Four Dimensions Of Tax Transformation: Process, Data, Technology, People

Changing legislation, resource constraints, and the increased need for operational efficiencies via digital methods are driving a focus on tax transformation – a form of digital transformation. In today’s fast-moving legislative and regulatory environment, change is the new normal for corporate tax departments. Now more than ever, there is an opportunity to reengineer the tax department through process improvement and technology adoption. However, transformation doesn’t happen overnight. Businesses should first take a step back and analyze themselves across four dimensions—process, data, technology, and people—to assess their starting point. While these dimensions are all interconnected and integral to a holistic approach, the transformation journey begins with incremental improvements in the right direction.

TRANSFORMING PROCESSES

The reality for most middle market businesses is that various departments across the business work in information silos, sprint to complete the entire record-to-report cycle before filing deadlines occur, and then gear up to do the whole thing over again. Exploring opportunities to refine processes, reduce redundant ones, and mitigate risks is often the first step any business or department can do to increase operational efficiency.

Optimizing processes for the tax department can reduce the record-to-report cycle length, increase internal controls and transparency, reduce risk, and ultimately enable tax professionals to spend time on business-critical objectives. This may include reacting to a tax law change or forecasting the impact of a major business choice to help inform management decisions.

Process Management Checklist

To reach this optimum state, businesses need to analyze how information, systems and processes intersect, where there are interdependencies, and how these elements cross internal and external organizational boundaries. Businesses should ask themselves:

- Does your business have an up-to-date representative model of tax processes across the enterprise?

- Does your business have established key performance indicators (KPIs) to measure process efficiency?

- Has an assessment been performed to identify tax process deficiencies and improvement opportunities?

- Has your business identified the associated business requirements of new functionalities or capabilities?

- Have you diagrammed your desired future state process design?

- Does your business currently use Business Process Management (BPM) or workflow management software?

- Do you have change management activities in place to prepare and train employees?

TRANSFORMING YOUR DATA

Quality data is the cornerstone of a well-functioning tax department. If the underlying data or analysis contains mistakes, the decision-making based on that data will be riddled with errors, too. Businesses need to ensure that tax data is clean, accurate and easy to access as part of an overall information governance strategy. For many, particularly middle market businesses facing significant resource constraints, this might seem like an uphill battle. Successful transformation is impossible without putting data at the forefront. A key component of strategic tax planning is using data from across the business to inform decisions, and the availability and quality of insights is dependent on the quality and availability of tax data.

Data Readiness Checklist

- Does your business have a documented information or data governance program that is used across the enterprise, including in the tax department?

- Is tax data maintained, stored and/or preserved to meet the business’ legal, regulatory and business needs?

- Has an assessment been performed to identify the current state of the information management program and to identify future state requirements?

- Can your information management systems reconcile tax data from disparate sources, across different departments, and in variable formats?

TRANSFORMING TECHNOLOGY

Technology is the tool by which a business automates a streamlined process using clean data. While technology is not the only element of a tax transformation strategy, it’s a critical tool to assist in eliminating laborious, non-collaborative activities and processes that have long challenged the tax department, particularly in the middle market.

Determining the right technology to implement depends on the business issue and pain point. Consider an analysis of technology enablers and out-of-the-box tax software options when developing the transformation roadmap. While it may not be necessary to use all of these tools, each can help combat typical tax department challenges. Ultimately, regardless of the enablers employed, the technology used by the tax function should be able to manage complexity, facilitate collaboration across the business, and streamline the compliance and reporting processes.

TRANSFORMING YOUR PEOPLE

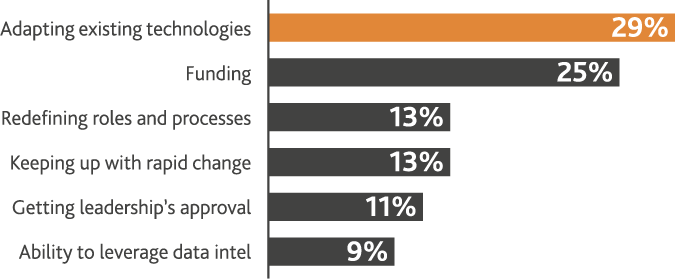

Process, data and technology are three-fourths of the equation. Considering the people component and implementing the change management discipline required to adapt should not be overlooked, as noted by BDO’s 2019 Tax Outlook Survey where adapting existing technologies was cited as the top challenge to tax transformation.

Top Challenges to Tax Transformation in 2019

.png)

*Data from BDO’s 2019 Tax Outlook Survey

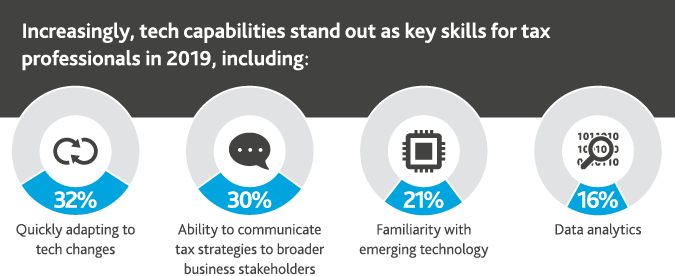

Tax executives surveyed in the Tax Outlook Survey indicate that tax professionals’ digital skills are deemed equally as important as their technical tax prowess. However, in BDO’s Digital Transformation Survey, 54 percent of businesses cited lack of skills or insufficient training as a top barrier to implementing a new digital initiative, and 28 percent cited employee pushback.

.png)

*Data from BDO’s 2019 Tax Outlook Survey

While it’s easy to focus on making changes to technology and processes, ultimately a business’ employees can make or break a transformation strategy’s success. It’s important for employees to understand what’s expected of them and have the resources and training in place to get there. Educating employees on why it’s important to leave the status quo behind, aligning personal goals to the strategic vision, and creating engagement in the transformation process can all assist in successful adaptation.

The good news is that many middle market tax professionals understand the current state isn’t desirable or sustainable in the long term. As businesses increasingly hire and promote younger digital-native employees, there is a growing expectation among professionals that businesses will be equipped with integrated and up-to-date-technologies and processes. Regardless of whether the tax department is populated by industry veterans or fresh talent, getting employees engaged in the transformation process and encouraging them to become change agents themselves is essential to success.

IT’S ABOUT THE JOURNEY

Technology is meant to enhance tax professionals’ work, not replace them. At the end of the day, technology can only replace processes—businesses still need trained professionals to extract insights from the information available. This is where value is created.

Tax transformation requires a commitment to change, a strategic vision, financial investment, and a consultative approach. It will not happen overnight but rather through incremental improvements over time. BDO’s Tax Transformation Guide is a step-by-step roadmap that helps businesses navigate the complexities of incorporating processes, data, technology, and people into their transformation plans.

For more information, visit BDO's tax transformation resource center.

SHARE