Current Business Issues and Risk Considerations

Reminders About Macroeconomic Conditions

- Recession risk

- Rising interest rates

- Continuing inflation

- Tightened labor market

- Credit contraction

- Climate risk

- Uncertainty in the real estate sector (residential and commercial)

- Fluctuations in foreign currency exposure (geopolitical environment and supply chain challenges)

- Cybersecurity

- Pace of technological innovation

- Uncertain regulatory environment in the U.S and globally

Financial Reporting Considerations

- Risk assessment

- Design and operation of internal controls

- SEC Disclosures

Accounting & Reporting Considerations During Economic Uncertainty

Accounting Considerations - Evolving situations that require continual assessment and analysis, particularly whether a downward measurement adjustment is required for assets or whether new liabilities may need to be recognized.

Importance of Disclosures - Transparency for investors through evaluation of the completeness and transparency of accounting, judgments, and as well subsequent events, risks and uncertainties, and going concern assessments.

SEC Reporting Requirements – Changing economic environment often creates new and evolving risks, uncertainties, impacts, and challenges that can affect SEC registrants’ disclosures.

Internal Controls Over Financial Reporting – Whether there may be a need to design and implement new or modify existing controls to address complexities and risks associated with events that cause economic uncertainty.

Auditing Considerations – Whether there may be heightened and new risks of material misstatement or more difficulty in an auditor’s ability to obtain sufficient appropriate audit evidence for both the audit committee and management to factor into their oversight and execution of financial reporting.

Corporate Governance - Highlights the importance of boards and audit committees working closely with management, auditors, and advisors to evaluate risks and form meaningful responses to and communications about those risks. This includes the effects on employees, customers, and supply chains, including how executives are planning for contingencies.

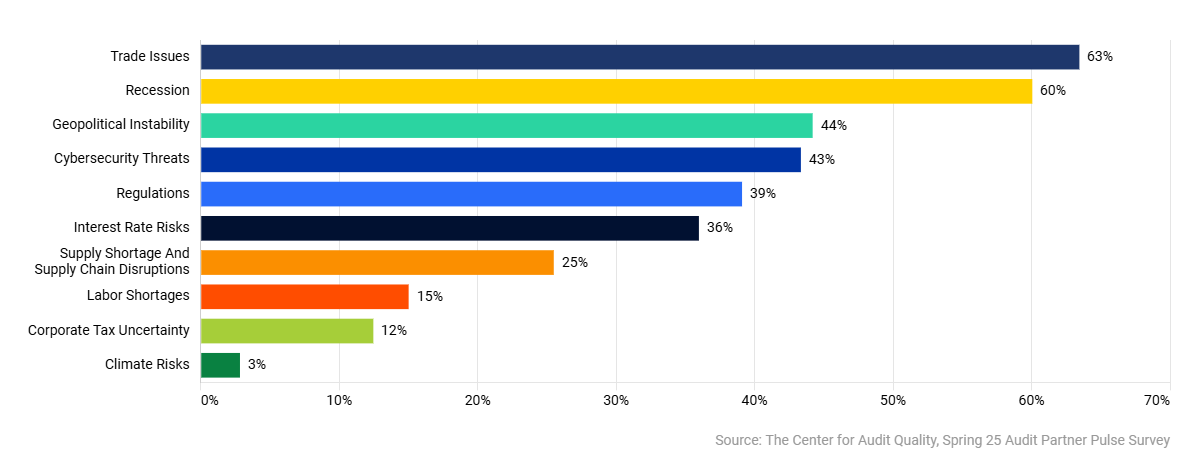

CAQ: Audit Partner Pulse Survey

The Center for Audit Quality’s 4th annual Audit Partner Pulse Survey gathers insights from top public company audit partners on the U.S. business environment, including economic health, business risks, strategy adjustments, talent shortages, fraud prevention, and emerging technologies like AI and crypto assets.

What do you believe are the largest economic risks facing companies in your primary industry sector over the next 12 months?

Internal Audit: Essential Questions for Board Directors in their Oversight Role

Effective board oversight is essential for IA’s success, guided by listing standards and the updated Global Internal Audit Standards™ from The Institute of Internal Auditors (IIA).

Below are some essential questions that boards of directors should consider in their oversight of the IA function:

- Alignment and Mandate: Are the board and internal audit aligned on purpose, mandate, expectations, roles, and responsibilities?

- Strategy and Risk: Are the board, internal audit, and management aligned on strategy and risk priorities?

- Quality Assurance and Performance: How is quality assurance and performance being monitored and evaluated?

- Resources and Performance: Does the IA team have the necessary resources and expertise to fulfill its current responsibilities and evolving needs?

- Board and Management Support: What is being done to ensure the board and senior management support and collaborate with IA?

Data Protection: Essential Questions for Board Directors

Data is a vital company asset and protecting it amid increasing cyber threats is a key challenge for boards and directors. Ensuring long-term success requires compliance with regulations, promoting innovation, and building trust in data protection.

Check out BDO’s recent insight which details questions that every board should consider regarding their company's privacy and data protection policies, procedures, and strategies.

Building a Transparent Shareholder Communications Strategy: 10 Questions Boards Should Ask

Here are several questions that boards should consider asking to ensure that they have a productive shareholder communication strategy in place:

- Do we regularly review and update our publicly facing governance documents to align with our board agendas, governance activities, meeting minutes and other publicly issued documents?

- Do we have a policy and process for shareholder outreach, and do we review our communications to shareholders and others to ensure transparency?

- What are the key concerns of our shareholders and are we adequately addressing them and communicating our response?

- How can we proactively engage and communicate further with our shareholders?

- Do our board composition and corporate governance policies align with our mission and values that provide credibility to our positions?

- Are there weaknesses in our business operations and strategy that would attract activist attention? How are we actively addressing these?

- Do we have a communication strategy in place for responding to activist demands?

- Do we have advisors identified to help us navigate an activist campaign?

- Do we have a strategy to balance prioritizing long-term value creation with addressing immediate concerns raised by activists?

- Can we withstand the financial costs of dealing with activist campaigns and what are the impacts that a proxy battle may have on our business operations?

.jpg)

Stay Updated on Tariffs

BDO in the Boardroom Podcast

Board Navigation Considerations

- How will tariffs impact our supply chain and how can we mitigate disruption? Can we identify and prioritize where increased costs from materials and/or finished goods may arise?

- How will tariffs impact our pricing strategy and market competitiveness?

- Have we carried out an assessment of all countries in which we operate or source materials from?

- Does our board have the knowledge and skills required to oversee global trade and economic policy impacts?

BEPS 2.0: Addressing Organizational Impact of Global Tax Reform

- Key questions for boards and management teams to consider when developing risk mitigation and operational strategies to address the organizational impacts of global tax reform, specifically under the Organisation for Economic Co-operation and Development’s (OECD) Pillar Two global minimum tax rules.

- Do we understand our reporting requirements?

- Have we created and collaborated as a cross-functional team?

- How are we monitoring and evaluating the evolving business and legislative landscape?

- Are we considering the impacts to overall business strategy and enterprise risk management?

- To dive deeper into these questions, read BDO’s insight here.

- For more insights and information on BEPS 2.0, refer to BDO’s Global Tax Reform hub and International Tax Services.

Corporate Governance Framework (CGF)

- The Committee of Sponsoring Organizations of the Treadway Commission (COSO) has released an exposure draft of a new Corporate Governance Framework (CGF).

- Designed to help entities assess and enhance their corporate governance practices in alignment with their unique organizational needs, the CGF is organized around:

- Six core and interconnected components.

- Each component is comprised of principles (24 in total) that represent key objectives.

- Each principle is further supported by points of focus that expand on how entities choose to work toward achieving the principles.

- The CGF further contains insights as to leading practices and advanced governance considerations.

- The framework structure and design is consistent with other major COSO frameworks on internal controls and enterprise risk management

- Public comments may be submitted via a survey link and are requested by September 12, 2025.

View the CGF exposure draft here.

PCAOB Activities Update

PCAOB Releases 2024 Annual Report

The PCAOB published its 2024 Annual Report, emphasizing its commitment to investor protection. The report outlines how this mission was carried out:

- Enhancing Inspections

- Improved firm deficiency finding rates.

- Faster release of inspection results.

- Increased focus on audit firm culture.

- New website features with inspection data.

- Resources and support for smaller audit firms.

- Timely updates on inspection trends and audit quality.

- Insights on best practices and emerging risks.

Modernizing Standards and Rules

- Adoption of new/revised standards for:

- Audit firm quality control

- Auditor responsibilities

- Accountability for violation.

- Use of technology in audits

- Withdrawal from registration

- Proposal on substantive analytical procedures

Safeguarding Investors Through Enforcement

- Targeted enforcement against serious investor risks.

- Penalties for severe violations (e.g., altering workpapers, misleading investigators).

- Sanctions for quality control failures at audit firms.

- Continued accountability for individual misconduct.

Prioritizing Organizational Effectiveness & Stakeholder Engagement

- Resources and forums for small audit firms, hosted by PCAOB Board Members.

- Stakeholder events on capital markets and global audit regulation.

- New educational materials for investors.

- Engagement with over 250 audit committee chairs.

- Record number of PCAOB scholarships, with mentoring for recipients.

2024 Conversations With Audit Committee Chairs

- Each year, the PCAOB staff interviews audit committee chairs from U.S. public companies and broker-dealers whose audits are inspected. These conversations offer valuable insights that help shape the PCAOB’s inspection planning.

- This year’s Spotlight summarizes key findings from 272 interviews conducted in 2024.

- Discussion topics included relationships with audit firms, the impact of the economic environment on audits, and the use of new technologies in the audit process.

- The Spotlight also addresses common questions from audit committee chairs, such as:

- How audits are chosen for review

- What the inspection process involves

- Whether the PCAOB offers educational resources or events for audit committee members

Auditing Accounting Estimate: PCAOB Audit Focus

Common Deficiencies Noted

Did not evaluate the reasonableness of significant assumptions beyond vouching

- Did not identify the significant assumptions

- Did not perform procedures other than inquiry and/ or reperforming the mathematical calculations

- Did not evaluate whether the company’s methods are in conformity with the applicable financial reporting framework

- Did not understand how management analyzed the sensitivity of critical accounting estimates

Good Practices that Firms have Implemented

- Updated guidance to ensure an appropriate scoping exercise

- Updated policies and procedures to require engagement teams to use their external audit methodology provider’s audit program for testing accounting estimates

- Updated partner and EQR partner review policies

- Development of risk assessment procedures

PCAOB Updates Standard Setting Projects

Recently Completed or Effective Standard Setting Projects

| Project | Effective Date | Date of Board Adoption | Date of SEC Approval |

| Other Auditors | Effective for audits of fiscal years ending on or after December 15, 2024. | June 2022 | August 12, 2022 |

| Confirmation | Effective for audits of fiscal years ending on or after June 15, 2025. | September 2023 | December 1, 2023 |

| Quality Control | Effective on December 15, 2025. The first evaluation period is for the period beginning on the effective date of the standard (i.e., December 15, 2025) and ending on September 30, 2026. The firm’s first evaluation must be reported to the PCAOB on Form QC no later than November 30, 2026. | May 2024 | September 9, 2024 |

| Amendments Related to Aspects of Designing and Performing Audit Procedures that Involve Technology-Assisted Analysis of Information in Electronic Form | Effective for audits of financial statements for fiscal years beginning on or after December 15, 2025. | June 2024 | August 20, 2024 |

| General Responsibilities of the Auditor in Conducting an Audit (AS 1000) | Effective for audits of fiscal years beginning on or after, December 15, 2024, except for the 14-day documentation completion date. | May 2024 | August 20, 2024 |

| Firm and Engagement Metrics | Subject to approval by the SEC, the final rules and reporting forms would take effect on October 1, 2027 with a phased implementation period as follows: Firm-level metrics reporting:

Engagement-level metrics reporting 35 days after issuance of the auditor’s report:

All other firms – for audits of companies with fiscal years beginning on or after October 1, 2028. | November 2024 | Withdrawn |

| To access Short-Term Standard-Setting Projects, click here. | |||

Short-term Standard-setting Projects

| Project | Effective Date | Date of Board Adoption | Date of SEC Approval |

| Consider the requirements in the interim attestation standards in connection with the PCAOB’s interim standards project. | Proposal | 2025 | |

| Going Concern | Consider the auditor’s evaluation and reporting of a company’s ability to continue as a going concern in response to changes in financial reporting, the auditing environment, and stakeholder needs, including by considering how AS 2415, Consideration of an Entity's Ability to Continue as a Going Concern, should be revised. | Proposal | 2025 |

| Substantive Analytical Procedures | Consider changes to an auditor’s use of substantive analytical procedures to better align with the auditor’s risk assessment and to address the increasing use of technology tools in performing these procedures, including whether to revise AS 2305, Substantive Analytical Procedures. | Adoption | 2025 |

| Noncompliance with Laws and Regulations | Consider changes to an auditor’s consideration of possible noncompliance with laws and regulations including how AS 2405, Illegal Acts by Clients, should be revised to integrate a scalable, risk-based approach that takes into account recent developments in corporate governance and internal control practices. | TBD (pending further analysis) | 2025 |

| Inventory | Consider updates to AS 2510, Auditing Inventories, in connection with the Interim Standards project to reflect changes in the auditing environment. | Proposal | 2025 |

| Auditor Reporting in Specified Circumstances | Consider updates to AS 3105, Departures from Unqualified Opinions and Other Reporting Circumstances, and other interim standards in the AS 3300 series. | Proposal | 2025 |

| To access Short-Term Standard-Setting Projects, click here. | |||

Mid-term Standard-setting Projects

| Project | Project Description |

| Use of a Service Organization | Consider how AS 2601, Consideration of an Entity’s Use of a Service Organization, should be amended to reflect changes in how companies use services of third parties that are relevant to the company’s own internal control over financial reporting and developments in practice. |

| Fraud | Consider how AS 2401, Consideration of Fraud in a Financial Statement Audit, should be revised to better align an auditor’s responsibilities for addressing intentional acts that result in material misstatements in financial statements with the auditor’s risk assessment, including addressing matters that may arise from developments in the use of technology. |

| Interim Ethics and Independence Standards | In connection with the PCAOB’s interim standards project, consider whether existing obligations of PCAOB registered firms and their associated persons should be enhanced and updated to better promote compliance through improved ethical behavior and independence. |

| Internal Audit | Consider updates to AS 2605, Consideration of the Internal Audit Function, in connection with the Interim Standards project to reflect changes in the auditing and reporting environment. |

| Interim Standards | Consider whether the remaining “interim” standards, as adopted upon the establishment of the Board, should be amended, replaced, or eliminated, as appropriate. As part of this analysis, evaluate which standards are necessary to retain and, of those, which should be retained with minimal updates, and which require more significant changes. Separate projects, including requests for comment on potential standards to eliminate, will be added to the standard-setting agenda as the staff completes its analysis. |

| Interim Financial Information Reviews | Consider updates to AS 4105, Reviews of Interim Financial Information, in connection with the Interim Standards project to reflect changes in the auditing and reporting environment. |

| Subsequent Events and Other Matters Arising After the Date of the Auditor’s Report | Consider updates to interim standards that address auditor responsibilities related to (i) certain events occurring between the balance sheet and the auditor’s report date and (ii) certain matters arising after the auditor’s report date, such as subsequently discovered facts and reissuance of the auditor’s report. This project considers updating AS 2801, Subsequent Events, AS 2905, Subsequent Discovery of Facts Existing at the Date of the Auditor’s Report, and certain other interim standards. |

To access Mid-term Standard-setting Projects, click here. | |

Research Projects

| Project | Project Description |

| Data and Technology | Assess whether there is a need for guidance, changes to PCAOB standards, or other regulatory actions considering the increased use of technology-based tools by auditors and preparers. This includes evaluating the role technology innovation plays in driving audit quality. Research from this project may give rise to individual standard-setting projects and may also inform the scope or nature of other projects that are included on the standard-setting agenda. |

| Communication of Critical Audit Matters | The project seeks to understand why there continues to be a decrease in the average number of critical audit matters (CAM) reported in the auditor’s report over time and whether there is a need for guidance, changes to PCAOB standards, or other regulatory action to improve such reporting, including the information that is provided as part of the CAM reporting. The staff continues to conduct research, including taking into account recent insights shared by the Investor Advisory Group. |

| To access Research Projects, click here. | |

Rulemaking Projects

| Project | Project Description | Next Board Action | Date of SEC Approval |

| Contributory Liability | Consider changes to the Board’s ethics rule, PCAOB Rule 3502, Responsibility Not to Knowingly or Recklessly Contribute to Violations. | Adopted June 2024 | August 20, 2024 |

| Registration | Consider changes to enhance the PCAOB’s registration program. | Adopted November 2024 | January 2, 2025 |

| Firm Reporting | Consider changes to audit firm reporting requirements including periodic reporting requirements, special reporting requirements, and other enhancements to the audit firm reporting framework. | Adopted November 2024 | Withdrawn |

| To access Rulemaking Projects, click here. | |||

Resources

View prior quarter Audit Committee Agendas: Q1 2025

BDO Center for Corporate Governance

BDO’s Accounting, Reporting, and Compliance Hub (ARCH)

BDO in the Boardroom podcast series

Quarterly Technical Update webcast series