BDO & Pitchbook: DEATH BY DELAY: Greater Scrutiny of FDI Weighs on Inbound U.S. PE Buyouts

Table of Contents

- Industries in the Hot Seat

- Growing Interest from—and Mirroring U.S. Focus on—China

- Still a Market in Demand

- Looking Ahead

China’s May 13 announcement to increase tariffs on nearly $60 billion in U.S. goods was just one of the latest salvos firedin the intensifying trade war between the two countries, and it sent markets tumbling immediately after.

Though public investors’ pain from the intensifying U.S.-China trade war may be more visible, it’s not necessarily the most painful. A turning point in 2015, marked by increased scrutiny of foreign direct investment (FDI) by the Committee on Foreign Investment in the United States (CFIUS), gave rise to a separate trend for global private equity investors looking to invest in the U.S.: death by delay.

A large number of FDI-involved deals have fallen by the wayside or been formally withdrawn before completion because of “unresolved CFIUS concerns”—to the tune of $2.5 billion in 2018, just considering inbound investment from China alone. This trend is even impacting industries outside of those expected, according to BDO and PitchBook analysis, as the infiltration of technology into business has widened the definition of “critical infrastructure,” CFIUS’ main priority.

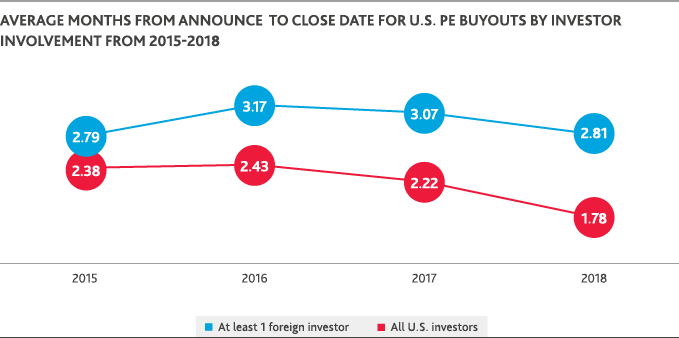

Meanwhile, deals involving FDI that do make it across the finish line take considerably longer to close than those involving only U.S. investors. In 2018, PE buyouts involving at least one foreign investor took, on average, nearly three months (2.81) to close, while those involving U.S.-only investors took less than two months (1.78), the BDO/PitchBook analysis revealed.

Following 2015’s turning point, overall, 2016-2018 saw much longer delays of FDI-involved buyouts compared to U.S.-only transactions. FDI-involved buyouts jumped to 44 percent longer for 2016 deals, 60 percent longer for 2017 deals and 53 percent longer for deals done in 2018.

Examples of foreign investors and their advisers being caught flatfooted by the CFIUS review process include Xcerra’s February 2018 withdrawal from its $580 million sale to an investor group supported by a China-controlled fund. The Massachusetts-based tech company said it withdrew because it realized the deal was unlikely to pass muster for CFIUS approval.

Soon after, at the request of CFIUS because of the nature of the transaction, President Trump intervened in a deal before it was even finalized: Broadcom’s hostile takeover of U.S.-based Qualcomm, one of the largest producers of semiconductor and telecom equipment in the world, The Wall Street Journal reported. In a March 2018 letter, CFIUS named several reasons why the deal could present national security concerns, including the role of Qualcomm’s semiconductors in creating the next generation of 5G networks.

Industries in the Hot Seat

CFIUS reviews now expand well beyond the expected industries like aerospace and military technology, especially following Trump’s October 2018 Foreign Investment Risk Review Modernization Act (FIRRMA). The law, which effectively formalized a practice that BDO/PitchBook data indicates began sooner—the closer scrutiny of certain industries—expanded the committee’s purview and designated 27 new ‘critical technology’ sub-industries.

In FIRRMA, Congress instructs CFIUS to consider the extent to which foreigninvolved transactions could expose personally identifiable information of U.S. citizens and impact U.S. cybersecurity vulnerabilities. It also directs CFIUS to consider the impact of a foreign government or person gaining control of any type of “critical infrastructure, energy asset, critical material or critical technology.”

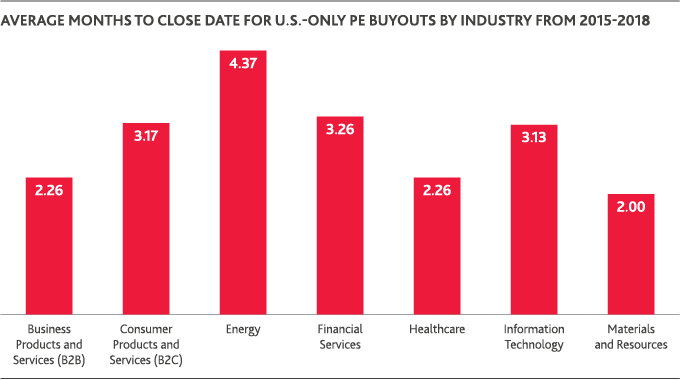

Industries facing increased scrutiny in today’s new world include energy and information technology—as the withdrawal of both the Xcerra and Qualcomm deals bluntly underlined. On average, IT transactions involving FDI participation take nearly four months (3.7) to close, compared to a relatively quick turnaround for B2B transactions (an average of 2.2 months), according to BDO/PitchBook analysis.

Energy-related transactions, meanwhile, take even longer (3.8 months), and delays in that industry have grown in recent years, with cyberattacks on energy grids around the world bringing concerns to the forefront. Between 2015 and 2018, the average closing period for energy-related deals was about 4.3 months, compared to 2.4 months in the previous four-year period.

Growing Interest from—and Mirroring U.S. Focus on—China

Though investment from entities headquartered in the U.K., Japan, Germany, France, Canada, Switzerland and the Netherlands made up about 72 percent of inbound U.S. investment as of 2015, Chinese acquirers have become steadily more active, driven in large part by Made in China 2025. The 10-year plan, released by the Chinese government in 2015, calls for updates to the country’s manufacturing industry by developing 10 high-tech industries. Manufacturing and other industry stakeholders in China have responded in part by pursuing acquisitions that would grant them access to new intellectual property around the world.

In response, by 2015, the closing process for inbound buyouts involving Chinese investors began to lengthen, jumping to an average of 5.1 months from 3.6 months in 2014. In 2016, when Chinese acquirers made up more than 7 percent of North American M&A according to PitchBook data, the time between U.S. PE buyout announcements and close remained elevated, increasing to 6.4 months.

For comparison, U.S. buyouts involving Canadian investors took four months or less to close throughout the same timeframe. It’s likely both trends will continue indefinitely, with much more scrutiny on Chinese involvement going forward.

BDO's Quick Take

Since CFIUS’ expanded powers only took effect as part of a pilot program near the end of last year, it will likely take until the end of 2019 before we really see their impact on investment. But we expect that unless current trade and investment policy relations change, inbound investment from China is likely to show a notable decline trend this year, particularly when it comes to subsectors of technology and life sciences.

Another X-factor on the horizon is a potential economic downturn. We expect investors to increase their focus over the next year on investments in sectors that are centered on constant, irreplaceable consumer needs. This could come at the expense of certain industries, notably biotech for instance, which is perceived by some as riskier or less profitable than others in the near-term.

BILL LIAO

BILL LIAO

Assurance Partner, China and ASEAN Desk Leader

Crafting a Successful FDI-Backed Deal

A Q&A with Michael Barba, managing director and leader of BDO’s National Security Compliance practice, and Scott Hendon, International Private Equity leader and international liaison partner.

With so much talk of trade wars and tariffs, inbound foreign investment is in the spotlight. What do foreign entities or individuals interested in the U.S. need to consider?

Michael: For foreign investors considering the U.S., especially those based in countries the Trump administration has focused on, CFIUS can no longer be an afterthought. Investors should consider CFIUS review a priority variable. Recent regulatory updates give the committee power to intervene much earlier in the negotiation process, so for deals involving certain industries, it’s no longer a question of if CFIUS should be considered but how, and how early.

For example, CFIUS conducts national security reviews of any deals that could result in control of U.S. companies by foreign investors, and the Committee is especially concerned with protecting U.S.-owned companies’ IP if it’s related to critical infrastructure like healthcare, energy and other industries with elevated cybersecurity risk.

But it’s important to remember what “control” can mean. We tell our clients that in addition to more traditional definitions, it also includes minority investments, and reviews are triggered by transactions that give non-U.S. investors access to board seats or authority to guide any material decision-making for a U.S.-based company. U.S. entities considering deals with foreign investors need to keep this in mind and plan accordingly.

How do you predict uncertainty around trade and tariffs will impact international deal flow in the year ahead?

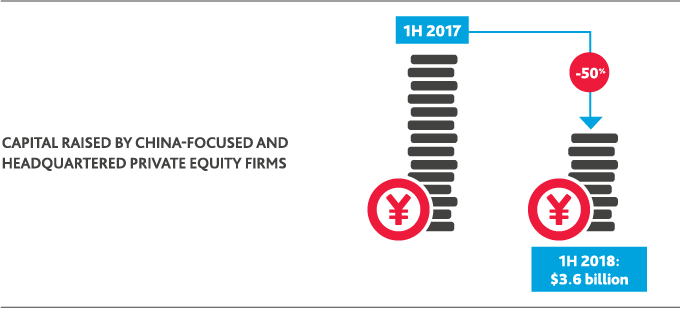

Scott: Last year, many fund managers took the “waitand-see” approach when it came to international investment as public U.S. and China trade tensions deepened. Because of that, capital raised by Chinafocused and headquartered PE firms fell by almost 50 percent in the first half of 2018 compared to the same period in 2017.

Looking ahead in 2019 and beyond, we expect continued uncertainty to weigh on deal flow, particularly among funds with portfolio companies that rely heavily on international manufacturing and distribution, given the Made in China 2025 plan.

Why is so much scrutiny placed around deals involving U.S. companies in tech and healthcare in particular?

Michael: In short, data is king, and tech and healthcare entities possess a plethora. Its quantity and quality, born from the creation of the internet of things, has made data one of the most valuable assets a company—and a country—can protect, revolutionizing how we define national security risks. Traditional computing devices are no longer the only technologies accessing or storing data, especially as healthcare becomes more consumer centric. Tools like wearables and biometric applications are now used to access and store data—making them potential entry points for malicious activity.

Thus, a key risk component of any CFIUS review process is personally identifiable information (PII). This includes genetic information, protected health information, geographic movement and other sensitive data. For CFIUS to assess national security risks of a proposed transaction, the entities involved must recognize the threat, vulnerability and consequences of exploitation of data resulting from the deal.

How can companies balance the need for greater capital—including from foreign investors—with protecting their digital assets and mitigating CFIUS risk?

Scott: Today’s CFIUS environment creates new opportunity costs for foreign investors. So, the key goal of any successful mitigation strategy when it comes to concerns around FDI is alleviating the national security concerns of the transaction in a way that’s efficient, effective and verifiable. This could include compliance requirements that are specifically targeted towards “access to” and “storage of” certain types of information like PII, PHI or end-user.

Michael: BDO recommends companies use the following guidelines when evaluating their critical data and information in the context of FDI:

| 1. Assess compensating controls, policies and procedures created, amended or already in place specific to compliance requirements under the mitigation terms. | |

| 2. Evaluate the effectiveness of the current state of compliance or the program for facilitating compliance with the mitigation terms negotiated with CFIUS. | |

| 3. Assess the conceptualization, development and deployment of technical controls capable of providing a defense-in-depth and/or a defense-resiliency security posture relating to the integrity, reliability and responsiveness of the organization. | |

| 4. Evaluate the controls deployed in the operational environment and providing a validation of the implementation, maintenance and remediation of such controls. | |

| 5. Assess enterprise-wide compliance efforts, including their availability, completeness and auditability. | |

| 6. Evaluate physical and logical security features of key sites, including data, network operation and backup center facilities. | |

| 7. Establish guidance on compliance strategy and operational implementation of controls when it comes to identified gaps in compliance or risk areas. As technological innovation continues to dictate the rules of modern-day business, entities employing a cross-border investment strategy should ensure national security compliance is a key part of that. |

MICHAEL BARBA MICHAEL BARBATechnology and Business Transformation Services Managing Director |

SCOTT HENDON SCOTT HENDONNational Private Equity Industry Group Leader |

Still a Market in Demand

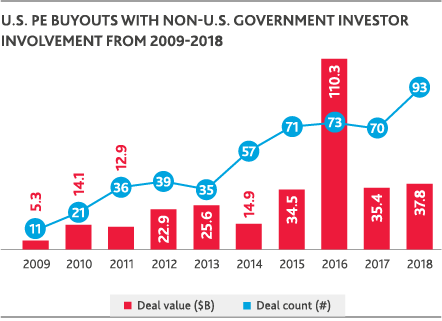

Despite greater roadblocks, the U.S. is still a much-desired market by foreign investors—with interest from foreign government capital specifically on the rise. BDO and PitchBook’s analysis captures an upswing in U.S. buyouts involving foreign sovereign wealth funds (SWFs), government agencies or non-U.S. public pensions, including a record high last year.

Ninety-three such deals were struck in 2018, a 33 percent increase over 2017 totals. In this case as well, foreign investment spiked in 2015 and remained elevated for the next two years, BDO and PitchBook’s analysis found. A similar trendline was captured around Asian investment participation, which popped 92 percent between 2014 and 2015 and remained consistently strong in the intervening years.

Examples of foreign investors working with U.S. companies to successfully close a deal in today’s more stringent environment include Shanghai’s Will Semiconductor Co. It successfully completed the acquisition of OmniVision Technologies, a Santa Clara-based digital imaging company, after CFIUS cleared the deal In April 2019. Sellers of the company included Hua Capital Management, CITIC Capital and GoldStone Investment Co. CITIC is an affiliate of a larger, state-owned conglomerate in China, and the initial transaction in January 2016 also had to gain CFIUS approval. The current political climate, however, gave the impression that Will Semiconductor’s offer would be nixed under stricter guidelines. When the deal was approved, some observers noted the favorable optics surrounding the decision could prove helpful for the rest of the market.

Consider another example. Goldman Sachs acquired Boyd, a California-based manufacturer, through a transaction that CIC, a Chinese sovereign wealth fund, participated in indirectly through Goldman’s buyout fund. The structure made the acquisition team a “U.S. person” in the eyes of regulators.

Looking Ahead

As of Q1, 2019 looks to be another big year for FDI despite mounting headwinds, with 21 participatory deals already inked—the lion’s share being from Canada and Singapore.

Canadian public pensions, for example, have become buyout shops in their own right, not merely backing private equity funds as limited partners but also building sophisticated investment teams to do direct buyouts themselves. Singapore’s numbers, meanwhile, are similarly dominated by legitimate investors, including Temasek, a $300 billion holding company owned by the government, and GIC, a $100 billion sovereign wealth fund that manages Singapore’s foreign reserves.

Sovereign wealth funds, which have expressed more interest in PE co-investments in recent years, could also be a notable driver of increased FDI activity this year. Historically, SWFs have limited themselves to fund commitments, where returns can be weighed down by management and performance fees, but the tide appears to be shifting. Buyout firms have acquiesced over time, allowing some limited partners to directly contribute capital to individual transactions. From a regulatory point of view, the concern is access to underlying company information—as well as, potentially, the technology behind it—that they would not be privy to as limited partners in a covered fund. Most of today’s SWF co-investments are done with U.S. allies such as Qatar Investment Authority, Abu Dhabi Investment Authority, GIC and the Investment Corporation of Dubai.

The strength of FDI investment going forward may depend even further on players from Canada and Singapore, among others, should Chinese investment be further complicated by CFIUS and evolving trade tensions.

As the broader U.S. regulatory environment continues to evolve, foreign investors involved in both inbound and outbound U.S. deals should be mindful of the potential for retaliatory CFIUS actions from foreign governments in a tit-for-tat trade war that appears to be gaining momentum, incorporating potential implications into the deal process accordingly.

Learn more about navigating U.S. national security compliance.

SHARE