The Counter: Restaurant Industry Scorecard

Q1 2019

Same-Store Sales

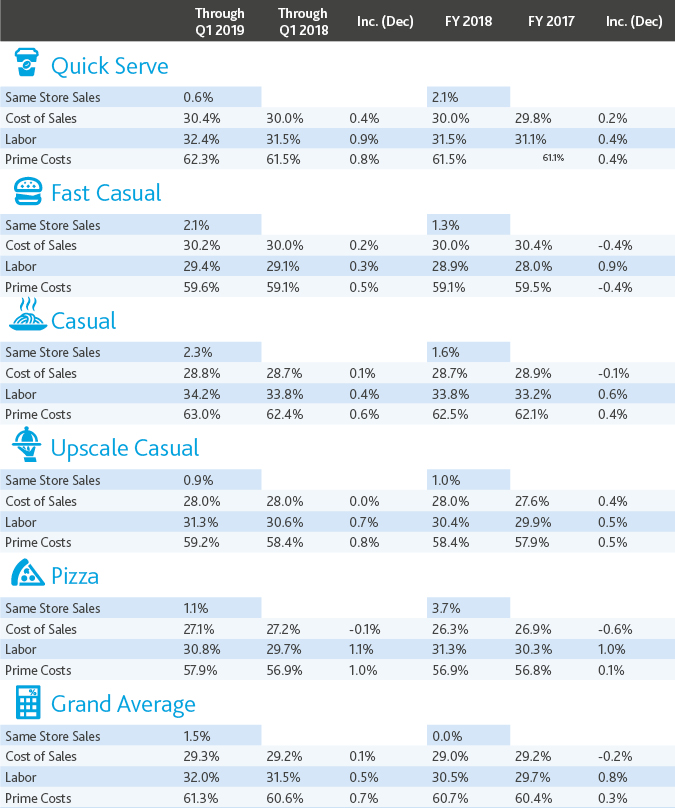

Same-store sales for the first quarter of 2019 rose 1.5%, level with 2018 year-end results. As restaurants strive for profitability in a highly competitive and mature market, many are recognizing that to stay in business, they need to depart from business-as-usual.

To meet evolving customer expectations, restaurants are continuing to enhance their digital presence, as well as roll out delivery, promotions and loyalty programs. These efforts helped drive same-store sales growth in the first quarter, partially offsetting the persistent challenge of higher labor costs.

The Casual segment’s same-store sales saw the highest increase in the first quarter, rising 2.3% and outpacing Fast Casual’s gains of 2.1%. Unlike the Fast Casual segment’s results, which were bracketed by a 9.9% increase in same-store sales by Chipotle and a -4.7% decrease by Potbelly’s, the Casual segment posted modest yet steady same-store sales: Texas Roadhouse again led Casual peers with 5.2% growth in same-store sales, including a 2.6% increase in traffic. The only negative result for the Casual segment came from Darden Restaurants’ Bahama Breeze, which saw a dip of -3.7% in same-store sales.

Darden’s Olive Garden and Longhorn, however, posted same-store sales growth of 4.3% and 3.8%, respectively. Notably, Olive Garden’s same-store sales were driven in part by a decrease in limited time offers (LTOs). Their push toward fewer specialty value items caused check sizes to increase 4.2%. While pulling back on LTOs worked for Olive Garden, it should be noted that the restaurant benefits from favorable traffic; other brands struggling to get diners through the doors will likely continue to promote LTOs.

In Fast Casual, Chipotle’s same-store sales (+9.9%) were driven by digital sales, which doubled, and a new loyalty rewards program, launched in March. In addition to its loyalty program, Chipotle’s digital approach includes order ahead, delivery, catering, second make lines, and a mobile order pickup shelf.

The Quick Service Restaurant (QSR) and Upscale Casual segments saw the smallest gains, with 0.6% and 0.9% increases in same-store sales, respectively. However, excluding two segment anchors, Steak N Shake (-7.9%) and Good Times Burger (-7.5%), QSR same-store sales were up 2.5%, with YUM! brands, Kentucky Fried Chicken (+5%) and Taco Bell (+4%) and McDonald’s (+4.5%) leading the segment’s same-store sales. McDonald’s benefited from its promotions of hour-long free bacon, 2 for $5 mix-and-match, and donut sticks.

QSR Carrols Restaurant Group (+2.4%) is aggressively acquiring more Burger King and Popeyes restaurants, thereby expanding and diversifying its geographic footprint. In addition to completing an April acquisition of 165 Burger King and 55 Popeyes restaurants, Carrols is approved to acquire an additional 500 Burger Kings and has agreed to develop 200 new Burger Kings over the next six years.

In Upscale Casual, Capital Grille and Eddie V’s, also owned by Darden, saw the highest same-store sales (4.3% and 3.7%, respectively), while two other restaurants it owns, Yard House and Seasons 52, saw the weakest same-store sales (-2.1% and -1.3%, respectively).

The Pizza segment, excluding Papa John’s, saw same-store sales growth of 1.1%. Domino’s, which had growth in both tickets and orders, saw same-store sales increase 2.1%, though acknowledged it was experiencing pressure from aggressive marketing from third-party aggregators. Pizza Hut’s same-store sales were flat for the quarter. The restaurant said its value menu items helped drive traffic, as well as provide a pipeline for future product innovation.

Commodities and Cost of Sales

As restaurants seek to mitigate the impact of labor costs, which continue to rise and exert the most significant downward pressure on margins, they are focusing on variables they can control: namely, cost of sales and managing inventory—for example, by challenging broadline vendors on prices and controlling portion size and waste. Restaurants should absolutely be utilizing software that analyzes actual versus theoretical food and beverage costs in order to address potential lost opportunities for better margins and to make informed decisions on how to improve those margins.

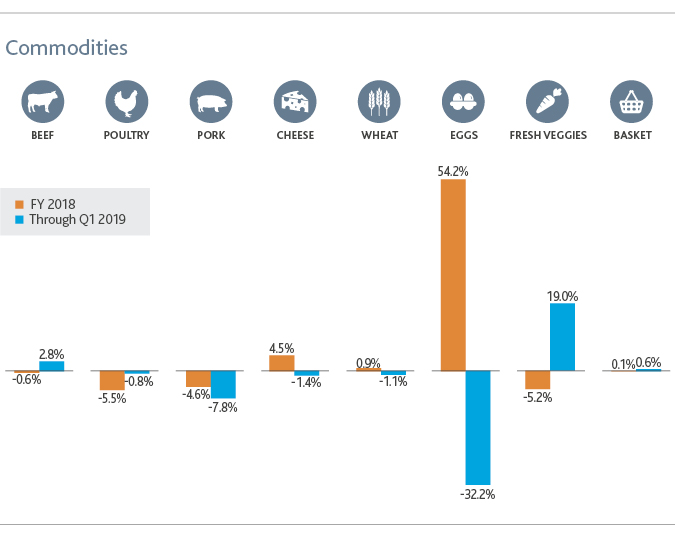

In commodities, the cost of fresh vegetables rose 19% while the cost of eggs, which were up 54.2% at the end of 2018, fell -32.2%. Beef rose 2.8%; poultry, cheese, and wheat all posted declines. The cost of pork was down (-7.8%), even as the outbreak of African swine fever in China spread: China’s hog herd may fall 30% to 40% in 2019, according to some estimates, but this may not have a material impact on U.S. pork prices, as the USDA predicts U.S. production to rise 5% this year.

Labor Costs

Labor costs are the single most pressing issue on restaurants’ minds and margins. The cost of labor rose 0.5% in the first three months of 2019. While statutory minimum wage increases typically go into effect on Jan. 1, thereby affecting first-quarter results, the industry has been contending for some time with expanding wages to reduce employee turnover.

To mitigate the bottom-line effect of labor costs, which were 32% of net sales in Q1, some restaurants, like McDonald’s, have rolled out order kiosks, reducing the need for employees to take orders. Traffic forecasting algorithms can also help restaurants better predict how many employees may be needed throughout the day.

Restaurants also are investing in retaining talent. To do so, they are conducting more employee training, improving benefits programs, and providing clearer career trajectories.

What’s Next for Restaurants

As restaurants contend with challenging margins, many are taking calculated risks.

Some restaurants are raising menu prices to offset the added pressure on margins from labor costs and investments that they hope will result in customer engagement and loyalty. Olive Garden and Texas Roadhouse, for example, increased menu prices by 1.8% and 1.5%, respectively. But this has its own set of consequences, of course, as higher prices can turn off customers and result in lower foot traffic.

Menu engineering and strategic pricing are tools that can help balance these competing priorities. Driving more profitable items over labor-intensive, low-margin items and adjusting serving sizes can have a material impact on the bottom line. But restaurants shouldn’t forget their customers’ wallets. This is especially true with the specter of an economic slowdown on the horizon. While raising prices may be a necessary evil for some brands, value remains a significant driver of customer loyalty.

Restaurant success stories will hinge on margins: those who can absorb or offset cost increases will be better positioned to compete.

SHARE