2016 BDO Retail Compass Survey of CFOs

“Retailers are realizing that putting more money towards their digital presence is not necessarily going to help them compete any better against e-commerce giants like Amazon. They need to focus on what they know and have historically done well, and that is the in-store experience. Savvy retailers are focused on creating tactile, engaging in-store experiences that entice their customers and keep them coming back for more.”

- Natalie Kotlyar, partner in BDO’s Consumer Business practice

Market Volatility Shapes Retailers’ 2016 Industry Outlook

An improving job market. Low inflation. Diminished energy prices. These positive economic indicators should point to an optimistic outlook for the retail industry, but retail CFOs (chief financial officers) feel otherwise. According to our 10th annual Retail Compass Survey of CFOs, retailers are forecasting modest performance in 2016.

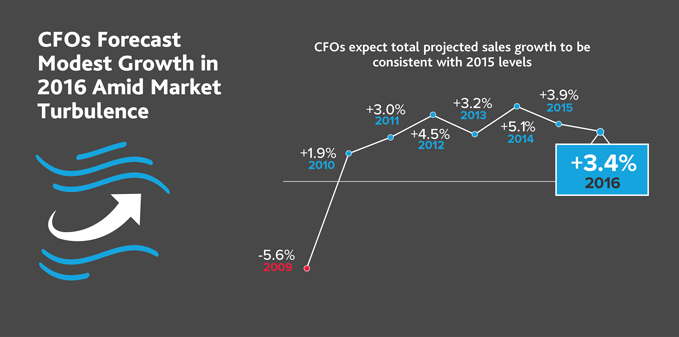

Overall, retailers project a 3.4 percent increase in total sales, nearly in line with the National Retail Federation’s 3.1 percent projection for 2016 growth. This is the second consecutive year that the total store sales projection has dipped since it spiked to 5.1 percent in 2014.

Influencing this forecast is a combination of diminishing consumer confidence and financial market volatility. Twenty-six percent of CFOs believe consumer confidence will decrease this year, up from 8 percent in 2014. Contributing to the increase could be financial market volatility, cited as the leading factor influencing consumer confidence by 46 percent of CFOs this year. Another 21 percent of CFOs point to personal credit availability and debt levels as a significant influence.

In spite of these challenges, CFOs are holding out hope that economic tailwinds might lead to a healthy 2016, with nearly three-quarters believing their total store sales will be higher compared to 2015.

“[Retailers have] been through their budgeting and planning season, and they’re not going to have a knee-jerk reaction just because holiday sales were a bit off plan and there’s global market turbulence. They’re still looking to the long term, and there’s a lot that can happen between now and next fall and the holiday season.”

- Doug Hart, partner in BDO’s Consumer Business practice, CFO Magazine (2/22/16)

Retailers Rethink Strategies to Remain Competitive

Increasing competition—especially from e-tailers—also continues to challenge many retailers. For the second year in a row, a plurality of CFOs (29 percent) cite competition and consolidation as their top concern in 2016. This comes as little surprise as several retailers announce plans to restructure their brick-and-mortar presence this year in response to growing competition from e-commerce. Most recently, Kohl’s announced that it will close 18 underperforming stores this year.

“Retailers should evaluate the benefits of right-sizing their stores by reducing the square footage and updating e-commerce features. For example, some larger retailers, including Wal‑Mart, Target, Best Buy and Staples, have begun opening smaller locations in urban areas that better suit consumers’ increasing demand for convenience.”

- David Berliner, partner in BDO’s Consumer Business practice, Forbes (1/7/16)

Beyond rebalancing their store portfolios to remain more competitive, traditional brick-and-mortar retailers are also exploring merger and acquisition (M&A) strategies in order to grow their reach and omnichannel presence. Nearly half (45 percent) of retailers anticipate M&A activity in the retail sector to increase in 2016. The majority of CFOs expect financial buyers (51 percent) to drive most of the M&A activity this year, but strategic buyers will still have a significant role to play, particularly as traditional retailers look to acquire online competitors to build out their omnichannel capabilities. For example, earlier this year, Hudson’s Bay Company acquired luxury discount e-tailer Gilt Groupe Holdings for $250 million.

As the appetite for deals grows, CFOs believe valuations will follow suit. Survey respondents expect buyers will pay an average EBITDA multiple of 5.8, up from 2015’s projected multiple of 5.2.

Retailers are also looking to shore up their brick-and-mortar operations by investing in their physical locations to evolve the in-store shopping experience. Thirty-one percent of CFOs plan to invest the most capital in redesigning and remodeling their stores, up from 9 percent in 2015. They are also investing in their talent, recognizing that their on-the-floor employees play a large role in providing a compelling consumer experience. The number of CFOs who expect to increase headcount in the next 12 months grew to 48 percent this year, up from 33 percent in 2015. And no retailers expect to decrease their employees’ average compensation, only to increase it or keep it the same.

Regulations are Top of Mind for Retailers

Operating against the backdrop of an election year, many retailers have concerns about how who ultimately lands in the White House will impact the regulatory environment. Twenty-one percent of retailers identify federal, state and local regulations as their primary risk, second to competition and consolidation and slightly ahead of geopolitical events and natural disasters.

According to the second annual BDO Tax Outlook Survey, one in five public company tax directors say planning for reform under the next president is their primary tax concern at this time. And when asked if the outcome of the presidential election will or will not result in significant tax code changes, 77 percent of public company tax directors indicate they believe tax reform will pass if the next president is a Republican. Thirty-three percent believe tax reform will pass if the next president is a Democrat.

“An election year can be a challenging time for businesses to think about taxes. With widely divergent proposals from numerous candidates and heightened tensions in Congress, critical bills may wind up on the cutting room floor or stuck in revision purgatory. The resulting uncertainty around the future of tax policy makes business decisions impacted by such uncertainty a challenge. Businesses need to be particularly cautious about instituting structures that may prove costly to unwind if future changes make them inefficient or obsolete.”

- Matthew Becker, regional managing partner for BDO Tax Services, Accounting Today (11/12/15)

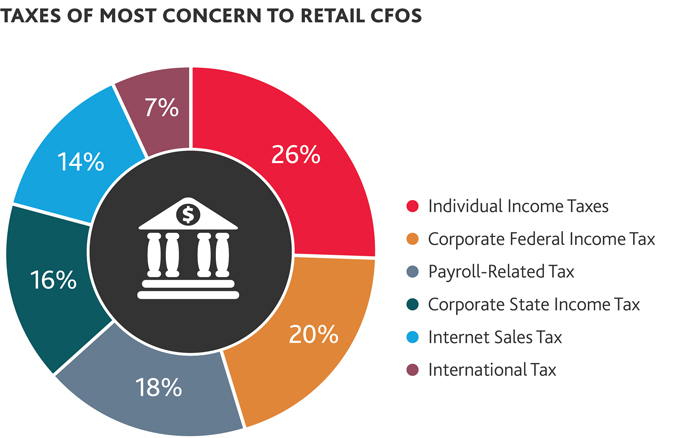

When asked what taxes they are most anxious about, retail CFOs identify individual income taxes first (26 percent), followed by the corporate federal income tax (20 percent), payroll-related tax (18 percent), corporate state income tax (16 percent), internet sales tax (14 percent) and international tax (7 percent).

Evolving Accounting Standards Drive Additional Concern

It’s not just government mandates worrying retail CFOs. New decisions from the Financial Accounting Standards Board (FASB) are also forcing retailers to evaluate their operations and internal controls. In particular, 43 percent of retail CFOs say they are concerned about the FASB’s release of new lease accounting standards, which were published in late February.

“For many businesses, retailers in particular, the largest asset and liability on their books could become their lease obligations. The challenge will be in explaining that to investors and lenders, so some metrics will have to change. Currently, retailers and other operating businesses have elected to lease rather than buy locations, or even sell and lease back existing locations, to reduce balance sheet assets and liabilities to appease the investment community. This new rule may cause a major shift in management plans, as the balance sheets would reflect large “non-income producing” assets and associated debt or lease liabilities, whether a business chooses to lease or own the space in which it operates. Because the implementation isn’t due until 2018, in the short term, I’d expect to see a push for education for the users of financial statements and for retailers and the landlords to develop a strategy to address it.”

- Stuart Eisenberg, national practice leader for BDO’s Real Estate and Construction practice, BDO Real Estate Monitor (12/23/15)

Retailers’ Promotions Sync with Consumer Preferences

According to non-adjusted estimates released by the U.S. Department of Commerce, 2015 web sales totaled $341.7 billion, a 14.6 percent increase from 2014. Survey participants believe this growth is likely to continue in 2016: Seventy-six percent of CFOs report that online sales will increase, and on average, retailers expect e-commerce sales to grow 9.7 percent from 2015 levels.

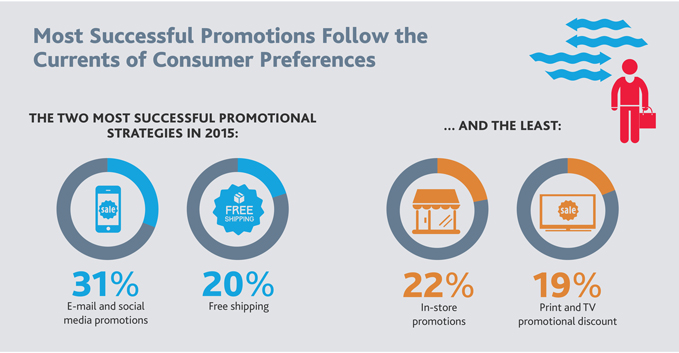

As more consumers choose to shop online, retailers are adjusting their promotional strategies, placing more emphasis on web-based marketing activities. According to survey participants, the two most successful promotional strategies in 2015 were email and social media promotions (31 percent) and free shipping (20 percent). The two least successful were in-store promotions (22 percent) and print and TV promotional discounts (19 percent).

With their web sales on the right track, many retailers are making the decision to refocus the dollars they once allocated towards e-commerce to other channels in order to enhance their omnichannel experience and spread the e-commerce success to other areas of their business. Only 25 percent of CFOs will focus on online and mobile commerce as a growth tactic in the next year, down from 37 percent in 2015. Additionally, only 41 percent of CFOs are planning to increase their investment in mobile, compared to the 68 percent who planned to do so in 2015. And after making significant investments from 2013 to 2015, just 9 percent of CFOs plan to invest the most capital in their online and mobile platforms, down significantly from 26 percent in 2013.

“Retailers are realizing that putting more money towards their digital presence is not necessarily going to help them compete any better against e-commerce giants like Amazon. They need to focus on what they know and have historically done well, and that is the in‑store experience. Savvy retailers are focused on creating tactile, engaging in-store experiences that entice their customers and keep them coming back for more.”

- Natalie Kotlyar, partner in BDO’s Consumer Business practice

Cybersecurity Remains a Priority

Despite a plateau in investment in e-commerce and mobile, retailers continue to prioritize safeguarding their—and their customers’—sensitive data. More than half (52 percent) of CFOs say they have increased their spending on cybersecurity in the past year.

A cyber incident could be disastrous for any retailer in terms of the costs required to repair the damage, as well as the loss of customer trust and loyalty. And both the government and financial services institutions in the card industry are working to minimize retailers’ and their customers’ exposures. Recently, the federal government passed the Cybersecurity Information Sharing Act of 2015 and U.S. card networks mandated a shift to EMV payment systems. As more regulations and industry-wide initiatives are implemented, it’s critical that retailers stay on top of the latest developments. Sixty-nine percent of respondents expect cybersecurity regulation to grow in 2016, and 76 percent report that they are currently EMV‑compliant.

Retailers are employing a wide range of tactics to shore up their cybersecurity. Eighty-five percent have begun using new software security tools, while 71 percent have created a security breach response plan. At the same time, 43 percent have hired an external security consultant and 19 percent have brought in a chief security officer.

“The retail industry is incredibly vulnerable to breaches, given the number of access points that exist within their operations and the continuous evolution of hacking methods. It is not enough for retailers to simply comply with existing regulations—rather, the most adept retailers are building redundancies into their cybersecurity infrastructure, developing rapid response plans to quickly address breaches, and looking ahead to guard their business and their customers from emerging threats.”

- Shahryar Shaghaghi, national practice leader for BDO Technology Advisory Services

Pace of Retail IPOs Chugs Along

2015 saw 15 retail and consumer IPOs, down slightly from 2014 levels, according to Renaissance Capital. And two of the top 10 biggest IPOs of the year—Fitbit and Blue Buffalo Pet Products—were consumer businesses, according to data from FactSet and Dealogic.

Looking ahead to 2016, retail CFOs expect the pace of IPOs to remain largely steady. For the second year in a row, two-thirds of retail CFOs expect the number of retail and consumer products IPOs to stay about the same as 2015 levels, while 21 percent forecast an increase.

“While some retailers may be preparing to move in on the opportunity to go public, many are still weighing the risks and rewards of such a move (in 2016). When considering an IPO, companies need to look beyond the current business landscape and evaluate the long-term profitability of being publicly traded.”

- Ted Vaughan, national practice leader for BDO’s Consumer Business practice, Chain Store Age (1/19/16)

These projections fall in line with BDO’s recent IPO Outlook Survey, which found that 18 percent of investment bankers expect the number of retail and consumer products IPOs to increase and 40 percent expect them to remain flat. CFOs report the strength of the U.S. economy and stock market (cited by 30 percent) and strength of brand (cited by 27 percent) will be the top factors driving a company’s ability to go public this year.

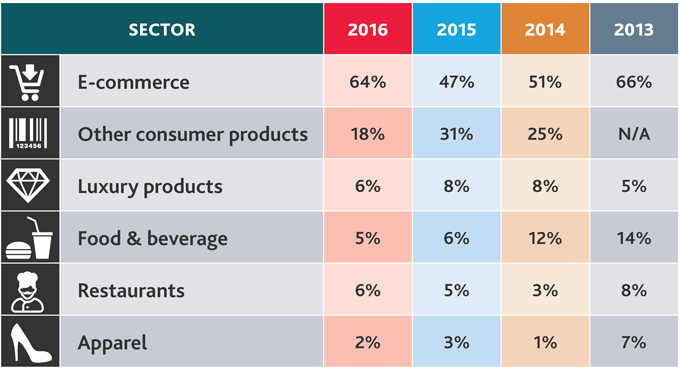

For four consecutive years, CFOs have identified e-commerce as the sector that will experience the most IPOs.

With Their Eye on the Bottom Line, Retailers Look to Gross Sales as Priority Metric

While CFOs last year reported using EBITDA as their priority financial metric, a plurality (30 percent) identify the market’s traditional measuring stick—gross sales—as their preferred performance indicator this year. This is up from 20 percent in 2015. Another 24 percent say they are watching free cash flow most closely, while 20 percent point to comparable store sales, 19 percent cite EBITDA, and 7 percent say return on equity is their most important financial metric.

Retailers’ returned focus on gross sales could be due to the fact that many may be trying to sell their way out of debt. However, with consumers’ growing preference to allocate dollars towards experiences, like travel, instead of goods, this strategy could be an uphill battle. Nearly three-quarters (72 percent) of CFOs say it will be at least slightly difficult for retail and consumer businesses to refinance debt, up slightly from 68 percent last year.

The pressure to perform is on for retailers as they face a slew of challenges, from an overcrowded marketplace to a more sophisticated consumer who now prefers shopping online. And the discomfort retailers are feeling from these seismic changes that are shaking up the industry is contributing to their modest 2016 forecast. However, if retailers are able to rally and realize the right strategies in 2016 to overcome some of the obstacles they face, then future projections could be much brighter.

The BDO Retail Compass Survey of CFOs is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly with chief financial officers. The survey was conducted within a scientifically-developed, pure random sample of the nation’s leading retailers. The retailers in the study were among the largest in the country. The 10th annual survey was conducted in January of 2016.

For more information on BDO USA’s service offerings to this industry, please contact one of our regional practice leaders.

SHARE