BDO & PitchBook: Trade Tensions Suppress Manufacturing & Distribution Deal Activity

In an otherwise strong sector, manufacturers confront international hurdles.

An enduring economy. A revitalized domestic manufacturing steadily creating jobs across the country. A sector harnessing the power of Industry 4.0 to streamline operations.

On the surface, many signs point to a strong U.S. manufacturing and distribution industry with positive momentum. Yet, dig a little deeper, and uncertainty around costs and materials sourcing due to trade tensions is noticeably impacting the sector’s ability to close deals. By understanding the current challenges facing investors, middle market manufacturers will be better positioned to compete for capital in this uncertain funding environment.

Mixed Economic Signals Complicate Growth Outlook for Manufacturers

Correlating with the U.S. economy as a whole, the manufacturing sector continues to expand, with demand, production and employment for industrial supplies and machinery remaining strong, according to the recent Manufacturing ISM Report on Business. However, ongoing trade tensions with China and other trading partners has curbed momentum in recent months, with this past October’s U.S. export orders seeing the biggest decrease in more than a year. Additionally, the U.S. tariffs on imported steel and aluminum, which are subject to 25 percent and 10 percent tariffs, have contributed to higher costs for manufacturers.

In early December 2018, positive news broke as the U.S. and China announced they had agreed to a 90-day moratorium on further tariff implementations beginning on January 1, 2019. However, investors should not get their hopes up for a final solution just yet. Chinese President Xi Jinping’s speech to commemorate the 40-year anniversary of the opening of China’s economy to the world may have major implications. In his comments, Xi showed little signs of changing the country’s current stance on international trade. Only time will tell whether the moratorium will result in some sustainable relief.

For manufacturers, the tariffs’ effects are no longer hypothetical, as many companies have started to reevaluate their international strategies. Will production costs increase for imported materials? Will trade deals spur a revamp of operations to comply with new policies and regulations? Will retaliatory tariffs mean products are less competitive abroad? What is my exposure to sourcing from China? In September 2018 alone, U.S. businesses spent $4.4 billion in tariffs, an increase of more than 50 percent from the same month a year ago, according to a recent study.

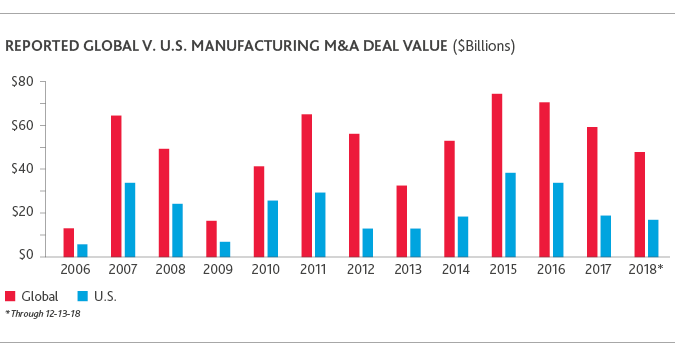

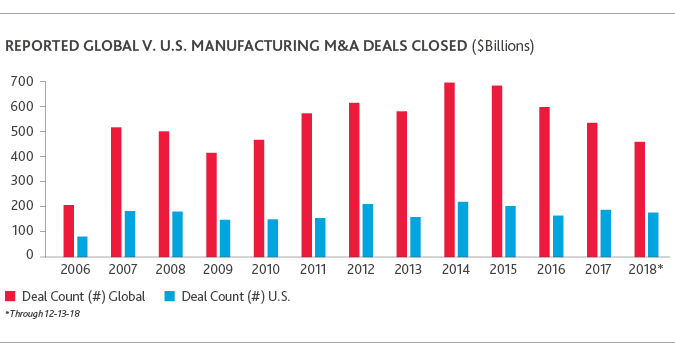

This uncertainty has extended to private equity firms with both domestic and foreign manufacturing portfolios. Both global and U.S. M&A deal flow is down, however the trough is relatively deeper for the former. U.S. dealmakers are decelerating their activity with manufacturing-heavy businesses, especially those with significant sourcing from China, which has largely been the focal point of trade disputes. Simultaneously, U.S. investors are seeing manufacturers shift further towards onshoring, as domestic operation grants businesses shelter from these tariffs as well as greater protection of intellectual property while minimizing both lead times and supply chain disruptions. This reshaping of manufacturers’ supply chain networks necessitates substantial investment and may ultimately accelerate domestic M&A activity in the sector in 2019.

Private Equity Adopts a “Wait and See” Approach

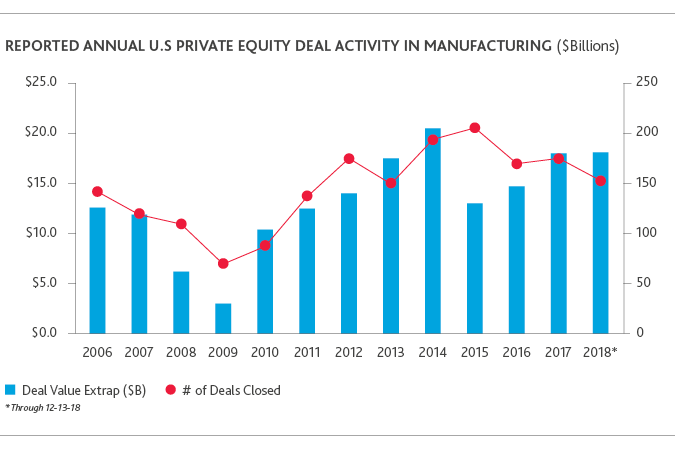

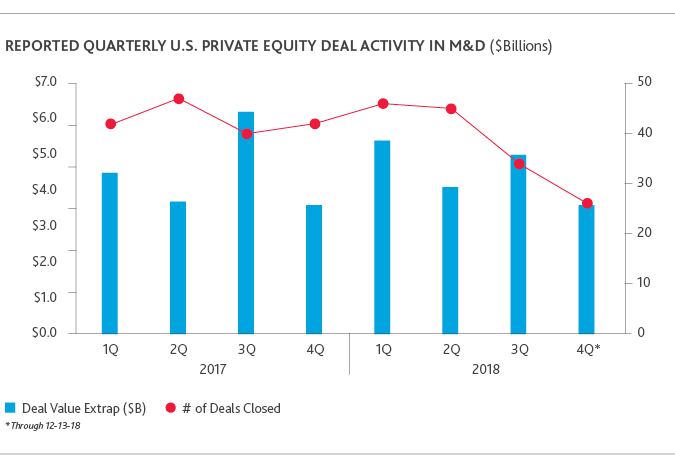

Private equity investment activity in the manufacturing and distribution sector may be waning due to these uncertainties, despite other positive economic fundamentals. Of course, deal valuation hinges in part upon the predictability of future cash flows, and therefore, rising and unpredictable input costs is indeed starting to temper activity. In 2017, private equity investors closed 171 reported deals in the sector. In 2018, that number is likely to be approximately 150 (annualized based on mid-December YTD data), a 12 percent decrease in year-over-year activity. History might suggest that this drop is caused by the natural ebbs and flows of the industry, however, reported data suggests substantial further decline in deal activity as we approach year-end.

Is this foretelling a very challenging 2019 funding environment? Perhaps. It is notable that U.S. companies across industries have stated that they are currently mitigating the impact of tariffs with China through price increases or changes to their supply chains, and they have warned investors that the situation could worsen in 2019.

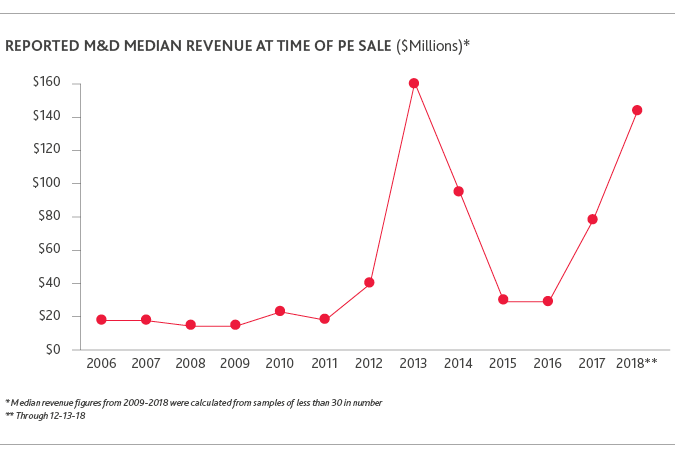

Complicating the outlook, valuations remain high for manufacturing companies due to a number of factors. Demand and capital are abundant with private equity firms’ record amount of dry powder, strategic buyers’ strong appetite for deals given unending pressure to grow and substantial excess cash on balance sheets, and the willingness in the lending community to fund deals. Of course, broader positive economic fundamentals also strengthen this momentum. Last but not least, U.S. companies generally continue to grow and perform, making them more valuable at the time of sale. Median revenue for U.S. manufacturing companies at the time of a PE deal has increased 61 percent between 2017 and 2018, from $78.2 million to $143.8 million, respectively. In practice, this makes it more challenging for PE investors to find bargains, creating additional drag on investment activity.

.png)

Tariffs Favor Some Manufacturers Over Others

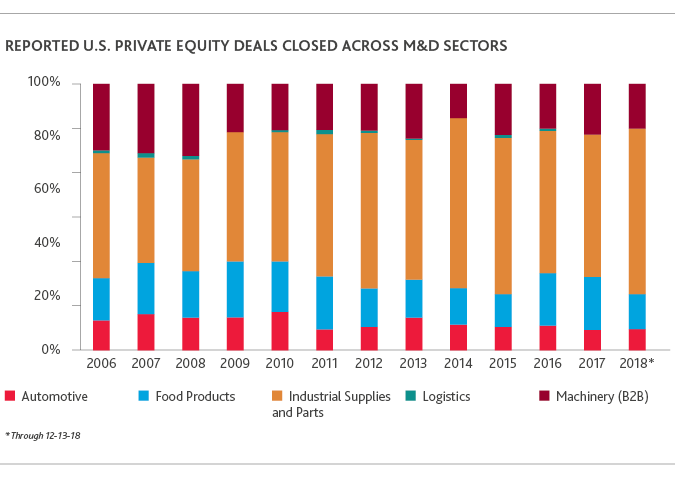

After petitioning the U.S. Trade Representative in September 2018, the steel industry successfully lobbied for relief on 66 tariff lines–mostly raw materials and chemicals used in the steelmaking process that many manufacturers import from China. Going forward, it’s likely that the steel industry will face fewer hurdles when pursuing deals. It follows, then, that private investors may look for manufacturing sub-sectors that are insulated from tariffs. To that end, manufacturers of industrial supplies and parts have experienced an increase in private equity investment between 2017 and 2018–from $1.2 billion to $4.6 billion in deal value, respectively, capitalizing on strong economic growth while seemingly avoiding the tariff impact. Conversely, automotive companies have not been so lucky and, as such, we have seen some decline in related deal activity. However, the new United States-Mexico-Canada Agreement (USMCA), which replaces the North American Free Trade Agreement (NAFTA), as well as China’s temporary auto tariff reduction (from 40% to 15%) has provided welcome stability for investors. The automotive sector may shift strategies in 2019 after spending a large part of 2018 playing defense amid criticism for its integrated supply chain under the preceding NAFTA agreement.

Industry 4.0 Compels Strategic Buyers

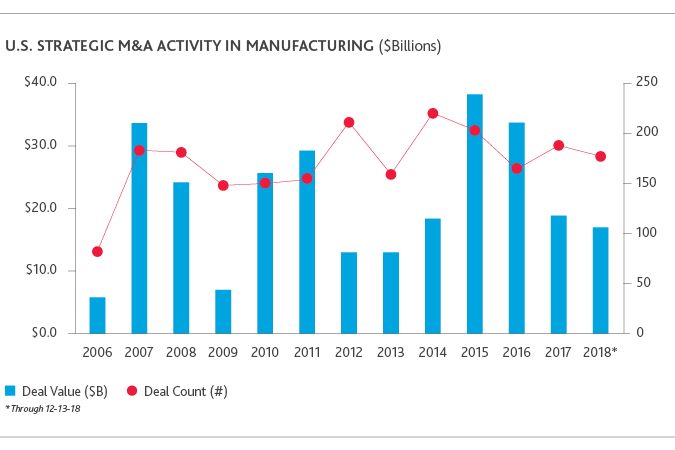

In 2018, strategic buyers have been more active than private investors when it comes to consolidation in the M&D sector, closing a reported 177 deals through October compared to private equity’s 150 deals this year. Manufacturers’ race to meet Industry 4.0’s new digital standards may be fueling these strategic acquisitions, as more companies compete to adopt the most technologically advanced offerings to increase production and save costs. However, it is important to note that consolidation activity and deal value have also noticeably slowed for strategic buyers this year as they continue to weigh the potential impact of trade uncertainty on production costs and resource availability.

Furthermore, the median deal size for strategic buyers fell from $59.5 million to $50 million between 2017 and 2018, reversing an upward trajectory since 2015 and providing an interesting contrast to the increase in manufacturers’ median revenue at the time of a private equity acquisition. This suggests potential acquirers are now more cautious about placing bigger bets, yet could also suggest that the available targets have simply been off lesser size and value this year.

Manufacturers’ Next Moves

For manufacturers looking for capital to reach their full Industry 4.0 potential, among other strategic needs, the latest deal numbers confirm that tariffs are complicating an otherwise robust economic outlook that would typically make for a strong funding environment.

While the tariffs have been enacted with the intent to rebalance the trade relationship between the U.S. and China, recent deal activity numbers illustrate how these changes make it more difficult for manufacturers to access capital. Only time will tell how international tensions reshape the manufacturing industry.

In addition to the more traditional metrics, fund managers will be prudent to evaluate their portfolios’ strengths and weaknesses through the lens of U.S. and global trade policy. As our findings reveal, not all manufacturers are created equal. It takes a nuanced approach to understand the likely impact of tariffs based on global supply chain dependence among other variables.

Navigating Changes in International Trade: Q&A with Johny Chaklader

In this Q&A, Johny Chaklader, who leads BDO’s Export Controls and International Trade practice within BDO’s Industry Specialty Services – Government Contracts group, analyzes how the U.S. tariffs on imports are disrupting manufacturing operations and what manufacturers can do about them.

Pitchbook: What manufacturing sectors are hurt the most by tariffs?

Johny: When it comes to tariffs, there are always winners and losers. The latest rounds of tariffs between the U.S. and China are increasing production costs and eroding margins, impacting a range of goods from raw materials to electronics and machinery. The bottom line is: if you’re a manufacturer that imports or uses goods from China in your processes, and if any of those goods are on the tariff lists, your materials costs will increase substantially. The party that ultimately bears the burden of that cost increase will vary, depending on their position in the supply chain. Many U.S. manufacturers either import goods directly from China or are downstream from those that do. To mitigate cost increases, manufacturers may pass some or all of the cost increases downstream—to other manufacturers, distributors, retailers, or in some cases, the end‑consumer.

The only manufacturers that benefit from the tariff increases are those that do not import goods from China and are not located downstream from parties that do. Such manufacturers benefit because their competitors’ costs will increase, while they can continue to operate more or less as usual.

Pitchbook: How can manufacturers find relief from the tariffs?

Johny: For starters, the 90-day moratorium on List 3 tariffs from January through March should provide some short-term relief. To address some of the longer-term effects, many U.S. manufacturers submitted product exclusion requests to the Office of the U.S. Trade Representative for goods described under Lists 1 and 2. The success rate for securing product exclusions compared to the number of submitted proposals, however, is very low.

In late December, USTR announced the first set of products, all under List 1, that it approved for exclusion. The exclusions are retroactive as of July 6, 2018. Any one that imports goods approved for exclusion will find relief because the approval is not limited to the specific requestor. Manufacturers and importers should examine the list of excluded products to see whether their imports qualify for relief. The exclusion will remain in effect for one year till late December 2019. USTR indicated additional approval decisions are forthcoming.

Going forward, manufacturers should keep track of their direct and indirect cost increases resulting from the tariff actions. At a minimum, this data can prove very helpful if and or when USTR decides to open an exclusion request docket for List 3 items and/or subsequent tariff actions. Manufacturers should also maintain rigorous and coordinated government relations efforts to ensure elected representatives are aware of how the tariff actions are impacting their own operations, their upstream and downstream partners’ businesses, as well as their sector as a whole. Manufacturer engagement with local elected representatives, either via traditional lobbying efforts or a grassroots approach through employees or local community leaders is critical in the run up to the 2020 elections. Letter writing, phone calls and publishing thought leadership can be effective methods for raising awareness about the tariffs’ impacts.

Large manufacturers or those that can pool their resources through collectives or trade organizations will likely have the most success, as they often have the most available resources to invest in these efforts.

Manufacturers should use this opportunity to review their tariff classifications, international sourcing strategies, potential costs and benefits of using free trade zones for duty deferral, options for duty drawback, and their overall approach to import compliance.

Pitchbook: How have the tariffs impacted M&A activity?

Johny: Previously, prospective buyers paid comparatively less attention to a potential target’s spot in the overall supply chain. Recent uncertainty around the future of U.S. trade policy has made prospective buyers wary of a target’s exposure to tariffs and the potential impact to margins and operations. Consequently, buyers have increased their due diligence around transactions to assess a target’s current and future exposure to tariffs, with a focus on supply chain and procurement. Overall, prospective buyers have grown wary about pursuing a deal in the current environment, adopting a “wait and see” approach until deals are reached between the U.S. and its trading partners.

SHARE