CAQ Issues A Tool For Audit Committees: Preparing For The New Credit Losses Standard

The FASB’s ASU 2016-13, Financial Instruments – Credit Losses (Topic 326) (current expected credit loss or CECL) is being called the biggest change to bank accounting ever; and it doesn’t just affect banks. This guidance has broad implications and affects any company holding financial assets and net investment in leases that are not accounted for at fair value through net income (e.g. loans, held-to-maturity (HTM) debt securities, accounts (trade) receivables, net investments in leases, certain off-balance-sheet credit exposures, reinsurance receivables, and other financial assets included in the scope). Adoption of the new CECL standard will require companies to have adequate planning and an implementation timeline. SEC Chief Accountant Wes Bricker stated, “I want to emphasize the positive impact an audit committee has on implementation when it understands management’s implementation plans and the status of progress, including any required updates to internal control over financial reporting. The audit committee plays a vital role in overseeing a company’s financial reporting, including the implementation of new accounting standards.”[1] To assist in this oversight, the CAQ has issued A Tool for Audit Committees - Preparing for the New Credit Losses Standard. The tool provides audit committees with summary information, resources and important questions to consider when implementing this standard.

Background

In 2016, the FASB issued ASU 2016-13[2] (CECL), which (i) significantly changes the impairment model for most financial assets that are measured at amortized cost and certain other instruments from an incurred loss model to an expected loss model; and (ii) provides for recording credit losses on available-for-sale (AFS) debt securities through an allowance account. The standard also requires certain incremental disclosures.

Ultimately, CECL implementation requires a philosophical change in mindset: from a backward-looking to a forward-looking approach in setting allowances for credit losses. It is not just a method of increasing provisions against the loan portfolio, it creates an opportunity to gain a better understanding of the loan portfolio.

BDO Insight

Transitioning to CECL is extremely complex and time consuming, with extensive data requirements and enterprise-wide interdependencies that require a holistic, cross-functional approach and potentially a data governance overhaul. Depending on the complexity of an entity’s financial assets (e.g. loan portfolios), and the sophistication of its risk management infrastructure, IT environment and accounting processes, implementation can take anywhere from three to six months—if not longer. We expect new data to be used in the CECL estimate that may not have been previously subjected to internal controls or external audit procedures. Accordingly, consideration of the internal controls surrounding the data and information used in the model is critical. And CECL isn’t a one-and-done project: maintaining a steady-state program requires ongoing monitoring and management. Please refer to BDO’s CECL Implementation Guide for more information.

The CAQ Tool is aimed to assist audit committees in their role in overseeing this process and asking the important questions along the way.

Audit Committee Role in CECL Implementation

-

Ensure sufficient training and understanding of CECL by all members/directors

-

Ensure solid corporate governance and internal control from the top down

-

Meet with external auditors for independent discussions on management’s CECL efforts and results

-

Provide oversight to the internal audit function

Summary: CAQ Tool for Audit Committees: Preparing for the New Credit Losses Standard

Understanding the Standard

The standard has tiered effective dates as follows:

-

For public business entities that are SEC filers, the amendments are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years.

-

For all other public business entities, the amendments are effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years.

-

For all other entities, including not-for-profit entities and employee benefit plans within the scope of Topics 960 through 965 on plan accounting, the amendments are effective for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years.[3]

Committees should be aware of the following:

Scope – the standard applies to most financial assets measured at amortized cost and certain off-balance sheet exposures

Estimation – various estimation methods are allowed (e.g. discounted cash flow, loss-rate, roll-rate, probability-of-default, etc.)

Historical data – historical credit loss experience of financial assets with similar risk characteristics generally provides a starting point for the company’s CECL assessment. Data may be internal or external (e.g. peer data)

Reasonable and supportable forecasts – when using historical loss information, adjustments should be made for differences in current conditions together with additional available information related to the period which management can reasonably forecast.

Pooling of financial assets with similar risk characteristics – aggregate financial assets based on similar risk characteristics

Purchased financial assets with credit deterioration (PCD) – the definition of PCD assets is different from the currently used vernacular; and the accounting under the new standard is significantly different from current GAAP, aimed at making the allowance for credit losses more comparable between originated assets and purchased financial assets, and reducing complexity with the accounting for interest income

Troubled debt restructurings (TDRs) – the definition remains the same, but the timing of when the related allowance is recorded is affected. The allowance for TDRs should be recorded when a TDR is reasonably expected to occur

AFS debt securities – credit impairment is now recognized through an allowance for credit losses instead of a direct write-down. Recoveries of fair value can be recognized immediately as opposed to when the security is sold or liquidated

Transition disclosures – under SAB 74, public companies are required to disclose the impact of new accounting standards when they become known

New disclosures – in addition to newly required vintage disclosures (e.g. Public Business Entities), companies will need to determine what and how much they disclose about the models used, assumptions made and changes in assumptions between reporting periods

Communication – companies should communicate with investors early and often as to the changes in terminology, definitions, accounting and impact of the standard

Banking regulators and the impact of U.S. GAAP on regulatory capital for financial institutions – it is expected[4] that adoption will increase allowance levels and lower the retained earnings components of equity, thereby lowering common equity Tier 1 capital for regulatory purposes

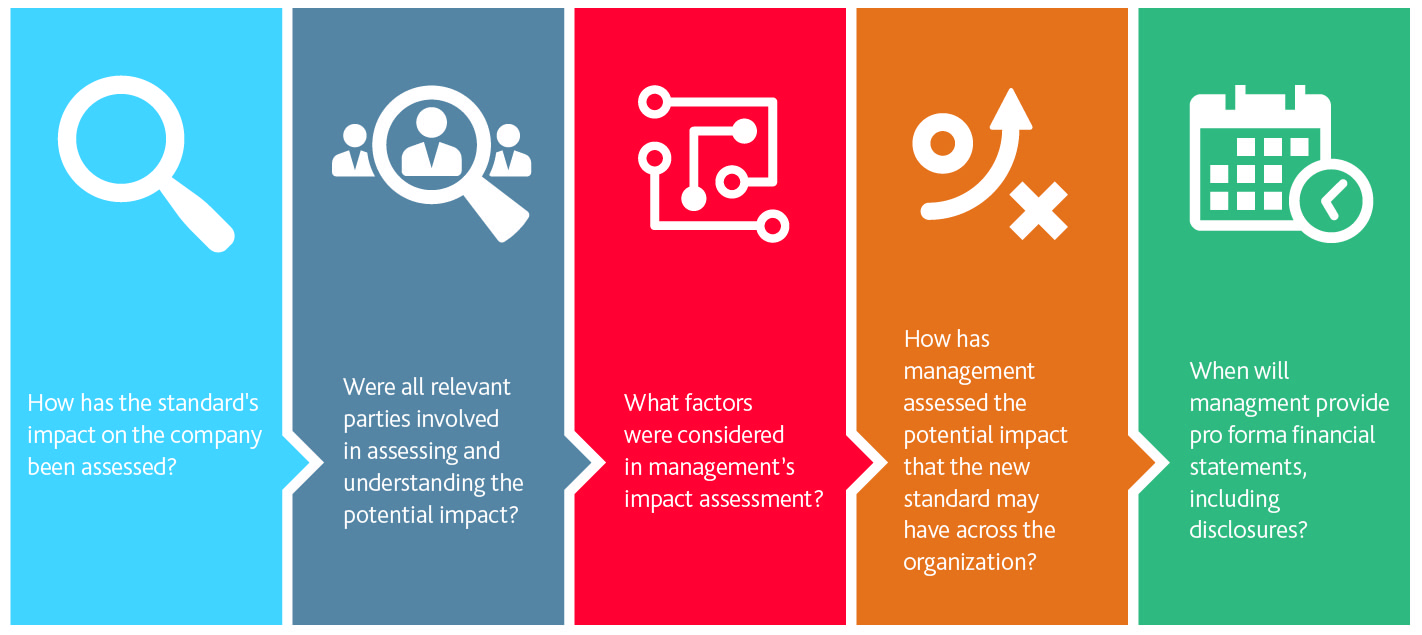

Evaluating the Company’s Impact Assessment

While the new standard has broad implications, it is imperative that each company perform an assessment to evaluate the impact of the standard. When discussing this assessment with management, audit committees should consider the following:

See the CAQ’s publication for additional detailed questions in each area.

Evaluating the Implementation Plan

For CECL to succeed, companies need to understand how the new standard affects systems, technology, and processes; and where interdependencies exist.

Success will look different for every company, depending on business goals, current and desired level of sophistication as well as effort required. The CAQ has developed a comprehensive list of questions audit committees should consider asking management categorized under eight main topics pertaining to implementation.

For each of the categories provided by the CAQ, we have included brief background considerations and resources in preparing for these conversations.

The Implementation Plan

For small and large entities alike, active project management and change control will be imperative to staying on budget and on time. Don’t underestimate the amount of time that review and approval of model outputs and the ultimate CECL reserve amounts will take. Make sure you involve external auditors and examiners early and often to avoid surprises late in the game that may cause unexpected delays or do-overs.

Culture and Resources

CECL implementation will require disciplined change management—not just because it requires an overhaul of accounting processes and IT systems, but because it heralds a new way of thinking. Make sure every member of the CECL team understands their roles and responsibilities. Another critical piece of the people puzzle will be fostering collaboration between functional areas that may have historically operated in silos.

Systems and Data

Your entity can decide between leveraging existing technologies and tools or acquiring new capabilities. It’s important to consider all interdepartmental needs when determining which vendor’s software (or an internal approach) will best position you to achieve your CECL goals.

Regardless of which tools you use, CECL success is predicated on a disciplined process, clean data and organized teams. Data should be available in usable and exportable formats, and stored in a secure database that can be updated and backed up frequently and that can be integrated into the spreadsheet environment or a more sophisticated analytics platform. A system capable of detecting and flagging errors or stale data is ideal.

Controls

Consideration of the controls that support the accounting and disclosures is as important as the reporting for these new standards. Your entity must consider Sarbanes-Oxley implications and develop documentation on processes and establish the necessary controls to ensure those processes are being followed correctly. Processes both around implementation and future accounting should be considered. If you are a financial institution, you should also consider governance model standards included in the Federal Reserve SR 11-7 supervisory letter.

Accounting Policy and Significant Accounting Judgments

Like any significant accounting estimate, significant judgments need to be made and this standard is no different. Management must make numerous significant accounting judgments. Additionally, existing accounting policies will need to be reviewed to determine if they remain appropriate and in accordance with GAAP and new accounting policies need to be considered. Understanding the impact the policy and judgment decisions have on the methodology will help inform the decisions being made. Significant judgments and policy decisions should be documented, including alternatives considered and why they were rejected.

For some industries, we expect this new standard to be considered a critical accounting estimate and therefore, subject to reviews and communications associated with such a designation.

Modeling and Assumptions

Estimation methods can range anywhere from simplistic approaches to sophisticated models. Most larger entities will use predictive models leveraging advanced data analytics. However, smaller entities are weighing the costs and benefits of a variety of CECL-compliant approaches, which fall on a spectrum between model-based and analytical. Similar to the significant judgments and policy decision discussion above, assumptions required in the modeling should be documented, including the basis for the assumption, alternatives considered and why they were rejected.

Regardless of the method used, the same objectives must be met: relevant variables need to be identified, the relationship between the variables and losses need to be estimated, models employed need to be validated and the entire end-to-end process will be subject to Sarbanes-Oxley (SOX) controls.

Involvement of Stakeholders

Companies need to identify all relevant stakeholders and determine the communication and training plans for each group. Example stakeholders include internal personnel, investors, regulators, external auditors, and internal auditors.

Questions for the External Auditor

Communication with external auditors early and often is always recommended when implementing new accounting standards. Your auditor should be a trusted advisor with industry insights to assist in the review of your implementation plan and execution.

See the CAQ tool for specific questions in each of these categories.

Other Important Implementation Considerations

When considering transition, companies must evaluate the potential adverse impacts CECL could have on earnings and capital while also considering Sarbanes-Oxley implications, and develop documentation on processes and establish the necessary controls to ensure those processes are being followed correctly, including internal controls over transition.

In addition to SAB 74 disclosures detailing the potential impact of adoption, there are several new disclosures that companies must make under CECL. SEC Chief Accountant Wes Bricker recommends consideration of the following when drafting disclosures:

-

Easy-to-understand explanation of new terms and key concepts

-

Specific descriptions of the methodology and significant judgments made by management

-

Tabular presentation of the economic assumptions utilized

-

Quantified effects of moving from incurred to expected credit losses, disaggregated by lending portfolio

Additional questions to ask related to transition, disclosure and other considerations follow:

Resources

Audit committees are encouraged to review recommended resources including the following to keep current on developments with respect to the CECL standard implementation:

Next Steps

We encourage audit committees, management, and our audit professionals to remain abreast of guidance and resources being issued relative to CECL and dialogue regularly about such matters throughout the audit process. Please stay tuned for additional thought leadership and educational opportunities from BDO’s Center for Corporate Governance and Financial Reporting.

[1] Wes Bricker, SEC Chief Accountant, remarks before the AICPA National Conference on Banks & Savings Institutions September 21, 2016.

[2] The FASB established a transition resource group (TRG) for credit losses. Management and those charged with governance are encouraged to monitor these developments.

[3] The effective date for “all other entities” was recently amended through FASB’s issuance of ASU 2018-19, “Codification Improvements to Topic 326, Financial Instruments—Credit Losses”. This ASU also clarified that receivables arising from operating leases are not within the scope of Subtopic 326-20. Instead, impairment of receivables arising from operating leases should be accounted for in accordance with Topic 842, Leases.

[4] The actual effect of implementation on regulatory capital will vary by entity and depend on many factors

SHARE