How to Set Effective ESG Goals and Targets

Stakeholder demands for companies to commit to clear environmental, social and governance (ESG) goals and targets have become commonplace.

In addition to strengthening stakeholder relationships, setting goals and targets can help companies further their corporate sustainability strategies, improve operational and financial performance, enhance credibility, and achieve other benefits.

Without careful planning at the initial goal and target-setting stage, it may be impossible for companies to unlock the potential for value creation. For example, setting goals and targets that are not aligned with corporate purpose or that are unattainable could expose companies to risks when corporate performance doesn’t measure up. And setting commitments for immaterial issues could misuse valuable time and resources. It could also prompt claims of “greenwashing.”

In this article, the third in BDO’s series on starting your ESG journey, we outline key considerations that can help your company set effective ESG goals and interim targets to help achieve them. Leveraging clear objectives, processes and controls throughout the goal-setting process can help align ESG-related commitments with corporate priorities as well as ensure progress is accurately tracked.

Define Clear Objectives

Goal setting is rooted in clear objectives. Before setting a goal, it’s important for corporate leaders to be thoughtful about their reasons for doing so.

Each goal should be assessed as to whether it is tied to a tangible benefit or mitigation of meaningful risk. Motivations will be unique for each organization, but your company’s reasons for setting a commitment may include intentions to:

Communicate Your Priorities

Goals set a vision for your company and communicate the importance of your commitments both within your organization and to your business partners and customers. Goals communicate what success looks like for your ESG strategy and can help allocate resources needed for progress.

Measure Performance Over Time

When properly defined, ESG goals provide a clear path forward with metrics for improvement. The ability to track year-over-year trends and identify opportunities is essential for accurate performance measurement and communications.

Accelerate Value Creation

The business case for ESG is strengthening, with growing evidence for how ESG integration benefits business performance. Setting goals can help your company identify new markets, ensure efficient resource management and reduce operational costs.

Meet Stakeholder Expectations

Clear and defined objectives are critical for engaging with a variety of stakeholder groups. Ensuring continued growth and adaptability in a rapidly changing environment relies on meeting stakeholder expectations.

Ensure Greater Accountability

Boilerplate statements are no longer enough. Companies are expected to communicate quantifiable and verifiable ESG performance. Public goals demonstrate genuine sustainability efforts and help avoid accusations of greenwashing.

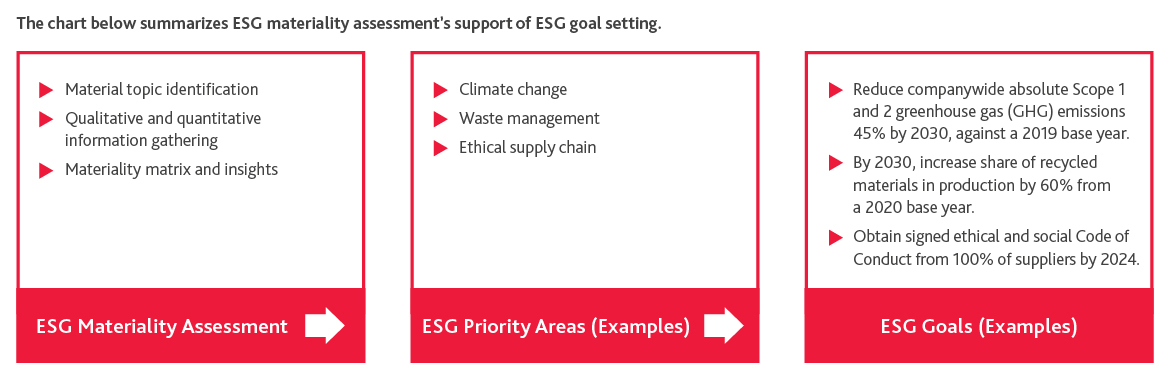

Build on Materiality

Prioritizing areas to focus on while setting goals can be difficult. Building on your ESG materiality assessment and using similar workflows can help you focus on the right issues for your business, while measuring progress and impact over time. The second article in our series on starting your ESG journey, “Materiality Assessment: Identify the ESG Issues Most Critical to Your Company,” goes into detail on conducting an ESG materiality assessment.

Like the processes for setting business goals and key performance indicators (KPIs), the ESG goal-setting process should focus on topics that are material — those likely to have the most significant impact, positive or negative, on your business.

Using similar methodologies for goal setting and materiality assessment will help identify areas with the highest value and impact. Similar workflows and processes will also help avoid setting overly ambitious and unrealistic goals.

Align Goals with ESG Standards, Frameworks and Initiatives

The information that ESG reporting standards, frameworks and initiatives request companies disclose about their goals can provide invaluable guideposts as your organization sets its own commitments. Understanding the nature of the information you may eventually be asked to disclose can strengthen future reporting and help create stronger goals.

Many ESG standards, frameworks and initiatives address goals or targets, but not all of them will apply to your company. We suggest that your goal setting includes an in-depth review of guidance and requirements for the standards and frameworks you plan to report against or for the initiatives that you may wish to join. Below are examples of standards, frameworks and initiatives to consider, including summarized descriptions of their goal and target-related criteria.

This is a non-comprehensive list. Your organization may fall under the scope of other reporting requirements.

Global Reporting Initiative (GRI) — GRI asks companies that use its voluntary reporting standards to disclose how goals and targets are set, the baseline and the timeline for achieving them, activities and business relationships where the goals and targets apply, if goals and targets are voluntary or mandatory, and if and how goals and targets consider broader sustainable development impacts.

United Nations Global Compact (UNGC) — The UNGC requires companies that join the voluntary initiative to disclose whether they set and track progress for goals and targets related to human rights, labor and environmental topics. The UNGC’s annual questionnaire also asks for additional details on environmental goals and targets, such as if they are externally verified, and asks companies to disclose any goals related to anti-corruption.

International Sustainability Standards Board (ISSB) — The ISSB will ask for disclosures on targets that include the metric used, the time frame and base period, and any milestones or interim targets. The ISSB’s proposed standards, which seek to establish global baseline sustainability disclosures for capital markets, will be voluntary unless a company operates in a jurisdiction that mandates them. The final versions of ISSB’s first two standards are expected to be released around June 2023, with reporting periods to begin in 2024.

Sustainability Accounting Standards Board (SASB) — SASB Standards are now part of the ISSB. The ISSB will require industry-specific disclosures and is updating the SASB Standards for this purpose. For many of its industry-specific sustainability accounting standards, SASB asks companies to report emissions reduction targets and an analysis of performance against those targets.

Task Force on Climate-Related Financial Disclosures (TCFD) — TCFD asks companies to describe key climate-related targets in line with anticipated regulatory requirements or market constraints or other goals. Disclosures should include if targets are absolute or intensity-based, target time frames and base years, and KPIs used to assess progress against targets. Although TCFD began as a voluntary reporting framework, many jurisdictions’ mandatory climate disclosure requirements have begun to adopt or reference TCFD.

Science Based Targets initiative (SBTi) — SBTi is a voluntary initiative that companies in certain sectors can join. SBTi creates a validation process for companies to demonstrate that their net-zero targets and interim emissions reduction targets are adequate to meet the Paris Agreement’s call to limit global temperature increase to 1.5 degrees Celsius above pre-industrial levels. SBTi criteria covers GHG emissions inventory and target boundary, emissions accounting requirements, and target time frame, among other categories.

CDP – CDP provides a platform for companies to disclosure their environmental information. CDP’s questionnaires ask companies to disclose climate, water and forest-related targets and details about these targets. Information requested includes the year the target was set, target coverage, base year, target year and target status in the reporting year.

Apply SMART Principles

For ESG goals to drive the desired impact and properly address stakeholder expectations, they need to be clear, defined, measurable and reasonably ambitious. Avoiding generic and broad statements that lack specific metrics and time frames is key.

Consider the following examples of ESG goals that are ‘SMART’ — specific, measurable, achievable, relevant and time bound. Adding specific metrics and time frames makes goals clearer and more achievable.

Generic Goal Reduce our environmental footprint. | Generic Goal Increase social involvement in the communities we serve. | Generic Goal Ensure oversight and accountability of ESG management. |

SMART Goal

| SMART Goal

| SMART Goal

|

A goal should be your company’s compass and map. Following the SMART methodology will help you explore and communicate where your ESG strategy and program is going and how to get there. Otherwise, you are risking your company’s credibility and undermining effectiveness.

Create Action Plans to Achieve Goals

Goals can be hollow statements without the activities and resources necessary to achieve them. Success will depend on leadership buy-in and accountability as well as employee commitment. And since stakeholder priorities and demands are likely to evolve, engaging on a regular basis to communicate progress will increase effectiveness and help protect reputation.

There are a few key considerations to create action plans to achieve your goals:

- Business Integration — For long-term impact, ESG goals should become part of your company’s DNA. It is critical to incorporate ESG metrics and targets into business KPIs and the performance evaluations of individuals and teams.

- Data Management — Reliable and accurate data is crucial for measurement of progress. For each goal, identify the subject matter experts in charge of collecting and analyzing data. Quality data management and insights will be valuable to help guide performance and for future strategy and goal setting.

- Disclosure and Reporting of Progress — Goals can be instrumental when engaging with different stakeholders. It is important to use goals as a central theme of corporate ESG reporting to add substance and proof of action.

- Oversight and Continued Management — Discuss the desired approach with leadership to institutionalize ESG oversight. For example, some companies include ESG metrics such as carbon intensity as part of executive and companywide incentive plans.

Setting goals and targets is a crucial step in your corporate ESG strategy and program development. The goal-setting process is an opportunity to realign with your business strategy, act on opportunity and mitigate risk. Goal and target setting is becoming a must-have component of corporate disclosure and a critical tool when communicating with investors, clients, employees and other stakeholders.

BDO helps organizations build ESG strategies and programs that create long-term, sustainable value. Contact us to learn more about BDO’s ESG Strategy & Program Development services and other solutions in our ESG Center of Excellence.

SHARE