CEO Pay Levels and Pay Structure – Predictors of Company Performance?

Much has been written about the relationship between CEO pay and company performance. Shareholders and other stakeholders expect pay and performance to align for executives, in general, and for the CEO. For many companies and boards, building an effective pay-for-performance program requires numerous decisions:

- What performance metric or metrics should be used to reflect performance?

- Should total shareholder return (TSR) be used, relative TSR or a more one-dimensional metric?

- How close of an alignment is possible between CEO pay and company performance?

- What percentage of pay should be linked to incentive or equity compensation?

To shed light on these issues, we examined executive pay and company performance alignment among the 600 companies in the BDO 600 2020 Study of CEO and CFO Compensation Practices of 600 Mid-Market Public Companies. Two reviews were conducted. First, we explored the relationship between CEO total compensation changes and changes in company performance over a multi-year period. Second, we examined the degree to which the CEO pay mix (expressed as a portion of total compensation derived from base salaries or incentives) correlated with company performance.

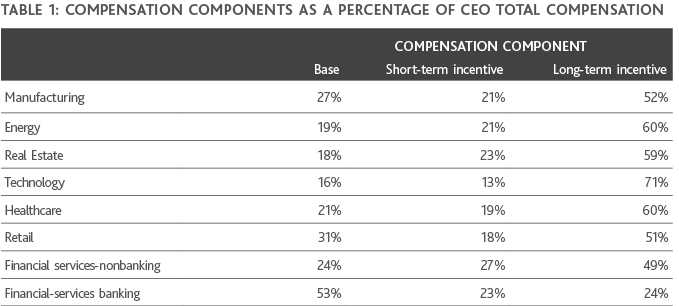

The BDO 600 companies represent eight industry groups. Analyzing pay-for-performance relationships by industry adjusts somewhat for specific industry practices. For example, the choice of performance metrics to assess company performance is often influenced by industry standards. In addition, CEO pay mix (fixed versus variable pay) typifies industry practice.

Table 1 shows average pay mix for CEOs in each industry group. Base compensation as a percentage of total compensation for each CEO ranged from a high of 53% in financial services-banking to a low of 16% in technology companies.

CEO Pay Levels and Company Performance

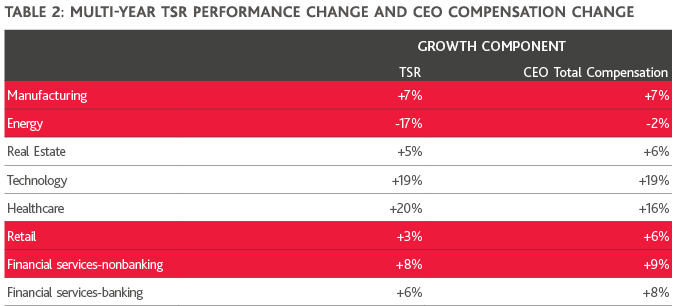

One indicator of a CEO pay-for-performance orientation is the relationship between CEO pay levels and company performance. We explored the relationship between changes in CEO total direct compensation over a multi-year period and changes in company TSR performance for the BDO 600 companies in the eight industries.

We found clear evidence of a significant correlation between company performance and CEO pay increases in specific industry groups. CEO pay increased or decreased over time in the manufacturing, energy, retail and financial services-nonbanking industries in concert with changes in company TSR. Companies in the other industry groups did not exhibit a significant alignment between changes in CEO pay and TSR performance over time.

However, it should be noted that percentage change in CEO total compensation and change in TSR performance were quite consistent across all industries. This suggests strong evidence for a pay-for-performance relationship.

CEO Pay Mix and Company Performance

A second indicator of a pay-for-performance orientation is the degree to which CEO total compensation is a product of variable pay (incentive compensation) versus fixed pay (base salary). Our review was guided by the following hypothesis: Did more incentive compensation in the form of incentive pay result in improvement in company performance over time?

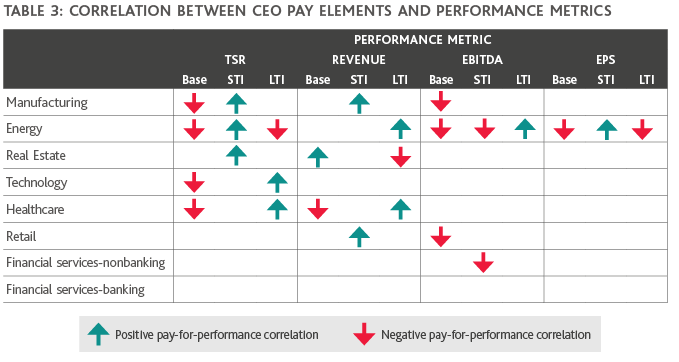

We assessed the change in company performance from 2017 to 2019 on four performance measures: Revenue, TSR, EBITDA and Earnings Per Share (EPS). In this review, the percentage of CEO total compensation in 2017 earned from either base salary, short-term incentives (STI) and long-term incentives (LTI) was determined for each CEO and correlated with change in company performance.

Conducting the analyses separately for each industry group was critical since the percentage of total direct compensation paid in the form of incentive pay differed across industries, ranging from a high of 82% for technology to a low of 45% in financial services-banking.

Table 3 summarizes the results by industry and performance metric. The compensation element that had a significant correlation with the performance metric is noted (Base, STI, LTI).

A significant relationship between the portion of CEO total compensation delivered through incentives and change in company performance was evident in seven of the eight industry groups for at least one measure of company performance.

Other findings include:

- Lower base salaries and higher incentive pay for CEOs predicted improved performance in five industries.

- TSR performance was aligned with at least one component of pay in five industries. A larger percentage of CEO total pay based on STI and LTI awards significantly correlated with TSR performance over the time period.

- Revenue growth positively correlated with the percentage of pay allocated to either annual incentives or LTIs in four industries.

- In contrast, lower annual incentives as a percentage of total compensation predicted higher EBITDA in two industries.

- The contribution of STIs to total CEO compensation was a slightly more potent predictor of performance than the portion of pay associated with LTIs.

- Companies in the energy industry had significant relationships between pay mix and performance on each of the four performance metrics.

Conclusion

The results of this review show promise for developing CEO pay programs that more closely align with company performance. In some industry groups, larger incentive compensation as percentage of total pay was associated with improved company performance on numerous metrics and CEO changes in pay were associated with changes in TSR performance.

Building a strong pay-for-performance program requires greater attention to incentive compensation funding metrics and pay mix over time. Building a strong alignment lies in:

- Selecting the right metric or metrics to measure performance,

- Adjusting for the lag between compensation in one year and company performance over a multi-year period,

- Estimating the probability of attaining target awards on STI and LTI measures,

- Increasing the portion of pay associated with incentive compensation within the framework of industry standards, and

- Benchmarking company performance and CEO pay levels over a multi-year period.

SHARE