9 Predictions for Middle Market Private Equity in 2019

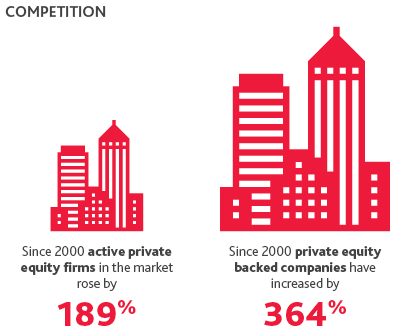

In recent years, competition has been steadily increasing in the private equity market to peak levels.

As investors seek greater transparency and better returns with lower fees, the resulting low-price environment is leaving many private equity sponsors needing to do more with less. Though more deals are closing, the race for qualified acquisitions has been more aggressive than ever. In addition, tax reform, regulatory and political changes are significantly shifting the rules of the road. Meanwhile, digital transformation is revolutionizing how organizations conduct business, but requires strategic adaptation to ensure that innovation remains sustainable. The way in which the industry responds will dictate its fate in

the years to come.

With a crystal ball—and extensive data—here are nine trends that will likely shape private equity in 2019 and beyond.

PREDICTION #1

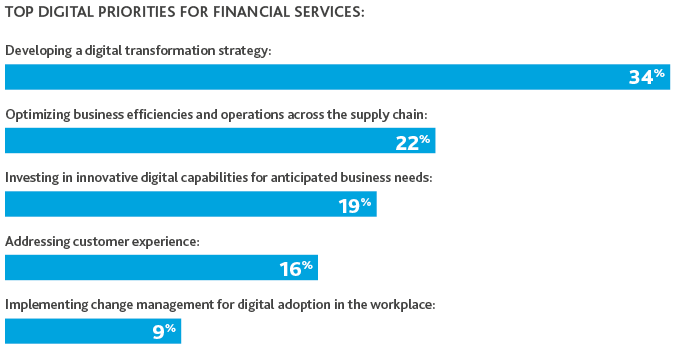

Private Equity Funds and their Portfolio Companies Will Prioritize Digitalization.

Long reliant on traditional investment methods, private equity is in no rush to reinvent the wheel.

However, in 2019, private equity funds and their portfolio companies will face increased pressure to shed old habits, update cultural norms, upskill their employees, and adjust their ways of thinking to become digital businesses.Those that resist change risk being outranked by their competition, losing industry relevancy, and being replaced by more technologically savvy, nimble competitors.

.png)

PREDICTION #2

Tariffs and Trade Uncertainty Will Continue to Dampen International Deal Flow.

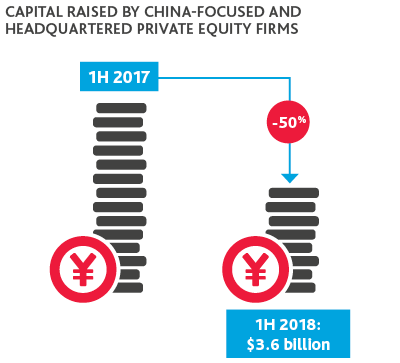

In 2018, many fund managers had a “wait-and-see” approach towards international investing as U.S. and China trade tensions deepened.

In 2018, many fund managers had a “wait-and-see” approach towards international investing as U.S. and China trade tensions deepened.

As a result, capital raised by Chinafocused and headquartered private equity firms declined nearly 50 percent during the first half of 2018, compared to the same period a year prior. Continued uncertainty means that 2019 will likely see deal flow remain sluggish among funds with portfolio companies that rely heavily on international manufacturing

and distribution.

Source: PitchBook

PREDICTION #3

U.S. Tax Changes Will Continue to Impact Private Equity.

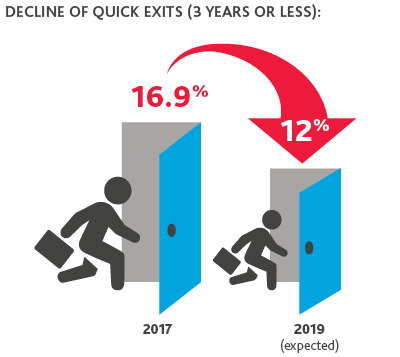

U.S. landmark tax reform enacted before the close of 2017 will continue to shape private equity activity in 2019.

U.S. landmark tax reform enacted before the close of 2017 will continue to shape private equity activity in 2019.

As a result of changes in carried interest taxation—which now requires a three-year hold period to realize long-term capital gains rates—it is expected that fewer private equity funds will engage in exits of less than three years. Further, a decreased corporate tax rate (from 35% to 21%) means that funds will enjoy an increase in free cash flow, and as a result, feel upward pressure on Enterprise Value and EBITDA multiples.

PREDICTION #4

Threat of a Market Correction Will Drive Investment in Consumer Staples and Essential Services.

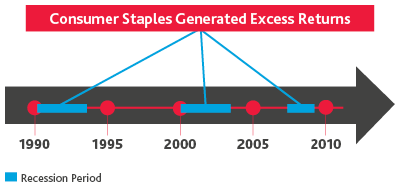

Whether or not it comes as soon as 2019, most dealmakers would agree that a market correction is impending.

Whether or not it comes as soon as 2019, most dealmakers would agree that a market correction is impending.

As such, we can expect an increased focus over the next year on investments in the consumer staples and essential services sectors—those that fulfill

constant, irreplaceable consumer needs. Consumer staples have beat the S&P 500 by 49 percent in the last 25 years and experienced most of its outperformance during recessional periods.

PREDICTION #5

Brexit Will Have a Major Impact on the UK, but the U.S. Will Keep Chugging Along.

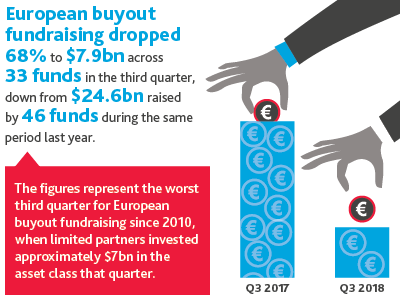

The UK is scheduled to leave the European Union at 11p.m. local time on March 29, 2019.

The UK is scheduled to leave the European Union at 11p.m. local time on March 29, 2019.

The tumultuous pending split between the UK and the EU has led to a major decline in investors’ appetite for UK-dedicated funds. In October 2018, fundraising for European buyouts hit its worst quarter since 2010. While the U.S. is likely to remain unscathed by the fallout, the UK will feel the impact sharply.

Source: Financial News

PREDICTION #6

Data-driven Investment Will Win Deals: Demand for Fast Decision-making and Closing Quickly is on the Rise.

In 2019, more firms are applying data science and algorithms to drive investments.

data science and algorithms to drive investments.

Meanwhile, smarter decisions are being made about what to pay for businesses by efficiently analyzing past bids. The private equity industry is increasingly using programs to figure out how companies will perform down the road. The future is on our doorstep as businesses harness the benefits of big data and technology in fascinating new ways.

Source: The Wall Street Journal

PREDICTION #7

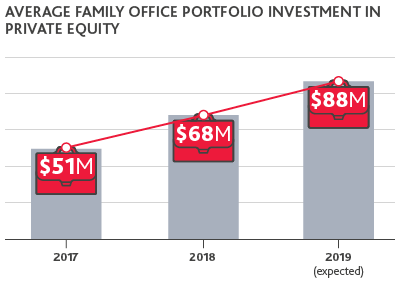

Family Offices’ Emerging Power Will Create More Investment Competition.

Family offices’ appetite for private equity has led to more investment competition.

Family offices’ appetite for private equity has led to more investment competition.

Showing no sign of slowing down, average family portfolio investment in private equity is expected to continue climbing in 2019. Private equity funds will continue to appeal to family offices for their potentially high returns, with the average allocation projected to rise 73 percent next year. Additionally, family offices are combining efforts to invest in deals by aggregating capital beyond their own family funds with other family offices sharing like-minded investment principles. An alternative to institutional money, family offices will have more clout than ever.

Source: Campden Wealth

PREDICTION #8

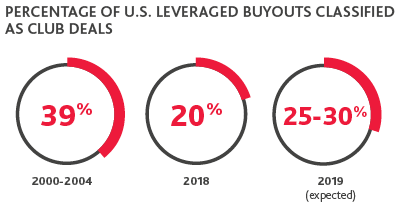

Teamwork Makes the Deal Work: Club Deals Have a Strong Resurgence.

Club deals, or those that involve two or more private equity firms, once boomed, representing nearly 40 percent of all U.S. leveraged buyouts in the early 2000s.

Club deals, or those that involve two or more private equity firms, once boomed, representing nearly 40 percent of all U.S. leveraged buyouts in the early 2000s.

The number has since halved, due in part to the deals’ perception of being uncompetitive, as well as their association with certain high-profile bankruptcies. However, loaded with dry powder and faced with inflated valuations that put good opportunities out of reach, club deals represent an opportunity for private equity funds to engage in bigger deals and utilize down capital. What’s more, it has been noted that club deals’ association with bankruptcy is largely unwarranted— these buyouts are in fact far less likely to go under. As such, it is expected that club deal making will make a strong comeback in 2019 as private equity deal makers team up to acquire highly-valued targets.

Source: PitchBook and Reuters

PREDICTION #9

Specialization is Key: Funds Will Continue Differentiating Themselves with Niche Industry Focus.

With greater competition, firms are striving to edge each other out for LP commitments.

With greater competition, firms are striving to edge each other out for LP commitments.

Many have adapted to increasing market pressure by developing unique specializations and differentiators to help them stand out. The value of working with a team of specialists with niche expertise will become even more pronounced in the year ahead.

Source: PitchBook

For questions, comments or suggestions, please contact:

SCOTT HENDON

National Leader, Private Equity

SHARE