Real Estate & Construction Monitor Newsletter - Summer 2019

Table of Contents

- Industrial REITs Cautious Amid Tariffs, Trade Turbulence

- BDO’s 2019 Real Estate and Construction Compass

- REITs Contending with Flexible Lease Demands

- Finding a Home for Your Multifamily Investments Amid a Cooling Market

- Coworking’s Lessons For Office REITs

Industrial REITs Cautious Amid Tariffs, Trade Turbulence

By The Real Estate & Construction Practice Leaders

Ignited by President Trump’s announcement of tariffs on foreign steel and aluminum, trade tensions have dominated news headlines since March 2018.

The impact was immediate: U.S. tariffs and retaliatory measures by other countries slowed the flow of global trade in 2018. The Wall Street Journal reports that, according to the CPB Netherlands Bureau for Economic Policy Analysis, the total volume of goods moving across borders increased just 3.3 percent in 2018 compared to the 4.7 percent rise in 2017.

The U.S.-China trade relationship has been the most contentious, resulting in multiple rounds of retaliatory tariffs amid U.S. allegations of Chinese business malpractice and industrial espionage. To date, nearly half of all Chinese goods brought into the U.S. have been subject to additional tariffs, many at a rate of 25 percent, and the remaining at a rate of 10 percent. The Trump Administration is also weighing implementing additional tariffs on autos and auto components, targeting major U.S. trading partners, including: the European Union, Japan and South Korea.

Protectionist trade policies and retaliatory measures have slowed the flow of goods in and out of warehouses and distribution facilities, impacting demand and pricing for industrial real estate after years of sustained growth.

Impact to industrials’ investments

Trade tensions slowed new investments by industrial REITs in 2018, a trend likely to continue until the uncertainties surrounding trade are alleviated. New industrial buildings under construction declined significantly between 2017 and 2018, according to analysis by BDO’s 2019 Real Estate & Construction Compass. Disruptions to global trade have made industrial REITs and other owners and operators cautious about making new investments in the near-term, as no one is sure how long the disruptions and uncertainty will continue.

What to expect in the long-term

We anticipate that industrial REITs will wait out the short-term trade turbulence, but the long-term outlook for the sector remains sunny. Industrial real estate performed well in the last decade—catalyzed by the rise of e-commerce and increased demand for omnichannel and last-mile delivery.

Consumer demand for rapid delivery and e-commerce is projected to continue growing and will increase the demand for distribution and warehouse spaces, especially in urban areas. To compete in crowded, primary markets, warehouses and distributors will need to invest in technology. Drones, AI, robotics and other technologies can lower system costs and improve efficiencies for warehouses or distribution centers.

For industrial REITs seeking new opportunities, they’ll need to assess demand for industrial and warehouse space based on existing market conditions as well as potential shifts due to technology and changes to distribution channels from major infrastructure projects.

Reprinted from Commercial Property Executive.

Read the Full Article

BDO’s 2019 Real Estate and Construction Compass

About the Study

BDO’s Real Estate & Construction practice and Valuation Services & Business Analytics practice analyzed 10 years of CoStar data in the Industrial, Retail and Multifamily sectors. The data was collected on December 3, 2018, and the Study is an analysis of the data coupled with insights from BDO’s Real Estate & Construction practice leaders.

Executive Summary

Ten years ago, the financial crisis wracked the U.S. economy—causing many major companies to fold and bringing others to the brink of collapse. Across the country, Americans lost their jobs, defaulted on their mortgages and saw their retirement savings devalued. Since the crisis, however, the U.S. economy has undergone an unprecedented period of continuous economic expansion and business growth.

Technological innovation catalyzed this growth, impacting nearly every aspect of how people work, play and live.

Consumers’ preferences, financial status and behavior have also evolved significantly since 2009, reshaping their choices in everything from the cities in which they live to how they buy their groceries.

These forces, along with competition for consumer loyalty, have impacted nearly every aspect of business operations and strategy—ushering in an era where customer service is paramount to success. Even for sectors that aren’t directly consumer-facing—such as distribution and warehousing—consumer tastes and demand directly impact how and where they need to operate to succeed. New technologies allow REITS and other owners and operators to automate aspects of residential building management, while consumer demand for convenience has given rise to rapid delivery systems and flourishing of e-commerce. In addition to these forces, U.S. regulatory policy, most notably tax reform, has impacted business planning, too.

This “new norm” is far from settled—and businesses are waking up to the fact that continual disruption and change is the new status quo.

BDO’s inaugural Real Estate & Construction Compass analyzed 10 years of CoStar data in the Multifamily, Retail and Industrial sectors of real estate to uncover how these forces have shaped the real estate industry since 2009, and the actions real estate businesses need to take to survive and thrive in the new paradigm. Our analysis uncovered that real estate owners and operators will need to become digitally-savvy, consumer-centric and think like urbanists and economists.

For a deep-dive into our analysis and forecast for how the Retail, Multifamily and Industrial real estate sectors are going to evolve, and how real estate companies should respond, click here.

Read the Full Article

REITs Contending with Flexible Lease Demands

By The Real Estate & Construction Practice Leaders

This year is poised to be an eventful one for REITs, with several regulatory and policy changes taking effect that will impact operations and balance sheets.

These changes—coupled with a real estate business cycle that many executives feel is at or past its peak, according to findings from BDO’s Global REIT Report—present a mixed bag for REITs in the new year.

As I wrote last year, REIT executives’ expectations have been tampered, but they remain overall confident for the near-future. The most recent and long-term change for REITs is the much-anticipated, new lease accounting standard that took effect at the beginning of the year for most public companies after it was first announced in 2016. For private companies, the new standard will begin in 2020.

Now that the new standard is officially here, I’ve outlined immediate takeaways and potential long-term impacts.

Immediate Impact to Your Balance Sheets

The new standard was designed to increase transparency and comparability across organizations that lease buildings, equipment or other assets by explicitly laying out all assets and liabilities that arise from any lease transaction. Previously only required for capital leases, the new standard now mandates all operating leases to be included in an organization’s balance sheet at the present value of future lease payments. In many cases, lease obligations on balance sheets will represent the largest asset and liability a company holds. The uncertainty as to how the large liabilities will be viewed by the investment community and lenders is of concern to both landlords and tenants.

Catalyzing the Shift Towards Flexibility

The rapid growth of WeWork and other coworking space providers has made short-term and flexible office leases more widespread. As major corporations follow startups and freelancers and embrace shorter leases, traditional landlords will increasingly expand their own flexible offerings to remain competitive. The new lease accounting standard provides an added incentive for tenants to demand shorter leases.

Beginning in 2019, more tenants will likely seek to restructure their leases or sign new leases with shorter terms. While tenants favor flexibility, the shift introduces uncertainty for landlords. Landlords are unlikely to reduce the length of leases to the shortest time periods offered by coworking companies, but landlords will need to make compromises to remain competitive. Additionally, lenders may be less willing to provide long-term financing for shorter leases on commercial properties, which would complicate budgeting and planning for owners of commercial properties.

BDO’s Outlook for 2019

The lease accounting standard is just one of many changes that REITs are contending with in 2019. By continuing to monitor both the immediate and long-term impact of these regulatory changes, REITs can position themselves to successfully navigate the shifting landscape this year and beyond.

Read the Full Article

Finding a Home for Your Multifamily Investments Amid a Cooling Market

By Ian Shapiro

BDO’s inaugural Real Estate & Construction Compass analyzed 10 years of CoStar data in the multifamily sector of real estate to uncover how the industry has evolved since 2009, and the actions real estate businesses need to take to survive and thrive in the new paradigm.

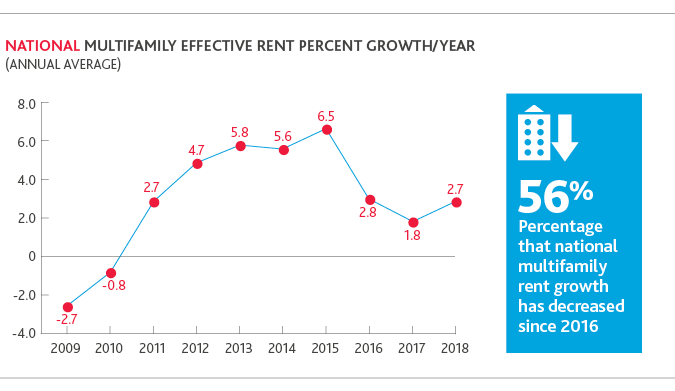

In the decade since the Great Recession, the multifamily market has been a bright spot for commercial real estate investors. Generational shifts in consumer behavior, shaped by the post-recession economy, have fueled high demand for rentals that is expected to continue. In recent years, however, multifamily supply has begun to outpace demand. In primary markets like New York City, the combination of cap rate compression and slowing of rental rate growth caused by additional supply has created a need for investors to look elsewhere to discover new opportunities.

Though it’s more difficult to find multifamily investments that offer the same returns compared to previous years, opportunities remain in the sector. These prospects, however, are complicated by a potential recession or economic downturn. According to a survey by the National Association of Business Economics (NABE), more than three-fourths of U.S. economists think the country is headed for a recession by 2021. To take advantage of the greater returns that may exist in properties outside of primary markets, multifamily investors must balance the potential rewards with the heightened potential risk of a recession.

Our Analysis Uncovered:

Demand for multifamily is expected to continue, but the supply glut means investors must look deeper or potential explore newer markets for opportunity.

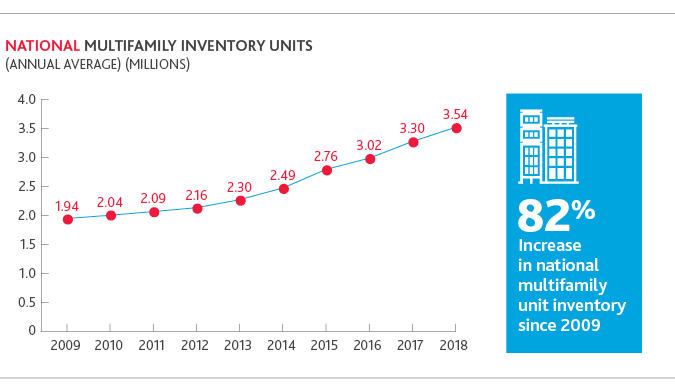

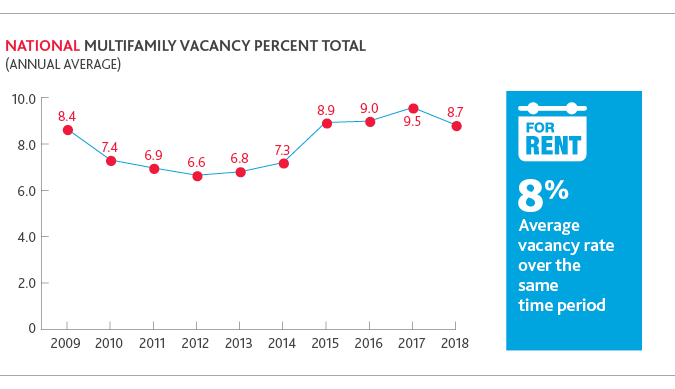

Multifamily inventory by units nearly doubled in the past decade while vacancy rates have remained relatively low.

With oversaturation in primary markets, there are opportunities for multifamily investors outside their comfort zones—but a potential economic downturn poses risks.

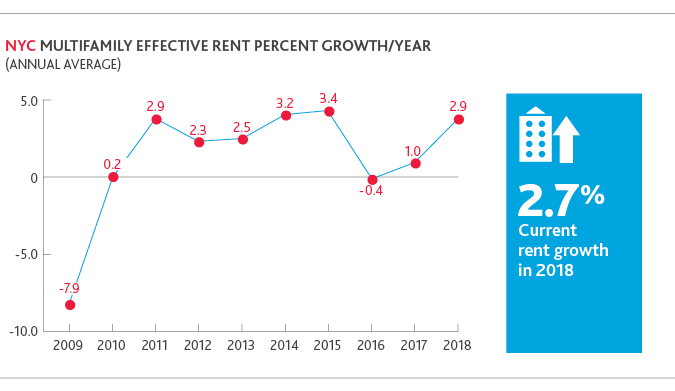

Despite sustained demand for multifamily rentals, the oversaturation of primary markets has caused rental rate growth to cool and created a need to look elsewhere for new opportunities.

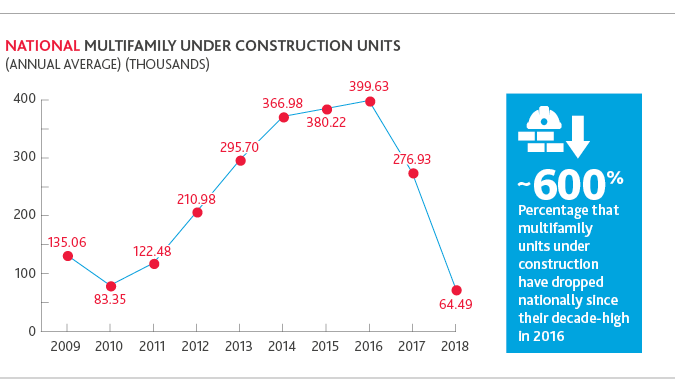

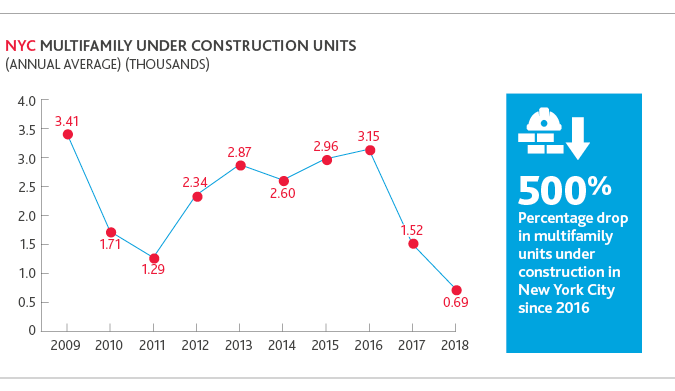

Construction has slowed both nationally and in New York City since 2016.

In the heavily competitive NYC market, the fluctuations have been less dramatic, though they still follow national trends:

To navigate these conditions and discover new opportunities, they’ll need to focus on fastgrowing secondary or tertiary cities.

This means entering untapped or unfamiliar markets—which is no easy undertaking. To identify the best opportunities, they’ll need to perform holistic urban analyses.

Here are some factors to take into consideration when entering a new market:

Investors need to perform the same kind of due diligence on an emerging city as they would for any transaction in a market they know well.

Conclusion

Though the market is cooling, the multifamily sector holds promise for those real estate investors open to exploring opportunities outside their comfort zones. In crowded markets, new technology and luxury amenities are key differentiators for landlords and management companies to attract and retain tenants. Whether the market continues its record period of growth or begins to contract, the multifamily sector may continue to serve as a resilient home for the savvy investor.

Coworking’s Lessons For Office REITs

By The Real Estate & Construction Practice Leaders

The rapid rise of coworking companies like WeWork have taken the office real estate market by storm. Coworking spaces have been lauded for their innovative design and luxury amenities and have surged in popularity over the past decade. After years of rapid growth, WeWork is now the single largest office tenant in Manhattan—occupying over 5.3 million square feet of space. Traditional landlords don’t need to offer coworking solutions of their own to compete with companies like WeWork, but there are aspects of the coworking business model that REITs and other office space owners would be smart to understand and potentially use to evolve their own offerings.

Despite the buzz, coworking spaces comprise less than 5 percent of the total office space market today, according to a recent report from JLL. While coworking does address many tenant demands and offers a competitive alternative to a traditional long-term commitment, office REITs shouldn’t panic. Rather, they should consider how adopting some of the front and back-end strengths of coworking companies might help them hone their competitive edge in the market.

Convenience vs. flash

Shared office space is not a new concept. Regus, a major provider of coworking and flexible office spaces, was founded in 1989. The secret to the modern coworking craze, however, is a hyper focus on convenience. Coworking companies’ greatest value propositions are the flexibility, collaborative space and amenities they can offer to tenants—along with time and effort saved to locate and occupy space. Coworking companies have been praised for their innovative design concepts and service-oriented mentality. Free food and beverages, organized networking and entertainment events and everyday access to like-minded entrepreneurs are sold as part of the modern coworking package. These benefits are key for attracting young and talented workers—especially in a tight labor market—and traditional landlords are getting the hint. Already some are working to offer WeWork-style amenities for long-term tenants by renovating previously underutilized areas to build everything from new communal spaces to gyms and swimming pools.

Rethinking the long-term lease

Office REITs need not fear displacement by coworking, but they would be smart to consider evolving their businesses to incorporate some aspects of the coworking model—including a willingness to lease spaces for shorter periods of time. One of coworking companies’ most significant impacts is changing tenant expectations for their landlords and leased spaces. Coworking companies’ popularization of flexible leasing has been compounded by the impact of the new lease accounting standard. As I wrote earlier this year, the new lease accounting standard gives tenants an added incentive to demand shorter leases. REITs that don’t adapt their businesses or start addressing tenant demands may lose a competitive edge, if not to coworking companies, then to other traditional landlords that do.

Reprinted from Commercial Property Executive.

Read the Full Article

SHARE