2020 BDO Tax Outlook Survey

This survey was conducted in Fall 2019, prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities.

The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Tax executives are entering the disruption decade, where the only constant will be more change, and at a faster pace. This is something they’re already familiar with—the landscape at nearly every level has shifted significantly in the last few years. What’s the answer to managing the aftershocks of changes that have already happened (like tax reform and the Supreme Court’s Wayfair decision) and those that are yet to come?

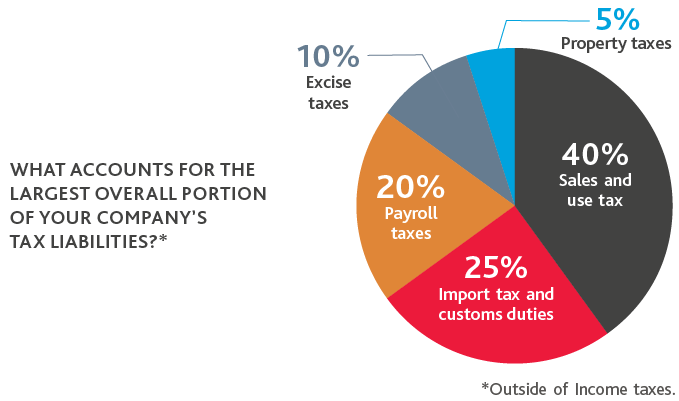

To keep up with the accelerating pace of change, companies must focus on maintaining a total tax liability mindset—a holistic understanding of the sum of all taxes owed across the entirety of the organization. To do so, they need to transform the tax function, focusing not only on adopting new technologies, but also empowering their people with the skills needed to thrive in a world where the rules of business are being reinvented every day, and the future is anything but certain.

The challenges are massive. The opportunities are even larger.

Our 2020 Tax Outlook Survey found that tax professionals are up to the task—focused on total liability, adjusting to the changes that have happened, and ready to adapt to those to come.

Learn more about the top five takeaways from this year’s BDO Tax Outlook Survey.

Takeaway #1

Total tax liability takes center stage.

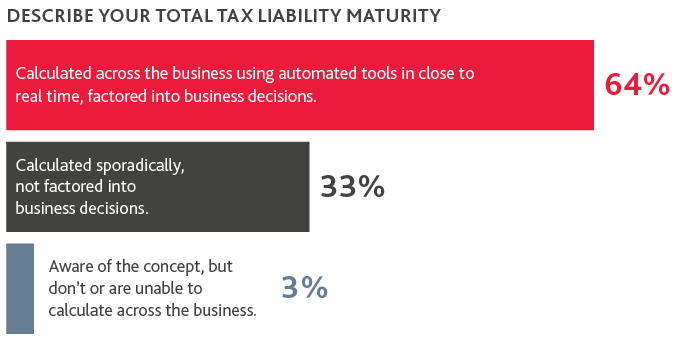

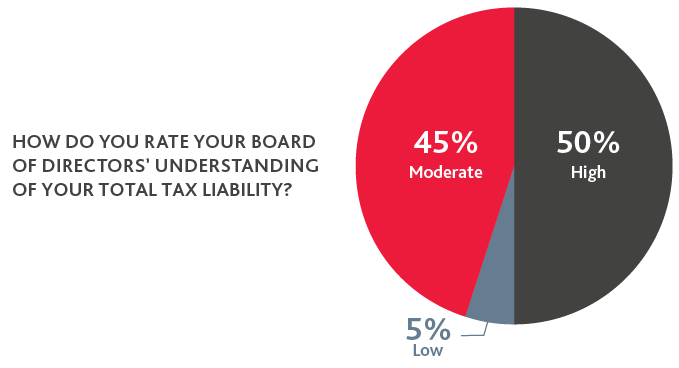

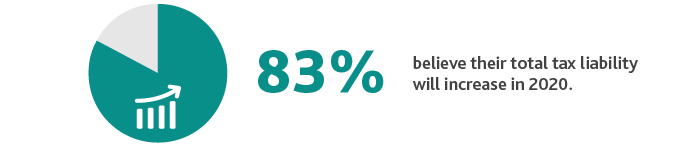

BDO recognizes the value of a total tax liability mindset and has been encouraging tax professionals to understand the concept, assess their maturity and undertake transformation initiatives to better comprehend and ultimately optimize it. It’s clear tax executives agree, and most have taken steps to be able to calculate it and consider it when making critical decisions. They’re also communicating the importance of understanding total tax liability to their boards.

Takeaway #2

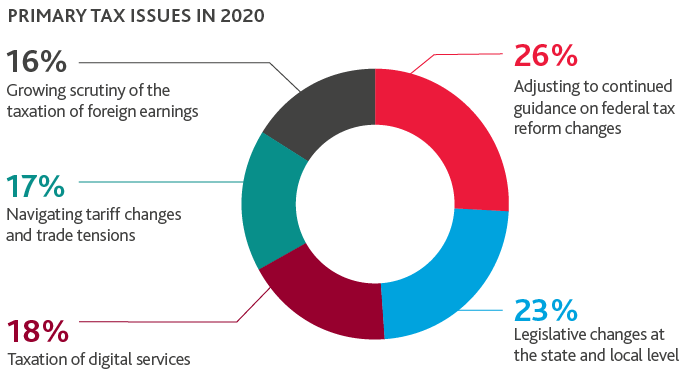

Tax complexity is accelerating at the international, federal and state levels.

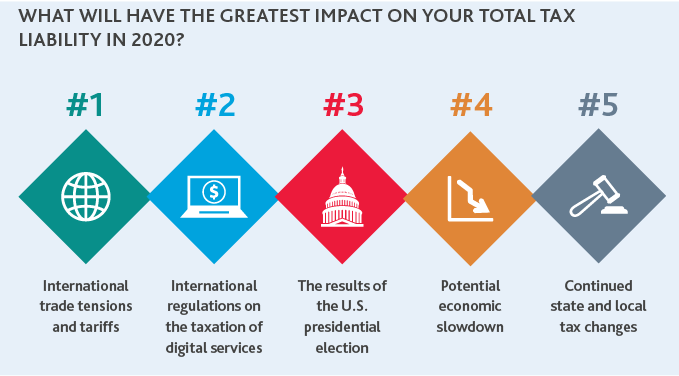

Tax rules have changed more in the past five years than in the past 50, and there doesn’t seem to be an end in sight. For tax professionals, the mandate is threefold: They must be able to 1) keep track of constantly shifting regulations; 2) map the impact of the regulations to the company’s total tax liability; and 3) adjust tax optimization strategies across the entire organization.

Federal Tax Reform is Far From Over

While many businesses got a boost from the reduced corporate rate, it hasn’t all been smooth sailing.

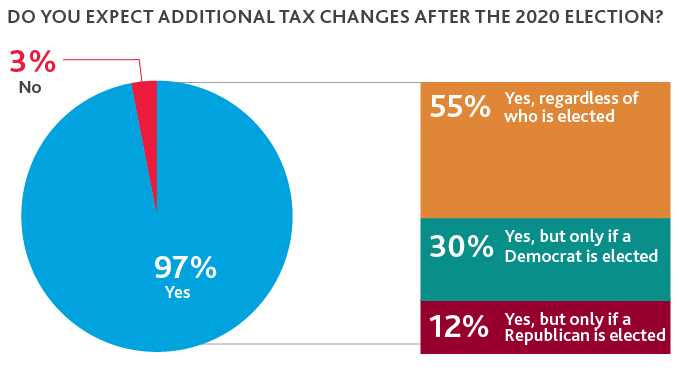

International tax provisions like the Base Erosion Anti-abuse Tax (BEAT) and Global Intangible Low-Taxed Income (GILTI) have been particularly challenging. And with regulatory guidance on these provisions finalized only recently, there is still plenty of uncertainty about how to interpret the law. With a potential economic downturn on the horizon and an election that’s anyone’s guess, executives are gearing up for additional developments.

State: Compliance in the Post-Wayfair World

The Supreme Court’s decision in the landmark South Dakota v. Wayfair case opened the door for states to use an economic nexus standard to mandate that out of state sellers collect and remit sales taxes, even if they have no in-state physical presence. Most states quickly adopted new tax statutes, creating serious compliance challenges in their wake. But they didn’t stop there—now states are using the Wayfair ruling to tax marketplace facilitators, and some are moving into taxing corporate income from out-of-state sellers. Navigating the increasingly tangled web of state tax laws is no easy feat.

International: Tackling Trade Turbulence

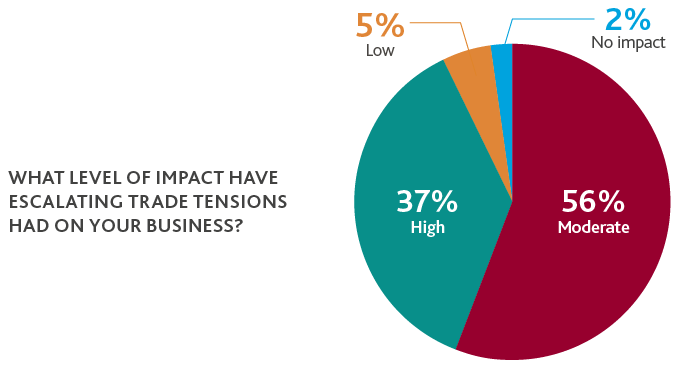

The Trump administration is wielding the full arsenal of trade tactics at its disposal: Billions of dollars in tariffs have been levied on major U.S. trading partners over the last two years. Various agreements have been reached along the way, but the tumult hasn’t stopped. While these tactics are intended to level the playing field for American businesses, they can leave tax professionals in a tough spot. Often, it’s the uncertainty more than the tariffs themselves that makes the current tax planning environment so difficult.

Takeaway #3

The digital economy is transforming tax.

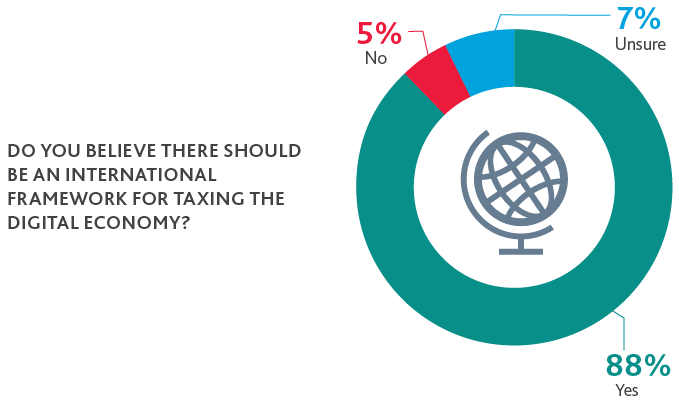

Digital disruption is affecting every aspect of business, and tax authorities around the world are scrambling to regulate a global economy that is no longer restricted by geographic borders. The Organisation for Economic Cooperation and Development (OECD) is leading the charge in the creation of a global framework for taxing digital businesses. Tax executives seem to support these efforts, which would help bring some uniformity to the patchwork of existing rules. While the OECD proposals are still in flux, they stand to impact any business that sells to customers abroad.

Takeaway #4

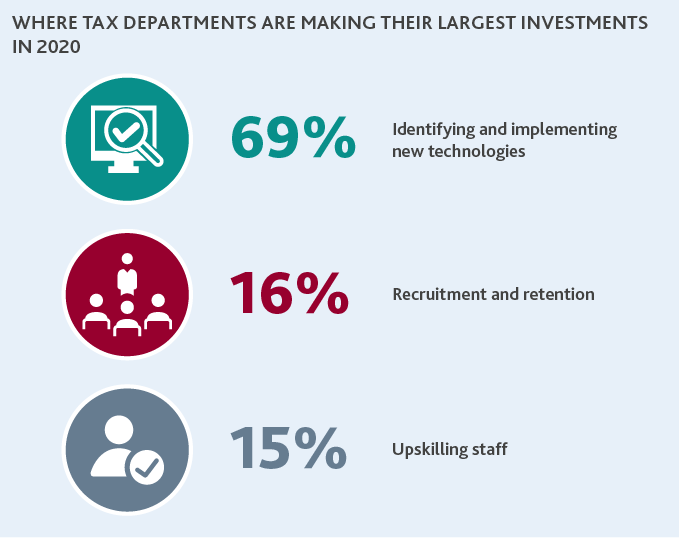

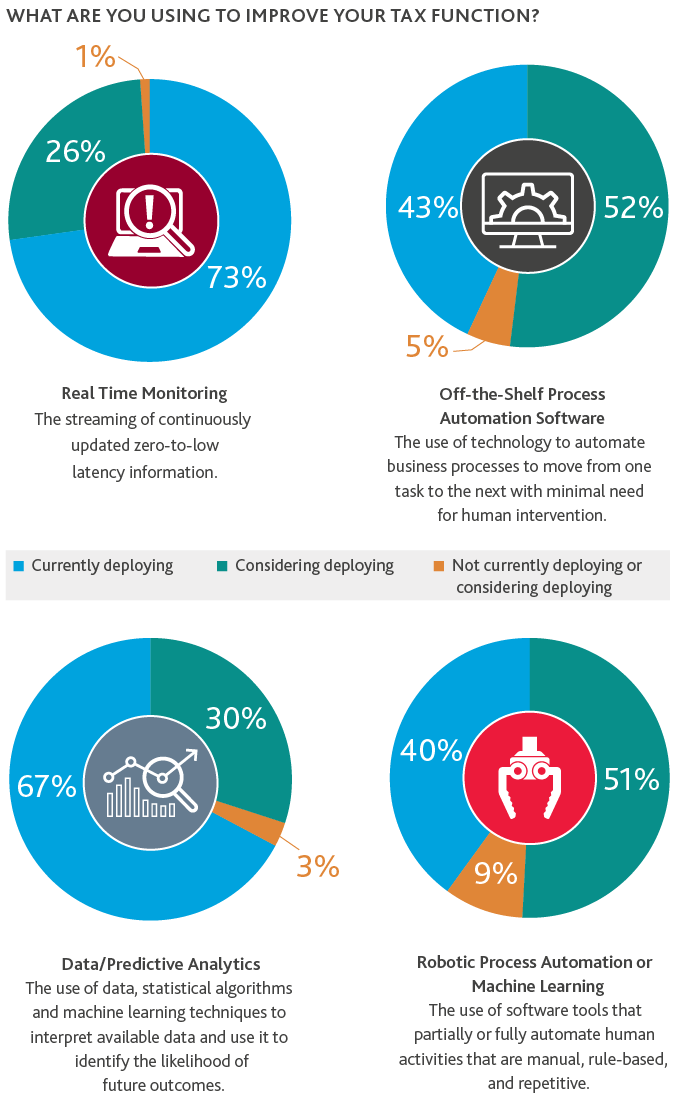

Tax complexity requires transformation.

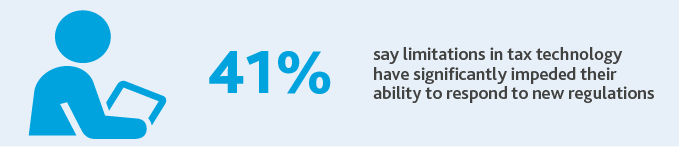

Regulators may be scrambling to catch up to the digital economy, but enforcement efforts are advancing rapidly. Tax authorities around the globe are effectively leveraging technology to more quickly and accurately identify violations. Tax executives need to adapt quickly to stay on top of shifting regulations, prevent tax issues, and respond to inquiries when they happen.

Takeaway #5

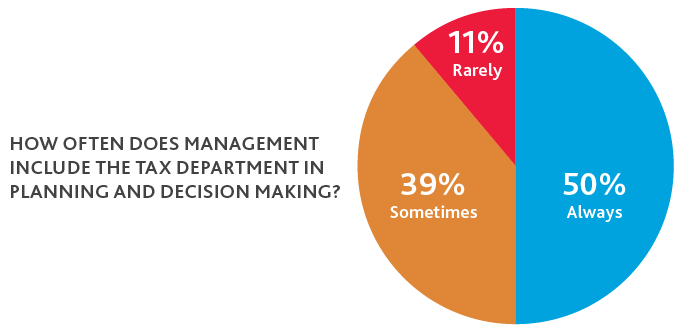

Tax executives are moving into the C-suite.

With ongoing disruption in the tax environment, the C-suite is increasingly looking to their tax department for insights and guidance on strategic planning and managing new developments. This means that tax compliance and accounting are no longer the only skills tax executives need to prove their value—they must be collaborative, tech-savvy and adaptable.

It’s never been a more demanding time to be a tax professional, but their work has never been more critical to a business’s long-term success. Want to know more about how tax professionals are gearing up for the disruption decade? Download the full survey report.

About the 2020 BDO Tax Outlook Survey

The 2020 BDO Tax Outlook Survey polled 151 senior tax executives at companies with revenues ranging from $100 million to $3 billion in October and November 2019. The survey was conducted by Rabin Research Company, an independent marketing research firm.

About BDO Tax

The Tax practice at BDO is among the largest tax advisory practices in the United States. With 65 offices and over 700 independent alliance firm locations in the United States, BDO has the bench strength and coverage to serve you.

SHARE