Innovation in Customer Experience: Opportunities for the Insurance Industry

The pandemic has been a wake‑up call to the insurance sector. Historically an industry reluctant to digitize, insurers have been forced to adopt a digital-first strategy in order to stay competitive amid the disruptions caused by COVID-19.

At the forefront of this digital awakening is customer experience (CX). BDO Digital’s 2021 Middle Market Digital Transformation Survey found that improving CX was the most commonly cited digital priority this year, ahead of other endeavors such as upgrading legacy IT and implementing change management.

But why CX? In 2021, consumers want seamless, personalized services that are tailored to their needs—and they’re choosing their insurance carriers with these expectations in mind. Onboarding and engaging with customers via telephone and mail are no longer the norm in modern society. Instead, customers expect online policy shopping, on-demand customer service and speedy claim payouts.

Technological innovation is key to meeting these demands. This article explores opportunities for insurers to harness data and technology to boost their CX.

Process Mining to Simplify Customer Journeys

CX is more than having a sleek user interface. Investment in back-end processes has a direct impact on customer satisfaction, particularly for incumbent insurers who are competing with insurtech entrants boasting advanced features like the ability to pay claims in a matter of minutes.

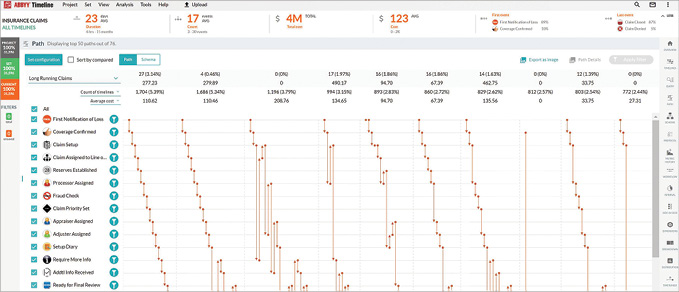

Process mining is a powerful tool that helps optimize the claims workflow by unlocking insights into inefficiencies and bottlenecks. Insurers can use these insights to overhaul, automate and standardize back-end elements of the claims lifecycle, leading to faster claim settlements and more straight-through claims processing.

It works by leveraging raw claims management data to build powerful visualizations that illuminate the claims workflow on different dimensions, such as the cost, aging or redundancy of process steps. For example, an insurer could use process mining to learn that collecting loss information from their policyholders is the lengthiest step in their claims process. Armed with this knowledge, the insurer could explore expedited methods to capture this information, like using speech to text integration to populate forms during customer calls. Eliminating bottlenecks like this reduces average claim durations and simplifies the customer journey, resulting in happier customers.

Process mining is particularly beneficial for those insurers in the early stages of digital transformation, as it helps to focus their initial efforts on the operational pain points that will lead to the biggest differences for their customers.

Collaborate with Insureds to Manage Risk

Both the insured and the insurer want to avoid losses. Nonetheless, until recently, insurers have not taken advantage of the opportunity to collaborate with their policyholders to manage risk. The growing volume of data available through technology, such as Internet of Things (IoT) devices, is changing the game of loss prevention by highlighting risky behavior and conditions before losses occur.

The obvious example of risk management in the insurance context is in-car telematic devices to monitor driving habits. But there are many more possibilities, such as in-home sensors for early leak detection, smart toothbrushes that monitor dental health or personalized health recommendations based on data from wearable devices. As connected devices continue to become more ubiquitous, so will the opportunities for insurers to leverage them to prevent claims.

These risk mitigation practices have a seismic impact on CX. For most consumers, insurance is a grudge purchase, ridden with distrust due to a belief that carriers don’t have their customers’ best interest at heart. If executed in a manner that is transparent and value-adding for the policyholder, claim prevention can help shift the model of insurance from antagonistic to mutually beneficial. Particularly at a time when losses are becoming less frequent in certain lines due to advancements in technology (think driverless cars), insurers must explore ways to remain relevant in the eyes of their customers.

A Streamlined, Personalized Approach to Underwriting

Insurance often gets a bad rap for its high-touch and drawn-out underwriting practices. In today’s market, insureds are gravitating toward carriers who can render instantaneous and highly personalized underwriting decisions. In order to keep pace, insurers must leverage forward-thinking technological solutions.

One such solution is automation. Underwriters have traditionally had to sift through large volumes of structured and unstructured data to extract relevant information, assign risk scores and quote policies. Automation can streamline the process by quickly lifting, interpreting and synthesizing the data, providing underwriters with the information they need in a format that’s easy to ingest.

Many insurers are going a step further and reimagining the underwriting process entirely. Instead of taking a one-size-fits-all approach to pricing policies based on statistical averages from historical data, these carriers are employing artificial intelligence (AI) to make future-thinking underwriting decisions customized to the individual policyholder. The AI approach to underwriting weaves together data from disparate sources—like self-reported data, third-party databases, geospatial data and even information from wearable or smart home devices—to form personalized risk profiles and price policies accordingly. The result is not only faster underwriting decisions due to less reliance on manual underwriting processes, but also sophisticated pricing that is accurate and customer-specific.

Customer Sentiment Analysis Draws Meaningful Conclusions from Disparate Sources

From social media posts to conversations with call center agents, there is a plethora of sources from which insurers can pull useful information to build customer insights and respond appropriately. Taken together, data from these seemingly unrelated channels can help them learn how customers feel about their brand, the claims process or other issues. While efforts to define insureds’ experiences might sound subjective and inexact, customer sentiment analysis uses natural language processing and other advanced machine learning techniques to assign a positive, negative or neutral rating to customers and prospects alike.

Large insurers and insurtech providers were early adopters of this technology, but organizations in the middle market are starting to realize the benefits of investing in this tool. Companies are deploying this technology to meet business goals, such as improving service offerings, identifying cross-selling opportunities and tracking the success of a new product launch based on customers’ emotions. Customer sentiment analysis also provides useful sales and marketing data outside of the direct interactions insurance companies have with their customers, which typically occur infrequently, such as during a claims event. Analyzing customer sentiment is another step forward in insurers’ broader digital transformation efforts—a robust data governance framework enables them to standardize the collection and management of disparate data sources into a “single source of truth” for better decision‑making.

The way that the insurance industry interacts with its customers has been remarkably unchanged for decades, but times are changing, and the practices that have made insurers successful up to now will not be what propels them forward. It is clear that the digital-first, customer-centric model is now the industry standard, and the insurtech propagators of this trend are only rising in prominence, with their funding at an all-time high. Now is the time for incumbent insurers to take a page out of their playbook and invest in CX.

SHARE