Effective business continuity plans for public and private organizations of all sizes, industries, and geographic footprints require early investment in a comprehensive ESG risk management and opportunities strategy. As the world weathers macroeconomic disruption and changing stakeholder expectations, those who recognize material ESG risks and capitalize on ESG-related opportunities are poised to capture competitive advantage.

2023 BDO ESG Risk & ROI Survey

Introduction

The world has clocked in another year of macroeconomic disruption, and its impacts are unlikely to subside before the end of 2023. Throughout this volatility, organizations have adopted and begun executing risk mitigation strategies to address the material environmental, social, and governance (ESG) risks they face.

Across sectors, market caps, and regions, many finance leaders have come to accept the reality of these risks, but balancing ESG risk mitigation amid other financial headwinds remains a challenge. As part of BDO’s 2023 CFO Outlook Survey, middle-market finance leaders across six industries benchmark their progress against ESG risks and opportunities.

This year, as regulatory advancement takes center stage, private and public companies in all sectors should prepare for new rules and increased stakeholder demands. Stakeholders will soon gain unprecedented levels of insight into corporate operations, and private companies will see increasing customer pressure to communicate their impact on people and the planet.

In the following report, we aim to help the finance function prepare for these imminent changes and chart a path forward toward regulatory compliance, stakeholder satisfaction, and environmental stewardship.

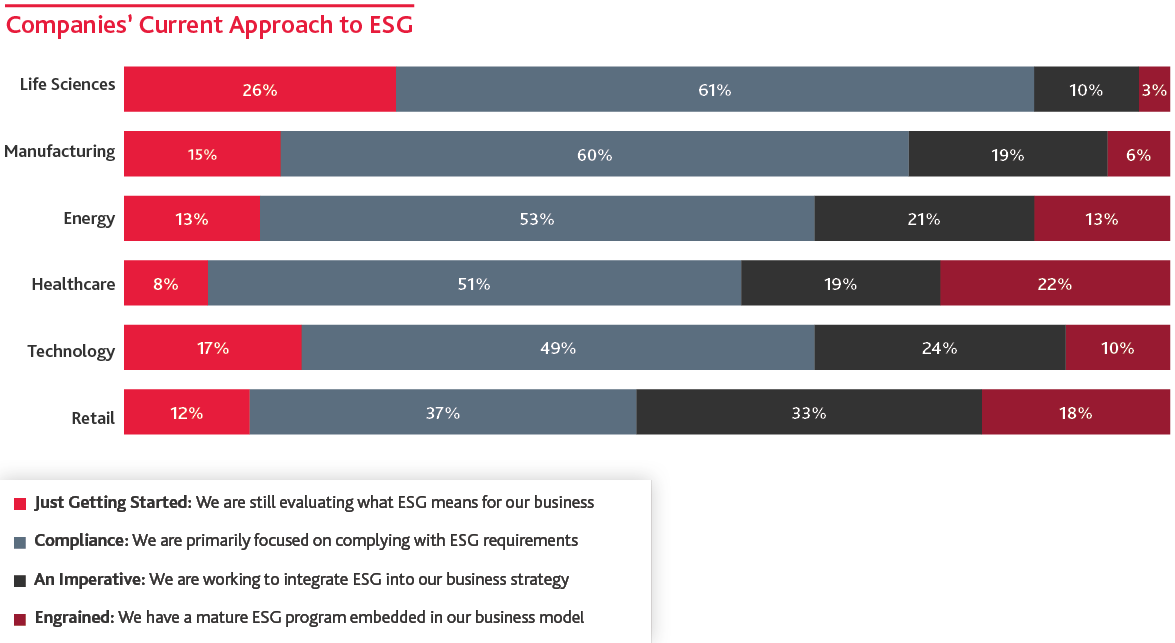

The resounding takeaway? The scale of an industry’s investment in sustainability and attention to ESG risks varies widely, largely determined by the regulatory environment in which they operate and the nuanced stakeholder pressures they face. Many middle market life sciences, manufacturing and energy CFOs still see their ESG programs as a compliance exercise, likely due to the expected greenhouse gas (GHG) emissions and human capital disclosure requirements, which the Securities and Exchange Commission (SEC) and other international bodies are expected to finalize in the coming months. Retail, healthcare, and technology, facing heightened regulatory, consumer, and stakeholder scrutiny, are more likely to see ESG programs as an imperative to their overall business strategy. Many have already engrained ESG strategy into their core business models.

Methodology

The 2023 BDO CFO Outlook Survey polled 625 CFOs from organizations with revenues ranging from $50 million to over $3 billion. The survey was conducted in October 2022 by Rabin Research Company, an independent marketing research firm, using Op4G’s panel of executives.

66% of middle market CFOs say they either consider ESG primarily a compliance exercise or are just getting started.

The large share of CFOs that consider ESG risk mitigation a compliance exercise likely reflects focus on the looming Scope 1, 2 and 3 GHG emissions that the SEC is expected to finalize this year. Additional cybersecurity risk disclosure rules, announced in late 2022, will likely follow. Public companies should now be thinking about their readiness to collect, verify, and disclose such data. Their privately held peers would be prudent to do the same, as their stakeholders will soon begin to question why they have not embraced transparency.

In retail, technology, and healthcare, far fewer finance leaders view their ESG program as primarily a compliance exercise. Retail CFOs, facing heightened stakeholder scrutiny about fair labor practices, supply chain sustainability, and other ESG concerns, recognize ESG investment and risk management as an imperative to securing competitive advantage while future-proofing their business.

In recent years, sector-specific ESG issues like health equity have upended the ways that public and private healthcare companies think about their duty to customers and consumers. Of the five sectors surveyed, healthcare CFOs were the most likely to classify their ESG programs as mature and engrained in their organization’s business model. As more leaders of healthcare organizations recognize the impact of social determinants of health (SDOH), the nonmedical factors that influence their consumers’ health outcomes, these companies are likely to invest further in ESG initiatives. Some industry giants have already built dedicated resource hubs, services, and tools to increase equitable access to quality healthcare. While some healthcare leaders are still catching up, overall ESG maturity across the industry is a positive indicator for the future.

Assessing the ESG Risk Landscape

CFOs across industries disagree on the materiality of ESG risks to their business in 2023, but their industry’s exposure to mandatory regulatory frameworks that drive compliance and the size of their multinational footprint may determine how they assess those ESG risks.

More than half of life sciences CFOs say ESG poses minimal risk to their business in 2023, and over a third of energy and manufacturing finance leaders agree. That percentage drops for healthcare, technology, and retail CFOs, who cannot ignore stakeholders’ demand for ESG risk management initiatives like net zero commitments and human capital strategies.

Risk profiles differ dramatically across sector but no matter the industry, CFOs cannot afford to underestimate ESG risks. Treating sustainability initiatives as check-the-box compliance plays will prove insufficient protection against material risks like talent crises, social and geopolitical disruption, customer attrition due to reputational setbacks, and sustainability-driven shareholder activism. Investment in ESG programs should be intentional, holistic, and engrained into business strategy.

Roughly two-thirds of CFOs surveyed believe ESG, natural disasters, data privacy breaches, and public health threats pose some or significant risk to the business in 2023.

Early ROI of ESG Initiatives

Across industries, ESG early adopters are already reaping the benefits of those investments beyond regulatory compliance. For many enterprises, ESG programs have sharpened their competitive edge. Retail, life sciences, and technology CFOs say their ESG initiatives have improved ratings. Those in manufacturing, healthcare, and energy say their ESG programs supported recruiting and retention efforts, a salve to a challenging talent market.

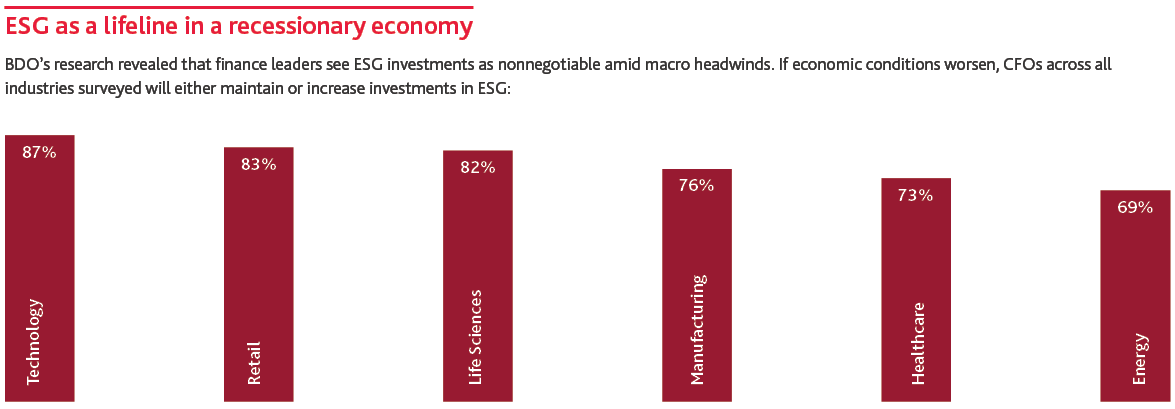

Even CFOs who say their ESG programs are less mature have begun to see ESG investments as a must-have: Nearly 80% of those surveyed plan to maintain or increase their ESG investments even if macroeconomic conditions were to worsen.

But there is also a clear link between business resilience and ESG strategy: Our survey found that CFOs of thriving companies are over three times more likely than their competitors to say that ESG is engrained in their business model or is an imperative.

With time, we expect the competitive gap to widen as material ESG risks and revenue-generating opportunities grow too formidable to ignore.

The Tax Advantage of Sustainability

For many organizations, the financial incentives to prioritize sustainability are too significant to ignore. In August 2022, the Biden Administration signed the Inflation Reduction Act (IRA) into law, marking the largest-ever American investment to mitigate climate change. Over the next decade, the U.S. will allocate $369 billion to energy security and clean energy programs, including provisions to incentivize the creation of clean energy projects and electric vehicles domestically. According to Credit Suisse, the actual spending will likely approximate $800 billion since much of the baseline investment is allocated to uncapped credit and incentive programs. Notably, the bill grants businesses the ability to transfer renewable energy tax credits, meaning organizations of any size and industry may benefit.

In response to the IRA, CFOs say they have already taken or plan to take the following steps:

89%

Take advantage of clean energy incentives and funding

86%

Revisit decarbonization plan

89%

Engage in tax scenario planning

This is a welcome trend, and businesses across the country would be wise to investigate how the IRA may benefit them. For organizations that are unsure how to take advantage of these credits, trusted third-party advisors can help. View our resources and insights here or get in touch with one of BDO’s ESG tax leaders.

Planned ESG Investment in 2023

Across industries, an average of 41% of CFOs plan to pursue ESG strategies over the coming year, up from 36% in 2022. These plans to capitalize on ESG opportunities vary by sector. If economic conditions worsen, more than a third of retail and technology CFOs expect their organizations to increase investments in ESG. Interestingly, the same share of life sciences CFOs, who had expressed the least concern for ESG risks, also predict greater ESG investment if economic headwinds worsen. Supply chain challenges, long-term energy- and cost-saving benefits of decarbonization activities, and concerns around worsening talent shortages are a few possible drivers of this dynamic.

While most finance leaders see the business case for investments in ESG risk management, their specific objectives when undertaking ESG initiatives this year vary widely, a symptom of sector-specific risk profiles that vary widely.

Top Objectives

- Technology, healthcare, and manufacturing CFOs say their top goal is management of ESG risks and compliance. Operating in highly regulated industries that will be significantly impacted by new and forthcoming reporting and disclosure rules, they are focused first on getting the fundamentals right.

- Life sciences CFOs’ top ESG goal is to embed sustainability into business strategy. This is likely a reflection of industrywide difficulty sourcing critical inputs. For these organizations, sustainable production is now a business imperative.

- For energy CFOs, the primary ESG objective is to embed sustainability into investing criteria. In a sector facing extreme shareholder scrutiny on its resilience through transition and geopolitical conflict, finance leaders are wise to allocate resources in better alignment with investor demands.

- Retail CFOs named improvement of ESG ratings as the top goal for their organizational ESG investments this year. In recent years, consumers have voiced their preference for sustainably produced goods. CFOs’ attention to evolving customer tastes is a step toward reputational improvement.

Tech Under the ESG Microscope

Under an ethical microscope and facing new cyber threats, the tech industry is embracing sustainability. To navigate shifting stakeholder demands, critiques, and preferences, tech companies are leaning into ESG-related growth opportunities and staying vigilant to ESG risks. In the coming year, 41% of tech CFOs indicate they plan to pursue an ESG strategy, up from 27% in 2022.

Tech’s ESG trailblazers are already seeing the ROI: In the face of stakeholder, government, and regulatory scrutiny, almost half of tech CFOs say their ESG initiatives have improved business resilience, generated new sources of revenue, supported talent and recruitment efforts, and improved brand reputation.

Still, only a third of tech CFOs (34%) say ESG is currently an imperative or an engrained part of their business model. However, this percentage climbs to 42% for tech companies that are thriving (those that saw increased profitability and revenue in 2022).

Amid a complex cybersecurity risk landscape, tech companies are wise to continue to lean into their ESG initiatives. It’s no coincidence that the sector’s strongest performers have prioritized ESG. These investments will continue to build business resilience, as the cyber risk landscape grows increasingly hostile and the regulatory environment grows ever more complex.

Tightening credit markets and recessionary global economic conditions have encouraged C-suites across sectors to rethink their growth strategies. Up against business-critical material risks and challenges, investments in ESG programs can improve access to capital while remediating product sourcing and logistics issues and softening recruitment and retention woes. The right preventive measures can help leaders manage risk and capitalize on growth opportunities as we weather the impacts of U.S. monetary policy together.

ESG-Driven Changes On the Horizon for the Energy Sector

Amid tumultuous geopolitics and supply chain troubles, incorporating ESG principles into business operations has become an unofficial mandate for both oil and gas and renewables companies. More than half of oil and gas CFOs from these groups (58% and 60% respectively) believe ESG issues pose at least some risk to their business in 2023.

Their yearly budgets, however, reflect slightly different levels of concern. While roughly half of oil and gas CFOs (52%) report that they allocate 1-5% of their budget to ESG initiatives, 54% of renewables CFOs say their allocation falls between 6-10%.

Should market headwinds intensify, almost two-thirds of oil and gas CFOs (69%) plan to either maintain or increase their current ESG investment, reflecting ESG’s growing importance to industry leaders and their recognition of sustainability as a business imperative.

However, despite keeping a close eye on the regulatory environment, and despite investments in decarbonization and data procurement, only 37% of middle market energy CFOs say their organization is fully prepared to report on Scope 3 GHG emissions — the upstream and downstream sources of emissions throughout their supply chain. Ramping up ESG investments to achieve regulatory compliance with forthcoming SEC disclosure rules will soon be crucial.

Facing global challenges like talent shortages, liquidity issues, faltering financial systems, inaccessible credit, and sky-high operational and resource costs, organizations’ investments in ESG strategy should be a lever for stability and growth. Reluctant CFOs can rest assured: developing an ESG program and integrating ESG risk into business strategy is no longer a gamble. Pioneering organizations across all sectors are already realizing the benefits and capturing a competitive advantage.

Ready to Embrace Change?

While CFOs in some industries are more proactive on ESG strategy and investments than their counterparts in others, none are immune to the many ESG risks that are becoming increasingly complex and ubiquitous. As investors, regulators, and stakeholders recognize the materiality of ESG risks, finance leaders must stay informed of these challenges and take action to mitigate them.

The 3x4: Three Questions to Ask In Four Areas of Change

- Are you familiar with international, state, and local ESG regulations that apply to your organization, your sector, and the jurisdictions in which you operate?

- How robust is your organization’s controls and processes for ESG data collection, management, and reporting?

- Have you begun to evaluate your carbon footprint to establish a baseline for reporting?

- Are there any significant gaps in stakeholder expectations that represent material risk factors for your organization?

- How well do current operations, policies, and protocols align with your customers’ expectations?

- Should your organization adjust its operations and sourcing to meet stakeholder expectations or comply with partners’ policies?

- What can your organization do now to address its greatest reputational risks?

- Do your organization’s cybersecurity policies, identification tools, reporting, and crisis response plan reflect the evolving cyber risk landscape?

- What role can the finance function play in integrating ESG risk materiality? Into your organization’s overall growth strategy?

- What areas of investments could help your organization position itself for longer-term, sustainable value creation?

- If eligible, have you best capitalized on sustainable tax credits and incentives, including their transferability?

- How might investments in sustainability support your access to more favorable financing?

The development and execution of an ESG strategy takes time, and investing in an ESG program requires cross-functional buy-in. Trusted partners can help bridge the gap from vague terminology and unclear priorities to actionable risk mitigation strategies and ROI.

Unsure where to go next? For support on your ESG journey, reach out to BDO's seasoned ESG leaders or read about how BDO can help.

SHARE