Key Takeaways

- Vaccine breadth of protection in low- and middle-income countries (LMICs) has increased significantly over the past 20 years, driven in large part by reductions in vaccine prices.

- The entrance of low-cost developing country vaccine manufacturers (DCVMs) has enabled this downward price trend and, simultaneously, enhanced supply security and contributed to breadth of protection improvements in LMIC markets.

- This market transition is the product of both the concerted effort of Gavi and global partners to leverage the consolidated buying power of LMICs to pursue a price reduction strategy, as well as the organic success of DCVMs in expanding production to compete with multinational companies (MNCs) and developing products targeted at LMIC needs.

- Following the COVID-19 pandemic, there has been increased interest in expanding the vaccine manufacturing base to include new manufacturers in regions currently under-represented in vaccine markets – particularly in Africa. We call these manufacturers “Startup DCVMs”.

- Based on available information and expert discussions, we analyzed how Startup DCVMs might compete with incumbent MNCs and DCVMs. We looked across generic profit & loss headers as well as at strategic considerations for vaccine markets to reveal 6 key profitability challenges which we expect Startup DCVMs may face:

- Competition in the last 20 years has made LMIC vaccine markets relatively saturated; the opportunities for Startup DCVMs pursing ‘me-too’ products are, therefore, limited.

- By definition, Startup DCVMs are being established in regions with limited vaccine manufacturing and, therefore, less mature supply chains for relevant raw materials. This can create extra logistics, tariffs and tax costs for new manufacturers compared to incumbents, despite both procuring from the same global materials providers.

- Operating in a new vaccine manufacturing region will mean limited availability of local labor with relevant experience. Startup DCVMs will need to rely on either expatriate labor and/or assume the expense of training a local workforce – both of which are likely to increase costs compared to incumbents in the early years.

- Administrative costs will typically be lower for Startup DCVMs in absolute terms given their small size. However, given Startup DCVMs will have an initially limited portfolio, there will be fewer products and/or markets over which to amortize costs, and, therefore, Startup DCVMs may have a higher cost per dose than incumbents.

- Equipment and facility investments will be roughly equivalent for Startup DCVMs compared to incumbents given the global equipment and facility construction ecosystem. However, given that Startup DCVMs typically operate with relatively smaller single product manufacturing sites, this may again result in higher cost allocation per dose compared to incumbents.

- Sustainability of vaccine manufacturers has historically relied on an in-house research and development pipeline. Developing an R&D pipeline from scratch may be crucial to long-term success, but challenging for Startup DCVMs located in environments without the broad research support in terms of financing, education and academic institutions to support local R&D efforts.

- To address these challenges, we identify five recommendations for Startup DCVMs:

- Startup DCVMs ought to be highly selective on antigen and product attribute for their portfolio to avoid entering highly competitive markets with ‘me-too’ products.

- Startup DCVMs can aim to strike a fine balance between achieving scale, to bring down unit price, whilst maintaining high utilization to optimize cost outcomes.

- Startup DCVMs can work with stakeholders to ensure access to global markets and, where possible, receive demand commitments that de-risk scaling vaccine facilities.

- Startup DCVMs can leverage partner support and strategic alliances to enhance funding or secure long-term contracts.

- Startup DCVMs can develop a product pipeline through in-house R&D where support is available or through partnerships with non-commercial technology providers.

1. Background and Introduction

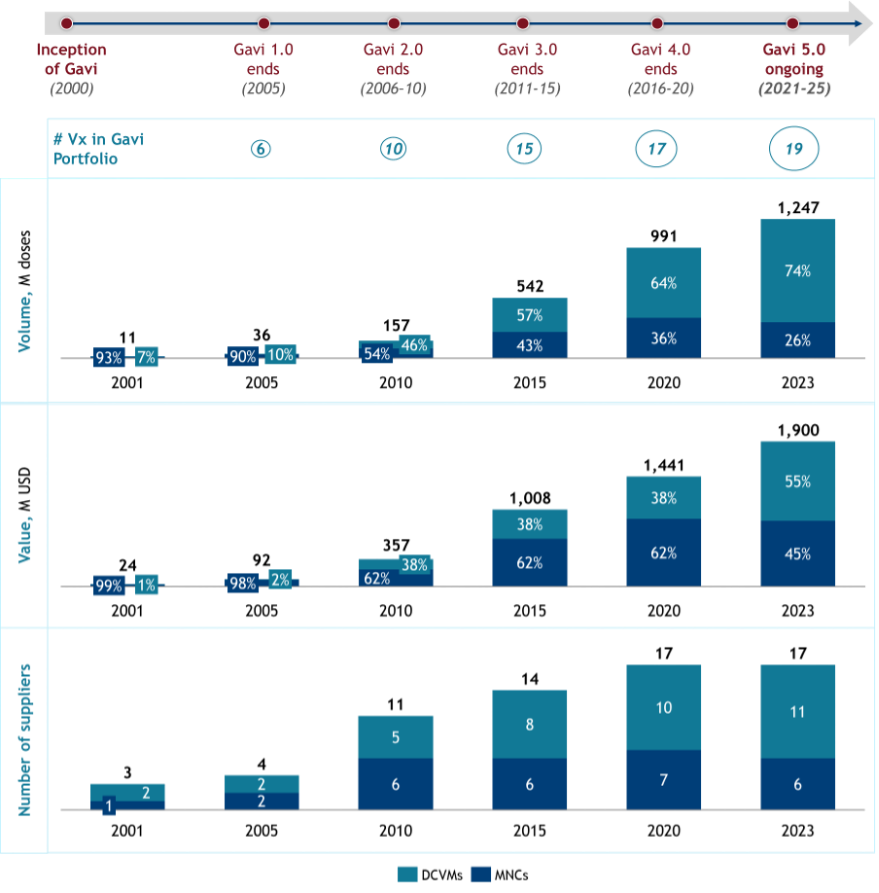

Since its founding in 2000, Gavi, the Vaccine Alliance, has transformed LMIC vaccine markets. By 2023, Gavi financed over 1.2 billion doses annually—valued at $1.9 billion—and supplied roughly half of LMIC vaccine demand,1 making it the world’s largest vaccine financier (see Figure 1). This growth was driven by coordinated efforts on both supply and demand sides.

Figure 1. Estimated volume and value of vaccines procured by Gavi countries and number of suppliers receiving UNICEF tender allocation between 2000 and 2023.2

On the demand side, Gavi strengthened health systems and improved long-term financing predictability for national immunization programs, unlocking vaccine demand in LMICs.3 On the supply side, increasing budgets through successive replenishments expanded Gavi’s portfolio to 19 vaccine types in 2023, attracting new manufacturers. Market actors like UNICEF supported supplier diversification by splitting tender awards, while instruments such as Advance Market Commitments (AMCs) helped reduce risks for new suppliers to new vaccine programs, such as PCV. Consequently, the number of vaccine suppliers increased steadily—from 3 in 2001 to 17 in 2023 (see Figure 1).

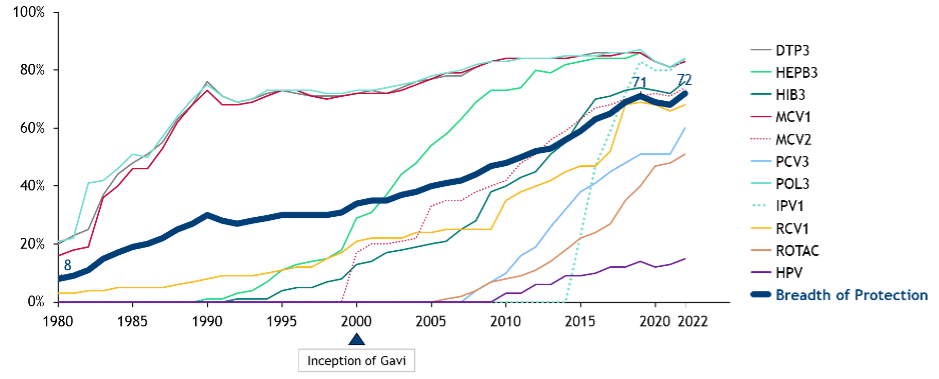

The establishment and growth of Gavi,4 the strengthening of global health services,5 and advancements in vaccine research and development6 have collectively led to a significant increase in global vaccination coverage, as evidenced by breadth of protection increasing from 34% in 2000 to 72% in 2022 (see Figure 2). The effect has been a major reduction in global mortality rates, especially among children under five.7

Figure 2. Increasing global coverage (%) across different vaccines.8

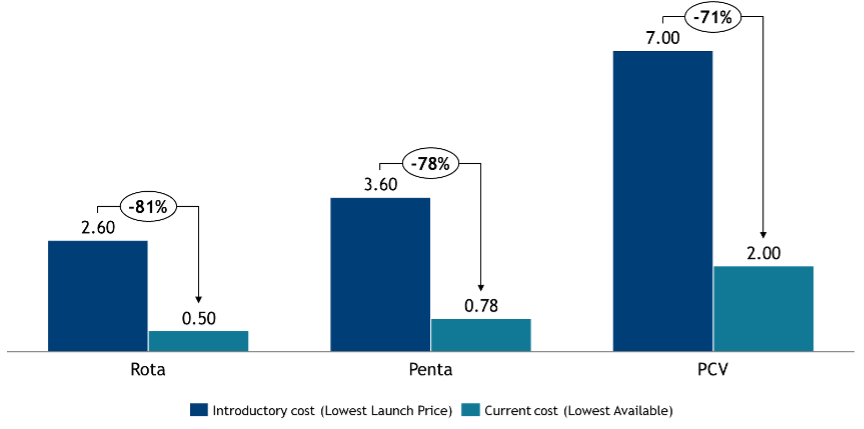

This expansion was enabled by Gavi’s growing budget over the past two decades and sharp price reductions for key vaccines,9 with prices for pentavalent, rotavirus, and PCV dropping by 79%, 77%, and 43%, since their introduction respectively (see Figure 3). These price declines allowed broader vaccine offerings and extended coverage within fixed budgets.

A major factor behind these price reductions has been the shift in suppliers. While multinational companies (MNCs) initially dominated — providing over 50% of Gavi volumes over the first decade — DCVMs from India, China, and other developing nations, now supply 70% of Gavi’s vaccine volumes (see figure 1). The entry of competitively priced DCVM vaccines has driven much of the market’s affordability gains.10

Figure 3. Lowest Gavi menu price per dose for selected Gavi-supported vaccines (2005–2025).11

Outside Gavi-supported countries, vaccine coverage and market dynamics differ. DTP3 coverage in non-Gavi middle-income countries (MICs) like Thailand, Egypt, and Chile was already high (>90%) in 2000 and has remained stable.12 However, new vaccine introductions have often lagged; for example, rotavirus and PCV3 coverage in upper-middle-income countries (UMICs) was 29–36 percentage points lower than in low-income Gavi-supported countries as of 2022.13 Price reductions seen in Gavi markets have not always translated elsewhere—some MICs pay up to 10 times more than the Gavi prices.14

Tracking DCVM penetration in non-Gavi LMICs is difficult, but WHO MI4A data suggest Indian and Chinese vaccines account for over 20% of procurement outside Europe.15 Still, access challenges persist. For instance, no DCVM HPV vaccines are registered in South Africa, where HPV vaccine prices are seven times higher than in Gavi markets.16 Barriers include limited market information, complex procurement, and competition from established MNCs, resulting in fewer DCVM competitors, higher prices, and slower uptake of new vaccines.

Against this backdrop, we stand in 2025 on the brink of another potentially significant transformation in the LMIC vaccine market: growing interest in vaccine manufacturing from new regions aiming to build their own capabilities. On the African continent, many heads of state are calling for the localization of vaccine manufacturing, with efforts spearheaded by the Africa Centres for Disease Control and Prevention.17 Similar initiatives are gaining momentum in Latin America18 and Southeast Asia.19 This shift promises enhanced regional health security and greater equity in global vaccine markets.

However, expanding the number of manufacturers risks fragmenting the market, potentially reversing affordability gains made over the past two decades. Primarily this risk could materialize if governments chose to procure from new, higher-cost local vaccines suppliers in order to support health security, at the expense of an increased burden on already stretched vaccination budgets. A secondary knock-on effect from this hypothetical procurement shift could impact existing suppliers, who, as a result of losing volumes to new entrants, may have to contend with reduced economies of scale, leading to higher prices from existing manufacturers as well.

These shifts come at a time when global health financing is under increasing pressure. Overall development assistance for health is plateauing or declining, donor priorities are shifting, and macroeconomic headwinds—including mounting debt burdens, currency depreciations, and reduced fiscal space in many LMICs—are constraining national health budgets. At the same time, rising protectionism and a less favorable global trade environment threaten to further limit access to affordable health technologies. These challenges raise the stakes for building sustainable, cost-effective vaccine manufacturing models that can thrive in an increasingly resource-constrained global landscape.

Amid these dynamics, this whitepaper examines the opportunities and challenges for new manufacturers aiming to build globally competitive and commercially viable businesses in the LMIC vaccine market.

To address these questions, the Clinton Health Access Initiative (CHAI), BDO, and Kroll conducted extensive interviews with executives from DCVMs, MNCs, and global health ecosystem stakeholders, as well as research into published documents. Through this analysis, we hope to distill actionable lessons from the history of vaccine markets to provide a roadmap for future endeavors. Coupled with our ongoing support to partners in the ecosystem, we look forward to implementing these learnings and to the next 25 years of increasing vaccine adoption and use worldwide.

2. Looking Ahead: The Next Frontier of Vaccine Manufacturing Localization

With the strong competition between incumbent MNCs and DCVMs, and the growing interest of Startup DCVMs in entering this space, LMIC vaccine markets have never appeared more crowded. Whilst our analysis cannot identify cast-iron strategies or guaranteed niches that will ensure success for Startup DCVMs, we hope that it can point to general rules of how Startup DCVMs can maximize their chances of success in this crowded market. As with many businesses, this can be boiled down to two sets of choices. Firstly, selecting the right vaccine markets where Startup DCVMs can carve-out a comparative advantage against competitor products. And secondly, structuring their business to create a competitive cost-base to ensure that they can compete effectively with incumbents in those markets. There are no short-cuts or silver-bullets to achieve this, but key lessons from history are expanded on in the following sub-sections.

2.1. Market Selection

Vaccine market growth has historically attracted new manufacturers to the LMIC ecosystem, supported by market actors aiming to bridge supply–demand gaps, increase supplier diversity, and lower prices. This environment created significant opportunities for DCVMs, which have delivered high-volume, low-cost vaccines to meet needs unmet by the MNC-dominated market.

Today, new manufacturers face a more complex and competitive landscape, contending not only with MNCs but also with established DCVMs. With many markets now mature, demand stabilized, global supply sufficient, and prices relatively low and sustainable, the vaccine market is largely 'healthy.' Emerging manufacturers are unlikely to compete effectively on cost with established DCVMs or on brand with MNCs. Their late start makes direct competition unviable, and producing 'me-too' products offers limited long-term prospects.

Despite overall market saturation, underserved niches remain that Startup DCVMs can target. These are few and often underdeveloped for good reason—such as low volumes and uncertain demand in outbreak-related vaccines, or limited competition where incumbents maintain high margins. While these markets present opportunities, accessing the necessary technology can be difficult due to strong or complex patents, making it challenging to build a viable portfolio. Nonetheless, a careful, data-driven assessment of vaccine market needs is essential to identify promising niche opportunities for new entrants.

To move beyond 'me-too' products, Startup DCVMs must disrupt the status quo by leveraging innovative technologies to offer vaccines with improved coverage, efficacy, or cost-effectiveness. This could include novel vaccines, technologies targeting unmet regional needs (e.g., for diseases endemic or exclusive to specific regions), or improved formats like combination vaccines or microarray patches that enhance ease-of-use at the point of care. Such innovations can boost product value and reduce direct competition with incumbents. However, these technologies carry higher development risks, as they are often unproven. Still, the potential rewards for offering a unique product are substantial.

Once clear niches—whether underserved markets or novel offerings—are identified, Startup DCVMs must occupy them while remaining cost-competitive. The next section explores the profit and loss (P&L) cost factors critical to commercial viability.

2.2. P&L Factors Analysis

A key driver of DCVMs’ success has been their ability to maintain a competitive cost base, enabling lower prices and greater market share. Understanding the sources of these cost efficiencies can help guide future DCVM strategies. Cost structures vary across manufacturers—shaped by geography, scale, and product focus—which influences how DCVMs and MNCs approach LMIC markets. To explore these differences, we examine cost factors across three archetypes: Startup DCVMs, Established DCVMs, and MNCs.

Building on these archetypes, a closer look at P&L factors reveals how specific elements impact financial performance. Table 1 outlines where Established DCVMs typically hold advantages or face challenges compared to MNCs and identifies cost optimization strategies available to Startup DCVMs. While not exhaustive, these factors highlight key areas of strategic differentiation.

Table 1. Potential cost differentiators between established DCVMs and MNCs and potential cost optimization strategies for Startup DCVMs.

| P&L Factor | Cost Differentiators Between Established DCVMs and MNCs | Potential Cost Optimization Strategies for Startup DCVMs | |

|---|---|---|---|

| Cost of Goods Sold (COGS) | Raw materials and consumables | Chinese and Indian DCVMs built cost advantage over MNCs gradually by increasingly sourcing locally | Reduce tax / tariff / logistics costs for raw material sourcing in the short term; and in the long term consider backwards integration. |

| Labor | Labor costs for DCVMs in low-cost regions such as India and China more than 25% lower compared to MNCs20 | Relying on local biotech ecosystems and minimizing expats can lead to labor cost advantages for Startup DCVMs | |

| Research & Development | DCVMs focused on established products, thus not typically incurring substantial R&D costs to develop novel vaccines21 | Startup DCVMs can seek commercial partnerships with research institutes; and technical assistance grants leveraging innovative technology donor organizations22 | |

| Selling, General, and Administrative Expenses | DCVMs focused on high-volume, low-price Gavi and public LMIC markets driven by large public tenders, keeping SG&A costs low | Startup DCVMs can focus on limited number of public markets and prioritize the large scale Gavi/UNICEF market | |

| Depreciation | DCVMs built large facilities, spreading high fixed costs over a larger volume to yield lower fully loaded per-unit costs | Startup DCVMs can focus on economies of scale and scope by using manufacturing resources in the same facility for different products23 | |

| Cost of Capital | Government-owned DCVMs often secured concessional funding; family-owned, privately held DCVMs often leveraged strong balance sheets | Startup DCVMs can work with local governments for tax incentives and business-friendly policies | |

Before addressing individual cost factors, it's important to highlight one overarching influence on the entire P&L: scale. Scale is a critical driver of financial performance in vaccine manufacturing. First, it spreads fixed costs—such as facility overheads and equipment depreciation—over larger volumes, lowering the cost per dose. Second, it increases procurement leverage, enabling better pricing and terms for inputs like raw materials, packaging and services. Third, higher production volumes improve facility and equipment utilization, reducing per-unit operating costs. Scale also supports investment in automation, process optimization, and regulatory capacity, all of which contribute to long-term competitiveness. In short, scale isn’t just a byproduct of success, it’s a prerequisite for sustainable cost leadership.

Raw materials and consumables

Raw materials and consumables can be a significant portion of vaccine production costs depending on the product. All manufacturers have access to the same global suppliers, which limits the extent to which raw material and consumable costs are a differentiator. That said, certain factors can create cost advantages; for example, manufacturers in regions with local sources (such as India or China) may save on shipping and import taxes compared with countries like South Africa or Argentina that rely heavily on imports. In addition, in regions with limited vaccine manufacturing, key raw materials and consumables have been found to have complex and burdensome taxation and tariff systems. This can raise costs as well as causing delays for manufacturers in those regions. Scale also matters, because larger manufacturers can negotiate lower prices with suppliers, reduce unit costs through bulk purchasing, and better manage inventory, all of which contribute to lower per-dose costs.

Startup DCVMs in regions without local supply chains may face higher raw material costs. To mitigate this, Startup DCVMs should prioritize local partnerships and, where feasible, invest in in-house production of critical raw materials (especially for specialized inputs like carrier proteins or rare adjuvants) to reduce cost volatility and improve long-term competitiveness.

Labor

Labor cost advantages for DCVMs compared with MNCs depend on the availability and cost of skilled local workers. Countries like India and China benefit from a well-trained biotechnology workforce at lower costs than in regions where MNCs operate, such as the US or Western Europe. Countries with skilled local labor, such as South Africa or Argentina, may offer moderate cost savings relative to MNC regions, though labor rates vary widely within and across countries and will typically be higher than in regions with established DCVMs (e.g., India and China). In regions without an established vaccine manufacturing workforce, like parts of Africa, Startup DCVMs may rely on expatriate labor, leading to higher costs due to expatriate salaries and relocation expenses.

Startup DCVMs should invest in training local talent to reduce reliance on expensive labor and form partnerships with academic institutions, governments, and global health organizations to build a pipeline of skilled workers, ensuring long-term labor cost competitiveness.

Overhead

In this context, overhead refers to production-related costs such as utilities and ongoing facility expenses; it excludes non-production costs like sales or administrative expenses. Many overhead costs scale with capital expenditure or labor. In regions with underdeveloped infrastructure, operating facilities may be more expensive because manufacturers may need to cover additional costs, such as ensuring consistent utility access. Although many DCVMs have limited options, decisions around facility locations may be informed by these factors where possible. Larger-scale production may be one strategy to help dilute overhead across a greater volume of doses, lowering per-unit overhead expenses, and bringing Startup DCVMs into line with incumbent manufacturers.

Research & Development

MNC business models rely heavily on the development of new vaccines, making R&D a significant ongoing investment. There is more than 10-fold absolute cost difference in this category because established DCVMs typically spend 0.1–3% of their revenue on R&D, compared with 5–8% of global vaccine revenue for MNCs. However, a significant portion of MNC R&D is underwritten by government grant funding (particularly evident during the COVID-19 pandemic).25

Tiered pricing allows MNCs to recover overhead and R&D investments in high-income countries, including for failed products, and offer products close to marginal production costs in LMICs. Established DCVMs, in contrast, specialize in low-cost manufacturing and often rely on technology transfers to produce vaccines rather than developing processes from scratch. This allows them to avoid significant upfront R&D costs, sometimes opting to pay royalties over the life of the product instead. Furthermore, DCVMs frequently receive R&D support via grants, partnerships, or technical assistance, reducing their financial risk and minimizing out-of-pocket expenses.

It is likely to be critical for Startup DCVMs to develop their own R&D over the longer term, because intellectual property ownership and development of targeted products has historically been the route to profitability for almost all vaccine manufacturers. To achieve this, Startup DCVMs may benefit from establishing commercial partnerships with research institutes or securing technology transfers and technical assistance grants to remain competitive without taking on a significant R&D burden.

Selling, general, and administrative expenses

Selling is a significant portion of both MNCs’ and DCVMs’ overall cost base when selling product into high-income countries, so recouping these costs is a consideration in vaccine pricing for those markets. Low-income markets are typically serviced by public procurement via bulk purchasing agencies, which mitigates the need for significant sales and marketing expenses when allocating a cost base specifically to Gavi and/or LMICs.

General and administrative (G&A) costs cover corporate expenses like executive salaries, HR, and compliance. Although not tied to specific products, manufacturers must broadly set prices to recoup G&A costs to ensure long-term sustainability. MNCs tend to have higher absolute G&A than DCVMs due to their broad operations and regulatory requirements, but scale allows them to spread these costs across a wide product portfolio, reducing per-dose administrative overheads. Startup DCVMs, in contrast, may be more exposed unless they can rapidly expand production or co-locate product lines to benefit from shared services.

In some cases, MNCs may choose not to recoup G&A from low-income market sales and instead rely on revenue from other markets, which can lower their cost base compared with smaller DCVMs that may have no other market in which to recoup these costs. Established DCVMs we researched and interviewed emphasized support from global health partners as pivotal to reducing administrative and compliance costs related to product registration. So Startup DCVMs may benefit from an early focus on forming strong relationships with these partners.

Depreciation

Depreciation applies to both equipment and facility expenses. Equipment costs are similar globally, aside from variations in shipping and tariffs, but facility costs vary more significantly. In low-cost regions, basic construction is cheaper, offering established DCVMs an advantage—but Startup DCVMs in regions lacking local materials or expertise may face higher costs, especially if they import materials or use prefabricated facilities. In areas with underdeveloped infrastructure, manufacturers may also incur additional expenses, such as generators to maintain power supply.

Manufacturers’ process choices can impact depreciation. For example, choosing a facility with more automation will increase capital expenditure and therefore depreciation. In theory, this additional expenditure is offset through a reduction in labor requirements; accordingly, this may be a net cost benefit for markets with expensive labor.

Production breadth can impact per-product facility costs. For example, given the advantages of scale discussed above, building a higher scale filling line and sharing it across multiple products can reduce costs allocable to any one product. This is true for both MNCs and DCVMs but it is more difficult to achieve for Startup DCVMs that initially focus on a single product, possibly leading to a cost disadvantage. Our analysis indicates that the ability to share the line leads to a depreciation cost savings for MNCs and established DCVMs (both $0.01/dose) relative to Startup DCVMs ($0.03/dose). In fact, some savings are possible even when production lines themselves are not shared, because products can still share other costs such as common space or power supply.

Both MNCs and established DCVMs have advantages of scale, technology, and scope over Startup DCVMs with respect to depreciation. To optimize costs, Startup DCVMs can pursue new technologies that reduce capital investment or aim to use manufacturing resources in the same facility for multiple products.27

Cost of capital

Manufacturers that are beholden to shareholders, particularly those that are publicly traded (as is often the case for MNCs), have a fiduciary duty to maximize their profits, which can conflict with the best outcomes for public health. DCVMs, whether private or government-owned, may have more leeway to balance competing objectives beyond profit maximization. A more significant advantage over MNCs is DCVMs’ ability to reduce cost of capital altogether by accessing grant and/or government funding – outside of abnormal periods like the COVID-19 pandemic. Such concessional funding sources typically require no or limited interest or repayment and significantly de-risk the development process, allowing DCVMs to garner crucial financing without the pressure of investors’ high return of investment (ROI) expectations.

Strategic approaches can significantly reduce Startup DCVMs’ upfront and ongoing expenses. By leveraging local labor, optimizing raw material sourcing, and using partnerships for R&D, these manufacturers can navigate the complexities of the vaccine market more effectively. However, scale underpins many of these cost advantages—supporting more favorable procurement, reducing fixed costs per unit, and enabling greater efficiency in overhead and depreciation. The following section outlines recommended strategies for Startup DCVMs to achieve sustainable growth and competitiveness in the global vaccine landscape.

2.3. Local Manufacturing Expansion: Recommendations for Success

New vaccine manufacturers must not only match or outperform incumbent costs but also target market opportunities where they can offer a unique or clearly superior product—avoiding direct price-based competition. By understanding how a Startup DCVM’s cost base compares to that of established players, and by taking a few strategic steps, startups can position themselves more competitively against incumbents.

Manage scale and utilization

Scale remains essential for achieving competitive pricing. Manufacturers must maximize both production volume and facility utilization to optimize costs—especially when serving LMIC markets. Emerging manufacturers should also leverage new technologies where possible to reduce costs. However, Startup DCVMs may struggle to reach the same scale as earlier entrants, given today’s more saturated market and the smaller size of many domestic markets outside India or China—unless 'local' demand is aggregated at a regional or continental level. Additionally, the growing number of DCVMs and the trend toward localization, where manufacturers serve defined markets, further limits scale potential and may drive prices up.

Secure demand commitments

Many DCVMs have scaled successfully thanks to clear demand commitments from their domestic governments. In India, established DCVMs built large-scale facilities with confidence, supported by a sizable domestic market (~80 million doses annually)28 and early access to a relatively noncompetitive Gavi market. This scale and consistent demand enabled them to secure lasting cost advantages. Manufacturers in China and Indonesia similarly benefited from strong domestic and Gavi-linked demand, allowing them to invest in capacity with limited risk. There are few other countries with large populations or with full-funded national health programs where domestic commitments will be sufficient to allow local companies to approach any meaningful scale, but they may be necessary for manufacturers to take the first steps towards scaling production.

Outside of domestic commitments, it is critical to access large markets that can allow companies to scale manufacturing efficiently. Regarding LMICs specifically this means it is critical to access the Gavi market, though other markets like PAHO may also support manufacturers business cases. Whilst not always possible, accessing third-party volume guarantees — backed by development banks, philanthropic organizations, or donor-led market-shaping initiatives — in these global and regional markets have historically been vital tools to de-risk early investments for Startup DCVMs. Without such assurances, manufacturers face a difficult path to market, as seen in the limited uptake of Aspen Pharmacare’s COVID-19 vaccine in South Africa.29 Clear, fair procurement commitments from global health stakeholders and national governments are critical to reducing business risk. In return, Startup DCVMs must actively engage with these stakeholders and offer competitive pricing to make such commitments viable.

Focus on product development for long-term sustainability

In most cases, long-term commercial viability of vaccine manufacturing requires access to intellectual property targeting specific market niches. Historically, DCVMs have initially relied on technology transfers from other vaccine manufacturers, but in so doing remain limited by the terms of the agreement and often are required to pay ongoing fees for access to the technology limiting the scope of their business. Successful DCVMs therefore usually rapidly moved to building a pipeline of products free from ties to other manufacturers, either through in-house product development or through partnership with non-commercial technology providers (e.g., Academic Institutions or Open-Access Initiatives). Emerging manufacturers should similarly focus on building an independent portfolio informed by LMIC market needs and carve out a competitive edge in the global market. Startup DCVMs located in environments that have broad research support in terms of financing, education and academic institutions could focus on developing their own R&D, but startups located in less supportive environments may want to focus on building internal manufacturing sciences and technology groups instead so to ensure successful tech transfer and ongoing manufacturing operations from non-commercial technology providers.

New manufacturers can target diseases that are currently underserved by larger players and demand is unmet to carve out a less competitive niche. Examples include local endemic diseases (e.g., dengue), as well as neglected tropical diseases which haven’t seen much global interest and investment yet. For diseases with established vaccines, Startup DCVMs can explore new technologies—for instance, offering combination vaccines to increase coverage and reduce the number of encounters required or developing microarray patches to eliminate the need for cold chains and allow administration by minimally trained personnel.

Innovations in upstream and downstream processes for established vaccines also present significant opportunities for emerging DCVMs to reduce costs or time to market. Startup DCVMs stand to benefit from the economics of disruptive technologies like mRNA platforms offering pathways to more efficient and affordable production. MNCs and established DCVMs face greater challenges because, once regulatory approvals and process validations are completed, their manufacturing methods become essentially fixed, making it costly—and often impractical—for them to implement new technologies. Startup DCVMs can exploit this opportunity to their benefit.

Leverage partner support effectively

Many successfully established DCVMs upscaled their technical capabilities while reducing costs by leveraging strategic partnerships and the expertise they offered. Technical support from organizations like PATH, often funded by the Gates Foundation, has played a significant role in developing established DCVMs and optimizing their COGS. R&D costs are often offset by funding from subsidies or grants, which can reduce or eliminate out-of-pocket spending. In a market with extensive philanthropic activity, emerging manufacturers stand to gain significant technical and cost benefits by establishing and leveraging connections to global partners.

New manufacturers can also align with public health goals by forming strategic alliances with local governments, nongovernmental organizations, or regional health initiatives to co-develop vaccines or secure long-term contracts. This can allow them to tap into funding and expertise that provides a competitive edge against established DCVMs or MNCs.

Building vaccine manufacturing capacity in new regions is a multifaceted endeavor that requires careful strategic positioning and execution. In the constrained operating space which global vaccine markets find themselves in, there is no surefire route to commercial viability for Startup DCVMS. However, new manufacturers can learn five lessons from their established and embedded counterparts to support them in their journey. 1. Startup DCVMs need to be highly selective on antigen and product attribute for their portfolio to avoid entering highly competitive markets with ‘me-too’ products. 2. Strike a fine balance between achieving scale, to bring down unit price, whilst maintaining high utilization to optimize cost outcomes. 3. Work with stakeholders to secure demand commitments that de-risk building and scaling vaccine manufacturing facilities. 4. Leverage partner support and strategic alliances to enhance funding or secure long-term contracts. 5. Focus on product development and intellectual property ownership to ensure long-term sustainability.

Although the path to establishing new vaccine manufacturing capacity is fraught with challenges. Embracing these strategies presents an opportunity for Startup DCVMs to evolve into competitive players in the international vaccine landscape and to contribute to global health equity and resilience.

A Whitepaper jointly authored by BDO, Kroll, and the Clinton Health Access Initiative.

Acknowledgments

This work was made possible with the support of the Gates Foundation, but the contents contained herein do not necessarily reflect the views of the Gates Foundation.

CHAI, Kroll, and BDO remain grateful to donors for their consistent intellectual collaboration. We would also like to thank the partners, vaccine manufacturers, and individuals who have contributed to this paper by commenting on the draft, reflecting on the data collected, or sharing their own thought leadership in this field. We extend our sincere appreciation to Africa Centres for Disease Control and Prevention (Africa CDC), PATH, Gavi, the Vaccine Alliance, UNICEF, the Coalition for Epidemic Preparedness Innovations (CEPI), and others.

1Access to Immunization in Middle-Income Countries: IA 2030

2Linksbridge, UNICEF price data, CHAI analysis; Data Note: Volume data is based on estimated antigen-level market demand and estimated market share of a supplier in a particular antigen market in the given year. The value data is derived based on available UNICEF price for each antigen. When there are multiple price points for a supplier and antigen in a given year, an average has been considered. As the historical demand is not supply-adjusted, the current volumes/value may not be an accurate reflection of actual procurement.

- Antigen markets considered: pentavalent, HPV, IPV, JE, meningitis A, measles and rubella, oral cholera, pneumococcal conjugate, rotavirus, typhoid conjugate, yellow fever.

- Countries considered: includes Gavi73 countries for the first year; countries are then excluded as they transition out of Gavi support. There are 54 Gavi countries as of 2023.

3Gavi second evaluation report

5Strengthening Health Systems and Communities

6Recent Global Trends in Vaccinology, Advances and Challenges

7United Nations Inter-agency Group for Child Mortality Estimation (UN IGME), Levels & Trends in Child Mortality: Report 2024 – Estimates developed by the United Nations Inter-agency Group for Child Mortality Estimation, United Nations Children’s Fund, New York, 2025

8World Health Organization and UNICEF Estimates of National Immunization Coverage (WUENIC), 2022

10Global Vaccine Market Report (2023)

11Gavi annual report 2022

12World Health Organization 2025 data.who.int, Diphtheria-tetanus-pertussis (DTP3) immunization coverage among 1 year olds (%) [Indicator]. https://data.who.int/indicators/i/48D7D19/F8E084C (Accessed on 25 March 2025)

14Cernuschi T, Gilchrist S, Hajizada A, Malhame M, Mariat S, Widmyer G et al. Price transparency is a step towards sustainable access in middle income countries BMJ 2020; 368 :l5375 doi:10.1136/bmj.l5375

15Global vaccine market report 2024. Geneva: World Health Organization; 2024. https://doi. org/10.2471/B09198

16https://medapps.sahpra.org.za:6006/

17Vaccine Manufacturing Needs a Favourable Environment to Deliver Returns on Investment

18Strengthening Local Manufacturing Capacities to Improve Equitable Access to Vaccines

19The World Bank - ASEAN Regional Vaccine Manufacturing and Development

20The complexity and cost of vaccine manufacturing – An overview

21A cost analysis of producing vaccines in developing countries

22Numerous DCVM interviews conducted by CHAI

23Sustainable vaccine manufacturing in low- and middle-Income countries

24CHAI analysis validated through interviews with vaccine manufacturers and global health stakeholders

26BDO and Kroll analysis

27Sustainable vaccine manufacturing in low- and middle-income countries

28Interviews of Indian DCVMs conducted by CHAI

29J&J partner Aspen, with no orders for its COVID shot, warns low demand sends 'bad message'