What Technology Companies Can Expect In 2019: Webinar Q&A

By BDO’s Technology Practice Leaders

A fourth of 2019 is already underway and tech is off to an exciting start. The announcements of several long-awaited IPOs—including those of Lyft and Pinterest—show promising signs of a strong year ahead, along with a couple of better-than-expected Q1 earnings. While a few uncertainties remain, the industry has much to look forward to in 2019.

What can tech companies expect over the next few months and beyond? BDO explored this question in a recent webinar, “What Technology Companies Can Expect in 2019,” which highlighted top findings from BDO’s 2019 Technology Outlook Survey.

Below are some of the most popular questions asked by our webinar participants and BDO’s written responses.

Q: According to BDO’s 2019 Technology Outlook Survey, 37 percent of technology CFOs believe U.S. tech IPO activity in 2019 will increase this year, and 46 percent expect it will stay the same—in other words, quite high.

Following this notion, there have already been several tech IPO announcements this year. What advice does BDO have for tech companies planning an IPO in the future?

A: Going public can be a major benefit to a business, and it’s certainly an exciting step—oftentimes, marking a critical milestone in a tech company’s journey to long-term success. Nevertheless, getting there is often a time-consuming and daunting process. Like any big initiative, preparation is key to a successful IPO, along with developing a comprehensive and forward-looking strategy.

Tech companies can expect that their responsibilities, financial structures and management policies will change fundamentally before and after an IPO. Whereas they may have been accountable to only a handful of investors before an IPO, they will now be working with a much broader and more diverse body of stakeholders afterwards—from investors to business analysts to the general public. A company may have been successful in drumming up excitement for its business before the process, but continuing to maintain public interest and momentum after it is public requires continuous effort.

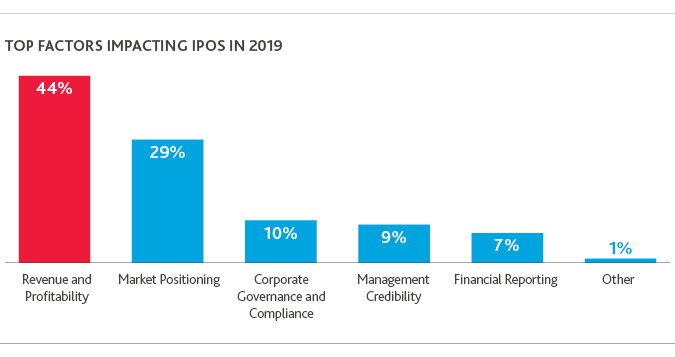

Because of the sheer complexity of the IPO process, there are too many action items to list in one answer. However, as a starting point, companies should focus on strengthening the areas considered by BDO’s 2019 Technology Outlook Survey participants to be some of the biggest factors impacting IPOs this year and beyond. These include a company’s revenue and profitability, market positioning, corporate governance and compliance, management credibility and financial reporting.

While external risks are unpredictable, IPO seekers should take heed of potential hurdles that can come up in the due diligence process, according to BDO’s 2019 IPO Outlook Survey. It’s common knowledge that companies will need strong governance and financial reporting functions to go public, but investment bankers also point to liquidity risks, employee misconduct and cybersecurity vulnerabilities as three top concerns if uncovered in the due diligence process. A lack of diversity and other poor governance practices are also concerns, particularly in the wake of high-profile issues at major public and IPO-seeking companies.

As scrutiny from investors, stakeholders and consumers intensifies, tech companies should consider the health and sustainability of their whole enterprise, not just their financials. They should implement strong internal controls, set up robust corporate governance and strengthen financial reporting infrastructure due to ongoing regulatory compliance and filing requirements. For more details, please refer to BDO’s Guide to Going Public.

More questions? Contact: BDO’s IPO Services practice

Q: This year looks to be a big year for tech, with 84 percent of tech CFOs expecting an increase in total revenue, according to BDO’s 2019 Technology Outlook Survey. What recommendations does BDO have for tech companies trying to scale up successfully in 2019 and beyond?

A: This is the million-dollar question, and one that tech companies will constantly have to ask themselves throughout their growth trajectory. While it’s difficult to get into the specifics without knowing the details of a business, there are a few best practices BDO recommends:

-

Aim for operational excellence. Scaling well is not just about driving growth, but also building capacity—expanding the systems, processes, resources and tools needed to ensure that an organization can actually support the high growth it’s experiencing. While it may be tempting to focus primarily on growth in numbers (especially when under pressure from investors), it’s important to expand both at the same time—or, at the very least, to schedule time to update or scale organizational systems in between growth spurts.

-

Understand all impending risks. While staying abreast of competitive or market risks is vital, tech companies need to be hyperaware of all the risks that may affect them now and in the future—including strategic, financial, operational, compliance, and reputational risks. Whether it’s a tax change at the state and local, national, or global level, or a new data privacy or antitrust law that requires compliance, businesses should actively prepare for everything coming down the pipe.

-

Make data-driven decisions. Every organization has heard of data analytics—but not all are actually taking advantage of its full potential. Sound data governance and analytics are key drivers toward efficiencies and optimization, and a good program and analysis can help a company identify gaps in its supply chain operations, uncover security weaknesses and gaps, establish a baseline for user behavior and industry trends, decrease costs and more. There are many decisions that can’t be made on data alone, but examining the facts is an important start.

-

Lead with vision. This may sound obvious, but having a well-communicated vision of a company’s goals remains vital, regardless of what stage it’s in. Tech leaders will need to balance maintaining strong principles with a willingness to change course if necessary.

There are many more factors critical to scaling up, but balancing growth and operational excellence is necessary at every stage. Lean too heavily in one direction, and it’s easy for a company to find itself in a hot spot when “riding the wave” alone is no longer feasible.

More questions? Contact: BDO’s Technology and Technology & Business Transformation Services practices

Q: Artificial intelligence (AI) is predicted to cause the greatest disruption to the tech industry in 2019, with 35 percent of CFOs ranking it first, according to BDO’s 2019 Technology Outlook Survey. Why is that?

A: To answer this question, it’s worth briefly examining the history of AI, which—while widely talked about today—is not exactly new. Some would say that the concept really first came into public awareness when Alan Turing, the British mathematician famous for breaking World War II codes, created the Turing test in 1950. The term, “artificial intelligence,” then continued to grow in popularity in the mid-1950s and beyond.

However, AI’s meteoric rise over the past few years can really be attributed to the development of several other technologies that made its development and proliferation more feasible. The explosion of Big Data, for example, formed a treasure trove of information that can be used to train AI algorithms and fuel continuous machine learning, which was previously not possible. Open source technologies, as well as increased access to the cloud, also enabled AI software to be developed and deployed more quickly, efficiently and effectively.

The introduction of various AI applications to the masses—such as Apple’s development of Siri—further heightened public awareness. Large investments in AI software by the world’s biggest tech giants—from IBM’s Watson to Google’s DeepMind—added credibility and legitimacy to the growing concept. As confidence in AI grew, so did its advancement and proliferation.

Today, there’s no doubt that AI is being used—or has the potential to be used—by virtually every individual, business and industry. Whether it’s a retailer delivering customized recommendations to a potential customer or a manufacturer auditing for payment fraud, AI applications will continue to revolutionize business now and in the future.

More questions? Contact: BDO’s Technology & Business Transformation Services practice

Q: Outside of AI and cloud computing, are there any other areas BDO is particularly excited about—and see great potential in—this year?

A: One technology BDO is highly anticipating this year (or early next) is the emergence of 5G, or fifth generation, mobile networks. 5G will greatly impact not only telecom companies, but virtually every business that uses or depends on a wireless connection.

For those who are not as familiar with 5G, it is expected to have much higher speeds and capacity than 4G, and much lower latency. Because 5G can send and receive signals almost instantaneously, it is expected to offer mobile internet speeds approximately a hundred times faster than 4G. So, a 5G user could theoretically download a feature-length movie in High Definition in less than five seconds.

Many carriers are already realizing the huge business opportunities that 5G brings. However, tech companies that create or use Internet of Things (IoT) devices—such as smartwatches, other wearable items, or sensors that can be connected to 5G networks—will also be significantly impacted. 5G will help spread the use of several cutting-edge technologies among both businesses and consumers.

More questions? Contact: BDO’s Technology practice

Q: Eighty-seven percent of BDO’s 2019 Technology Outlook Survey participants express a high or moderate concern about data privacy. How can tech companies shore up their data privacy and mitigate the risk of a data breach?

A: When dealing with data privacy, the most important thing to remember is that data privacy governance is an ongoing process and commitment to safeguarding personally identifiable information (PII) and other sensitive data that an organization collects, processes, transfers or stores—not a “one-and-done” deal.

From a high level, this means first making sure your organization has a holistic data privacy program in place. This may mean implementing a Privacy Operational Life Cycle that can help your organization keep employees apprised of new privacy requirements, and embraces recordkeeping and sound data protection practices.

To develop a sound Privacy Operational Life Cycle, we recommend the following steps:

-

Develop a privacy vision and mission for your company and document the program’s objectives.

-

Identify legal and regulatory compliance challenges that are relevant to your organization.

-

Locate and document where personal information resides throughout your organization or across third parties (e.g., hosting vendors, outsourced applications, etc.).

-

Develop a privacy strategy that identifies stakeholders, leverages key functions throughout the organization, creates a process for interfacing within the organization and outlines a data governance strategy.

-

Conduct a privacy awareness workshop to highlight the program’s goals to the entire organization.

-

Develop a structure for your privacy team with a governance model that is clear and consistent for the size of your organization.

These steps are a starting point, but there is more to do after developing an initial structure and communicating the purpose of the program. You can read more about these recommendations here, or refer to BDO’s GDPR Guide for U.S. Companies to learn more about current and upcoming data privacy regulations.

More questions? Contact: BDO’s Cybersecurity practice

Q: While three-fourths (75 percent) of technology CFOs anticipate tax reform will favorably impact their business this year, a fifth still expect it to have a “somewhat unfavorable” impact, according to BDO’s 2019 Technology Outlook Survey. What are some of the most common tax reform issues BDO sees with its clients?

A: We had mentioned a couple of them in the webinar, but the tax on Global Intangible Low-Taxed Income (GILTI) is one of the most common and problematic tax changes for companies to deal with, and even more so because the implications extend beyond the traditional corporate realm. A lot of PE-sponsored tech companies are organizing as partnerships, and individual partners are even more severely impacted by GILTI because they could end up paying the full 37 percent tax rate. This seems rather unfair, given that GILTI was introduced hand-in-hand with the territorial tax regime, which individuals can’t even benefit from.

Furthermore, GILTI is definitely a consideration in long-term planning. While it definitely discourages the migration of intellectual property to low tax jurisdictions like the Cayman Islands, business considerations often dictate that the activities cannot simply be brought back to the U.S. GILTI may have just as profound an impact in rationalizing the movement of those activities and the ownership of IP from low tax jurisdictions to simply moderate tax foreign jurisdictions.

While bonus depreciation is not a new concept, the liberalized rules make it important for tech companies and others. Now that used property can qualify for bonus depreciation, it is an important consideration in M&A, and will push buyers to favor asset deals even more than in the past.

More questions? Contact: BDO’s Tax practice

Q: Overall, tech CFOs seem to be fairly optimistic about the industry’s outlook for 2019. However, there have been a few initial discussions of a potential recession later this year. Do you believe there will be one, and if so, how might that affect tech companies?

A: While we can’t say for certain whether a recession will hit (although a number of uncertainties—such as the potential impact of a trade war with China, despite some recent restraint shown by both governments—remain), we can comment more generally about how one could affect tech companies.

The first thing that’s usually affected during a downturn is public stocks. Even if a tech company has a strong record of past earnings, its future earnings aren’t guaranteed—which, depending on investor sentiment at the time, could lead to a decrease in demand and share price. As a consequence, public tech company valuations may decrease, followed by private valuations.

Another factor that will likely be affected is the ability to raise capital. Even though investors may favor high-risk, high-reward investments now, they may find themselves treading more conservatively during a downturn and less willing to take a chance on a company that doesn’t have a long track record of success. This naturally will affect the latter’s ability to raise capital. Even if a company is able to tap into VC or PE funds, these firms may have higher requirements than normal (or demand more equity) as additional hedges against risk. They will likely ask more questions and be slower to commit.

Another (more) obvious effect in a recession is a slowdown in consumer spending, which may lead to a potential decrease in sales or revenue for tech companies. High growth companies may find demand for their products or services dwindling and may need to explore other channels for revenue and growth.

The combination of these factors—along with additional regulations down the line—can spell trouble for tech companies that don’t take steps to prepare. The good news is that organizations can prepare as best as they can by streamlining operations and having alternative growth plans in case their current revenue sources are disrupted—a practice they should do anyway, regardless of whether a recession hits.

More questions? Contact: BDO’s Technology practice

Missed the webinar? Listen to the recording here.

SHARE