Portfolio Companies’ COVID-19 Economic Stimulus Relief Incentives

Note: This piece was last updated on April 20, 2020.

The novel coronavirus (COVID-19) has disrupted businesses across every industry, requiring workforces to operate remotely and urgently pivot to crisis management mode. Meanwhile, the pandemic has ushered in a bear market and caused high unemployment, prompting massive economic uncertainty.

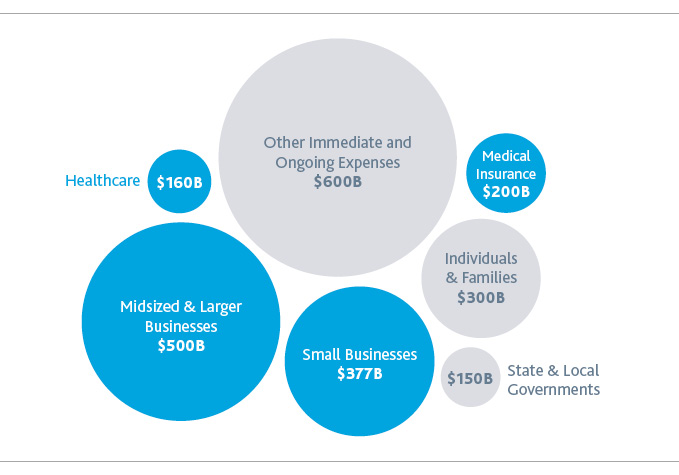

Given that the novel coronavirus’s economic damages have been acute and widespread, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2.2 trillion stimulus package signed into law on March 27, 2020, intended to help mitigate the economic devastation caused by COVID-19. Private capital-backed companies are generally ineligible for the prevalent Small Business Administration (SBA) loans due to the maximum employee test, described below. However, all hope for portfolio companies is not lost as there are several incentives outlined in Title IV of the CARES Act that merit attention for midsized and larger businesses as part of the $500B economic stabilization plan described in Title IV of the Act.

Unpacking the Coronavirus Aid, Relief and Economic Security (CARES) Act

The CARES Act comprises multiple loan programs targeted at different groups impacted by COVID-19. The programs PE and VC may be eligible for, both past and present, are highlighted in the figure below.

Small Businesses – $377 Billion

Paycheck Protection Program

Perhaps the most publicized feature of the CARES Act is the $349 billion in Paycheck Protection Program (PPP) loans being administered by the SBA. PPP loans are unique in that when they are used for certain designated purposes, such as payroll costs, the entire balance of the loan may be forgiven and excluded from taxable income.

The CARES Act outlines various qualifications that must be met by the borrower in order to obtain a PPP loan. One requirement that is significant for private capital-backed companies is the limit on the number employees that may be employed by the borrower and its affiliates. Small businesses that have received external growth capital from a private equity or venture capital firm will likely be required to include the employees of the private capital provider and its other portfolio companies when applying the 500-employee count, referred to as the maximum employee test. However, there are three potentially important exceptions. First, private equity-controlled hospitality and travel companies, those operating in food service industries (NAICS code 72) and franchises in the SBA’s Franchise Directory are not subject to the 500-Employee Test. Second, the SBA has published a list of maximum employees per industry, some of which include maximums in excess of 500 employees. Third, there is an exception if a company is backed by a Small Business Investment Company (SBIC), in which case they might qualify for PPP loans.

Given the complexities associated with the affiliation rules as well as the possible exceptions, care should be taken in evaluating individual companies’ potential eligibility. Further guidance can be found here.

In addition, SBA’s Economic Injury Disaster Loans (EIDLs), which are not new, are surfacing in light of COVID-19 since this is the first time a virus or pandemic event has been defined as a disaster. The CARES Act specifically allots $10 billion for EIDLs as part of the support for small businesses, and private capital-backed companies may find this option appealing since many previous underwriting restrictions have been removed, and potential terms include loans of up to 30 years with interest rates as low as 3.75% for small business and 2.75% for non-profits.

Midsized and Larger Businesses – $500 Billion Economic Stabilization Loan Program

Aside from SBA loans, the CARES Act allocates $500 billion for the Treasury to disburse as loans to midsized and large businesses of greater than 500 employees. These loans under the economic stabilization plan lack the option of being forgiven and come with public disclosure requirements but have attractive interest rates and give private capital-backed companies an opportunity to qualify for relief. Of the $500 billion, $46 billion is reserved for air carriers and businesses deemed critical to national security and $454 billion is allocated for other eligible businesses, states and municipalities. Of the $454 billion, $75 billion will be used to fund the Treasury collateral for the Main Street Business Lending Program, which results in $600 billion in Main Street Loans. The remaining $379 billion does explicitly include a loan program for midsized businesses—defined as organizations with between 500 and 10,000 employees, in addition to the general guidance provided in Title IV of the CARES Act.

Main Street Business Lending Program

The Main Street Business Lending Program is a subsequent action taken to offer companies liquidity. Using appropriated funds from the CARES Act, the Treasury will make a $75 billion equity investment in a special purpose vehicle to implement the Main Street Business Lending Program. This program aims to increase the flow of credit to small and medium-sized businesses that were in good financial standing prior to the COVID-19 crisis, including those that employ up to 10,000 employees or had 2019 annual revenues of $2.5 billion or less. This option is specifically aimed at the 40,000 medium-sized businesses that employ 35 million Americans.

Eligible borrowers cannot use the loan proceeds to repay other loan balances or other debt of equal or lower priority unless the borrower has repaid an eligible loan in full. Additionally, the borrower cannot cancel or reduce any existing lines of credit. Other important considerations for eligible borrowers include:

-

Attestation that the borrower requires financing due to the COVID-19 pandemic and will use loan proceeds to make reasonable efforts to maintain payroll and retain employees during the term of the loan

-

A requirement that loan proceeds not exceed a 4X multiple of 2019 EBITDA

-

A requirement that loans follow compensation, stock repurchase, and capital distribution restrictions as provided for in Title IV of the CARES Act

For more information on the Main Street Business Lending Program, see here.

The CARES Act’s Payroll Tax Incentives

The CARES Act provides payroll tax incentives to employers without regard to size or employee headcount. Sections 2301 and 2302 of the CARES Act provide two distinct employment tax benefits for employers, determined on a controlled group and affiliated service group basis. Section 2301-Employee Retention Credit provides a refundable payroll tax credit of 50% on qualifying wages paid from March 13 to December 31, 2020, up to $10,000 per employee, making the maximum credit $5,000 per employee. If an employer has more than 100 employees, on a controlled group or affiliated group basis, only wages paid for hours not worked qualify, while employers with 100 employees or fewer may include all wages to qualify for the credit. Procedures need to be established to document hours “not worked” that are eligible for this credit. This is also a troublesome provision for small businesses that have received external growth capital from a private equity or venture capital firm because any portfolio company treated as an affiliate that receives a PPP loan eliminates the Employee Retention Credit for all other portfolio companies.

Section 2302 provides additional cash flow to all employers, by allowing them to delay the payment of the employer’s share of social security tax (6.2% of wages) due from March 27-December 31, 2020, with 50% being due by the end of 2021 and the balance due by the end of 2022. Forgiveness of a PPP loan eliminates the ability to defer payroll taxes under this provision going forward. However, the statute does not use the term “employer” but indicates that the “taxpayer” who has loan forgiveness is not eligible. Therefore, a small business cannot lose its ability to defer payroll taxes allowed by this provision when a different portfolio company or investor receives forgiveness.

Navigating the Crisis

Understanding your business’ needs and goals in the face of this pandemic is a critical factor in maximizing the total benefit from potential loans, payroll tax incentives, and other tax incentives.

Alternatively, some organizations are urging Congress and the presidential administration to do more. On April 3, the door opened for companies to begin applying for SBA loans and, as to be expected, the system hit overload. Just one day prior, the Small Business Investor Alliance (SBIA) addressed a letter to Secretary Mnuchin asking that as many small businesses as possible have access to PPP emergency loans as quickly as possible. This letter came just after the release of Speaker Pelosi’s letter to Mnuchin and the Treasury on March 31.

While there are obviously a multitude of negative financial impacts due to the coronavirus, there are also some business opportunities based on the heightened need for increased cybersecurity services associated with a remote workplace environment, claims automation, and consumables as we weather the storm. The impact of COVID-19 on valuation, capital deployment and M&A will continue to play out, causing fund managers to pivot strategies and reassess deal flow.

Whenever the current state of affairs levels out, fund managers looking to deploy capital will need to factor in both current and longer-term economic implications of the pandemic on existing portfolios, the scope and nature of which will largely be driven by the industries in which their portfolios operate. Opportunities for investing in distressed situations will become more prevalent and are likely to require more diverse and nimble investment strategies. Currently, many private equity fund managers are laser-focused on triage, conducting assessment of impacts to their portfolio and shoring up capital resources. During this critical time, many firms are performing weekly cash flow calculations and tracking benchmarks that would otherwise occur on a monthly or quarterly basis. This is key in measuring lending capacities before making any new commitment. These significant shifts have the potential to weigh heavily on portfolio companies and may call for a reassessment of debt and accounting issues, as well.

Let us know if you would like to learn more about how your organization can navigate immediate disruptions due to the novel coronavirus and prepare for the future.

SHARE