Accounting Advisory & Outsourcing

Businesses must rapidly transform and adapt to change, while building resilient and efficient systems to withstand the next challenge. This constant change requires vigilance and agility, and that’s where BDO can help.

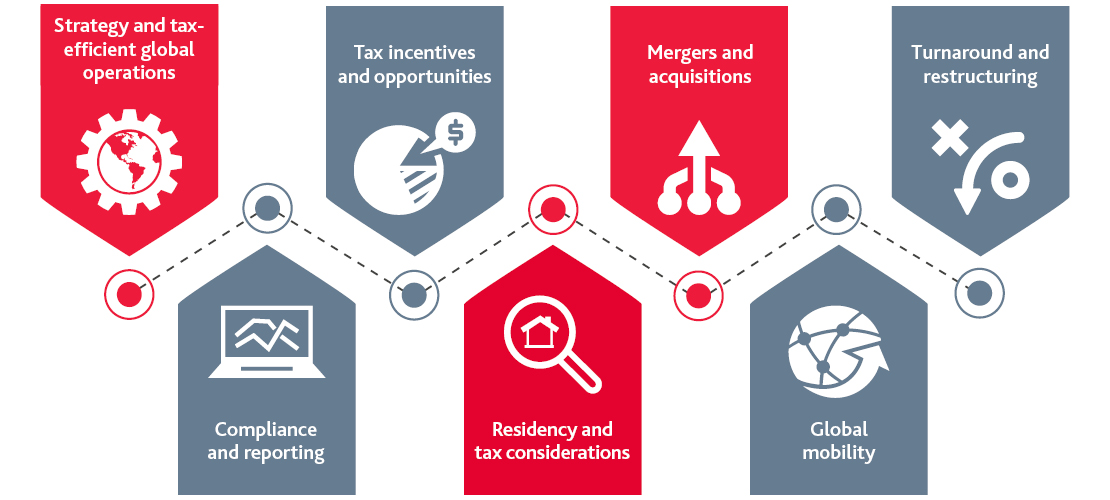

.jpg)