been turning heads,” says Alexis Becker, co-leader of the Restaurant practice at BDO. “There’s a bright spotlight on the hybrid fast-casual segment whose enthusiastic followers and well-known brands are rattling traditional fast food and casual restaurants, and CFOs’ conservative forecast for restaurant IPO activity in 2015 may reflect the uncertainty of the impact of this competitive and quickly evolving sector.”

West Coast Ports Have Retailers Rethinking Options

While labor issues at the West Coast ports were officially resolved in late February, there is ongoing congestion that will likely cause delays and increase transportation costs over the coming years. As a result, retailers are reassessing their sourcing strategies as a way to reduce their future exposures. This year, 43 percent of retail CFOs said that North America was the most attractive sourcing option, with another 12 percent citing Central America, including Mexico, and four percent citing South America. Although labor and importing costs from traditional sourcing strongholds like China are on the rise, 37 percent of CFOs still say Asia is the most attractive sourcing opportunity.

Tax Concerns Vary across the Board

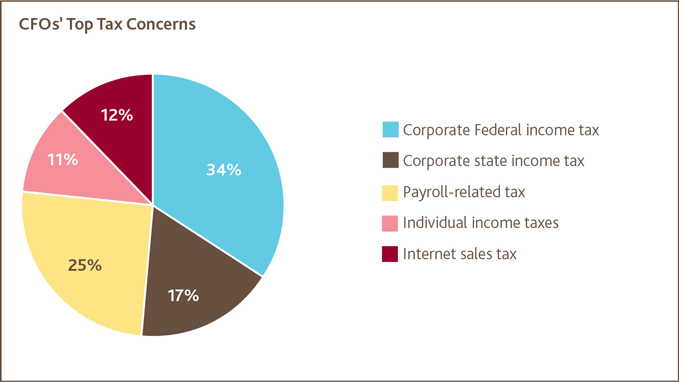

With ongoing debates about tax reform and more government scrutiny around tax inversion deals, a plurality of CFOs (34 percent) are most concerned about corporate federal income tax this year, directly in line with 2014’s numbers. As retailers continue to implement Affordable Care Act provisions, payroll-related tax ranks second among their top tax challenges, with 25 percent of CFOs citing it as such.

Despite retailers’ heightened digital focus in 2015, internet sales tax is not a major concern. After being shelved in the House during December, the Marketplace Fairness Act was reintroduced in the Senate in March. But when asked about their concerns, only 12 percent of CFOs cite it as their top tax worry, down from 17 percent in 2014. At the same time, most CFOs (69 percent) say they expect minimal impact on their business from the potential legislation. Still, for those CFOs who do foresee challenges were the bill to be enacted, 15 percent predict an increase in the cost of systems to track and report sales, and four percent anticipate a decline in e-commerce sales.

Regarding regulations overall, after entering 2015 with a relatively mild environment in Washington and a GOP-controlled Congress, retailers’ concerns over federal, state and/or local regulations fell nearly 50 percent year-over-year, with only 19 percent noting it as their top perceived risk for the year ahead.

Focused on Finances, Retailers Look to EBITDA as Priority Metric

While the market still uses sales as its preferred performance indicator, 39 percent of CFOs say the financial metric they are most focused on in 2015 is EBITDA, and only 20 percent of retailers say they are most focused on gross sales, down from 32 percent in 2014. Another 20 percent say they are watching free cash flow most closely, while 11 percent point to comparable store sales and 10 percent say return on equity is their most important financial metric. With positive market conditions for deal activity, retailers are looking to liquidity to help fuel strategic initiatives, and to do so, many may look to refinance debt in the year ahead. Just over two-thirds of retail CFOs (68%) expect to encounter some level of difficulty refinancing debt in 2015, down from 74 percent last year. However, only six percent of CFOs expect it to be “very difficult.”

Thanksgiving Weekend Holiday Promotions Flop

Holiday sales increased by four percent in 2014, according to the NRF, in line with the projection of 4.1 percent identified in BDO’s Retail Compass Survey of CMOs last fall. This past season was also the longest on record, as retailers began their promotional activity in earnest the day after Halloween and continued into January.

Catching consumers’ attention early and often required brands to offer convenient and competitive deals for online shoppers, and free shipping (cited by 26 percent), pricing matching (cited by 18 percent), and email and social media promotions (cited by 16 percent) rounded out the most successful 2014 holiday promotional strategies, according to CFOs. At the same time, with Black Friday and Cyber Monday sales relatively muted due to more promotional activity in early November, Thanksgiving Weekend deals were the season’s least successful strategy, cited by 31 percent of retailers as such.

Revenue Recognition Standard not yet on Retailers’ Radar

On May 28, 2014, the Financial Accounting Standards Board and the International Accounting Standards Board announced a new revenue recognition standard that takes effect in 2017, replacing existing U.S. generally accepted accounting principles (GAAP). Although the new standards may significantly impact the way retailers recognize revenue, BDO’s survey found that more than half of retail finance chiefs (59 percent) have not yet familiarized themselves with the changes.

As market conditions continue to improve and align, retail CFOs are largely optimistic about the health of the industry and their 2015 performance projections. Intense competition will remain entrenched across the sector, forcing retailers to strategically invest in both their people and their platforms to stay aggressive and relevant. The year ahead will reward those retailers who proactively and creatively vie for influence and market share to overcome the industry’s pressures and achieve growth.

“The Marketplace Fairness Act has gained some recent momentum in Congress, but it’s still uncertain whether the bill will maintain enough traction to push through the legislative process,” says Randy Frischer, tax partner in BDO’s Consumer Business practice. “Looking across the industry, many of the largest retailers anticipate little effect on their bottom line were the bill to be enacted, while smaller retailers are generally concerned that the Act could hinder competition and create administrative burdens.”

The BDO Retail Compass Survey of CFOs is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly with chief financial officers. The survey was conducted within a scientifically-developed, pure random sample of the nation’s leading retailers. The retailers in the study were among the largest in the country. The ninth annual survey was conducted in January of 2015.

Have Questions? Contact Us

SHARE