Incorporating sustainable practices can help organizations address a host of common business challenges and unlock opportunities such as enhanced resource management and reduced costs from operational efficiencies. In this edition of BDO Sustainability Insights, we dive into an example of sustainability’s impact — the potential for new revenue streams from minting engineered carbon credits tied to additionality associated with sustainable operations and products. We also include an update on compliance requirements under the EU’s CSRD as they relate to the Omnibus proposals and steps to prepare for an EcoVadis assessment for a company’s customers who require it.

FEATURED INSIGHT

Now May Be the Time to Start Minting and Selling Carbon Credits

In a commercial environment defined by uncertainty and financial pressures, companies may be able to leverage their investments in sustainability and efficiency to drive additional revenue by minting and selling carbon credits.

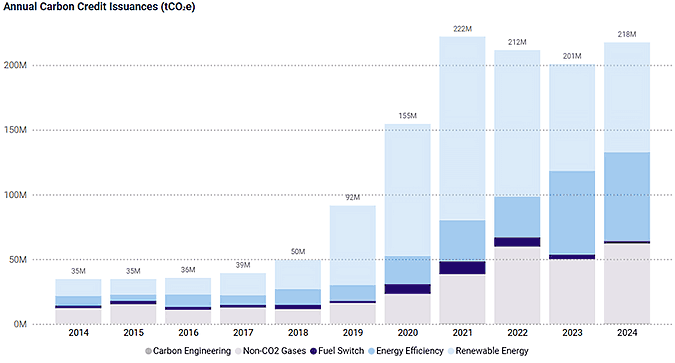

Last year, 218 million metric tons of greenhouse gas emissions were avoided or removed from the atmosphere by projects tied to engineered carbon credits, according to MSCI — that’s more than four times the engineered carbon credits issued in 2018.

Source: MSCI Carbon Markets as of June 23, 2025. Includes credit transactions from CDM - NDC Eligible, EcoRegistry, Gold Standard, ACR, Verra, CAR, Puro Earth, GCC, BioCarbon.

Economic pressures, combined with the maturing carbon credit market and businesses’ growing adoption of sustainable processes and products, mean that now may be the time to consider minting and selling engineered carbon credits. Read on to learn how the process works and why it matters.

Companies That May Be Eligible

Engineered carbon credits can be issued for projects that provide additionality to carbon reduction benefits achieved through investments in low-carbon technology and efficiencies. These can be loosely bucketed into carbon avoidance or carbon sequestration projects.

This means that companies that have invested in low-carbon technologies, processes, or products could mint engineered carbon credits that can be monetized through the Voluntary Carbon Market (VCM).

Questions to Ask: Could My Company Be Eligible to Mint and Sell Carbon Credits?

- Does my company have a range of low-carbon products that it advertises in the marketplace?

- Has my company invested in operational efficiencies in its manufacturing or industrial processes?

- Am I considering implementing the above?

If the answer to any of these questions is ‘yes,’ minting carbon credits may be a good fit for your company.

Reasons To Consider Carbon Credits

Engineered carbon credits can help companies drive new revenue streams from investments in operational or sustainability-focused efficiencies.

Issuing credits can also help companies gain recognition for the work they’re doing to embed sustainability into their operations. The credits help show measurable action: For example, ‘If my company runs its plant in this way, we reduce X amount of carbon from entering the atmosphere.’

How It Works

To mint a carbon credit, projects must adhere to a methodology that has been verified by a third-party (e.g., Gold Standard or Verra).

BDO helps companies establish a project-specific verification methodology to achieve this requirement. We leverage Environmental Product Declaration and Life Cycle Assessment data to develop a project-specific verification methodology, either from scratch or utilizing an existing methodology, then work with the verifiers to gain approval.

The approved verification methodology is used to establish the company’s Monitoring, Reporting and Verification process (MRV) to mint and sell carbon credits on the voluntary market.

Why It Matters

Companies that are innovating to develop low-carbon processes and products may be able to leverage carbon credits for new revenue streams and to help finance decarbonization and net zero commitments.

They’d be entering a VCM that has made considerable progress. Annual sales for credits are currently steady at $1.4 billion, according to MSCI, but are projected to reach between $7 and $35 billion by 2030 and $45 to $250 billion by 2050 as timelines for businesses’ climate commitments grow closer and the carbon credit market continues to mature.

Think now may be the time to start minting and selling carbon credits? Contact BDO for support.

REGULATIONS & STANDARDS

CSRD Omnibus: ‘Stop-the-Clock’ Adopted, Proposed Changes and Next Steps

The European Union’s Corporate Sustainability Reporting Directive (CSRD) requires companies in its scope — including certain U.S. businesses — to disclose sustainability information and obtain independent third-party assurance over their reporting.

In February, the European Commission proposed several updates to the CSRD’s scope and reporting requirements via an Omnibus package of proposals (“the Omnibus”). A ‘Stop-the-Clock’ directive included in the Omnibus, which granted a two-year extension to reporting deadlines for companies that were due to report in 2026 and 2027, has been adopted.

The Omnibus is now undergoing the EU's legislative process, and further amendments are possible before the final text is approved. The EU has requested a fast-track process for the Omnibus, aiming to finalize the changes by the end of 2025 or early 2026.

Proposed changes include simplified European Sustainability Reporting Standards (ESRS) with fewer data points and removing the potential for reasonable assurance requirements. Proposals also include scoping changes highlighted below.

| CSRD Compliance: Current & Omnibus Proposal | |||

|---|---|---|---|

Compliance Wave | Organization Type (Current Law) | Reports Due | Organization Type (Omnibus Proposal Feb. 2025) |

Wave 1 | Large Listed Entities: >500 employees & >€50M revenue or >€25M assets | 2025 (FY24 data) | Large Entities: >1,000 employees & >€50M revenue or >€25M assets |

Wave 2 | Other Large Entities:

| 2028 (FY27 data) | |

Wave 3 | Listed SMEs, small credit institutions, and insurance undertakings | 2029 (FY28 data) | Wave 3 entities would no longer need to comply |

Wave 4 | Non-EU Groups: >€150M revenue in EU & branch* or large** or listed subsidiary | 2029 (FY28 data) | Non-EU Groups: >€450M revenue in EU & branch† or large subsidiary** |

*EU Branch: **Large subsidiary:

†EU Branch: | |||

Why It Matters

Even with delayed implementation dates for certain companies and proposed simplified requirements, the CSRD establishes extensive mandatory sustainability disclosures. For example, companies will need to conduct a double materiality assessment and obtain limited assurance over sustainability information. They’ll also need to disclose information ranging from their business strategy and model to governance, controls, metrics and targets as they relate to sustainability matters.

Fulfilling these requirements is likely to take time and careful preparation. To stay on track, companies should take a proactive approach to determining potential scenarios of Omnibus applicability to their business. Companies can also assess their current reporting and assurance readiness, conduct their double materiality assessment, and perform a pilot test the year prior to compliance deadlines to uncover any areas that need to be addressed. For Wave 2 companies, this pilot test would cover fiscal year 2026 data, and for Wave 4 companies it would cover fiscal year 2027 data. If the Omnibus is finalized as drafted in February 2025, Wave 3 companies would no longer need to comply.

Contact BDO for help navigating CSRD reporting and potential Omnibus impacts.

HOW TO SERIES

How To Prepare an EcoVadis Sustainability Assessment

Learn what an EcoVadis sustainability assessment is and steps companies can take to prepare their submission.

What is an EcoVadis sustainability assessment?

EcoVadis is a sustainability ratings provider that assesses and scores a company’s sustainability performance. Once assessed, the company’s rating is then made available upon request through the EcoVadis website.

To gather information, EcoVadis asks reporting companies to fill out an industry-specific questionnaire and submit supporting documentation — such as sustainability reports, policies, operating procedures, and GHG inventory reports and third-party verifications if available — to substantiate their answers.

Companies receive an overall score, in addition to subscores that rate their performance across the specific themes of environment, labor and human rights, ethics, and sustainable procurement. Top performers may also be awarded an EcoVadis medal or badge.

Why do EcoVadis assessments matter?

Some customers make EcoVadis a term of engagement for their suppliers, so completing an assessment may be required for obtaining or keeping certain business opportunities.

Assessment results can also help companies advance their sustainability strategy, as scorecards identify steps a company can take to help improve its sustainability efforts. Results also include information on a company’s performance relative to its peers, and this benchmarking can further inform sustainability strategy and program development.

According to EcoVadis, more than 150,000 companies receive ratings, with more than 250 sectors covered in EcoVadis methodology.

What steps can a company take to prepare its EcoVadis submission?

Because an EcoVadis assessment covers so many topics, a company’s first submission may be a significant undertaking that requires input from subject matter experts (SMEs) across the organization.

To prepare, companies can begin by socializing the importance of EcoVadis and involving SMEs several months before the targeted submission date. A project manager will need to coordinate with these individuals to answer questions and obtain documentation about the company’s sustainability-related programs and processes. EcoVadis accepts up to 55 supporting documents each submission year, and it’s not unusual for assessments to include input from many SMEs across business functions.

Subsequent annual submission cycles carry over answers and documentation from previous questionnaires, allowing companies to focus resources on confirming the continued validity of information and determining if they wish to provide additional information.

Contact BDO for help navigating the EcoVadis assessment process and developing a sustainability strategy and program.

Contact Us

Whether you are starting your sustainability journey, seeking assurance on your reporting, need help with tax transparency and credits, or other services, BDO Sustainability & ESG services and solutions can help.