The Public Company Point of View: CFO Optimism Ahead in 2021

Even as middle market CFOs reckon with the impacts of a volatile year, most are entering 2021 with an optimistic mindset. As they face challenges like uncertain economic stability, new reporting standards, a changing workforce and more, CFOs feel ready for the road ahead.

Although the entire business world is coping with the reverberations from the past year, public companies face unique challenges as their actions are closely scrutinized by a range of stakeholders, to whom they must carefully communicate any obstacles and pandemic-related impacts on the business.

The 2021 BDO Middle Market CFO Outlook Survey, which polled 600 CFOs—including 300 from public companies—finds executives are hopeful for a strong 2021 but cautious of the challenges to come. The following observations reflect the opinions of public company CFOs. Here are five key takeaways:

1. Public Companies Forecast Clearer Skies Ahead

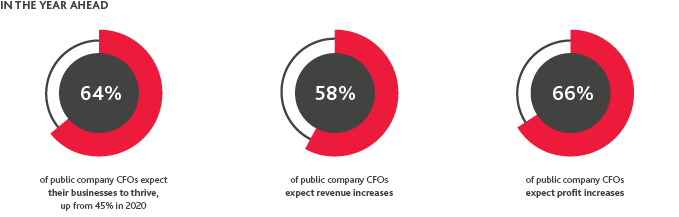

During a year when many businesses struggled, many public company CFOs were more focused on staying afloat than pursuing growth. However, public companies are confident that 2021 will bring balance back to the market, and with it, an opportunity to flourish.

The confidence is promising and marks a shift toward growth for the business community. The 2020 BDO Board Pulse Survey, conducted in July, revealed that 66% of public company board directors saw moderate to high impacts of the pandemic on sales revenue and another 34% cited declining product or service demand as top business challenges. C-suite optimism around financial forecasts has clearly grown since then, an encouraging change that CFOs expect to carry throughout the year.

In order to maintain this optimism and build momentum, CFOs will need to keep a close eye on how they are allocating resources. The balancing act of containing costs with investing in growth is bound to keep CFOs challenged as they chart the path for business moving forward, and strategic prioritization will be key.

2. CFOs Brace for New Reporting Challenges

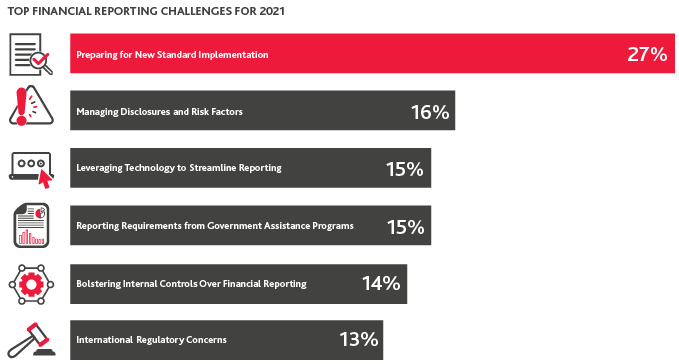

Public company CFOs are gearing up for a slew of challenges around financial reporting, all under the watchful eye of their various stakeholders as well as the government and other regulatory bodies.

Transparency in financial reporting is key for restoring and maintaining stakeholder confidence, which nearly 1-in-4 public company board directors noted as their most significant governance challenge at the end of 2020.

As market conditions continue to evolve, accuracy in reporting should also be a top priority for CFOs while they navigate recovery. The SEC recently made their position clear on the importance of accurately disclosing current and expected COVID-19 impacts on businesses when they brought an enforcement action against a public company for misleading investors about the pandemic’s effects. Strong oversight and governance will be crucial for ensuring financial reports and disclosures reflect the circumstances underlying organizations’ operational and financial conditions.

3. Deals Back Up After Downturn

As companies continue to recover from pandemic-related business impacts, many are looking to shore up additional capital in the near future. Others have realized that certain portions of their business no longer serve them as they are currently operating, and therefore will look to pursue a divestiture or sale.

Even as deal volume increases, CFOs must understand that not every transaction is created equal. Choosing the ideal path for growth will depend on finding the best matchup of priorities between buyer and seller or company and investor. CFOs must enter any deal with a clear vision, solid understanding of deal trends and terms, and established and specific success metrics in order to maintain thorough communication with necessary stakeholders. Across the board, the success of deals will be dependent on strong and balanced governance, including a clear view of a company’s risk profile and future opportunity.

4. Government Assistance Provides Relief, but Reporting Requirements Mount

New federal relief programs emerged in 2020 as the government attempted to rebalance the economy amid ongoing uncertainty. The majority of public companies surveyed took advantage of governmental assistance offered.

This assistance, while much needed, comes with requirements for transparency around the use of relief funds. CFOs will need to ensure their financial records are ready for review and that they are up to date on the latest guidance in the event they are subject to the single audit, which ensures that recipients of more than $750,000 in federal funds are in compliance with the program's requirements for how the money can be used. Planning for scrutiny in advance is always better than being caught off guard—CFOs who have documented programs they participated in, developed proper processes based on program requirements, designated responsibility to appropriate leadership and determined which requirements must be tracked will be on target to successfully comply.

5. New Working Reality Brings Both Risk and Opportunity

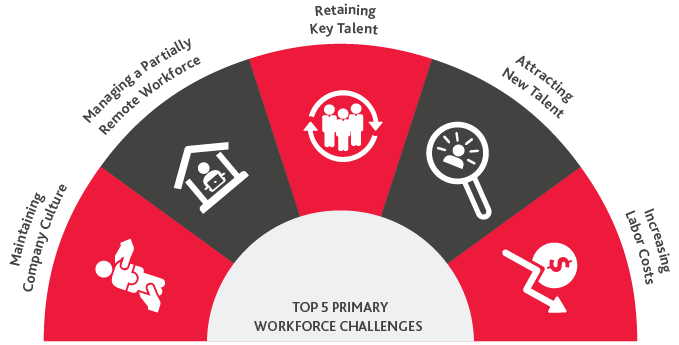

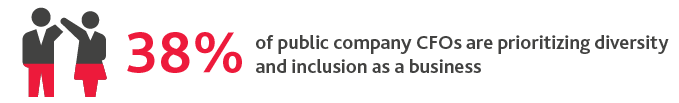

The pandemic impacted the traditional workplace by necessitating a nearly overnight shift to remote work, affecting employee satisfaction and disrupting company culture. Societal shifts and major events also shined a spotlight on diversity, equality and inclusion (DEI), calling for change and progress among corporate workforces.

In the latter half of 2020, boards prioritized maintaining employee welfare before turning their attention to diversity. As we head into 2021, DEI as a business strategy is emerging as a top human capital priority.

All eyes are on business leaders as they look to adjust workplace environments and teams to better reflect the world around us. Public companies can use their prominent platforms to commit to greater diversity and inclusion, set a new standard, and forge a path toward a more equitable working reality for all. Forward-thinking companies are leveraging technology to help ensure the right mix of skill sets and experiences for a competitive workforce.

2021 is bound to bring more shifts to the already changing workplace and uncertain business environment. CFOs of public companies should ensure that their business strategies are easily adaptable and built for resilience to better adjust to additional disruption down the line. See more on how the middle market is approaching the new disruption decade.

SHARE