The Biggest Change to Bank Accounting—Ever

Drawing from lessons learned during the global financial crisis, the FASB approved the final current expected credit loss model in June 2016 with the purpose of limiting the impact of potential losses in a future financial meltdown.

Before the financial crisis, there was some concern about the adequacy of loan loss reserves given that financial institutions were restricted under U.S. GAAP from recording “expected” credit losses that did not yet meet the “probable” threshold as required at that time.

In response, the FASB and its counterpart, the London-based International Accounting Standards Board (IASB), set out to develop a new accounting standard that incorporated forwardlooking information to determine future losses. The IASB and the FASB could not agree on a new standard, so the IASB issued the IFRS 9 Financial Instruments in July 2014, while the FASB developed a framework for CECL to replace the existing incurred loss methodology in U.S. GAAP.

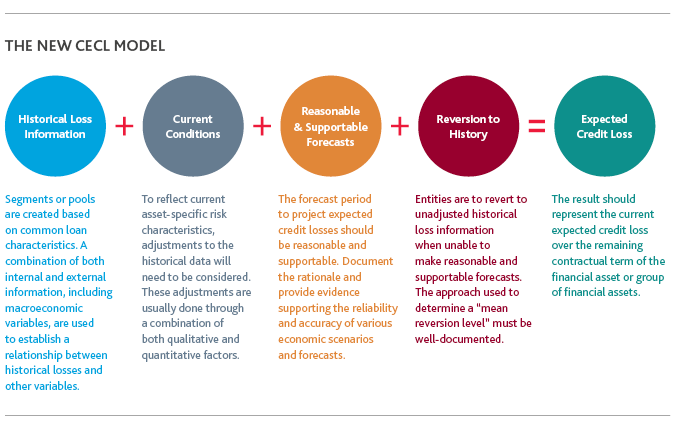

While the IASB standard recognizes expected credit losses when credit risk has increased significantly, CECL requires financial institutions to record expected lifetime credit losses at the time of origination. Institutions now must analyze past, present and future information to determine the appropriate reserve levels, considering changes in the underlying loan risk characteristics and economic conditions over the life of their loan portfolios.

The American Bankers Association has called CECL “the most sweeping change to bank accounting ever.” One of the most significant changes is that management will need to develop and document “reasonable and supportable” forecasts to estimate expected credit losses over the life of the loan. The availability and use of loan level data and macroeconomic data will be a key implementation challenge for many institutions.

Not only does CECL increase the complexity and cost of compliance and require more data, especially data that forecasts economic conditions or projects prepayment speeds, it may also require capital increases ahead of implementation. In the short term, it could put pressure on an institution’s profitability and increase the volatility of its Allowance for Loan and Lease Losses (ALLL).

The silver lining is that, in the end, CECL implementation will bring about greater discipline in the management, measurement and forecasting of credit risk, potentially driving improved profitability in the long run. While smaller organizations may simply strive to comply with CECL, larger institutions see this transition as an

opportunity, one much bigger than an accounting and financial reporting matter. They are building their CECL processes to provide greater insight into running a better business by way of enhancing credit policies and standards to continuously improve the credit quality of their portfolios over time. The new standard fundamentally changes how management will assess its credit losses in such a way that, if done correctly, will yield greater insight into an institution’s risk profile and can provide meaningful insight to further manage the underwriting of prospective loans.

Ultimately, CECL implementation requires a philosophical change in mindset: from a backward-looking to a forwardlooking approach in setting allowances for credit losses. It is not just a method of increasing provisions against the loan portfolio, it creates an opportunity to gain a better understanding of the loan portfolio.

THE OLD VERSUS THE NEW

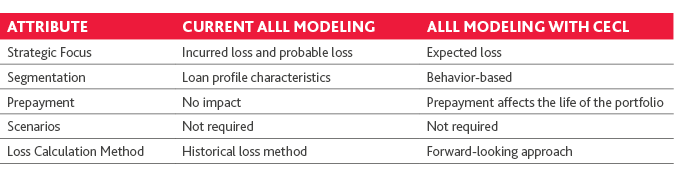

What worked for your institution under the ALLL model will not work for CECL. Whereas the incurred loss methodology recognizes credit losses when such losses are probable or have been incurred, CECL removes the concept of “probable” and requires recognition of credit losses when such losses are “expected.” FASB expects lifetime losses to be recorded on day one. In other words, an event does not have to have occurred but can be expected in the future.

For example, the impact of prepayments has been muted in historical ALLL calculations, but prepayments have a larger impact on loss calculations for financial assets with long contractual maturities—and therefore are more important in a CECL context.

IMPLEMENTATION TIMELINE

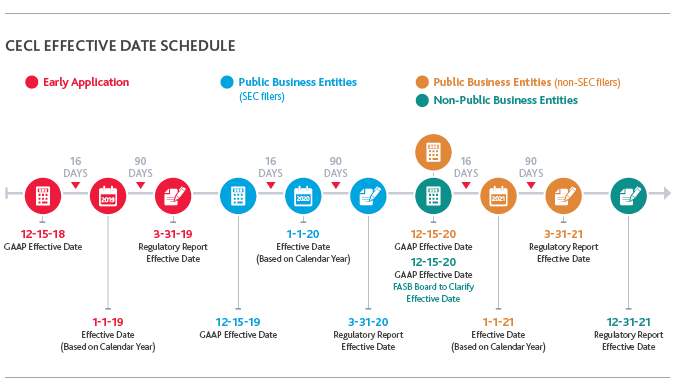

Public business entities (PBEs) that are SEC filers must adopt CECL in the fiscal years beginning after Dec. 15, 2019, including interim periods. Non-SEC PBEs must adopt CECL in the fiscal year beginning after Dec. 15, 2020, including interim periods.

All other financial institutions must adopt CECL in the fiscal year beginning after Dec. 15, 2020, and interim periods within fiscal years beginning after Dec. 15, 2021. Early adoption is allowed for all entities for fiscal years beginning after Dec. 15, 2018, including interim periods within those fiscal years.

Transitioning to CECL is extremely complex and time consuming, with extensive data requirements and enterprisewide interdependencies that require a holistic, cross-functional approach and potentially a data governance overhaul. Depending on the complexity of an institution’s loan portfolio, and the sophistication of its risk management infrastructure, IT environment and accounting processes, implementation can take

anywhere from three to six months—if not longer. And CECL isn’t a one-and-done project: maintaining a steady-state program requires ongoing monitoring and management.

If you feel overwhelmed by CECL, you’re not alone. Many financial institutions, especially smaller banks that are not subject to the Federal Reserve’s stress testing exercises, are unprepared to meet the CECL deadline. The largest banks and bank holding companies are likely in a better spot, as they are subject to the Federal

Reserve’s Comprehensive Capital Analysis and Review (CCAR), an intensive annual stress testing assessment that helps identify downside risks and the potential effect of adverse conditions on their capital adequacy. As part of CCAR testing, these banks use a model for their loan portfolios to estimate expected credit losses

during an economic downturn, which they can use as a starting point from which to build a new statistical model to comply with CECL. The main difference between CCAR and CECL is that the first predicts losses during a downturn and the latter does so over a prolonged economic outlook.

For small and large institutions alike, active project management and change control will be imperative to staying on budget and on time. Don’t underestimate the amount of time that review and approval of model outputs and the ultimate CECL reserve amounts will take. Make sure you involve external auditors and

examiners early and often to avoid surprises late in the game that may cause unexpected delays or do-overs.

DATA DUE DILIGENCE

The process to comply with the new standard is arguably as much about technology, data and information governance as it is about accounting. To put it into perspective, the estimated loss model may require 1,000 times more data than historical loss models. The availability, accessibility and integrity of that data—some of which will be generated internally, some of which may need to be purchased from third parties—is essential to a CECL-compliant estimate. Pay attention: auditors and examiners will closely review the appropriateness, accuracy and scope of all data and information used.

The CECL standard is designed to be flexible and does not prescribe the use of specific estimation methods, so the volume of data and the complexity of the analysis will vary. Data needs may, in part, be driven by your desired approach to CECL modeling, as noted in an Interagency Joint Statement on Dec. 19, 2016:

“To implement the new accounting standard, institutions should collect data to support estimates of expected credit losses in a way that aligns with the method or methods that will be used to estimate their allowances for credit losses. Depending on the method selected, institutions may need to capture additional data. Institutions also may need to retain data longer than they have in the past on loans that have been paid off or charged off.”

In an earlier Interagency Joint Statement from June 7, 2016, regulators clarified that they “do not expect smaller and less complex institutions will need to implement complex modeling techniques.” However, in a Feb. 2018 webinar geared towards “smaller, less complex community banks,” regulators made a point to say that while CECL calculations could potentially be spreadsheet-based, housing and maintaining loan data over time

could not.

Even with some level of scalability, data gathering and analysis for CECL will be a major undertaking—especially if your institution lacks a comprehensive information governance program. Implementing or updating a data retention and disposition strategy prior to CECL implementation is a great way to enhance the ability to quickly develop an early understanding of what information is available and begin to contain the likely scope and ultimate cost of the entire implementation process. Moreover, if the underlying data or data analysis has errors, the decisionmaking based on that data will be riddled with errors too.

Read Next

Return to CECL Implementation Guide

SHARE