2018 BDO Technology Outlook Survey

Update: We've recently released our 2019 Technology Outlook Survey. Learn more about the opportunities and challenges facing tech companies in 2019. Click here to view the full report.

The 2018 BDO Technology Outlook Survey is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly to chief financial officers (CFOs). Market Measurement used a telephone survey performed within a scientifically-developed, pure random sample of U.S. technology companies in the software, hardware, telecommunications, internet, and information technology services subsectors.

Last year witnessed a patchwork of social, political, and economic developments that rocked the industry.

The inauguration of a new U.S. president and administration opened up a new chapter for the sector, ushering in trade, immigration, and tax reform. Quantum leaps in technological progress led to new business opportunities, behaviors, and ways of thinking. Meanwhile, increased public scrutiny over the industry’s actions inspired leaders to reach new levels of accountability and transparency.

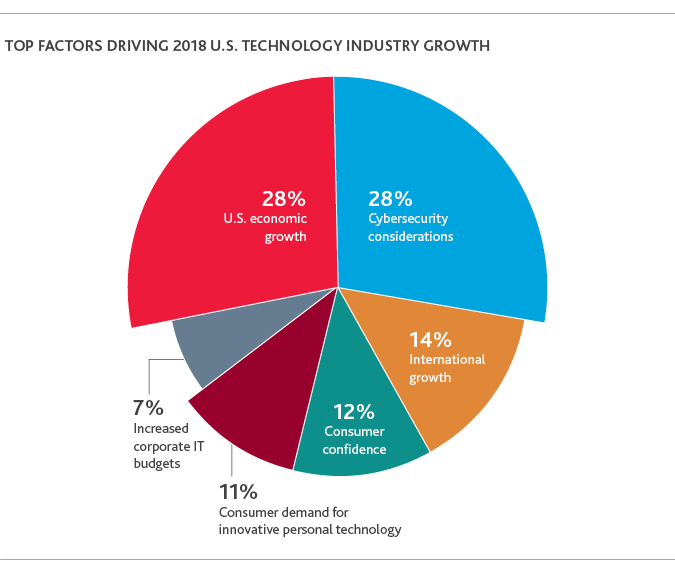

Despite many setbacks, tech persevered. If anything, a strong U.S. economy—cited by 28 percent of tech CFOs as the most important factor in determining sector growth—has led many executives to harbor an optimistic outlook for 2018, according to the 2018 BDO Technology Outlook Survey. .png)

In fact, more than a third (34 percent) of tech CFOs believe the U.S. will experience the most technology sector growth this year globally, followed by China (26 percent), India (24 percent), and Latin America (10 percent).

Meanwhile, U.S. real GDP is projected to grow 2.7 percent this year, according to the International Monetary Fund—much of which will be driven by tech. Political uncertainty and market volatility are still to be expected, but many tech executives feel prepared to face the challenges ahead.

“U.S. technology companies can expect an even greater barrage of competing demands this year, as the full impact of last year’s policy changes—from changing trade agreements to shifts in immigration policy to sweeping tax reform—come to light. Nevertheless, the industry’s resilience is not to be underestimated, nor the community’s ability to transform setbacks into opportunities. As our survey indicates, we expect 2018 to be a metamorphic year for tech, as leaders strive to balance their desire for economic success with the political and economic factors at play.”

Aftab Jamil

Aftab Jamil

Assurance Partner and Global Leader of BDO’s Technology practice

All Eyes on Revenue Growth

A strong U.S. economy fueled by robust consumer spending, business investment, and exports, has led tech CFOs to tout an optimistic outlook for company growth this year.

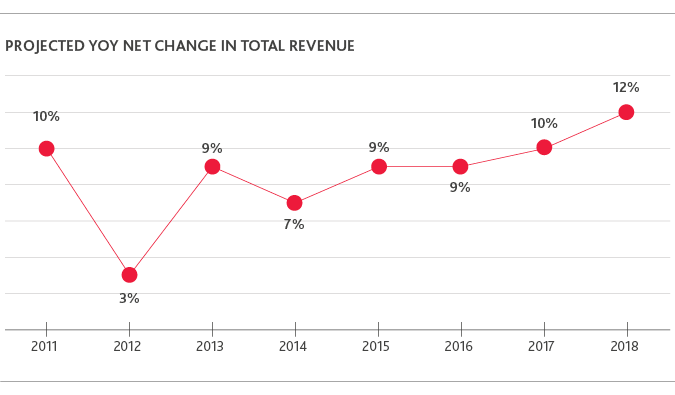

Eighty-four percent expect higher total revenues in 2018, with the anticipated net change in revenue—an increase of 12.2 percent—the highest ever recorded in this study.

These views are not surprising when considering the industry’s overall revenue hikes and growth in recent years, as well as its projections for this year. The 10 largest U.S. tech firms by revenue are expected to post aggregate sales of more than $1 trillion in 2018, according to CNBC—with Apple, Amazon, Alphabet, Microsoft, and IBM leading the pack.

.png)

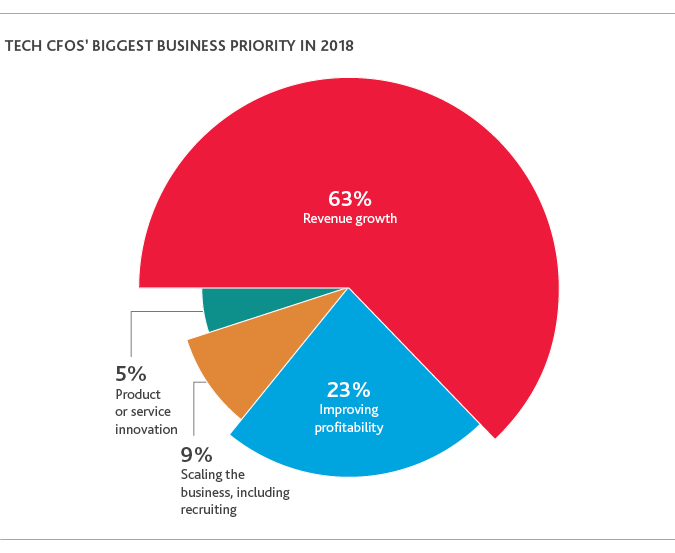

This is good news, considering that 63 percent of tech executives cite revenue growth as their biggest business priority in 2018. Public companies are especially focused on growing revenue: Three-fourths (75 percent) of public tech company CFOs name it as their number one priority, compared to 56 percent of private tech company CFOs. Part of this difference may be due to the abundance of investment dollars available to private companies today, with the ample funding helping ease some of the pressure to turn a profit.

Ready, Set, IPO: Tech IPOs Rebound in 2018

Could 2018 be a bumper year for U.S. tech IPOs?

Barring a few disappointments, last year saw a notable amount of U.S. tech IPO activity, with 37 tech IPOs raising a total of $9.9 billion in the U.S., according to VentureBeat. This marked a significant increase from the 21 U.S. tech IPOs that raised $2.9 billion in 2016.

Many tech CFOs expect this upward trend to continue and feel bullish about IPO stock performance. Sixty percent of those surveyed predict that stock performance for IPOs in 2018 will either improve somewhat (55 percent) or significantly (5 percent) compared to 2017. Thirty percent expect it to stay the same, and only 11 percent expect it to decline.

This optimism can be prescribed to several factors, including healthy public market valuations, a robust stock market, the benefits introduced by tax reform, and a hefty pipeline of tech unicorns—including Uber, Lyft, Dropbox, Pinterest, and Palantir Technologies, among several others—with long awaited IPOs.

Nevertheless, it’s worthwhile noting that while most private and public company tech CFOs shared similar optimism, private company tech CFOs were twice (14 percent) as likely as those at public companies (7 percent) to believe that IPO stock performance will decline.

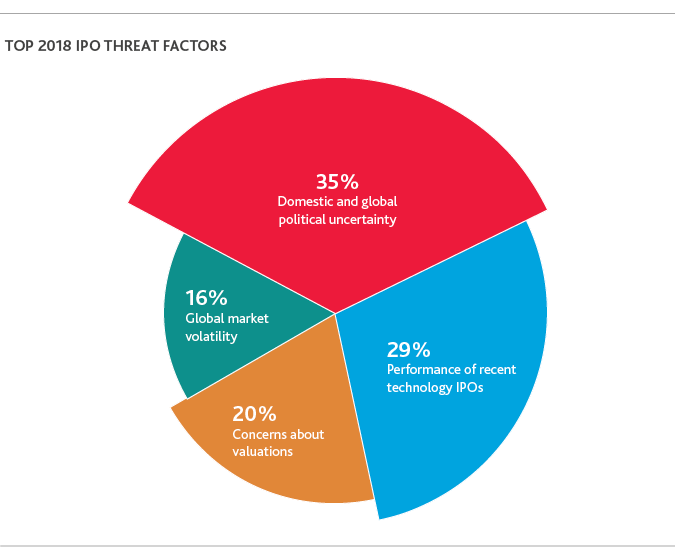

This might reveal a nuanced understanding of the high unpredictability of the IPO market, in which even strong tech companies may still find their stock performance thwarted by outside pressures beyond their control. These IPO threat factors include domestic and global political uncertainty, cited by 35 percent of tech CFOs, the performance of recent tech IPOs (29 percent), concerns about valuations (20 percent), and global market volatility (16 percent).

.png)

Many tech companies are also choosing to stay private longer, thanks to ample funding from deep-pocketed investors. In fact, the median time between the first funding round and an IPO for U.S. venture capital-backed tech companies has increased from 6.9 years in 2013 to 8.9 years in 2017, according to CBInsights. And while still rare, other companies may decide to pursue an alternate route, such as a direct listing, instead.

“This year and next are going to be blockbuster years for U.S. tech IPOs. While it might be unrealistic to hope for an IPO market as robust as the ones seen in 2014 or 2000, the overflowing pipeline of tech unicorns, combined with favorable market conditions, will be key ingredients in cultivating a plentiful harvest of public offerings.”

Christopher Tower

Christopher Tower

National Managing Partner for BDO’s Audit Quality and Professional practice

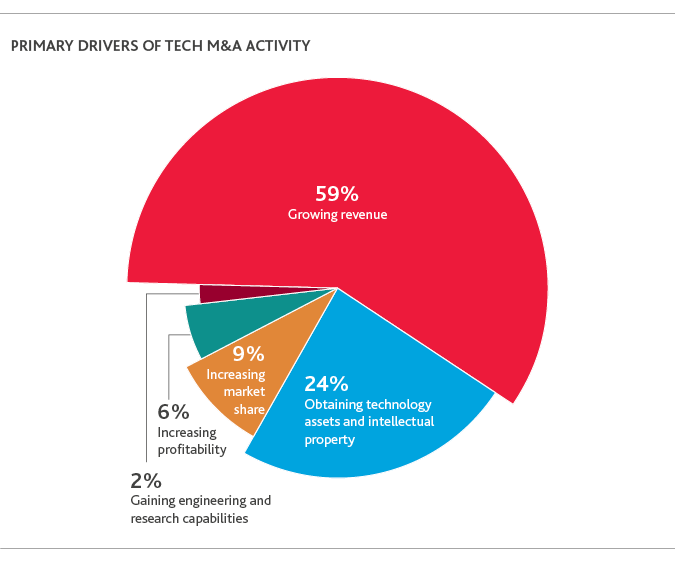

A Seller’s Market? Tech M&A to Surge in 2018

Last year’s U.S. tech merger and acquisition (M&A) activity may have been strong, but tech CFOs expect this year’s to be even stronger: 72 percent expect deal volume to increase in 2018, and one-fourth (25 percent) expect it to increase significantly.

Nearly all expect valuations to either increase (59 percent) or stay the same (40 percent).

Meanwhile, almost half of tech CFOs (48 percent) expect to engage in M&A activity this year—up significantly from 31 percent in 2017.

Mission Impossible: Tax Reform Becomes a Reality

U.S. tax reform is finally here.

The final bill, formerly known as the Tax Cuts and Jobs Act, was signed into law on December 22, marking the largest change to U.S. tax policy in decades.

The new law has significant implications for tech, and understanding its full impact on their business will be tech CFOs’ biggest tax reform-related challenge in 2018, according to 65 percent of participants surveyed after reform passed. Accounting for the changes in financial statements and mitigating unfavorable tax treatment are additional concerns.

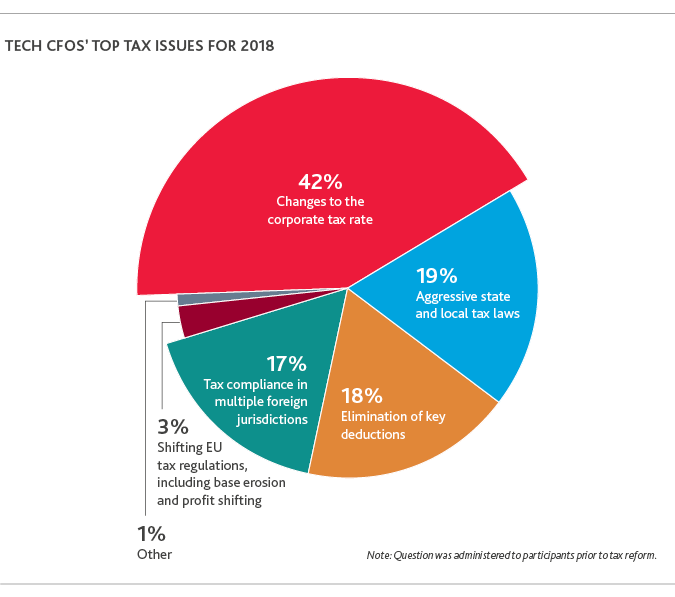

.png)

Meanwhile, the provision weighing most heavily on tech executives’ minds is the corporate tax rate reduction from 35 to 21 percent. While the tech industry’s average effective corporate tax rate was already well below 35 percent—largely due to lower foreign tax rates applicable to foreign activities of overseas subsidiaries and the indefinite reinvestment of those earnings abroad—many companies still stand to benefit from the reduction.

Nearly all tech CFOs surveyed after tax reform passed believe the change will have a significant effect on their business: 43 percent say that it will “very likely” have a significant impact, 21 percent believe it is “somewhat likely,” and 30 percent “only slightly likely.” Only 6 percent responded, “not at all likely.”

Nevertheless, this emphasis on corporate tax rates was already prevalent among tech executives prior to reform, with 42 percent citing changes to the corporate tax rate as their top tax concern for 2018. This puts it well ahead of other tax issues, indicating that federal tax issues still eclipse those abroad.

Tech companies must also not forget to account for how changes to the international tax provisions may affect their business. Over one-fifth (22 percent) of tech CFOs surveyed after tax reform passed cite navigating the law’s international tax provisions as their top tax reform-related challenge. These include the mandatory repatriation of foreign earnings, preferential tax rate on intangible income derived from foreign customers, and several others.

“Tax reform—particularly, the corporate tax rate reduction—may be seen as a boon to the U.S. tech industry, but not all tech companies will emerge as clear winners. At this point, many are still working to understand the total effect of reform on their domestic and international tax structures. If reform’s effects develop as planned, changes to the various international tax provisions may tilt tech companies in favor of domestic operations. The first round of tech company earnings this spring will help shed light on how tax reform is impacting the sector.”

David Yasukochi

David Yasukochi

Tax Office Managing Partner and Co-Leader of BDO’s Technology practice

Get Ready for RevRec

In May 2014, the Financial Accounting Standards Board (FASB) issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), otherwise referred to as the new revenue recognition standard.

ASU 2014-09 establishes comprehensive accounting guidance for revenue recognition and will replace substantially all existing U.S. GAAP on this topic.

While the standard went into effect on Jan. 1, 2018 for public entities, private entities are required to apply the new revenue standard to annual reporting periods beginning after Dec. 15, 2018. A significant portion of private tech companies surveyed have yet to implement the new standard and must formulate an action plan to do so if they wish to meet this deadline.

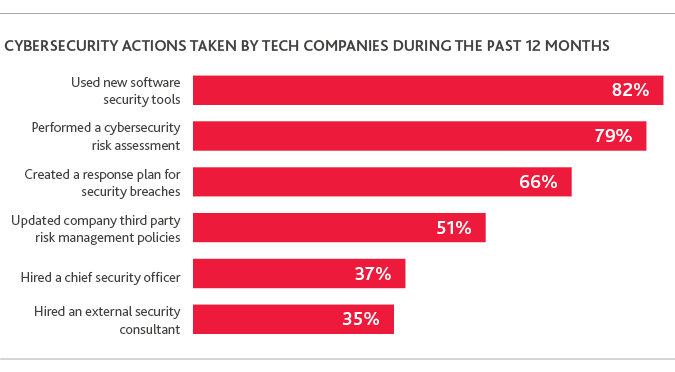

Cybersecurity and Data Privacy Concerns Accelerate

Cybersecurity and data privacy concerns reign this year, with 20 percent of tech CFOs citing compliance with data privacy and protection policies as their top policy concern.

.png)

Meanwhile, 28 percent point to cybersecurity concerns as the most important factor driving U.S. tech growth in 2018—a significant increase from 18 percent in 2017—placing it only second to U.S. economic growth.

As a result, many tech companies focused on fortifying their organizations’ cybersecurity programs last year. More than one-in-three tech companies (37 percent) hired a chief security officer in 2017. With these cyber enhancements, many tech CFOs report having a relatively high level of confidence in their company’s ability to detect a data breach: 61 percent cite being “very confident” in their organization’s abilities, 32 percent “somewhat confident,” and 5 percent “only slightly confident.” Only 3 percent report not being at all confident.

When it comes to data privacy regulations, many are preparing for the European Union’s General Data Protection Regulation (GDPR), which goes into effect on May 25, 2018. The GDPR will require stricter data privacy controls from all U.S. organizations that either sell or provide goods or services to EU individuals, or monitor the behavior of individuals in the EU. Organizations that fail to comply with the GDPR can face penalties up to €20 million, or 4 percent of their annual global revenue.

Cloud Remains Crucial, While AI Not Yet a Standard

This year, it’s back to the basics when it comes to emerging technologies, with 70 percent of tech CFOs planning to invest in cloud computing in 2018.

Although cloud computing may engender less fanfare in comparison to other emerging technologies, today’s tech companies cannot operate without a solid cloud infrastructure. As tech companies work to accumulate ever-increasing amounts of data, the cloud is key to sharing and storing important customer and internal information.

Another 64 percent of companies plan to deploy capital to enhance their data analytics capabilities this year. Managing information properly and efficiently continues to determine the success of today’s tech companies.

Emerging tech, however, is a different story. The clear majority of tech executives surveyed (85 percent) do not plan to invest in artificial intelligence (AI), and 58 percent have no plans to invest in IoT technology this year. We expect investment will shift dramatically in the next few years once tech companies fully understand how to maximize emerging technologies’ potential to enhance their companies’ specific products and services.

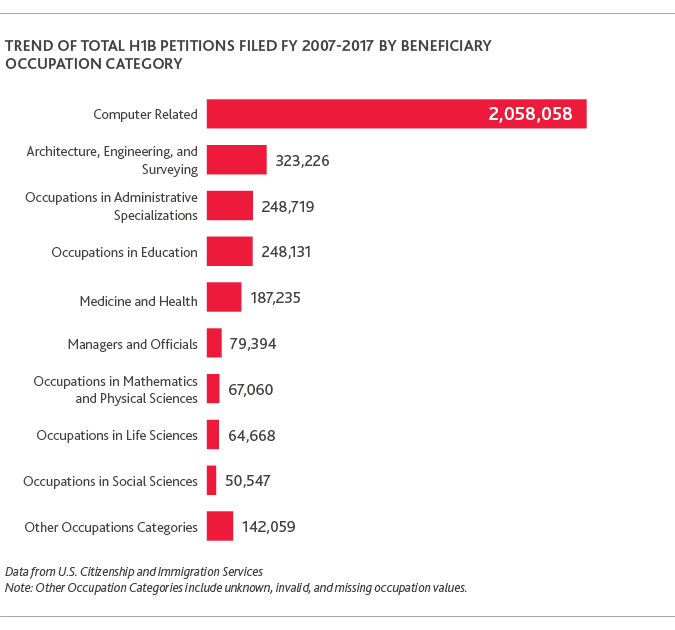

Tech Speaks Out Over U.S. Trade and Immigration Reform

Tech leaders are increasingly stepping into political debates.

Last year saw a significant number of tech executives commenting on the Trump administration’s various policies, including changes to the H1-B visa program, the Deferred Action for Childhood Arrivals (DACA) program, and net neutrality, among others.

.png)

The debate regarding the H1-B visa program began in April 2017, when the president issued a “Buy American and Hire American” executive order that encouraged increased federal scrutiny of H1-B visa applications. This increased scrutiny was extended to also include H-1B visa renewal requests, per a directive in October. These actions have dealt a significant blow to the tech community, which relies heavily on H-1B visa holders for tech talent.

Meanwhile, the ending of DACA, an Obama-era program that protects roughly 700,000 undocumented immigrants that came to the U.S. when they were children, will also heavily impact the industry and the many “Dreamers” currently working in tech. Since President Trump’s announcement last September, more than 100 companies, including Dropbox, Facebook, Google, IBM, and SpaceX, filed an amicus brief to reinstate the DACA program, with a warning that the U.S.’ “national GDP will lose $460.3 billion” over the next decade, if DACA is revoked.

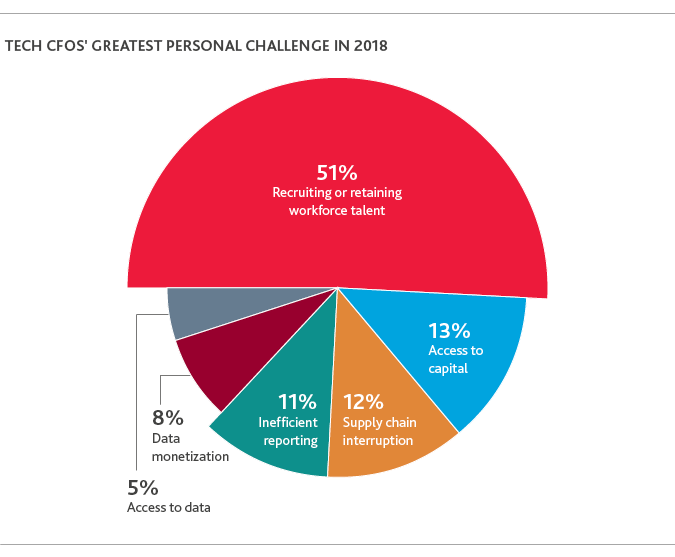

These concerns are among the many factors that led more than half (51 percent) of tech CFOs to cite recruiting or retaining workforce talent as their greatest personal challenge in 2018. While only 7 percent cite immigration as their top concern, the number of those who stand behind these issues reveals the significant impact changes in immigration policy would have on tech’s ability to attract and retain foreign talent.

America Still First? Tech’s Outsourcing Plans Hold Steady, Despite Political Rhetoric

“America First” rhetoric dominated much of the conversation last year, as the Trump administration issued a steady stream of executive orders aimed at bringing back overseas jobs to Americans.

Much of this was supplemented by direct criticisms from the President discouraging companies from outsourcing their future operations.

But whether U.S. tech companies plan to fall in line is another story.

Out of the 35 percent of tech companies surveyed that currently offshore or outsource their services or manufacturing abroad, just 17 percent plan to bring the work back to the U.S. in the near future, compared to 14 percent last year. Meanwhile, 13 percent of the remaining 65 percent of companies that do not currently outsource their activities state that they are likely to offshore their services outside the U.S. soon—more than three times the percentage last year (4 percent) and in 2016 (2 percent).

This sentiment may continue to evolve, as tech companies assess how changes to the international tax provisions under tax reform may impact their business and domestic and/or international operations. Nevertheless, these plans suggest that economic opportunity still trumps political rhetoric when it comes to making critical long-term decisions.

Conclusion

The outlook for the U.S. technology industry in 2018 is looking bright. A strong economy, robust pipeline of unicorns, and ample funding provide an atmosphere ready for takeoff. As the Trump administration enters its second year, and the industry absorbs the full impact of trade, immigration, and tax reform, tech companies would do well to keep their eyes and ears open for potential shakeups that could ultimately affect their bottom line.

SHARE