Year-end Transfer Pricing Considerations for 2021

For companies doing business around the world, the converging effects of COVID-19 and global tax complexities have caused an increased flurry of activity at year-end.

Executives around the world weighed in on the key business issues impacting their transfer pricing policies and their highest priorities to prepare for and adapt to evolving global tax challenges.

Key Regional Takeaways From The EMEA, Asia Pacific, and Americas Regions

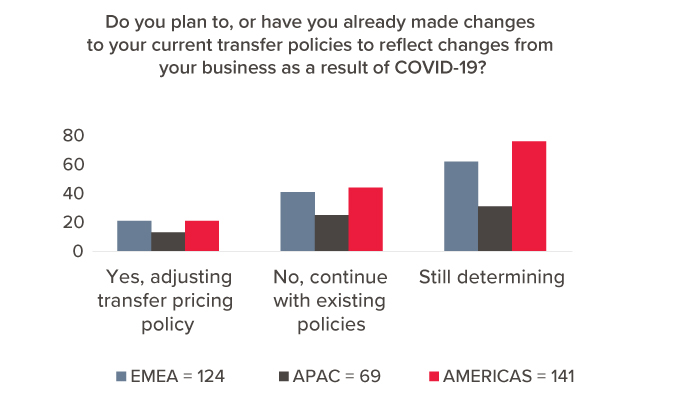

- Most companies are determining if changes to transfer pricing policy and/or pricing are needed. Because the current year is not a true reflection of historical performance, there is value in taking a fresh look at current models.

- With little guidance from local taxing authorities on how to effectively adjust transfer pricing policies for unexpected business interruption this year, many companies are reevaluating existing sets of comparables and assessing whether multi-year ranges are applicable.

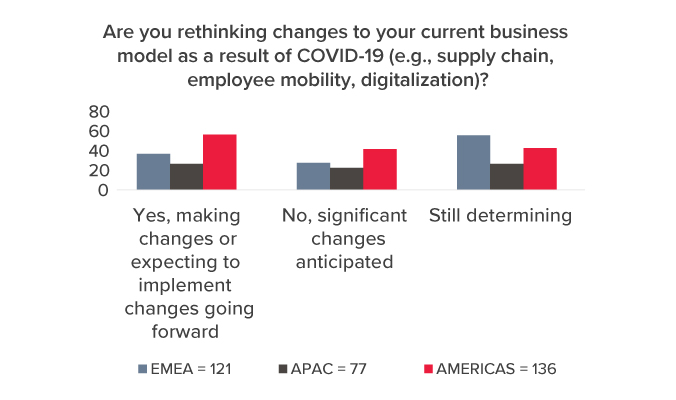

- Changes to current business models have or will occur for most companies. This is most evident in the Americas region where companies are more likely to be focused on achieving greater control over the supply chain as a result of COVID-19.

- Currently, new measures to tax digital products and services are having the most significant impact on how companies do business. The OECD’s agreed-upon approach to taxing the digital economy is expected in mid-2021. Until then, countries continue to introduce unilateral measures to tax digital products and services.

SHARE