For the most recent updates on these rules, please visit Climate Reporting Due 2026: California Rulemakers Provide Updates on Senate Bills (SB) 261 & 253.

California’s slew of new climate reporting laws will require thousands of public and private companies to disclose details like their Scope 3 emissions, climate risks and use of voluntary carbon offsets.

If companies impacted by these laws want to keep doing business in California — a $3.6 trillion economy — without paying penalties, they’ll have to meet reporting requirements for some or all of the state’s three new climate disclosure laws.

Companies that need to comply with any or all of the three new laws should begin to prepare now.

Emissions and Climate Risk Reporting

Two of California’s climate reporting laws, the Climate Corporate Data Accountability Act (SB 253) and Greenhouse Gases: Climate-Related Financial Risk (SB 261), apply to large companies that do business in the state and exceed certain revenue requirements.

SB 253 requires companies to disclose their Scope 1, 2 and 3 emissions and obtain independent third-party assurance of their data. SB 261 requires companies to publish climate-related financial risk reports every two years.

Reporting under both laws is set to begin in 2026, and as the state moves toward implementation, some details and deadlines may be updated.

In September 2024, the laws were amended slightly by the adoption of SB 219. Reporting still begins in 2026; however, the deadline for the California Air Resources Board (CARB) to develop and adopt emissions reporting requirements was pushed back from January to July 2025. This further compresses the timeline for companies to prepare reports, making planning ahead even more crucial.

The amendments permit consolidated emissions reporting at the parent company level, and they remove a deadline for Scope 3 emissions to be reported within 180 days of Scope 1 and 2 data. Instead, the Scope 3 reporting deadline will be determined by CARB.

CARB has issued an Enforcement Notice regarding SB 253. This notice, released on December 5, 2024, indicated that CARB will not issue penalties in the first reporting cycle to companies who demonstrate good faith effort to comply with the law. According to the Notice, CARB recognizes that companies may need some lead time to prepare their reports regarding their Scope 1 and Scope 2 emissions, which are due in 2026, based on 2025 data. This does not reflect an extension of the compliance deadline but rather an understanding that comprehensive reporting will take time.

Imminent Regulations and Application Analysis

CARB is set to adopt regulations governing the required disclosures by July 1, 2025, with reporting entities due to publicly disclose emissions starting in 2026 on a date to be determined by CARB.

California SB 253 and SB 261 apply to an entity that meets the following criteria:

(1) A partnership, corporation, limited liability company, or other business entity formed under the laws of California, the laws of any other state of the United States or the District of Columbia, or under an act of the Congress of the United States;

(2) Total annual revenue from the previous fiscal year in excess of $1 billion ($500 million for SB 261);

And,

(3) Does business in California.

Neither SB 253 nor SB 261 clearly defines “doing business" in California, and the bills do not define how revenue should be calculated. More details are expected to be included in CARB’s upcoming regulations.

It should be noted that the laws may ultimately use the California Franchise Tax Board (FTB) definition, which was referenced in a California State Senate floor analysis of SB 253 before the bill was adopted. The FTB considers an entity to be “doing business” in California if it meets any of the following criteria:

- Engaging in any transaction for the purpose of financial gain within California, or

- Being organized or commercially domiciled in California, or

- Sales > $735,019; Property > $73,502; or Payroll > $73,502, or

- In each case, an amount > 25% of the total.

Reports may be consolidated at the parent company level. If a subsidiary of a parent company qualifies as a reporting entity, the subsidiary is not required to prepare a report separate from its parent company.

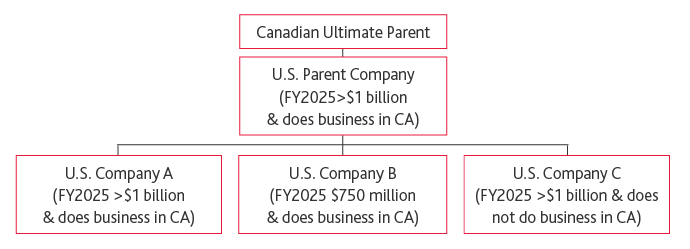

In this example, the entities would report under SB 253 as currently drafted, as follows:

- Canadian Ultimate Parent would not be obligated to report because it is not a U.S. legal entity.

- U.S. Parent Company would be obligated to report because it does business in California and exceeds the revenue threshold of $1 billion. U.S. Parent Company would prepare a consolidated emissions report, which includes U.S. Companies A, B and C.

- Although U.S. Company A meets the required thresholds for SB 253, it would not be required to provide a separate report because it is included within the consolidated report of the U.S. Parent Company.

- U.S. Company B would not be obligated to report because, although it does business in California, it does not exceed the $1 billion revenue threshold currently stipulated by SB 253. However, because U.S. Parent Company is preparing a consolidated report, Company B would be included.

- U.S. Company C would not be obligated to report because although it exceeds the $1 billion revenue threshold, the company does not do business in California. However, because U.S. Parent Company is preparing a consolidated report, Company C would be included.

Current requirements of 253 and 261 are summarized below.

GHG Emissions Reporting (SB 253) | |||

| Applies To1,2 | Public and private U.S. companies with total annual revenues > $1 billion and do business in California | ||

| Disclosure Highlights |

| ||

| Reporting Frequency | Annual | ||

| Disclosure Process | Companies must submit data to an emissions reporting organization to be contracted by the state board | ||

| Noncompliance Penalties | Up to $500,000 | ||

| Scope 1 Reporting | Scope 2 Reporting | Scope 3 Reporting | |

| First Report Due | 20263 (2025 Data) | 20263 (2025 Data) | 20274 (2026 Data) |

| Assurance Effective Date |

|

|

|

Climate-Related Financial Risk Reporting (SB 261) | |

| Applies To2,6 | Public and private U.S. companies with total annual revenues > $500 million and do business in California |

| Disclosure Highlights | Climate-related financial risk reports that:

|

| Reporting Frequency | Every two years |

| Disclosure Process | Companies must publish reports on their websites |

| Noncompliance Penalties | Up to $50,000 |

| First Report Due | Jan. 1, 2026 |

Voluntary Carbon Offsets and “Net Zero” Claims

The third law, Voluntary Carbon Market Disclosures (AB 1305), increases transparency around voluntary carbon offsets.

Some portions of AB 1305 apply only to companies that market or sell voluntary offsets in California. However, several of its requirements apply to companies that purchase and use these offsets or companies that make claims that their business or product contribute no net carbon dioxide or greenhouse gas emissions to the atmosphere — commonly known as achieving “net zero” or “carbon neutral.”

Voluntary Carbon Market Disclosures (AB 1305) | |

| Applies To7 |

|

| Disclosure Highlights |

|

| Reporting Frequency | Annual |

| Disclosure Process | Companies must publish disclosures on their websites |

| Noncompliance Penalties | $2,500 per day for each violation — up to $500,000 |

| First Report Due | Jan. 1, 2025 |

How to Prepare

For companies that will be impacted by California’s climate reporting laws, here are some steps to take to get ready.

1. Conduct a Gap Analysis

First, evaluate the organization’s existing sustainability reporting program, if one is in place. Some companies may already be fulfilling some of the California climate laws’ requirements through voluntary disclosures or other mandatory reporting.

Take inventory of any climate-related disclosures, including any TCFD, business resilience plan and emissions reporting. Additionally, determine whether assurance over some or all of emissions data or claims is being provided. If not, for SB253 determine whether processes for assurance readiness are in place.

After establishing this baseline, identify data, processes, controls and reporting gaps that will need to be addressed to comply with California’s requirements.

2. Design a Roadmap

Next, formalize the plan to establish leadership, processes, controls and protocols to comply with California’s climate laws. This will likely require a team that represents business functions across the organization. Team members and their roles may include:

- Sustainability, Operations and/or Finance — Conduct greenhouse gas inventory assessments and collate required information for disclosure, including execution of controls to validate data. Also lead coordination with a third-party assurance provider.

- Internal Audit — Lead efforts toward assurance readiness. Evaluate controls and processes.

- Investor Relations and/or Communications — Manage disclosure drafting, publication and filing.

- Enterprise Risk Management — Integrate the climate risk assessment into broader risk management functions.

- Legal — Oversee compliance and legal risk exposure.

- IT — Implement the necessary software for emissions data collection.

3. Data Collection and Reporting

Finally, the company will be ready to execute on the roadmap.

This step may include more work to define emission sources or other relevant climate-related information such as physical and transition risks, and it may require collecting additional data. It will also require the design and/or evaluation of internal data collection controls and processes around metrics. A flowchart and risk control matrix will be helpful in this effort.

Engagement with an independent third party to obtain assurance before reporting will also be part of this step.

Efficiencies for Future Rulemaking, Business Performance

While the initial administrative and operational demands of California’s requirements may seem onerous, there are clear benefits and efficiencies, despite the laws being challenged in federal court. Companies can leverage the information they gather and report to enhance decision-making rather than viewing the process as simply a compliance exercise. For example, the data can inform key risk management functions, identify business opportunities, and help improve discourse with investors and other stakeholders.

California’s climate disclosure requirements seek to establish a baseline of climate reporting that will allow companies to fulfill and comply with their jurisdictional requirements associated with global climate reporting.

Additional Resources and Related Links

BDO can help companies prepare for California climate reporting and identify other sustainability-related opportunities and risks. We offer practical guidance and solutions, tailored to each organization’s industry and priority outcomes. Contact us to learn more.

References

1 The law defines a reporting entity as a partnership, corporation, limited liability company or other business entity formed under the laws of California, the laws of any other U.S. state or the District of Columbia, or under an act of U.S. Congress, with total annual revenues of more than $1 billion and that does business in California.

2 The laws do not clarify what it means to ‘do business’ in California. This will be established by CARB as it develops regulations to carry out the laws. Criteria could potentially align with amounts set by the California Franchise Tax Board.

3 CARB will determine an exact date. Reporting period covers previous fiscal year.

4 Beginning in 2027 and annually thereafter, on a schedule to be specified by CARB. Reporting period covers previous fiscal year.

5 CARB may establish an assurance requirement for third-party assurance engagements of Scope 3 by Jan. 1, 2027.

6 The law defines a covered entity as a corporation, partnership, limited liability company or other business entity formed under the laws of California, the laws of any other U.S. state or the District of Columbia, or under an act of U.S. Congress, with total annual revenues of more than $500 million and that does business in California. Insurance entities are excluded due to TCFD reporting requirements through the National Association of Insurance Commissioners.

7 ‘Making claims in the state’ of California is not clearly defined in AB 1305. Until there is further guidance, a company may be subject to compliance if it does any business in California.