This newsletter includes a comprehensive overview of current business issues, risk considerations, and recent regulatory developments to keep audit committees in the know.

Contents

Current Business Issues and Risk Considerations

Reminders About Macroeconomic Conditions

- Recession risk

- Rising interest rates

- Continuing inflation

- Tightened labor market

- Credit contraction

- Climate risk

- Uncertainty in the real estate sector (residential and commercial)

- Fluctuations in foreign currency exposure (geopolitical environment and supply chain challenges)

- Cybersecurity

- Pace of technological innovation

- Uncertain regulatory environment in the U.S and globally

Financial Reporting Considerations

- Risk assessment

- Design and operation of internal controls

- SEC Disclosures

Accounting & Reporting Considerations During Economic Uncertainty

Accounting Considerations - Evolving situations that require continual assessment and analysis, particularly whether a downward measurement adjustment is required for assets or whether new liabilities may need to be recognized.

Importance of Disclosures - Transparency for investors through evaluation of the completeness and transparency of accounting, judgments, and as well subsequent events, risks and uncertainties, and going concern assessments.

SEC Reporting Requirements – Changing economic environment often creates new and evolving risks, uncertainties, impacts, and challenges that can affect SEC registrants’ disclosures.

Internal Controls Over Financial Reporting – Whether there may be a need to design and implement new or modify existing controls to address complexities and risks associated with events that cause economic uncertainty.

Auditing Considerations – Whether there may be heightened and new risks of material misstatement or more difficulty in an auditor’s ability to obtain sufficient appropriate audit evidence for both the audit committee and management to factor into their oversight and execution of financial reporting.

Corporate Governance - Highlights the importance of boards and audit committees working closely with management, auditors, and advisors to evaluate risks and form meaningful responses to and communications about those risks. This includes the effects on employees, customers, and supply chains, including how executives are planning for contingencies.

View the publication here.

CAQ: Institutional Investor Perception of Fraud

Key Findings:

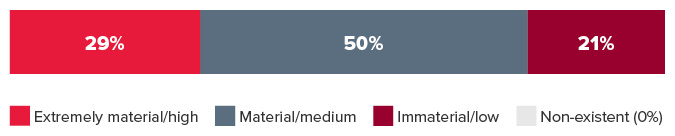

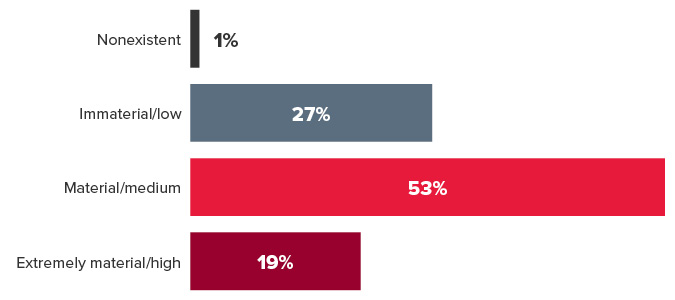

- Eight in ten investors believe fraud at U.S. public companies is medium-to-high, translating to an average of 3% of annual revenues based on investor estimates.

- Investors believe that internal audit teams hold the primary responsibility for preventing and detecting fraud, followed closely by company management and boards of directors.

- When financial fraud does occur, the plurality of investors view a company’s senior management as most responsible for the incident.

- Most investors believe that fraud prevention and detection can be more successful by placing a greater focus on monitoring transactions, especially with AI, and via employee training & culture.

- Investors believe the types of fraud most likely to occur are external, including cyberfraud, customer payment fraud, or fraud by vendors and sellers.

- Investors believe that cyberfraud has the potential to be the most catastrophic.

Top 5 Boardroom Conversations on Technology Governance

- Technology has shifted from being merely operational to a central driver of strategy, risk, and opportunity

- The top five boardroom conversations focus on how directors can balance innovation with protecting organizational integrity and value:

- Assessing the board’s technological literacy and access to expertise

- Remaining apprised on a shifting regulatory landscape

- Engagement with management to understand risk management effectiveness

- Cultural alignment and workforce preparation

- Prioritizing technology investment

Strategic Oversight & Governance in the Age of Artificial Intelligence: TRUST Framework

What is the TRUST framework* and what should boards be asking?

Triage: Classify AI use cases by risk like a traffic light. Red light for prohibited AI, yellow for high risk and green for medium/low applications tied into enterprise goals and ROI.

Right Data: Verify that there are privacy, intellectual property, and business rights to utilize the data. Companies using generative AI models trained on flawed internet data must correct for these issues.

Uninterrupted Monitoring: AI systems must be constantly tested and audited for accuracy. This can be accomplished by embedding checks into the application.

Supervision: Human oversight is a necessity. Companies need to embed their values and ethical standards into their AI systems and continue to monitor so that they can act quickly upon notification of deviations.

Technical Documentation: When AI models drift (e.g., degradation of machine learning model performance over time) or fail, having clear documentation enables teams to identify problems, restore functionality, or deactivate the system, if necessary.

Trust and Communication: Bridging the Gap Between the Board and C-Suite

For effective decision-making and long-term success, there must be a pathway for dialogue based on mutual trust and two-way information exchange between the board and executive team.

How to Create Trust in Communication:

- Lead with inquiry: Ask about their viewpoint before you indicate your own.

- Adopt a stance of humility, assuming there are things you don’t know/aren’t aware of; it is the most credible place you can come from.

- Clearly define roles and responsibilities through frequent communication and clarification.

Trust

Fair

Safe

Autonomy

Supported

Cared For

Heard

Empowered

2025 BDO Tax Strategist Survey

The latest BDO Tax Strategist Survey highlights that tax professionals are increasingly involved in connecting financial and operational decisions, advising C-suite executives on the tax implications of business strategies. In turn, organizations are empowering tax functions with the appropriate resources, technology, and talent to take a total tax approach.

Highlights:

- 90% of tax leaders say they are invited to weigh in on business decisions before they are made, and their recommendations carry significant weight.

- 67% say they will increase investment in tax technology.

- 41% say changes to U.S. trade and tariff policy will be a significant challenge for their organization, the most cited concern among tax leaders.

- 56% say they have a tax risk mitigation and response strategy and take a proactive approach to preparing for changes that affect their tax risk

Strategies to mitigate trade and tariff concerns

41% surveyed in the 2025 BDO Tax Strategist Survey said changes to U.S. trade and tariff policy will be a significant challenge for their organization, the most cited concern among tax leaders.

Here are some of the steps companies are taking/planning to take in response to trade and tariff policy changes:

- 49% Change sourcing strategies

- 45% Review transfer pricing protocols

- 44% Conduct a tariff code review

- 43% Increase prices for customers

- 38% Reduce capital expenditures

- 38% Pursue customs valuation strategies, such as first sale for export

- 30% Use foreign trade zones or bonded warehouses

- 30% Duty drawback strategies

- 29% Onshore or decrease international footprint

- 6% No significant changes planned

Proxy Season Review 2025 from Diligent

Highlights:

- Board Representation Demands: Although overall board representation demands at U.S. companies declined due to trade policy uncertainties, activists were able to secure 112 board seats by shifting strategy and increasing the quality of director nominees.

- Settlements: Over 90% of activist-won board seats at U.S. companies in early 2025 were obtained through settlements—the highest rate in five years—with many settlements reached more quickly than before.

- ESG Proposals: Both pro- and anti-ESG shareholder proposals dropped to record lows. Support for environmental and social proposals fell to 11%, and anti-ESG resolutions received only 1.4% investor backing.

- CEO Compensation: Median CEO pay in the S&P 500 rose 8% year-over-year to $17.2 million, but investor support remained steady due to the structure of pay plans.

- Short Selling: Short sellers targeted 60 companies globally in the first half of the year, with AI-related stocks being especially popular. U.S. companies made up 87% of these targets as a more favorable market for short selling.

Key Takeaway: Proactive & multi-layered year-round monitoring of shareholder composition along with timely & continuous shareholder engagement helps ensure successful proxy defense strategies.

Keeping An Eye on State Regulations: Texas Enacts New Law to Regulate Proxy Advisory Firms

- Texas Senate Bill 2337 took effect September 1, 2025.

- Proxy advisors are now required to disclose when their voting recommendations for Texas companies are based on “non-financial reasons” (e.g., ESG, DEI, sustainability, or related organizational commitments) or when they give conflicting advice to clients.

- Institutional Shareholder Services Inc. (ISS) and Glass, Lewis & Co., LLC have challenged the law in court, but no ruling has been made yet.

- A hearing on a preliminary injunction was scheduled for August 28, 2025

- On August 29th, Judge Albright of the U.S. District Court for the Western District of Texas issued a preliminary injunction blocking enforcement of Texas Senate Bill 2337 (SB 2337) against ISS and Glass Lewis.

- The injunction prevents the Texas Attorney General from enforcing the law against these two proxy advisors while lawsuits proceed, with trial set for February 2, 2026.

- The injunction does not apply to other proxy advisors or prevent enforcement by parties other than the Attorney General.

The Impact of Fraud at U.S. Public Companies Benchmarking Report

Association of Certified Fraud Examiners & Anti-Fraud Collaboration

Current Overall Level of Fraud at U.S. Public Companies

- Over 70% of respondents rated the current level of fraud at U.S. public companies as medium or high.

Factors that Contribute to the Current Level of Fraud:

- Employees identified the regulatory environment as the most significant factor contributing to fraud.

- Governance respondents (board and audit committee members) pointed to the quality of external audits as most significant.

- External respondents (regulators, consultants, external auditors) considered economic conditions/environment as the top factor.

- Economic conditions/environment was the only factor ranked in the top five by all respondent groups.

Developments in SEC Rulemaking: RegFlex Agenda

Agenda Stage of Rulemaking | Title |

|---|---|

Prerule Stage | Foreign Private Issuer Eligibility |

| Prerule Stage | Asset-Backed Securities Registration and Disclosure Enhancements |

| Prerule Stage | Evaluating the Continued Effectiveness of the Consolidated Audit Trail |

| Proposed Rule Stage | Rule 144 Safe Harbor |

| Proposed Rule Stage | Crypto Assets |

| Proposed Rule Stage | Enhancement of Emerging Growth Company Accommodations and Simplification of Filer Status for Reporting Companies |

| Proposed Rule Stage | Shelf Registration Modernization |

| Proposed Rule Stage | Updating the Exempt Offering Pathways |

| Proposed Rule Stage | Rationalization of Disclosure Practices |

| Proposed Rule Stage | Shareholder Proposal Modernization |

| Proposed Rule Stage | Updates to "Small Entity" Definitions for Purposes of the Regulatory Flexibility Act |

| Proposed Rule Stage | Amendments to Form N-PORT |

| Proposed Rule Stage | Amendments to Rule 17a-7 Under the Investment Company Act |

| Proposed Rule Stage | Amendments to the Custody Rules |

| Proposed Rule Stage | Transfer Agents |

| Proposed Rule Stage | Publication or Submission of Quotations Without Specified Information |

| Proposed Rule Stage | Amendments to Broker-Dealer Financial Responsibility and Recordkeeping and Reporting Rules |

| Proposed Rule Stage | Crypto Market Structure Amendments |

| Proposed Rule Stage | Trade-Through Rule |

| Proposed Rule Stage | Definition of Dealer |

| Proposed Rule Stage | Enhanced Oversight for U.S. Government Securities Traded on Alternative Trading Systems |

| Final Rule Stage | Financial Data Transparency Act Joint Data Standards |

| Final Rule Stage | Customer Identification Programs for Registered Investment Advisers and Exempt Reporting Advisers |

Staff Guidance Reminders

Macroeconomic Factors | Financial Reporting Considerations |

|---|---|

| Tariffs | Revenue recognition, cost of goods sold, impairments, income taxes |

| Decrease in interest rates | Debt restructuring, modifications, and extinguishments |

| Inflation | Goodwill and other impairments |

| Labor market | Pensions and other post-employment benefits |

| Changes in tax law (One Big Beautiful Bill Act of 2025) | Tax accounting |

| Climate risk | Risk assessment |

| Artificial intelligence | Design an operation of internal controls |

PCAOB Activities Update

PCAOB Board Update

- Erica Y. Williams resigned from the PCAOB effective July 22, 2025.

- Under her leadership, the PCAOB developed and executed an ambitious strategic plan to modernize standards, enhance inspections, strengthen enforcement, and improve the PCAOB’s organizational effectiveness.

- More information on the activities under Williams’ term can be found here.

- The SEC designated George R. Botic to serve as Acting Chair of the Public Company Accounting Oversight Board, effective July 23, 2025 but actively solicited candidates for all five PCAOB board positions, including the Chair. The terms will have staggered terms ending in October from 2026 through 2030, with opportunity for appointment to a second term.

- Submissions were due by August 25, 2025

Engagement Acceptance

PCAOB Audit Focus

This edition of Audit Focus highlights key reminders for auditors from PCAOB standards related to engagement acceptance for the initial engagements of auditors who audit smaller public companies or brokers and dealers.

Good Practices that Firms have Implemented:

- Assessing Partner Capacity: Audit firms use a points-based “scorecard” to measure each partner’s workload, based on the number and type of audits handled. Partners above a set threshold must discuss capacity with leadership before taking on new engagements.

- Use of Templates: Templates are used to guide decisions on accepting new engagements, incorporating risk factors that may indicate the firm should not proceed.

- Implementation of a Pre-Assessment Process: An evaluation team pre-screens potential engagements before bidding, ensuring the opportunity aligns with the firm’s capabilities and risk appetite.

- Industry Expertise: Firms have updated policies to decline engagements where they lack the necessary expertise or resources, including opting out of certain industries or types of audits (e.g., integrated audits).

PCAOB Postpones Effective Date of QC 1000 and Related Standards, Rules, and Forms

- The effective date for QC 1000 and related new/amended PCAOB standards, rules, and forms is postponed by one year to December 15, 2026.

- The related rescission date for certain existing rules and standards is also postponed by one year.

- For more information on the standards, rules, and forms affected by the change in effective date please click here.

- The postponement responds to feedback that some firms face significant implementation challenges that could not be resolved by the original 2025 deadline.

- The text of the new and amended standards, rules, and forms remains unchanged from what was adopted on May 13, 2024.

- Registered firms may still choose to comply with QC 1000 before the new effective date, except for reporting requirements to the PCAOB on quality control system evaluations.

A Study by and Recommendations From the Technology Innovation Alliance Working Group

- The Technology Innovation Alliance (TIA) Working Group, chaired by Board Member Christina Ho, consisted of external experts in emerging technologies relevant to financial statement preparation and auditing.

- The group’s main roles were to advise the Board on how new technologies affect audit quality and to recommend how oversight programs should address these technologies.

- Their recently posted deliverables include:

- Current State Deliverable (Aug 2023): Examines investor needs, the evolution of auditing, current technology use in auditing and financial reporting, and challenges in technology adoption.

- Transforming Audit Quality Through Technology (May 2024): Suggests four strategic ways for the PCAOB to advance technology in auditing: promoting structured data, focusing on AI, building regulatory innovation capacity (including an Innovation Lab), and encouraging technology literacy among auditors.

PCAOB Updates Standard Setting Projects

Recently Completed or Effective Standard Setting Projects

| Project | Effective Date | Date of Board Adoption | Date of SEC Approval |

| Other Auditors | Effective for audits of fiscal years ending on or after December 15, 2024. | June 2022 | August 12, 2022 |

| Confirmation | Effective for audits of fiscal years ending on or after June 15, 2025. | September 2023 | December 1, 2023 |

| Quality Control | Effective on December 15, 2026. The first evaluation period is for the period beginning on the effective date of the standard (i.e., December 15, 2026) and ending on September 30, 2027. The firm’s first evaluation must be reported to the PCAOB on Form QC no later than November 30, 2027. | May 2024 | September 9, 2024 |

| Amendments Related to Aspects of Designing and Performing Audit Procedures that Involve Technology-Assisted Analysis of Information in Electronic Form | Effective for audits of financial statements for fiscal years beginning on or after December 15, 2025. | June 2024 | August 20, 2024 |

| General Responsibilities of the Auditor in Conducting an Audit (AS 1000) | Effective for audits of fiscal years beginning on or after, December 15, 2024, except for the 14-day documentation completion date. | May 2024 | August 20, 2024 |

| Firm and Engagement Metrics | Subject to approval by the SEC, the final rules and reporting forms would take effect on October 1, 2027 with a phased implementation period as follows: Firm-level metrics reporting:

| November 2024 | Withdrawn |

Short-term Standard-setting Projects

| Project | Effective Date | Date of Board Adoption | Date of SEC Approval |

Consider the requirements in the interim attestation standards in connection with the PCAOB’s interim standards project. | Proposal | 2025 | |

| Going Concern | Consider the auditor’s evaluation and reporting of a company’s ability to continue as a going concern in response to changes in financial reporting, the auditing environment, and stakeholder needs, including by considering how AS 2415, Consideration of an Entity's Ability to Continue as a Going Concern, should be revised. | Proposal | 2025 |

| Substantive Analytical Procedures | Consider changes to an auditor’s use of substantive analytical procedures to better align with the auditor’s risk assessment and to address the increasing use of technology tools in performing these procedures, including whether to revise AS 2305, Substantive Analytical Procedures. | Adoption | 2025 |

| Noncompliance with Laws and Regulations | Consider changes to an auditor’s consideration of possible noncompliance with laws and regulations including how AS 2405, Illegal Acts by Clients, should be revised to integrate a scalable, risk-based approach that takes into account recent developments in corporate governance and internal control practices. | TBD (pending further analysis) | 2025 |

| Consider updates to AS 2510, Auditing Inventories, in connection with the Interim Standards project to reflect changes in the auditing environment. | Proposal | 2025 | |

| Auditor Reporting in Specified Circumstances | Consider updates to AS 3105, Departures from Unqualified Opinions and Other Reporting Circumstances, and other interim standards in the AS 3300 series. | Proposal | 2025 |

Mid-term Standard-setting Projects

| Project | Project Description |

| Use of a Service Organization | Consider how AS 2601, Consideration of an Entity’s Use of a Service Organization, should be amended to reflect changes in how companies use services of third parties that are relevant to the company’s own internal control over financial reporting and developments in practice. |

| Fraud | Consider how AS 2401, Consideration of Fraud in a Financial Statement Audit, should be revised to better align an auditor’s responsibilities for addressing intentional acts that result in material misstatements in financial statements with the auditor’s risk assessment, including addressing matters that may arise from developments in the use of technology. |

| Interim Ethics and Independence Standards | In connection with the PCAOB’s interim standards project, consider whether existing obligations of PCAOB registered firms and their associated persons should be enhanced and updated to better promote compliance through improved ethical behavior and independence. |

| Internal Audit | Consider updates to AS 2605, Consideration of the Internal Audit Function, in connection with the Interim Standards project to reflect changes in the auditing and reporting environment. |

| Interim Standards | Consider whether the remaining “interim” standards, as adopted upon the establishment of the Board, should be amended, replaced, or eliminated, as appropriate. As part of this analysis, evaluate which standards are necessary to retain and, of those, which should be retained with minimal updates, and which require more significant changes. Separate projects, including requests for comment on potential standards to eliminate, will be added to the standard-setting agenda as the staff completes its analysis. |

| Interim Financial Information Reviews | Consider updates to AS 4105, Reviews of Interim Financial Information, in connection with the Interim Standards project to reflect changes in the auditing and reporting environment. |

| Subsequent Events and Other Matters Arising After the Date of the Auditor’s Report | Consider updates to interim standards that address auditor responsibilities related to (i) certain events occurring between the balance sheet and the auditor’s report date and (ii) certain matters arising after the auditor’s report date, such as subsequently discovered facts and reissuance of the auditor’s report. This project considers updating AS 2801, Subsequent Events, AS 2905, Subsequent Discovery of Facts Existing at the Date of the Auditor’s Report, and certain other interim standards. |

Research Projects

| Project | Project Description |

| Data and Technology | Assess whether there is a need for guidance, changes to PCAOB standards, or other regulatory actions considering the increased use of technology-based tools by auditors and preparers. This includes evaluating the role technology innovation plays in driving audit quality. Research from this project may give rise to individual standard-setting projects and may also inform the scope or nature of other projects that are included on the standard-setting agenda. |

| Communication of Critical Audit Matters | The project seeks to understand why there continues to be a decrease in the average number of critical audit matters (CAM) reported in the auditor’s report over time and whether there is a need for guidance, changes to PCAOB standards, or other regulatory action to improve such reporting, including the information that is provided as part of the CAM reporting. The staff continues to conduct research, including taking into account recent insights shared by the Investor Advisory Group. |

Rulemaking Projects

| Project | Project Description | Next Board Action | Date of SEC Approval |

| Contributory Liability | Consider changes to the Board’s ethics rule, PCAOB Rule 3502, Responsibility Not to Knowingly or Recklessly Contribute to Violations. | Adopted June 2024 | August 20, 2024 |

| Registration | Consider changes to enhance the PCAOB’s registration program. | Adopted November 2024 | January 2, 2025 |

| Firm Reporting | Consider changes to audit firm reporting requirements including periodic reporting requirements, special reporting requirements, and other enhancements to the audit firm reporting framework. | Adopted November 2024 | Withdrawn |

Resources

- View prior quarter Audit Committee Agendas: Q1 2025, Q2 2025

- Audit Committee Requirements Practice Aid

- BDO Center for Corporate Governance

- BDO Sustainability Center of Excellence

- BDO’s Accounting, Reporting, and Compliance Hub (ARCH)

- BDO in the Boardroom podcast series

- Quarterly Technical Update webcast series

- Internal Audit webcast series

- Quarterly IFRS Accounting Standards webcast series

- BDO Corporate Governance Matters webcast series