BDO Biotech Brief - Summer 2023

Table of Contents

- Introduction

- Biotechs Are Returning to Pre-pandemic Market Expectations, but Not Evenly

- Spending Is Slowing as Biotechs Tighten Their Belts

- Biotech Staffing Equilibrium

- Stock Issuance Declined Along With Share Price

- Looking Ahead

Introduction

The pandemic years were marked by an influx of investment for the biotechnology industry. As a result of this cash surplus, companies were able to make advancements in research and development and expand their business through acquisition. But the white-hot market of the pandemic has significantly slowed in the past year. Some of the companies that benefited from relatively easy access to capital are now finding it much more difficult to raise funds to continue development, and those new funds may be more costly or have higher dilution impacts than in the past. As economic conditions shift, biotech companies are faced with a new normal as biotech indices rebound from the lows seen in summer 2022.

While biotech companies are adapting to this new normal, not all companies are rebounding at the same level. According to BDO’s Summer 2023 Biotech Brief, an analysis of the 10-K filing data from companies on the Nasdaq Biotech Index (NBI), larger companies have proven better able to hold onto the financial momentum they gained during the COVID-19 pandemic and are continuing to see growth. Small and medium biotech companies, on the other hand, are seeing slower rates of growth more consistent with pre-pandemic markets.

Biotechs Are Returning to Pre-pandemic Market Expectations, but Not Evenly

The flood of venture and government funding, and overwhelming willingness to take on more risk for critically needed COVID-19 vaccines and treatments throughout the pandemic, gave the illusion that drug development timelines can be significantly accelerated. But now, amid higher interest rates and tighter funding conditions, it is difficult for biotechs to get access to the cash needed to fund R&D and maintain those same timelines. It is also challenging to manage the same number of R&D investment projects as they have in the past. Small and medium-sized companies might be feeling this change the most. Larger companies often have deeper relationships with banks and more resources available, allowing them to get the financing they need, while small and medium companies are more immediately affected by market changes.

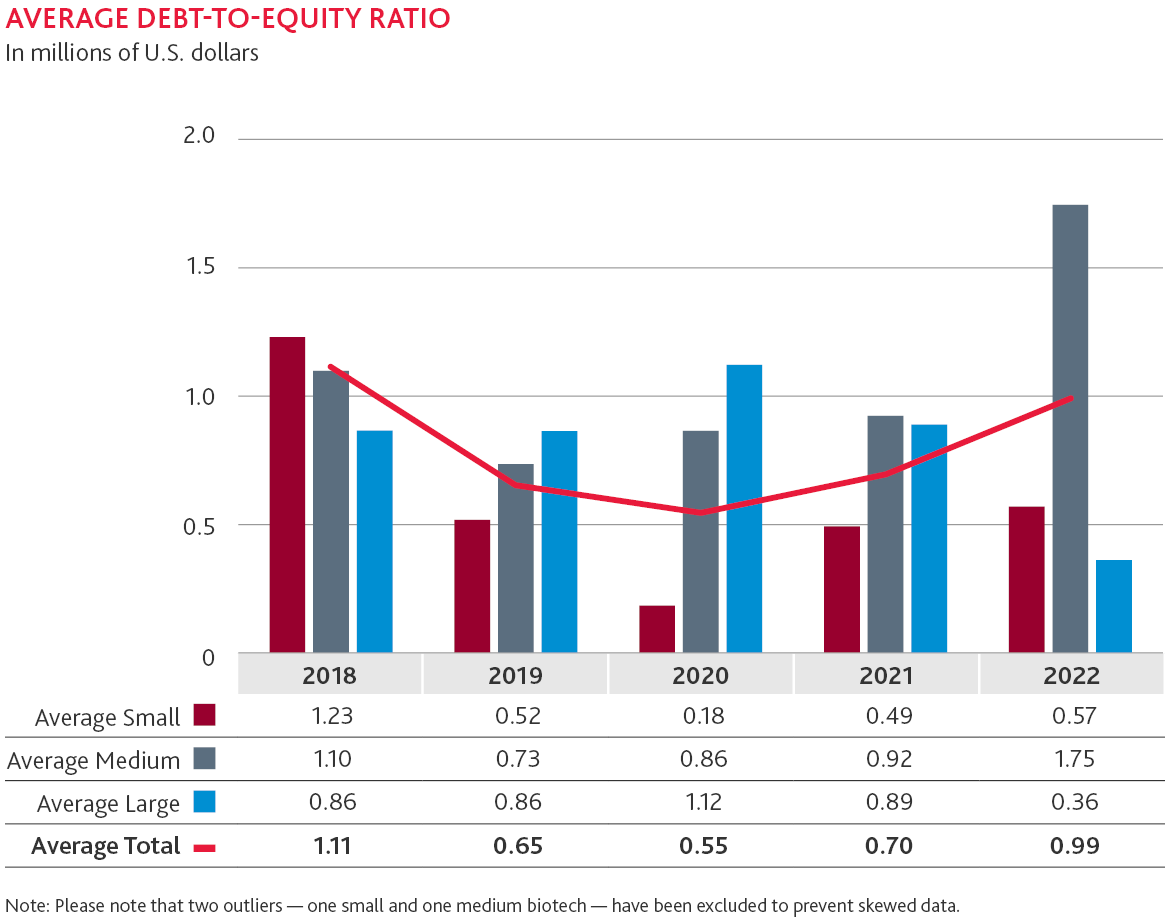

This disparity is evident in biotech companies’ financial reporting. There was a significant increase in the debt-to-equity ratio for small companies in 2022. This is likely because small companies continued losing money, which depleted their equity, and were unable to raise additional equity to make up for the loss. Additionally, liabilities either stayed the same, increased, or did not decrease at the same rate as these small biotechs were losing money, which would have increased their debt-to-equity ratio. Larger companies did not see this same impact because they have greater stability, which enables them to better manage their margins, equity, and debt.

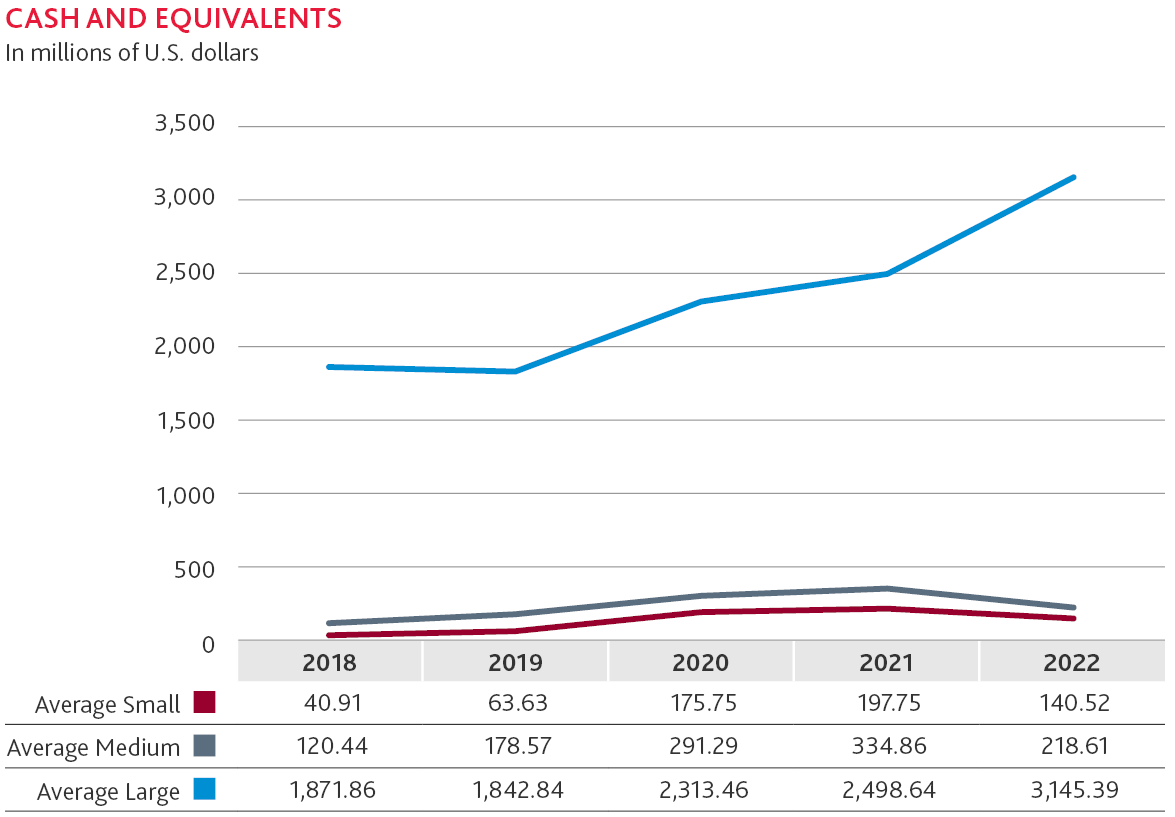

Meanwhile, large companies are faring better in the market. In 2022, large companies saw a 26% increase in cash and equivalents, which is more than three times higher than the 8% increase they saw in 2021. While larger companies excelled, small and medium companies saw cash and equivalents decline for the first time in the last four years. Investments made during the pandemic put large companies in a better position to ride out market shifts and maintain cash.

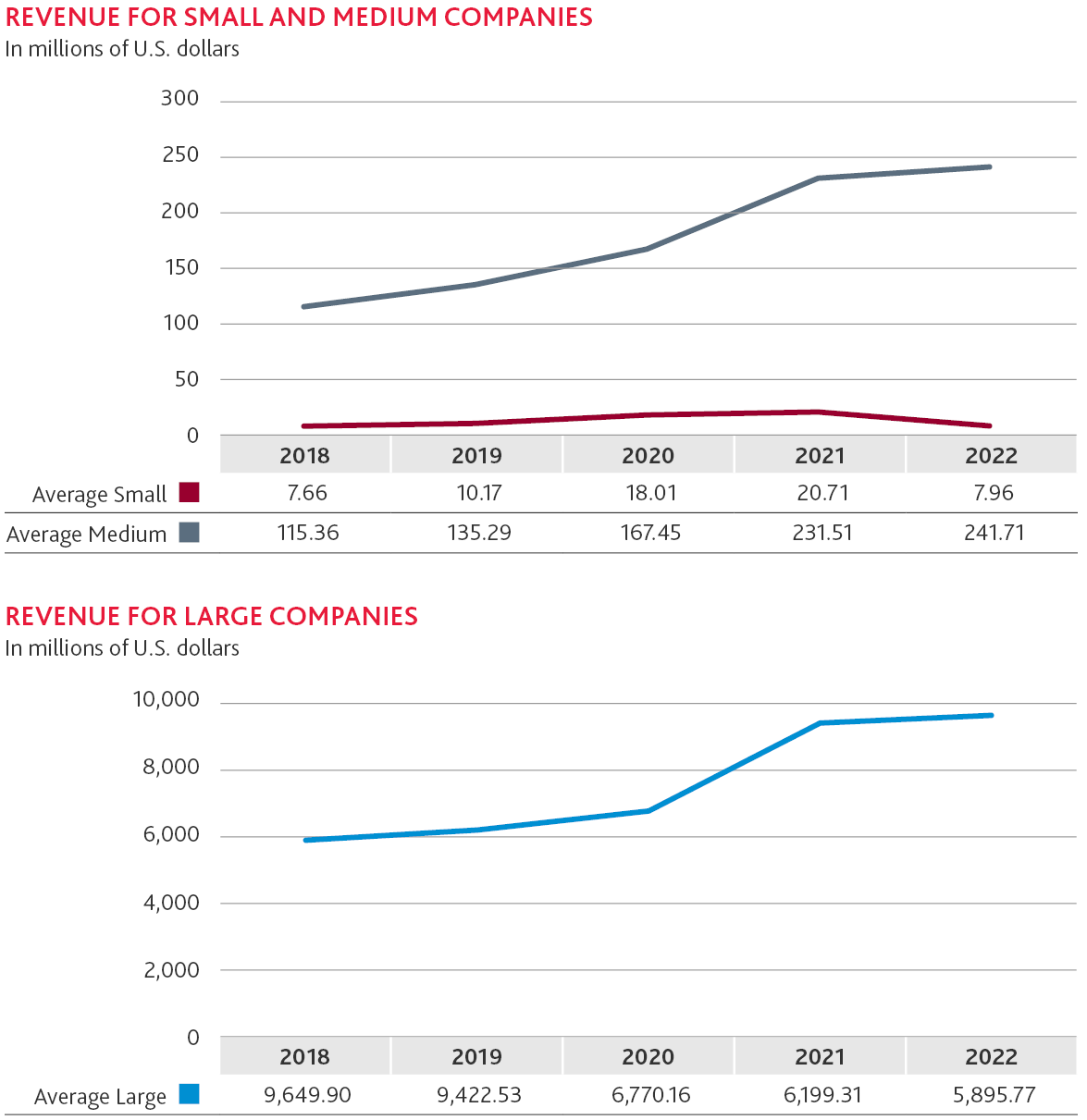

Larger biotech companies also generated significant revenue during the pandemic compared to medium and small biotechs, adding to their capital reserves, and making their financial strategies much more resilient than those of small and medium companies. While small biotech companies experienced a decrease in revenue for the first time in the last four years in 2022, large and medium companies saw a mild increase in revenue. Small biotech companies have seen diminishing revenue growth rates since the biotech boom of 2020. Though medium and large companies appear to have maintained growth for longer than their smaller counterparts, they have also seen diminishing revenue growth rates since 2020.

Spending Is Slowing as Biotechs Tighten Their Belts

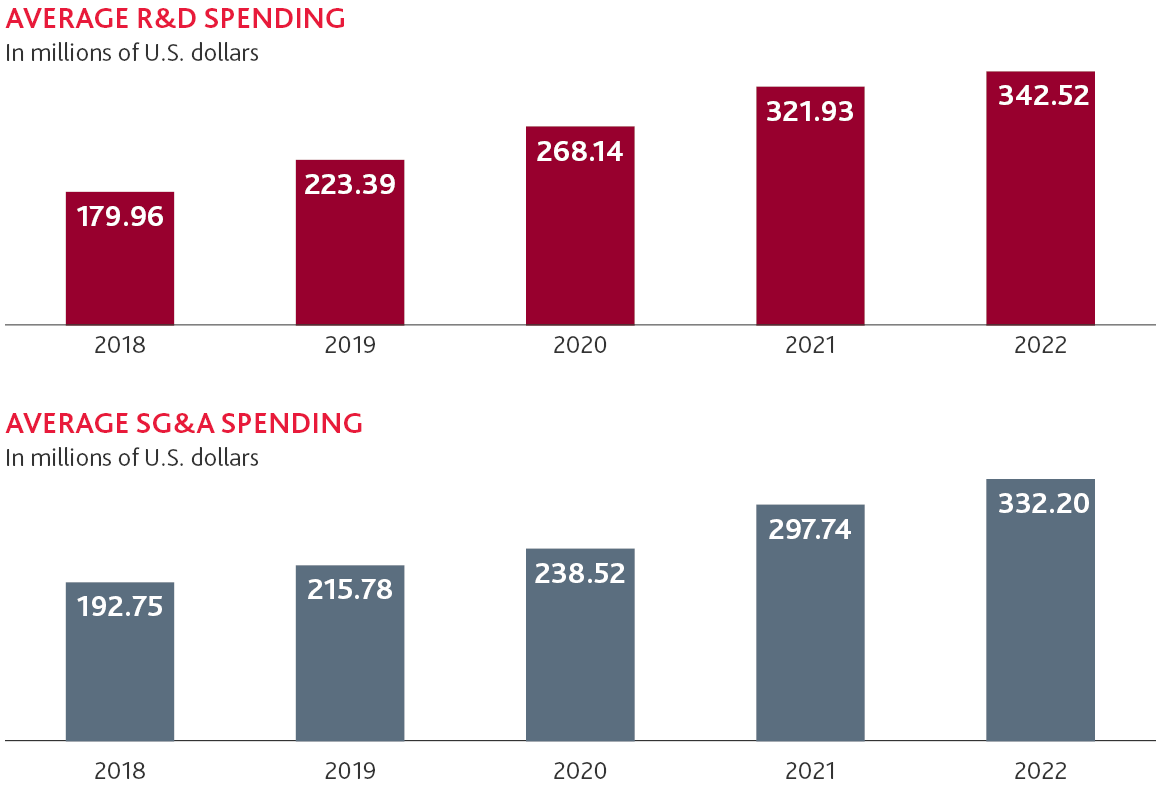

As the biotech market continues to return to pre-pandemic conditions, companies are revisiting their investment plans. While overall R&D spending continues to increase, the rate of that growth has slowed to only a 6% increase in spending overall in 2022. By contrast, R&D spending increased by 20% each year in 2020 and 2021.

As biotechs are contending with less cash on balance sheets, they are slowing their budget increases for SG&A spending as well.

After a 25% increase in SG&A spending in 2021, SG&A returned to a 12% increase in 2022, a rate of growth more in line with pre-pandemic budgets. This decreased rate in SG&A spending is likely due to the fact that 2022 saw the fewest new drug approvals since 2016. In 2021, the FDA approved 51 novel drugs whereas in 2022, there were only 37 approvals. With this many drug approvals in 2021, an increase in SG&A spending would be expected in late 2021 and into 2022 as companies work to ensure their new products penetrate the market. With just 37 drugs approved in 2022, we could see less SG&A spending in 2023. However, given that 22 new drugs were already approved in the first half of 2023, there could also be a resurgence of new drugs on the market and a subsequent increase to SG&A spending in 2023.

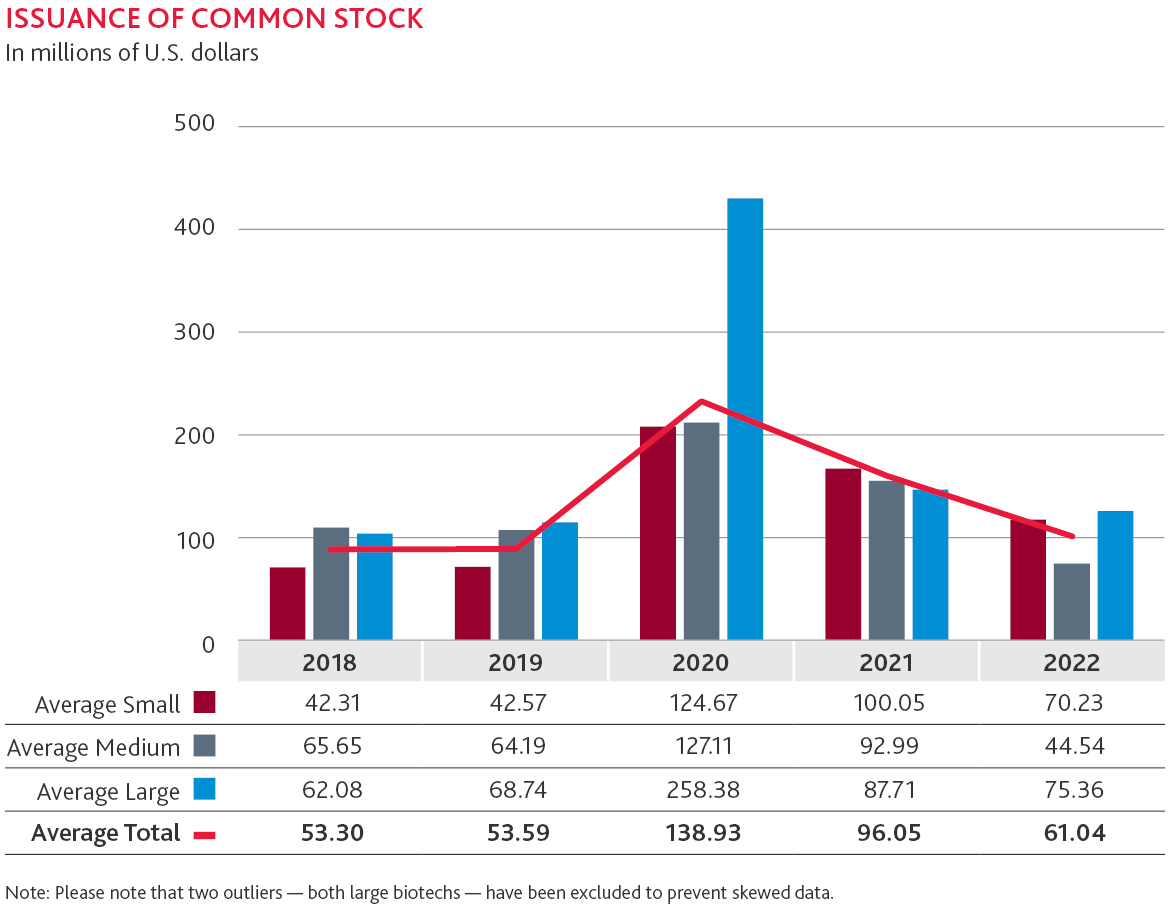

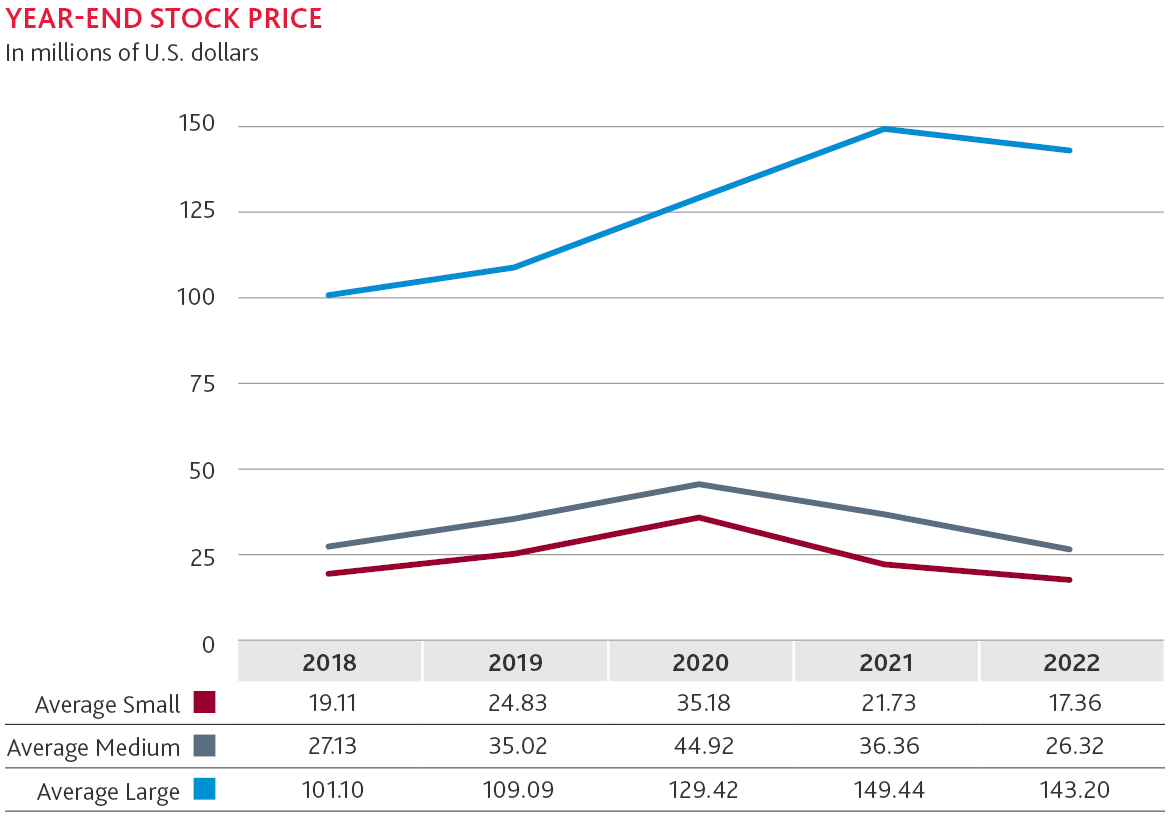

Stock Issuance Declined Along With Share Price

The issuance of common stock continued to decline for the second year straight in 2022. This is likely due in part to the decline in IPOs in the last year as well as economic factors that have lowered the demand for biotech stock.

Biotech’s stock prices across the board also fell by 18% in 2022. For larger companies, 2022 was the first time since 2018 that stock prices have dropped, but for others, 2022’s decline continued a downward trend. Small and medium companies have seen declining stock prices for the last two years after reaching a peak in 2020 and are now on par with pre-pandemic prices.

Looking Ahead

The biotech market is returning to a pre-pandemic normal. Biotechs, particularly small and medium companies, will need to carefully manage cash in the year ahead and maintain a balance in investments so that cost-cutting doesn’t restrict potential growth in the future.

In the year ahead, we expect a rebound in the M&A market. A recent influx of M&A activity for biotechs could hold significant opportunity both for cash-low companies with positive clinical data and for cash-rich companies looking to enhance their product pipelines. Furthermore, with 43% of life sciences CFOs planning to pursue a collaboration agreement to bring in cash, according to the 2023 Life Sciences CFO Outlook Survey, struggling companies might be able to access talent without pursuing a full acquisition. Increased layoffs in the industry could also provide biotechs with the specialized workforce they need as layoffs will make it easier to find experienced talent.

Over the next year, biotechs will need to effectively manage their resources to make sure their progress does not stagnate in the face of economic volatility.

To learn more about how to improve valuation of your biotech business and prepare for a potential sale, read our Guide to Selling your Biotech Business.

Methodology

This edition of BDO’s Biotech Briefing analyzes the 10-K filing data of companies listed on the Nasdaq Biotechnology Index, which includes organizations classified as biotechnology or pharmaceutical companies according to the Industry Classification Benchmark with a minimum market capitalization of at least $200 million and an average daily trading volume of at least 100,000 shares. BDO used CalcBench to conduct this data analysis and supplementary sources where noted.

SHARE