2020 BDO Board Pulse Survey – Fall 2020

Boards’ High Stakes Balancing Act: Navigating Through Crisis

Table of Contents

2020 has forced company boards to respond quickly to new risks while planning ahead for the unknown—a balancing act of the highest stakes in the face of economic turmoil, a global health emergency and civil unrest and outrage over continued inequality. Boards have needed to mobilize urgently for immediate crisis response without making rash decisions that compromise long-term business viability. The magnitude of this challenge is exacerbated further by a lack of available data and precedent to inform critical decisions.

Companies need strategic foresight, a focus on the right priorities and clear stakeholder communication. Our 2020 BDO Board Pulse Survey - Fall 2020 reveals how public company boards are meeting the moment.

“The COVID-19 crisis has been a defining experience for company boards, putting their judgement and diligence to the test. But under the pressure, boards are coming to the table with the right balance of prudence and insight.”

|

AMY ROJIK National Partner, BDO Center for Corporate Governance |

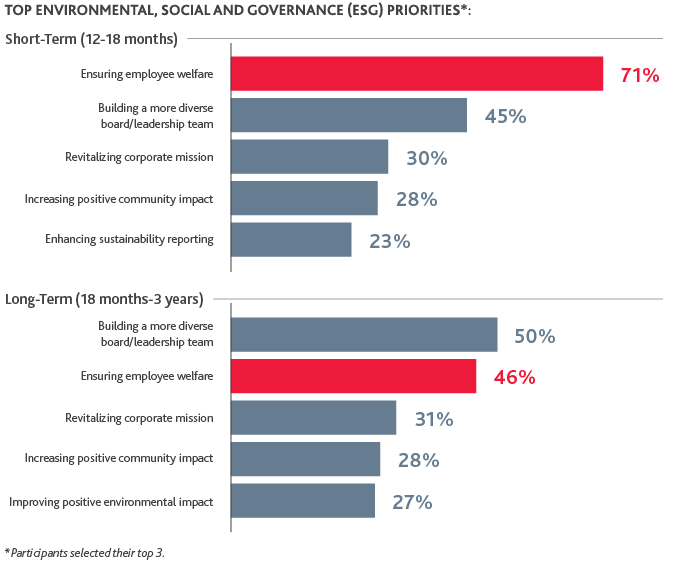

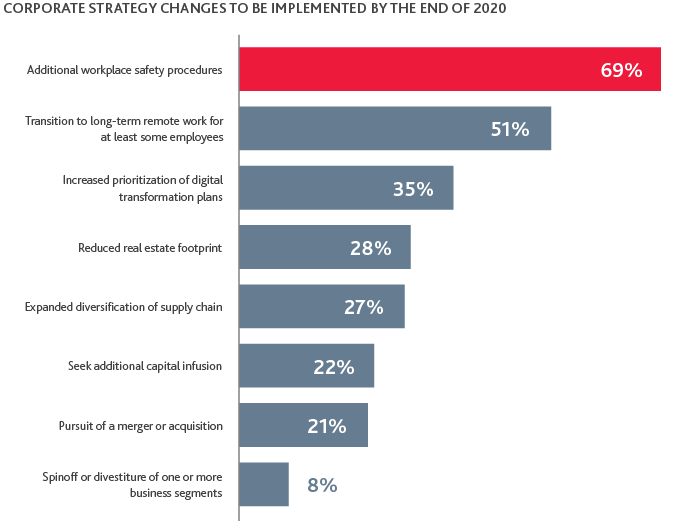

Safety Now, Diversity Next

Boards are first and foremost concerned about ensuring the health and welfare of people, from employees to customers and vendors. Once immediate safety issues are addressed, boards are intent on shifting their focus to improving leadership diversity. Businesses are increasingly recognizing that diversity across backgrounds, experiences and perspectives is a critical business asset that drives higher levels of innovation and thoughtful solutions.

Workforce Disrupted

Remote work is here to stay. While the shift was both forced and fast, companies can benefit from greater workplace flexibility, broader geographic reach and freed up capital as they reimagine office space needs and reduce real estate liabilities and travel expenses. However, companies will need greater vigilance around security and cyber risks and may find it difficult to foster a strong corporate culture that keeps employees engaged as lines between work and personal responsibilities blur. At the same time, companies that reduced headcount may face challenges in re-hiring the qualified staff needed to resume or expand operations.

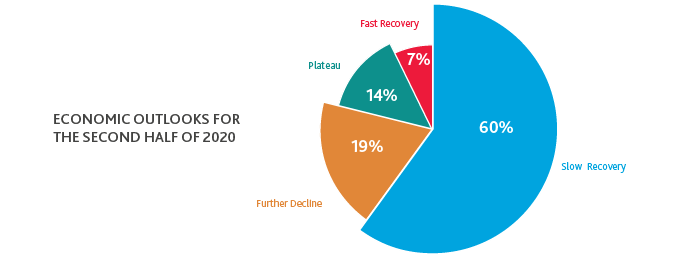

Liquidity Prized Amid Slow Recovery Outlook

Making staffing changes or minimizing real estate costs may not be enough to offset continued economic disruption for many companies. More than one-in-five boards are also looking outside for assistance to improve liquidity as they work to drive financial stability and make changes to their business.

Impact on Demand and Revenue

When asked about their top business risk for the next 12 months,

| 66% saw moderate to high impact on sales revenue | ||

| 34% cite declining product or service demand | ||

| 16% cite access to capital |

Efforts to Generate Cash Flow

| Between March and June of 2020, 39% of companies sourced outside funding | ||

| 26% sought and disclosed government assistance | ||

| 22% intend to seek an additional capital infusion before the end of the year |

Cash flow may be further hindered by supply chain challenges. Nearly half (48%) report moderate to high disruption to their supply chain operations.

Reporting in Focus

To address stakeholder concerns, boards are prioritizing increased communication and transparency, particularly around financial reporting and disclosures to convey evolving market conditions and risks:

The Board’s Role in Resilience & Recovery

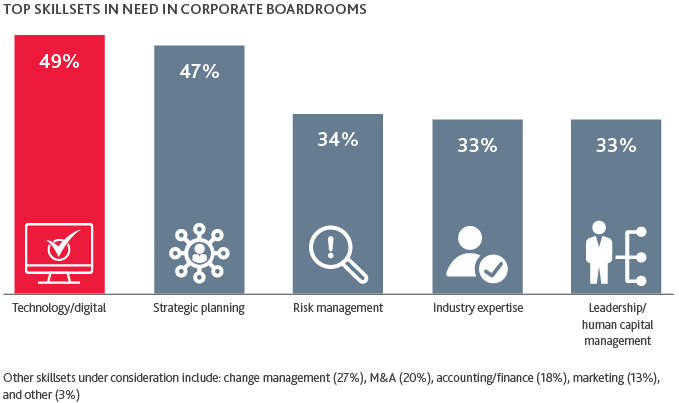

Most boards (87%) did not delegate COVID-19 oversight to one specific committee, demonstrating that continued recovery is the role of the full board and management team. As they look beyond immediate challenges and toward the new normal, boards are aiming to improve their digital capabilities with stronger technology skillsets and revitalized digital transformation plans.

What's Next?

Continuing education will remain a critical aspect for thoughtful corporate governance responses over the coming months. We invite you and your fellow directors to receive timely thought leadership and access to live and on-demand programming designed with your needs in mind from BDO’s Center for Corporate Governance and Financial Reporting.

SHARE