U.S. Private Capital Outlook 2020

Bracing for a Bear Market: Private Capital Readies for Economic Impact

Ten years into a bull market, economists and analysts have been biting their nails in anticipation of the economic indicator that will flash with finality “Recession.” Between slowing global GDP, decreasing global corporate capex, deflating U.S. manufacturing reports, Fed rate cuts and inverted yield curves, there has been no shortage of developments to mine for economic forecasts. Predictions about when a bear market might begin have been replaced by mobilizing for the eventuality of one. What goes up, must come down.

Indeed, 72% of private equity funds expect an economic downturn within two years, according to BDO’s inaugural U.S. Private Capital Outlook, which updates and expands the longstanding Private Equity PErspective Survey. The venture capital industry—surveyed alongside PE for the first time—is slightly more optimistic on timing, with just over half (56%) anticipating a downturn to hit within the next two years. However, that a bear market is coming is a foregone conclusion: 92% of PE and 87% of VC respondents expect a downturn to occur within four years—less than the length of most investment holding periods.

Most recessions are triggered by unforeseen shocks to the financial system—but there are other indicators of fragility. Here’s what to watch:

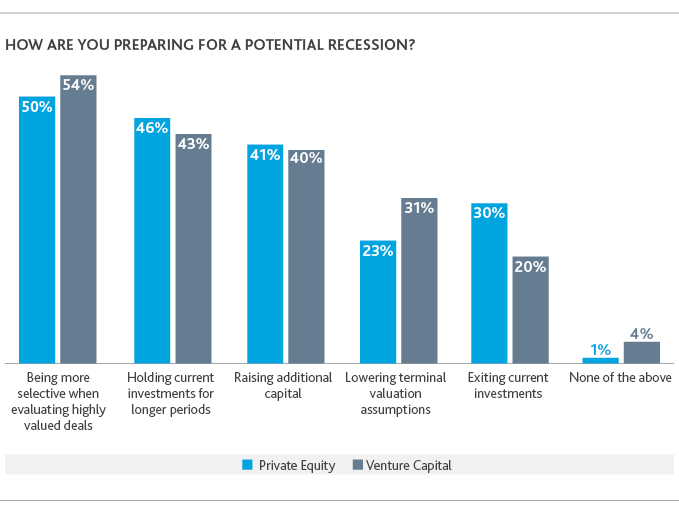

Recession doesn’t strike the same note of fear in the world of private equity and venture capital, where assets are, at least in theory, less vulnerable to the whims of the market and investment cycles may outlast a market downturn. It pays to invest during a downcycle: Assets can be bought “on sale” and, if managed well, anticipated to return to pre-recession levels as the market recovers. It’s the pre-downturn period that is most difficult, inciting a shift in strategy: more defensive investments, more conservative bids and tweaks to financial modeling to factor in downside scenarios.

In a sign that fund managers may be rushing to close their vehicles before a market correction hits, fundraising activity is also picking up. According to a November PitchBook report, U.S. PE funds in 2019 have raised the largest amount of capital on record. VC fundraising activity also remains strong, though the number of U.S. VC funds raising capital will likely come in well below 2018’s total fund count.

The challenge in today’s environment isn’t raising capital; it’s putting that capital to work. With the specter of recession looming and competition intensifying, investing in the right assets without overpaying is a delicate balance. Despite trillions of dollars in dry powder, capital deployment is slowing as funds fight it out for a limited pool of quality deals.

“Expecting economic contraction has sent PE and VC to the markets in droves as they look for liquidity to augment their stockpiles during a down economy. With funds chasing the same types of recession-proof investments, competition has been unbridled, sending valuations to historic levels. Though we expect this trend to continue, we are seeing private capital funds deploying more creative ways to put their capital to use.”

SCOTT HENDON

National Leader of Private Equity and Co-Leader of Global Private Equity

Evolving U.S. Deal-Making Environment

The Changing Competitive Landscape

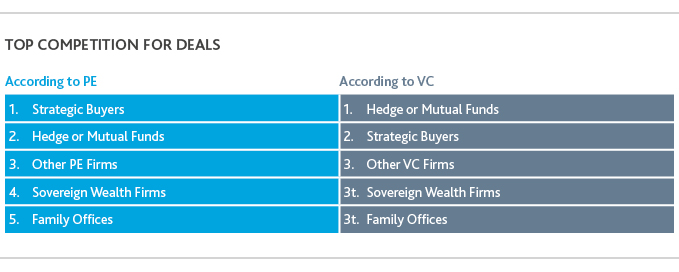

Private equity as an asset class has matured, and with the continued outperformance of the private markets over the public markets, it has become a staple of institutional investors’ portfolios. In response to investor appetite, newly formed firms have joined existing shops. Traditional hedge fund firms have also expanded into private company investments through hybrid structures, and a growing handful of mutual funds are buying into private companies as well. More funds in the game means more competition.

While limited partners (LPs) have been increasing their private markets allocation and are generally content with fund performance, they’re not so content with paying high management fees. Over the last several years, LPs have turned to co-investments and direct investments to increase their private market exposure, thereby reducing or eliminating those fees. Family offices, in particular, have ramped up direct investments, sometimes competing for deals with PE and VC shops to whom they previously—or even currently—have committed capital. In response to growing demand, 43% of PE funds report offering co-investments to their LPs, this year’s survey found.

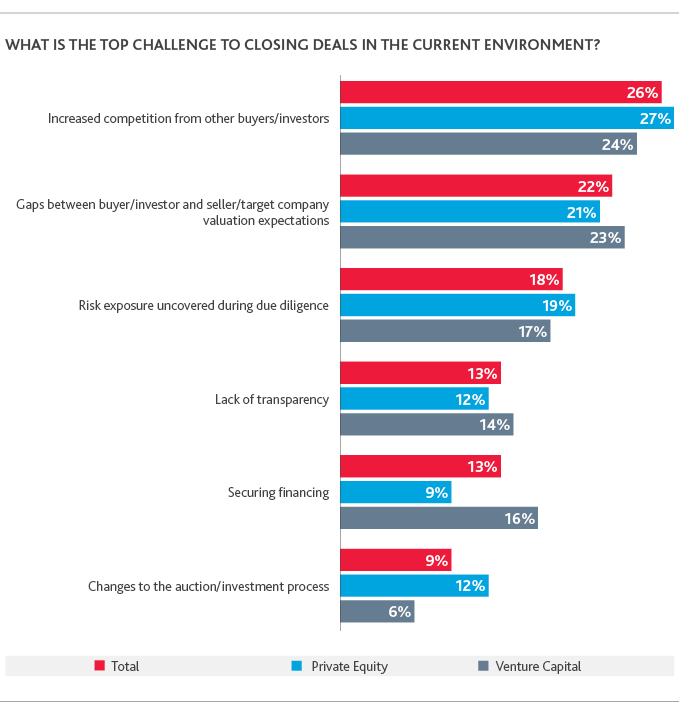

Both PE and VC respondents cite increased competition as the top challenge to closing deals and investments in the current environment. Close behind is gaps between buyer and seller expectations, as high deal multiples become more concerning given the aging upcycle.

With limited quality targets and aggressive competition, asset prices continue to be high—sometimes when a high valuation is not warranted. Yet just as fund managers cannot afford to overpay, they also can’t afford to continue to sit on mountains of dry powder. This underscores a trend toward more deliberation and selectivity in highly valued deals juxtaposed with greater creativity in capital deployment.

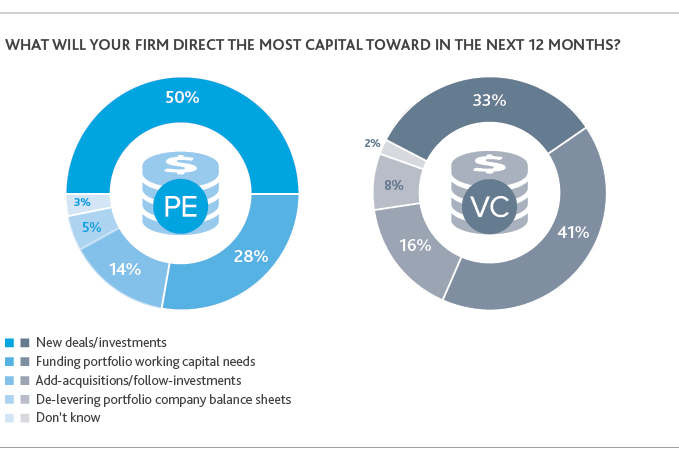

The data supports this: Over the next 12 months, just 50% of PE respondents said they would direct the most capital to new deals, compared to almost 90% a year ago. Meanwhile, a greater percentage of VC respondents anticipate directing the most capital toward portfolio working capital needs than those expecting to direct the most capital to new deals.

“Private capital is being more realistic about company performance during hold periods. When evaluating targets, PE funds have been considering the downside of their revenue profiles for the three- to six-year holding period, and these downsides are being factored into the purchase price. Three years ago, that would have been less likely.”

JIM LOUGHLIN

Managing Director, Restructuring & Turnaround Services

Spotlight on the Corporate Carveout

In recessionary environments, corporate “carve-outs” can offer significant upside opportunity to a savvy financial buyer. Sales multiples are typically lower and bargains and relative bargains can be found. The benefits include:

- The opportunity to buy an existing business with a portfolio of typically proven products and an established customer base.

- The ability to reshape the business and create a culture of growth and profitability improvement, as these operations are often neglected by senior management or starved for capital investment.

- The ability to upgrade processes and systems to create effective and efficient operations, and an organization that is nimble and can quickly react to market conditions.

However, effectively transitioning the corporate carveout to a “stand-alone” operation is not without challenges. Common hurdles include:

- Carve-outs typically need to create the infrastructure required to operate as a “stand-alone” entity, resulting in additional annual operating costs and significant initial investment.

- Reliance on the corporate parent often requires interim support from the seller, including a detailed Transition Services Agreement.

- Key management may not exist, or they may be disengaged, deficient or unwilling to stay, necessitating substantial recruiting efforts and possibly interim management resources.

- Often neglected, the carved-out operation may need an injection of capital, redirection or a turnaround.

- The ability to immediately finance the stand-alone operations post-acquisition almost always means replacing the credit, banking and cash management functions centralized with the parent corporation.

For a carve-out to succeed, it must be properly scoped, with an implementation plan put together upfront including all aspects of “standing up” the new entity.

“We are seeing a strong amount of volume in the value-oriented end of the market, but these valuations do require some amount of tradeoff. There are certain criteria that we aren’t willing to sacrifice to find a value price, such as a company’s competitive positioning or its value proposition. However, we are willing to look past other issues, such as a lack of sophisticated management teams, under-investment, lack of systems and process, or other areas of underperformance, given Hidden Harbor’s integrated operations team, which is somewhat unique to the lower middle market. As a firm, we focus on these areas of operational improvements during our ownership, with the goal of improving our companies such that those initial areas of capability gaps no longer impinge on valuation. As such, we are seeing our most interesting opportunities in transactions that involve corporate carve-outs or buying companies from founders/entrepreneurs/family owned businesses.”

ANDREW JOY

Principal, Hidden Harbor Capital Partners

Investors Retreat to Defensive Strongholds

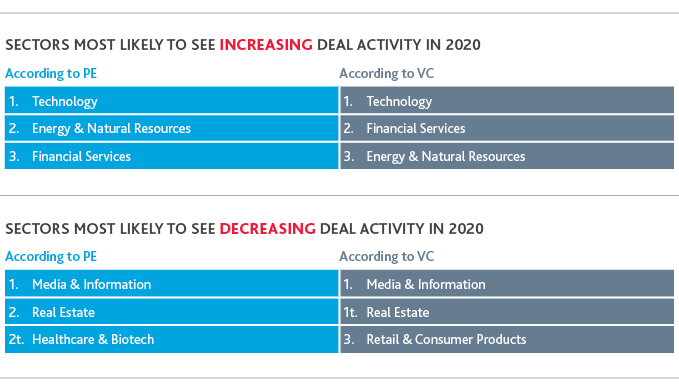

With recession-proofing underpinning their strategies, both PE and VC are on the lookout for defensive investments and are relatively aligned on their deal outlook. Technology reigns as hottest sector, with 54% of PE and 51% of VC identifying it as most likely to experience increasing deal activity. Respondents also anticipate an uptick in the financial services sector—potentially reflective of the industry’s reputation as a countercyclical asset class.

The energy sector, meanwhile, is really a tale of two different industries: oil & gas and renewables. The latter has several secular trends behind it: climate change, responsible investing and increasing power capacity, to name a few. For oil and gas, the paradoxical environment of production growth amid a challenging market may have depressed activity in recent years, but the sector is now ripe for consolidation.

"While tax policies have boosted the economy and consumer confidence, industry-specific challenges have become the new normal. The agricultural, energy, oil and gas and retail industries, to name a few, are seeing headwinds. A strong balance sheet is the best protection against adverse economic conditions. It's critical to have a good organic growth strategy, because if you can grow your business prior to that storm coming in, you further protect it by starting at a higher base."

TROY TEMPLETON

Managing Partner, Trivest

Spotlight on Tech

While VC has historically been synonymous with tech financing, private equity is a more recent convert, attracted by the recurring revenue from the software-as-a-service model now embraced by a wide swath of the tech industry. According to PitchBook data, more than a third of U.S. PE deals so far this year have been tech-related. Private equity firms are also edging closer to venture capital-backed territory by recapitalizing startups that are growing long in the tooth.

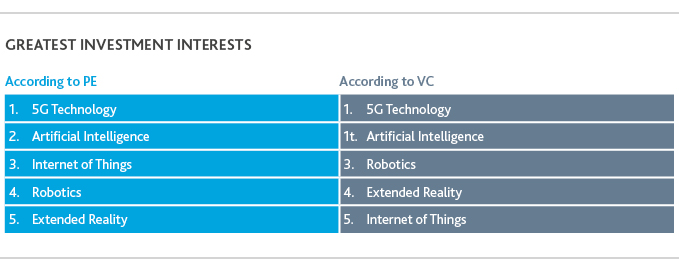

Within the tech sector, 5G and artificial intelligence (AI) are the top two technologies of investment interest, followed by the Internet of Things (IoT), robotics, extended reality (which includes augmented, virtual and mixed realities), blockchain/distributed ledger technology (DLT), and biometrics.

The market for 5G technology, the evolution from 4G LTE, is expected to grow to $251 billion by 2025, according to NetScribes. Besides offering higher downloading and processing speeds, 5G is expected to significantly boost connectivity, productivity and the proliferation of Wi-Fi-enabled devices. While many telecoms are still working out the kinks, 5G is expected to make 4G feel like dial-up internet.

Because 5G technology has tremendous potential to drive economic expansion, it has the blessing and support of the U.S. government: The Trump administration has been aggressively positioning the United States as a leader in 5G technology and has lowered regulatory barriers to deployment. In December, the FCC will hold the largest auction of spectrum, 3,400 megahertz, essentially selling licenses to transmit signals over the electromagnetic spectrum.

“Private equity investment in the technology industry reflects both reality and optimism: Reality in that the tech sector is responsible for a significant percentage of overall growth in the economy, and optimism that the sector will remain a long-term driver of sustained growth.”

AFTAB JAMIL

Partner and National Leader of BDO’s Technology Practice

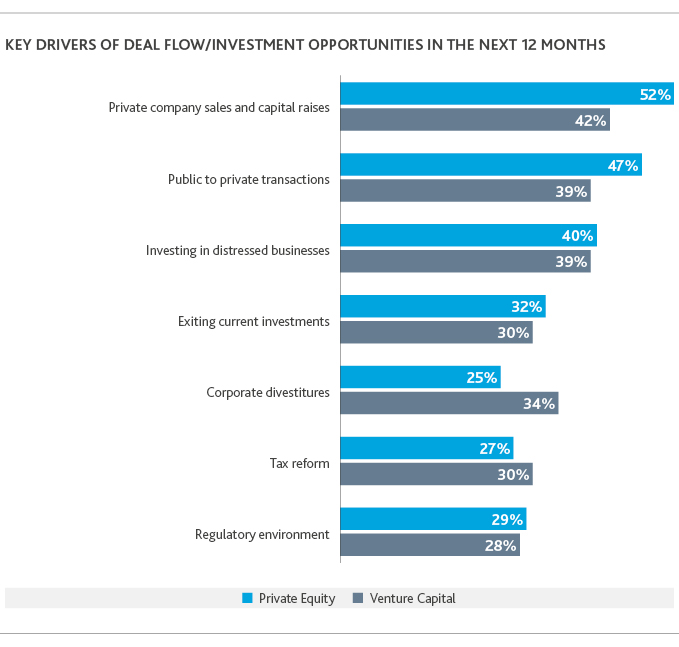

Increased Activity Around Distressed Businesses

Both PE and VC respondents pointed to investing in distressed businesses as one of the top three key drivers of deal flow and investment opportunities for their firm in the next 12 months. In last year’s Private Equity PErspective Study, just 1% of PE firms cited investing in distressed assets as a key driver of deal flow.

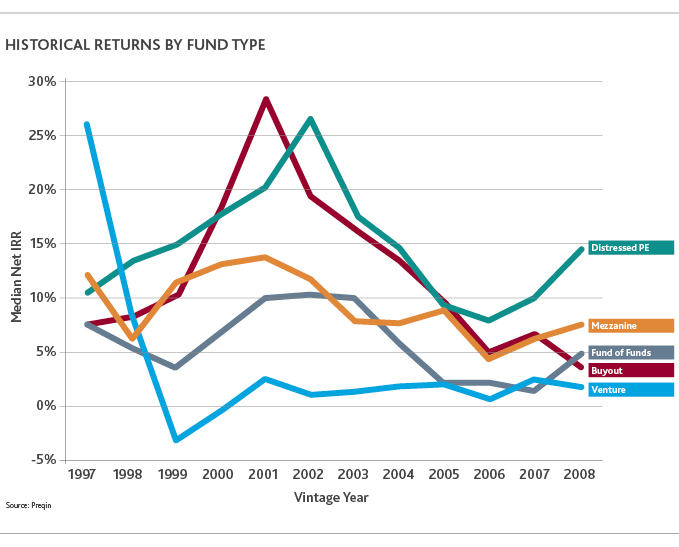

While the number of distressed opportunities in the market is currently quite low, fund managers appear to be anticipating increased investor appetite for capitalizing on distressed assets. During the Great Recession, LPs flocked to distressed debt funds, as such funds typically outperform other PE fund strategies during a downturn. However, other fund strategies that were relatively nascent in 2008—such as special situation and direct lending vehicles—may prove more popular than distressed debt this time around.

“There will be opportunities for those who are prepared to step into a distressed situation that others are trying to move out of. A combination of having a lot of leverage but lower demand for certain services allows lenders or distressed investors to come in at more realistic valuations, take over ownership and wait for the economy to come back for the business to perform better and see great returns.”

JOHN KRUPAR

Managing Director, Restructuring & Turnaround Services

Spotlight on Distressed Assets

The opportunity in distressed is clear, as lenders are highly motivated to move troubled assets overleveraged during the last economic cycle out of their portfolio. However, significant challenges exist that require expertise in the distressed buyout market. Key considerations include:

-

Feed the beast. Between their financial condition and, in all likelihood, a tense lending arrangement, distressed businesses may be starved for capital. Determine whether capital investment or necessary working capital investment will need to be put into the business by the new buyer.

-

Don’t forget the people. Turnover and the lack of appropriate incentives to retain the best performers often leads to a demoralized management team and troubled workforce.

-

Understand the technicalities. The business may potentially need to go through a Chapter 11 process to accomplish the transaction. The use of a section 363 sale, which allows the buyer to acquire the assets of the business of interest while leaving behind certain liabilities and contracts, can be an effective tool.

Be the stalking horse. When it comes to the auction process, the stalking-horse bidder has the clear advantage. They set the terms of the transaction and are given certain protections by the court, such as breakup fees and reimbursement for expenses.

BDO’s highly experienced transaction advisory, interim financial management, operational value creation and business restructuring capabilities can help the buyer successfully navigate the process and create value.

Cross-Border Investing

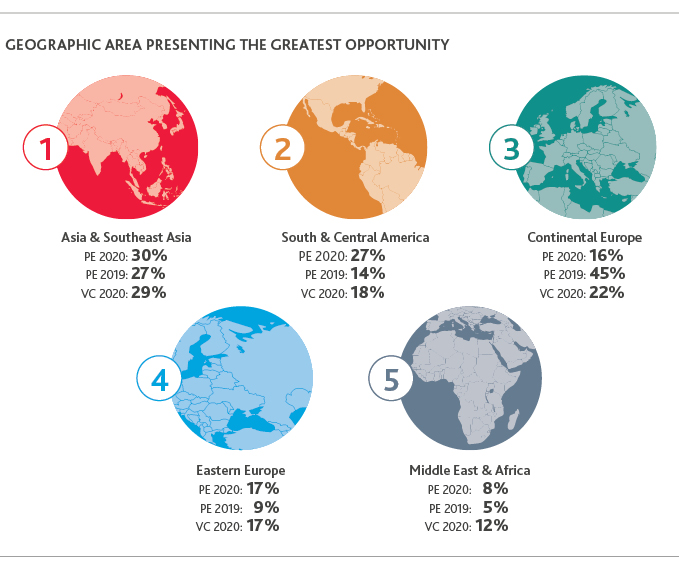

For both PE and VC, Asia and Southeast Asia are the geographic regions, aside from North America, that present the greatest opportunities for new investment. The region replaces Continental Europe, which had been first choice for PE for the past two years (venture capital was not surveyed before this year). This indicates that the U.S.-China trade war, while dampening global GDP, is not wholly suppressing investment opportunities—rather, to a degree it is redirecting investment into emerging countries like India and Indonesia, for example. Continental Europe has seen its own set of challenges: slowing or negative growth, the U.S. tariffs in response to illegal EU subsidies awarded to Airbus, and Brexit (though notably, Brexit, ranks at the bottom of fund managers’ list of regulatory concerns).

“Right now Southeast Asia is one of the largest growing middle-class economies in the world. India, Indonesia, and the Philippines, though experiencing political struggles, represent strong opportunities to diversify away from China, and are attracting global investment. Greater interest in other emerging economies is becoming a reality given the U.S.-China trade war.”

LEE DURAN

Assurance Partner and Leader in BDO’s Private Equity & Venture Capital Practice

Exit Readiness: A Need for Speed

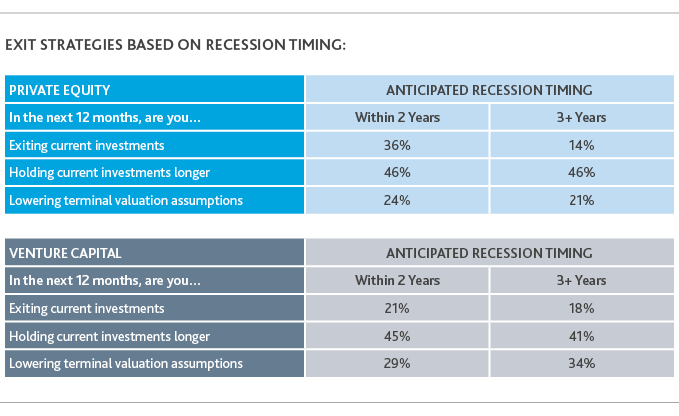

As we prepare for a potential slow down, acquiring assets is only one part of the investment story: exit strategies—in particular, exit timing—is critical to maximizing returns and continuing to curry the favor of LPs. Both PE and VC firms are evaluating their portfolios to determine which companies they should be shedding ahead of a downturn: 30% of PE respondents and 20% of VC respondents are looking to exit current investments in preparation for a recession. That percentage rises to 36% of PE respondents and 21% of VC respondents among those anticipating a downturn to hit within two years.

Funds have seen some pressure from lenders insistent on such evaluations, demonstrating a concern about whether some businesses can weather a less-than-robust economy. Despite this pressure, private equity firms have sold fewer companies this year as high valuations may have deterred some recession-leery buyers. PE-backed exit value dropped significantly from 2018’s all-time high. And while U.S. VC exit value has hit an all-time high of $200 billion, buoyed by a few outsized liquidity events, the total number of VC exits is down. Further, the IPO opportunity has been inconsistent given recent volatility of the stock markets and may lessen given several recent high-profile flops. The result is that a significant portion of fund managers may need to hold on to their current investments longer, possibly through a slowdown and into the next market upcycle.

Spotlight on VC-Backed IPOs

Venture capital-backed IPOs have slowed as investors have become more discriminating—famously evident in WeWork’s failed IPO and headlong valuation tumble. In the third quarter, $27.5 billion of new capital was raised, a decline of 17%, according to Dow Jones’ VentureSource report. Continued investor interest in cloud-based companies is strong and supports venture capital’s pursuit of technology. Though the IPO pipeline is strong in the final quarter of 2019, IPOs that are consumer facing—Uber and Lyft are two examples—will continue to see pressures on their stock during a downturn.

WeWork, which innovated coworking and was valued at $47 billion, was set to IPO in the fall when it saw its valuation—and its IPO—crumble at breakneck speed, prompting its largest investor, Softbank, to step in and rescue it. The company is now valued at around $8 billion and has ousted its founder. The WeWork story provides a useful cautionary tale. Some have conjectured that Softbank’s application of tech company multiples to companies like WeWork—which, compared to SaaS companies, comprise a capital intensive and low-margin model—contributed to WeWork’s fall. Adjusted, speculative metrics in the valuation of startups have been in use since the dot-com bubble, but traditional and real valuation metrics are being employed during buyside due diligence, which is becoming increasingly cautious. What’s more, public investors and banks in capital markets are also looking much more carefully at real valuation metrics.

“There are lessons to be heeded from WeWork’s IPO. In this environment of intense competition over a limited number of attractive targets, investors and lenders are scrutinizing underlying fundamentals to justify valuations. Companies that present a rational revenue stream and foreseeable profits will remain desirable. That means in the tech world, cloud-based software companies will continue to be sought after.”

VISHNU PATWARI

Assurance Partner

Read more about why investors should exercise caution with new valuation metrics here.

A Rising Baseline of Digital Expectation

While economic cycles generally follow the same basic patterns, there is an unpredictable “X factor” complicating investment scenarios for PE and VC fund managers alike: digital disruption. Inevitably, there will be both winners and losers of this new digital economy. Digital disruption can enhance portfolio company returns, but it can just as easily manifest in significant losses: Organizations that fail to evolve their business models for the new digital economy may not come out the other side of the next downturn.

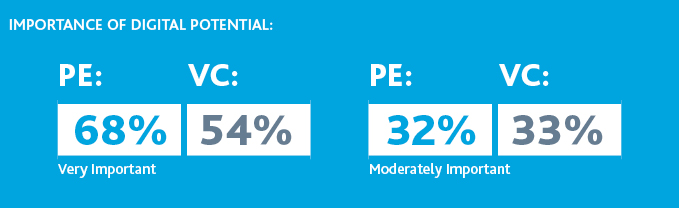

Digital potential—the estimated bottom-line and top-line growth that can be achieved through digitization and digitalization strategies—has thus become critical investment criteria: 100% of PE fund managers and 87% of VC fund managers, respectively, say a target’s long-term digital potential is “very” or “moderately” important to their investment decision.

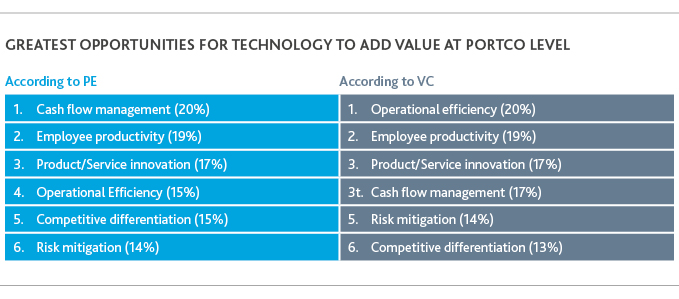

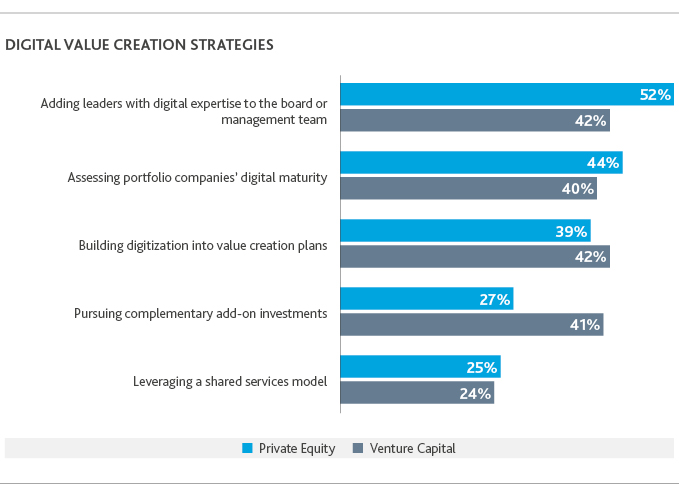

Because VC and PE funds typically invest in different growth stages of a company’s operations, they diverge on where they see the greatest opportunity for technology to add value. A company’s digital maturity is not correlated with its overall business maturity. Startups are likely much more technologically sophisticated than a well-established company, as they tend to be inherently digital. They also employ digital strategies as a value creation lever in different ways. Nearly half of large venture capital funds are building digitization into their value creation plans, intimating that intentionally building digital transformation plans into value creation strategies is emerging as a best practice.

“Data truly is the new oil. To gain a competitive edge, we are seeing more private equity and venture capital funds build digitization into their investment strategies as digital transformation priorities begin to emerge as a best practice.”

KEVIN BIANCHI

Assurance Partner

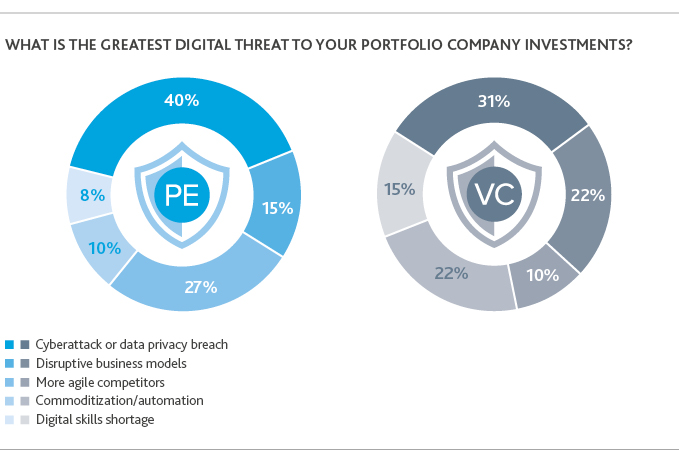

But with digital potential comes digital risk: massive volumes of ungoverned data, more interdependencies, relentless cyberattacks, devastating privacy breaches and new regulations with hefty penalties, as well as the existential threats of automation, commoditization and capricious customer expectations. Both PE and VC respondents rank a data breach as the greatest digital threat to their portfolio companies. Cyber due diligence has become best practice—and for good reason: Fund managers uncover cybersecurity issues when performing due diligence on a target investment, on average, 40% of the time.

However, PE and VC respondents aren’t aligned when it comes to the next-biggest digital threat to their portfolio companies. VCs are equally concerned about disruptive business models and commoditization. PE fund managers, on the other hand, are much more concerned with more agile competitors.

“A few years ago, discussions around digital transformation were centered around marketing tactics. Today, we see digital transformation as a board level and C-suite priority that is impacting all business models and functional areas. Middle-market companies that are aggressively investing in their digital strategy, leveraging data and insights, will continue to outperform.”

JUSTIN LIPTON

Managing Partner, CIP Capital

The Politics of Dealmaking

Compounding the challenges inherent in an economic downturn is continued geopolitical and regulatory uncertainty and turmoil. The ongoing U.S.-China trade war, the 2020 U.S. presidential election and U.S. and foreign tax regime changes present both opportunities and caveats for investors. As the Trump administration reshapes American foreign policy, fund managers with stakes in multinational companies—particularly those in the manufacturing and technology sectors—are finding the predictability and calculation of future cash flows less certain. Private equity and venture capital firms are tailoring their strategies as they raise funds to carry them through the downturn and into the next bull market.

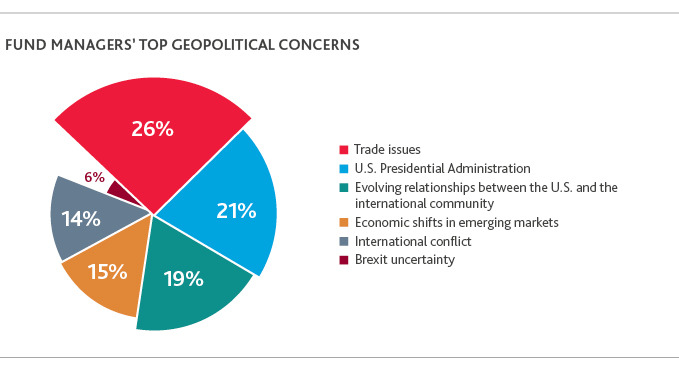

Indeed, trade issues top the list of global political concerns for both private equity (30%) and venture capital (21%) and are underscored by concerns about the U.S. presidential administration (24% and 18%, respectively). These concerns go hand-in-hand, as the trade war is singularly fueled by heads of state.

While the U.S.-China trade relationship has dominated news headlines, the Trump administration has also imposed tariffs on the EU and has threatened to impose tariffs on Mexico, adding to trade uncertainty. An aggressive approach to export sanctions has also disrupted trade flows, which may have financial repercussions for American suppliers to companies on the Specially Designated Nationals and Blocked Persons List.

“As a lender to borrowers owned by a private equity sponsors who are seeking the initial buyout financing and/or acquisition growth capital for their portfolio companies, our risk appetite is not increasing with the rise in overall enterprise valuations. We will continue to lend in our comfort zone of 3.5x to 4.0x regardless of the purchase price multiple that the equity sponsor is paying. At this stage in the credit cycle, we need to assume that each loan we are underwriting will be in our portfolio during the next downturn. As such, we need to ensure that we are setting up our portfolio to withstand recessionary headwinds. Lenders that are lending at conservative leverage levels with large equity cushions below them and with ample covenants and protections in place with borrowers, will be better positioned to emerge on the other side relatively unscathed.”

ORIN PORT

Managing Director, Deerpath Capital

Six Steps Fund Managers Can Take to Navigate Trade Upheaval

- Assess impact. Measure the impact of tariffs and any exemptions on product lines for each company within a portfolio to gauge the holistic effect on the bottom line of these companies.

- Assemble a team. While the heaviest burden may fall on accountants, individual companies and their finance teams will all have an important role to play in gathering and evaluating all the necessary information.

- Dig into the data. Assessing the impact of trade tensions requires a substantial amount of data to be readily available, mainly concerning the tariff code for all product lines. GPs can use this data to begin modeling how trade changes within certain areas of the world will affect their portfolio companies’ businesses.

- Prepare Investors. Be prepared to communicate with investors about the potential impact of tariffs or free trade agreement changes (such as the pending US-Mexico-Canada Free Trade Agreement) on their returns.

- Establish priorities. Focus on the areas that could have the greatest impact on companies within your portfolios. For portfolio companies that are drastically affected, it may be worth prioritizing a reassessment of the supply chain network to unearth potential savings.

- Navigate ripple effects. Work with your tax advisor to understand not only how the changes apply at a federal level, but also how to navigate the ripple effect this is likely to have on the fund lifecycle as well.

Navigating Regulatory Uncertainty

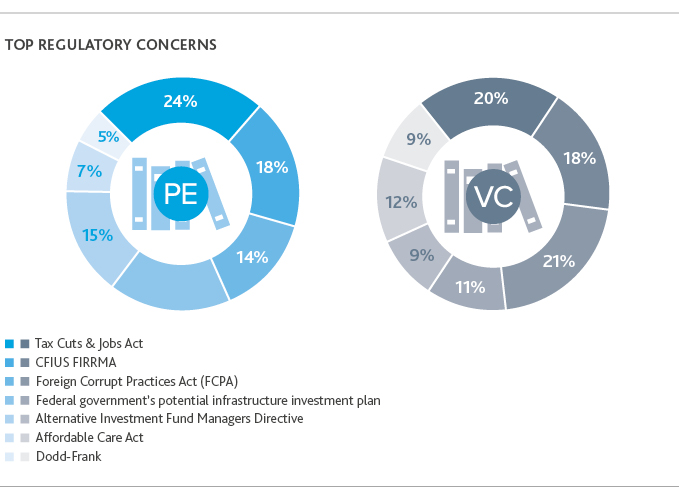

Adding further complexity and turmoil for funds navigating cross-border investment is greater scrutiny of transactions involving foreign investors by the Committee on Foreign Investment in the United States (CFIUS). Chaired by the U.S. Department of the Treasury, this interagency task force is responsible for the review of foreign direct investment (FDI) that could result in the control of a U.S. business or U.S. critical infrastructure. With the enactment of the Foreign Investment Risk Review Modernization Act (FIRRMA) in August 2018, the committee’s purview has increased significantly. A large number of deals involving FDI have fallen by the wayside or been formally withdrawn before completion because of “unresolved CFIUS concerns”—to the tune of $2.5 billion in 2018, just considering inbound investment from China alone. Of note, venture capital respondents rank post-FIRRMA CFIUS review as their top regulatory challenge.

While private equity respondents also expressed concern regarding CFIUS, the Tax Cuts & Jobs Act (TCJA) continues to top their list of regulatory challenges. The first full year under an overhauled tax regime was bound to be one of adjustment, and that the TCJA continues to weigh on PE’s decisions comes as no surprise. Challenges arising from the TCJA include limited interest expense deductions, change to carried interest treatment and a new qualified business income deduction, among other things.

"Overall, the effect of tax reform on private capital has been to increase caution and due diligence in order to ensure deals align or entities are formed according to the most beneficial and logical tax structures: Should an entity be pass-through, partnership, C-corporation or S corporation, for example?”

JEFF BILSKY

Tax Partner

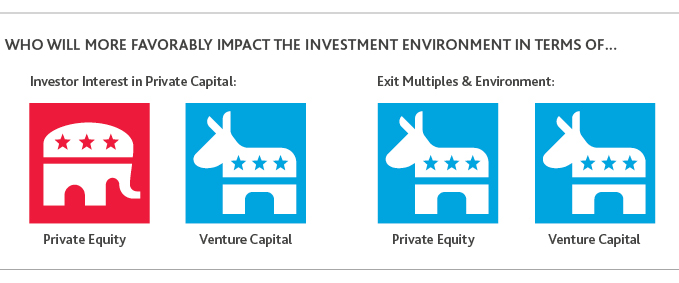

With the next U.S. presidential election on the horizon, both PE and VC are more optimistic than pessimistic on the impact of either a Democrat or Republican taking office, and there is surprisingly little difference between them: 51% of private equity and 30% of venture capital said investor interest in private capital would increase under the policies of a Republican president, compared to 46% of private equity and 37% of venture capital who said the same under a Democrat.

By contrast, 26% of PE and 36% of VC said investor interest in private capital would likely decrease under a Republican, while 36% of PE and 27% of VC said the same with a Democrat in office.

However, both PE and VC see bigger returns under a Democrat: 34% of PE and 29% of VC say exit multiples and the exit environment are likely to improve under a Democrat, compared to 30% and 28%, respectively, under a Republican.

The Outlook for 2020

As another year winds down, the private equity and venture capital industries continue to tap the markets for capital to add to their growing stockpiles and more readily deploy during times of macroeconomic uncertainty, when the fund-raising environment will be more challenging. With the capital markets amenable to fundraising, we expect fund managers to continue to augment their stockpiles in order to be able to strike favorable deals during a downcycle and generate positive IRR.

As funds continue to scrutinize targets more closely to ensure underlying fundamentals are sound, they will also assess their own portfolios to shake out any companies that could be a drag on their returns. Deal volume will remain steady as they execute on these deals in preparation for an economic contraction.

"The flow of private capital investment is challenged by slowing global GDP, valuations that continue to be pushed up by intense competition and geopolitical tensions and uncertainties. But in turmoil comes opportunity: Corporates are looking to shed excess weight ahead of a recession and are investigating how private capital can help them grow their businesses."

SCOTT HENDON

National Leader of Private Equity and Co-leader of Global Private Equity

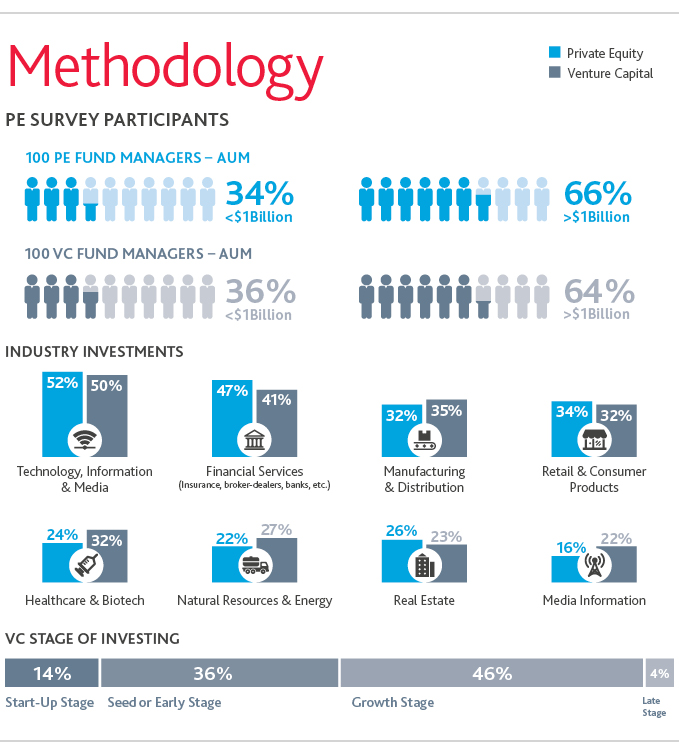

About the BDO U.S. Private Capital Outlook Survey

The BDO U.S. Private Capital Outlook is a survey of 200 fund managers at private equity and venture capital firms in the U.S. The survey was conducted by Rabin Research Company, an independent marketing research firm, in October 2019.

SHARE