Biotech IPO Checklist: The Road to Going Public & Beyond

In the push to innovate patient care and improve health outcomes, biotech IPOs are on a hot streak this year. Endpoints reports that as of July 22nd, 82 firms have gone public through an IPO and an additional 47 have gone public via SPAC, globally. In total these companies have raised a combined $25.86 billion.

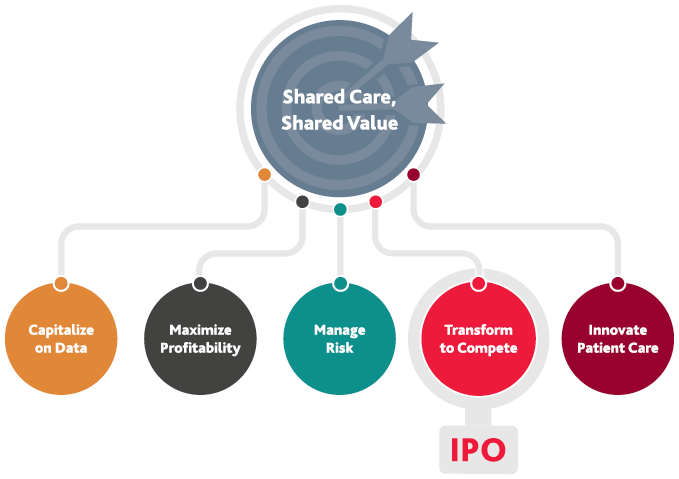

Both life sciences and healthcare organizations are being charged to develop life-saving vaccines and treatments to combat the COVID-19 pandemic, in addition to breaking down silos across the health ecosystem to bring down care costs and improve consumer health outcomes. To do this, companies must achieve five imperatives:

Shared Care, Shared Value is the strategy health entities need to pursue to achieve improved patient outcomes and unlocked value across the entire health continuum.

Types of IPO Transformation

Pursuing an IPO is one of the key paths companies can choose to achieve the fourth imperative, Transform to Compete, but there are different ways transformation can take shape:

IPOs can be a thrilling milestone, but transforming into a public entity is not an easy undertaking. A successful IPO requires significant focus, as well as time and resource investment, before stakeholders get to ring the bell. Indeed, leadership should view an IPO as a fulcrum point in the organization’s lifecycle and take the opportunity to reexamine the business’ operations and long-term strategy.

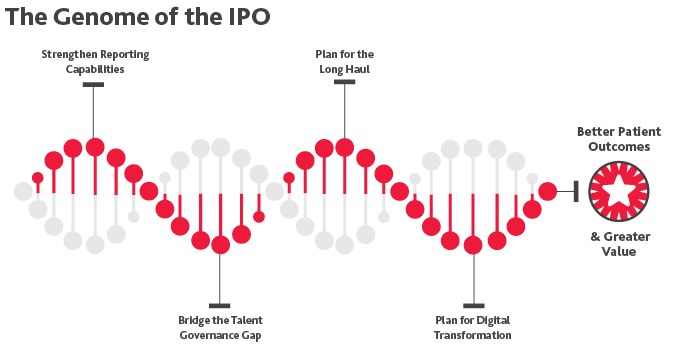

Organizations should consider the following steps—and answer the corresponding questions—ahead of IPO consideration.

Step 1: Assess and Strengthen Financial Reporting Capabilities

Early in their lifecycle, organizations might not allocate resources to administrative tasks. Delivering for the earliest backers often takes precedence over less pressing tasks, such as developing robust financial reporting functions.

As an organization prepares to undergo an IPO, however, organizational and investor priorities change. Investors— especially new or potential investors—will want to see that leadership knows how to run a business well, as well as progress in the organization’s stated vision. This necessitates taking steps to transform the organization into a well-oiled machine, and fully prepare it for all the requirements of being a public entity. The first step in this process: Make sure that the financial reporting and accounting systems are prepared for the demands of a public organization.

Public organizations are required to provide timely financial reports to investors and federal regulatory bodies year-round, but in recent years, the burden has been intentionally eased on emerging growth organizations like biotechs. The 2012 JOBS Act reduced the reporting and disclosure requirements organizations initially file when they go public and extended the grace period of reduced filing requirements for up to five years after the IPO.

The Trump administration focused on capital formation and showed an openness to reasonable requests for waivers of existing rules. While the Biden administration had indicated some desire to crackdown on antitrust activity, by increasing M&A scrutiny, there's been no indication of increasing IPO regulations or restrictions. While frequency or volume may change, public entities will always be required to provide at least some level of financial disclosures to federal agencies and investors. Additionally, organizations should familiarize themselves with the new ASC 606 revenue recognition standard and ASC 842 standard, as well as ensure their systems are fully compliant under the new guidelines.

Organizations may need to build these reporting functions from the ground up, which may require onboarding a team specifically tasked to helm this initiative. Don’t underestimate the importance of having reporting, data gathering and storage systems in tip-top-shape—regulatory bodies and investors will thoroughly examine the books in preparation for an IPO and the rest of an organization’s lifecycle.

Step 1: Internal Assessment

- Does the organization have the appropriate resources, information, technology, and systems necessary to meet reporting needs?

- Is the organization aware of the deadlines it will have to meet?

- Does the organization have someone who can effectively communicate the contents of financial documents and other materials to regulators and investors?

- Is there capacity to handle this reporting on a regular basis?

- Are current teams trained in these requirements?

- Does the company have the appropriate advisors to cover specific needs such as valuation, income taxes, preparation of the initial SEC filing, or will these need to be outsourced?

Step 2: Bridge the Gap between Talent & Governance

As an organization grows, so does its priorities, responsibilities, and talent management needs, which may require onboarding new team members.

Existing team members may even need to be retrained in the new or expanded responsibilities of their existing roles. For instance, organizations may need to hire an entire team dedicated to handling operational scaling as the business grows. If an organization has plans to expand internationally, they may need to onboard team members with expertise in navigating international regulatory environments.

Additionally, organizations undergoing an IPO must become compliant with SOX, which dictates rules for corporate governance, as well as any stock exchange-specific rules. For instance, NYSE adheres to one set of rules while NASDAQ identifies with another. SOX dictates that a board of directors must have a majority of independent members, and that audit committees must be made up of at least three independent members with one member that qualifies as a “financial expert,” per the SEC’s definition.

Step 2: Internal Assessment

- Does the organization have an individual who can handle investor relations and effectively communicate financial results to shareholders?

- Is there a person capable of leading expansion and scaling operations?

- Is there a need for individuals with international financial, legal, or operational experience?

- Is the current leadership suited to run a large public entity?

- Does the organization have individuals experienced in undergoing an IPO?

- Has your organization given due consideration to board structure and composition, policies, procedures and oversight approach?

Step 3: Plan for the Long Haul

Remember, this process isn’t just about completing paperwork, raising capital, and listing on the stock market.

An IPO is not the end, but the beginning of a company’s journey to its ultimate goal: innovating patient care by bringing its therapy to market.

A company’s long-term plan for growth may involve domestic or international expansion, or strategic partnerships. Each of these goals requires evaluation and input from experienced individuals in relevant areas such as due diligence, tax planning, international tax, state and local tax and accounting.

Step 3: Internal Assessment

- Is there a plan to bring products to market?

- Is all the necessary IP secured?

- Is there a plan in place for scaling operations domestically and internationally?

- Does the organization have a five-year plan?

- Will the organization pursue a government contract?

- Has the company planned accordingly for the potential loss of funding sources by going public, such as SBIR grants from the NIH?

- Will the organization handle personal health data? Any organization, whether private or public, needs to be HIPAA compliant if it collects public health data.

Step 4: Re-evaluate Organizational DNA to Plan for Digital Transformation

The IPO journey should set the stage for a successful transition to a public entity, ensuring the organization is poised to sustain long-term growth.

This means considering how to adapt to regulatory, health, and consumer changes, and how to re-imagine the business and operations for the future digital economy. The process of digital transformation is one of a series of deliberate steps to mature the digital capabilities underpinning the desired future state of the business. This process starts with developing—if they don’t already exist—protocols for information governance, as well as establishing threat-based cybersecurity procedures and adopting best practices. Review our data privacy and governance checklist for more details.

Step 4: Internal Assessment

- Does the organization have a digital transformation strategy?

- Does the organization have a plan for updating and incorporating new digital tools and technologies into its offering and operations?

- Does the organization have established protocols for information governance?

- Will the organization ultimately need to become GDPR compliant? HIPAA compliant?

- Is the organization adhering to cybersecurity best practices, and if not, what steps need to be taken to address this?

These questions and considerations will help inform the development of an organization’s long-term business strategy, which will, in-turn, serve as the bedrock for decision-making in the years to come. A thoughtful approach combined with appropriate counsel will ensure an organization is set up to succeed in its IPO.

SHARE