Now Open: Main Street Lending Program

On Monday, June 15, the Federal Reserve Bank of Boston (“FRBB” or “Fed”) announced that the Main Street Lending Program (“MSLP”) is OPEN for lender registration, signaling that the first loans will be made to borrowers as soon as lenders can complete registration and implement the loan program within their own operations. The announcement also included encouragement by the FRBB for lenders to begin making loans as soon as possible. Lenders can find all the applicable registration documents on the FRBB’s website.

Compared to the typical commercial loan, a Main Street loan includes several unique terms, eligibility requirements, certifications and covenants that will need to be evaluated prior to working with a lender.

On June 8, the Fed issued expanded guidance addressing numerous questions from the marketplace. BDO previously provided an analysis of the systemic changes in all three Main Street loan facilities.

The Fed is consistently making updates to the MSLP term sheets in order to make the loans more accessible to the borrowers through expanded eligibility. Below are key takeaways from the FAQ’s published June 8th and expanded upon during the June 15th FRBB Q&A Session for Borrowers:

- Pari Passu (Seniority & Collateral)

- MSNLF may not be subordinate to any other debt instrument.

- MSPLF and MSELF may not be subordinate to any other debt instrument except for mortgage & equipment debt (secured by real property and/or equipment).

- More complex seniority rules exist if the existing debt has a collateral position.

- Loan Maximum Calculation

- Existing debt instruments refinanced at the time of loan origination with the MSPLF should be excluded from the leverage calculation in determining the maximum loan amount.

- Refinance prior to MSLP

- Once established, non-MSLP debt cannot be pre-paid with MSLP funds unless the existing loan agreement mandates those payments in the normal course of business.

- It is permissible to restructure existing debt prior to establishing a Main Street Loan facility thus causing a revised amortization schedule and allowing contractual payments with MSLP funds.

Updated details on the MSLP are available via term sheets provided by the Fed:

MSLP’s Proposed Expansion for Nonprofit Organizations

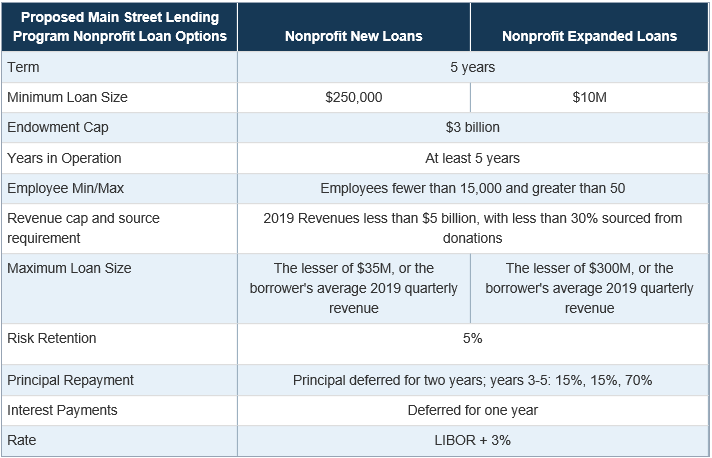

On June15, the Fed announced two additional proposed MSLP loan facilities specifically targeted at the nonprofit industry and is seeking industry feedback. Under the Main Street Lending Program, the Fed has proposed a “Nonprofit New Loan Facility” and “Nonprofit Expanded Loan Facility.” Previously, nonprofit organizations were not eligible to participate in the program given the absence of EBITDA, a key underwriting metric required for the three existing MSLP facilities. The new facilities substitute revenue for EBITDA in the leverage calculation. Amortization, interest rate and lender participation remain consistent with the commercial Main Street facilities. Below is a summary of key proposed nonprofit loan terms. BDO will issue more guidance in the near future specific to these new proposed facilities.

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200615b.htm.

How to Apply for a Main Street Loan

A Main Street loan application is to be made at a federally insured lending institution, which will apply its own underwriting criteria. In addition, the Federal Reserve also released several application forms and agreements that will be completed by the lender and signed by the borrower in conjunction with the primary loan application. The documents include borrower certifications and covenants.

The Federal Reserve cautions that “eligible borrowers should contact an eligible lender for more information on whether the eligible lender plans to participate in the program and to request more information on the application process.”

Please refer to the Federal Reserve’s Main Street website for the latest program information.

Disclaimer

The above has been prepared solely for informational purposes. Any opinion expressed herein shall not amount to any form of guarantee that BDO USA, LLP (“BDO”) has determined or predicted future events or circumstances, and no such reliance may be inferred or implied. BDO accepts no duty of care or liability of any kind whatsoever to any party, and no responsibility for damages, if any, suffered by any party as a result of decisions made, or not made, or actions taken, or not taken, based on this information.

© 2020 BDO USA, LLP

SHARE