Nonprofit Standard Newsletter - Spring 2018

Table of Contents

- Six Tax Reform Issues Impacting Nonprofit Organizations

- Other Tax Items

- New Tax Law’s Excise Tax ‘Bite’ on Exempt Organization Compensation

- Is Your Not-For-Profit Financially Fit?

- The Integration of Data Privacy into a Data Governance Program

- Mission Matters

- Survival Tips for the New Era of Fundraising

- How do You Read and Understand Nonprofit Financial Statements?

- Updates to FASB Proposed Guidance for Contributions

- Shaking Off the Stigma of Indirect Costs

- The Great Act – Transforming How the Government Uses Grant Reporting Data

- Possible Update to the GAAP Definition of a Collection

Six Tax Reform Issues Impacting Nonprofit Organizations

The Tax Cut and Jobs Act of 2017 (the “Act”) will have a profound impact on tax-exempt organizations. Even those that don’t report unrelated trade or business income or pay their executives over $1 million may still be affected.

Here are the top six tax reform-related issues nonprofits will need to address:

1. Internal Revenue Code (IRC) Section 512(a)(7): Certain qualified transportation fringe benefits, including those relating to parking garages, must be reported as unrelated business income (UBI).

All tax-exempt organizations will have to include as unrelated business taxable income (UBTI) any amount paid or incurred for any qualified transportation fringe benefit or any parking facility used in connection with qualified parking.

If an organization has a parking garage that offers free parking to its employees, the new law says that the costs paid or incurred by the organization for providing the parking must be included in its UBTI. However, if its garage is used for parking that is already counted as UBI, such as parking for the general public, then the percentage of those costs attributable to the amount already included in its UBI does not have to be included in the amount treated as UBI under the new provision. The organization may be providing parking in the structure to students, patients, and visitors, and those costs would not count as UBI; as a result, the organization would then have to allocate all the costs of providing the parking to come up with the amount that is included in UBI. The only way an organization can avoid counting the employee parking as UBI is to have employees pay for the parking with their after-tax dollars.

The new provision also taxes certain other transportation fringe benefits, including commuter transportation and transit passes.

This provision was an attempt to put exempt organizations on the same footing as taxable organizations that will no longer be able to deduct these costs. It is effective for amounts paid or incurred after Dec. 31, 2017.

2. IRC Section 4960: Tax on excess tax-exempt organization executive compensation.

Tax-exempt organizations that pay an executive considered a “covered employee” more than $1 million will be subject to a 21 percent tax on the excess amount over $1 million. A covered employee is any current or former employee of a tax-exempt organization who is either (a) one of the five highest compensated employees in the organization for the tax year, or (b) was a covered employee in the organization, or any predecessor of the organization, for any tax year after Dec. 31, 2016. So, once an individual is a covered employee, he or she is always considered a covered employee.

In addition, the new provision imposes the same tax on certain parachute payments (which may be less than $1 million). This provision applies not only to typical 501(c) tax-exempt organizations, but to all organizations that derive their income tax exemption from Internal Revenue Code section 501(a), including pension trusts. It also applies to non-501(c) exempt organizations, such as state and local government entities, which includes state colleges, so that highly-compensated athletic coaches would be on equal footing as coaches from private universities (although some believe that a technical correction is needed to impose the tax on state institutions). There is also a special carve-out for licensed medical professionals, including veterinarians, for the performance of medical or veterinary services, to the extent that the compensation received is for the provision of medical services and not for other services, such as administration or business development.

Most significantly, it is not only the compensation from the tax-exempt organization that counts towards the $1 million, but also the compensation paid from both tax-exempt and taxable related organizations. A related organization is an organization that controls, or is controlled by, the organization (parent/subsidiary); is controlled by one or more persons that control the organization (brother/sister); and/or is a supported or supporting organization. If compensation from more than one employer is used to calculate the excise tax, then each employer is liable for its proportionate share of the tax.

Because of its complexity, the Treasury Department has added this provision to its list of Priority Guidance items. It’s important to note that there is no relationship between this new provision and the intermediate sanctions provisions; for example, just because a person makes over $1 million does not mean the compensation is unreasonable. However, we expect that those who are subject to the provision will undergo greater scrutiny. Thus, it’s important that organizations establish the rebuttable presumption of reasonableness when it comes to executive compensation. An independent authorized body can help by reviewing the proposed compensation based on comparable data and documenting both the independence and the basis for the decision.

The effective date of this provision is for all tax years beginning after Dec. 31, 2017.

3. IRC Section 512(a)(6): The losses from one unrelated trade or business activity cannot be used to offset the income from another unrelated trade or business.

Section 512(a)(6) is consistent with the position that the IRS takes on audits, which is to deny the losses of an activity if the loss occurs year after year. The IRS believes that if there were perpetual losses, there was no profit motive, which is a requirement for the existence of a trade or business. Without a trade or business, there could not be an unrelated trade or business. This was a similar approach the IRS had to “hobby losses.”

This provision is effective for tax years beginning after Dec. 31, 2017. Net operating losses arising in tax years beginning before Jan. 1, 2018 are not subject to the rule and may be used to offset income from any trade or business to the extent of 80 percent of the income from the trade or business. Any amount so limited may be carried forward to future years.

Nevertheless, many questions remain regarding this provision:

-

Will each investment in a partnership (a so-called “alternative investment”) be considered a separate trade or business, or can the alternative investments be aggregated, with each one’s income and losses offsetting the income and losses of another?

-

Will all rental activity be aggregated as one trade or business?

-

Will management of other associations be treated as one management activity or multiple businesses?

To address these questions, the IRS plans to include additional guidance on this provision in its Priority Guidance items.

4. IRC Section 4968: Endowment tax.

Even though IRC Section 4968 is called “Excise tax based on investment income of private colleges and universities,” large exempt organizations with post-secondary schools should also review the basic rules. The new law imposes a 1.4 percent tax on the net investment income of certain private educational institutions. These institutions must have more than 500 full-time students attending the institution, at least half of whom are in the U.S.; in addition, their non-exempt purpose assets must be at least $500,000 per student. Meanwhile, part-time students should be taken into account by proportionally adding them to the full‑time equivalency.

The rationale behind this provision is to tax college and university endowments in the same manner as private foundations. In fact, net investment income is defined by the private foundation provisions of IRC 4940 and generally includes interest, dividends, rents, royalties, and capital gain net income, and is reduced by expenses incurred to earn this income. In reaching the asset threshold, the assets of related organizations are considered.

Many initially thought the provision would only impact between 30 and 60 colleges and universities. However, large healthcare systems and other exempt groups may have nursing schools or other schools that could be impacted when the assets of the related entities are considered. The rules are effective for tax years beginning after Dec. 31, 2017, so there may be opportunities to make the educational institution independent of the other entities so that the asset test is not met.

5. IRC Section 162: New lobbying rule.

Tax-exempt organizations, such as 501(c)(6) organizations that lobby, must either notify their members as to how much of their dues are nondeductible because they’re spent on lobbying or pay a proxy tax at the highest corporate rate. Under the previous tax law, an exception to the definition of lobbying existed when the lobbying amounts were paid or incurred to local councils or similar governing bodies, including Indian tribal governments. However, the new law repeals the exception for such amounts paid or incurred after the law’s enactment date.

Nevertheless, this change does not impact section 501(c)(3) organizations. This is because the definition of lobbying—for purposes of whether a substantial part of an organization’s activities includes influencing legislation—already included attempts to influence the actions of any local council or similar governing body.

6. Various new tax provisions will change charitable giving.

With the increase in the standard deduction and the limitation on deducting state and local taxes, fewer people will likely itemize their deductions on their 2018 returns, thus decreasing the tax incentive to make charitable gifts. In addition, the estate and gift tax exclusions were also doubled, which may lessen the incentive to make bequests to charities. These changes may lead to an estimated $12 to $20 billion decline in overall charitable giving (http://www.taxpolicycenter.org/taxvox/21-million-taxpayers-will-stop-taking-charitable-deduction-under-tcja).

Nevertheless, the tax incentives for high net worth persons were increased by raising the annual limit of cash donations to public charities from 50 percent of a person’s adjusted gross income (AGI) to 60 percent. The Act also repeals the “Pease” limitation, which was originally created to raise tax revenue by reducing the amount of the allowable itemized deductions (including charitable contributions) once a taxpayer’s AGI reached a certain amount. This provision came into effect on Jan. 1, 2018 and sunsets in 2025. Therefore, charities should focus on developing high net worth donors now.

Finally, the law eliminates the 80 percent charitable deduction for contributions to organizations where the donor receives the right to purchase tickets to college and university athletic events. The prior law ran contrary to established tax law, which stated that there would be no charitable deduction when something of value was received in return. Thus, individuals should take extreme caution if they encounter a scheme that allows for a tax deduction in exchange for a chance to buy priority seating. Just as a raffle ticket sold by a charity is not deductible, neither is purchasing a chance to buy tickets. The IRS will be on the lookout for new arrangements that attempt to avoid the new law and could even go after them as tax shelters.

LOOKING AHEAD

The tax law is constantly changing. For example, the Philanthropic Enterprise Act of 2017, which was part of the Budget Reconciliation Act, was signed into law on Feb. 9, 2018. The law amends the “excess business holding” rules imposed on private foundations and allows them to own all (100 percent) of a business under certain conditions (without the law, the foundation would have had to divest itself of 80 percent of the stock). The bill was led by Newman’s Own Foundation, which owns a hundred percent of the entity that sells salad dressing and spaghetti sauce. The new law allows a foundation to have a hundred percent ownership of a company if the company is independently run, and all its profits go to charity. This new law may provide new charitable giving opportunities.

Thus, it’s important that organizations stay tuned for guidance on the new and upcoming rules.

Reprinted from the Nonprofit Standard blog.

Return to Table of Contents

Other Tax Items

A few more items of note:

Applications for Exemption and Fees:

The IRS has revised the applications for exemption and reduced the user fee.

See: https://www.irs.gov/charities-non-profits/applying-for-tax-exempt-status.

Exempt Organizations Relocating to Another State:

The IRS has issued a new revenue procedure (Rev. Proc. 2018-15) indicating that a new application for exemption is not necessary for the reincorporation of an exempt organization in another state.

See: https://www.irs.gov/pub/irs-drop/rp-18-15.pdf.

Donor Advised Funds (DAFs):

Proposed regulations are under consideration that would, if finalized, provide that: (1) certain distributions from a DAF that pay for the purchase of tickets that enable a donor, advisor, or related person to attend a charity-sponsored event result in a more than incidental benefit to such person; and (2) certain distributions from a DAF to a charity that are treated as fulfilling a pledge made by a donor do not result in a more than incidental benefit if certain requirements are met. Also under consideration are rules that would change the public support computation for organizations to prevent the use of DAFs to circumvent the excise tax rules applicable to private foundations.

See https://www.irs.gov/pub/irs-drop/n-17-73.pdf.

New Tax Law’s Excise Tax ‘Bite’ on Exempt Organization Compensation

By Michael Conover

The bill known as the Tax Cut and Jobs Act of 2017 (the “Act”) in Internal Revenue Code (IRC) Section 4960 (specifically Sec. 13602) imposes a 21 percent excise tax on employers for any remuneration in either or both of two specific situations: amounts in excess of $1 million paid to a covered employee by an applicable tax-exempt organization for a taxable year, and/or any separation or “parachute” payments made to a highly-compensated employee (defined by the IRS as greater than $120,000 for 2018) terminating employment that is equal to or greater than three times the average W-2 earnings of that individual for the five years prior to the year of termination.

This new regulation should not be confused with the excise tax levied on executives and the organization for excess benefit transactions under the IRS Intermediate Sanctions (IRC 4958) which continue to be in effect. The focus here is on compensation in excess of certain amounts specified in the new regulations. An organization’s ongoing adherence to guidance for the Rebuttable Presumption of Reasonableness found in IRC 4958 is still very important, but will not invalidate the provisions of the new regulations.

Many organizations may focus on the $1 million compensation amount, and thus quickly dismiss any concern over it. However, they may be surprised that the separation payment provision may impact a large group of employees making much less than $1 million, resulting in an excise tax on the organization for all highly-compensated employees. Failure to recognize this may result in a rude awakening when those employees depart.

Let’s start with some basic information:

Applicable Organizations:

All tax-exempt organizations (including governmental entities and farming cooperatives) are subject to these rules for tax years beginning after Dec. 31, 2017.

Covered Positions:

-

The five most highly-paid employees earning in excess of $1 million in the current year or in any prior year beginning after Dec. 31, 2016. Once an individual is a covered employee they will always remain a covered employee. The only exception is for licensed physicians, nurses or veterinarians (or that portion of compensation paid to an individual for providing these specific services).

-

Any highly-compensated employee (per IRC definition – at or above $120,000 annual compensation for 2018) receiving a separation from service payment equal to or greater than three times the employee’s five-year average compensation.

Includable Compensation:

-

All forms of direct remuneration reportable on an employee’s W-2 are included in the determination of the $1 million amount except qualifying contributions to a Roth IRA (or payments for the licensed professionals described above). See this article for more details.

-

The present value of separation or parachute payments made to a highly-compensated employee that are contingent upon a separation from employment, with certain amounts being excluded including qualified retirement/retirement savings plans (i.e. 401(k), 403(b), Simplified Employer Pension Plan), and 457(b) plan amounts).

Application of Excise Tax:

-

Compensation in excess of $1 million – the employer is subject to a 21 percent excise tax on any includable compensation in excess of $1 million.

-

Separation/parachute payments – if the payment is equal to or greater than three times the employee’s “Base Amount”, the employer is subject to a 21 percent excise tax on any amount in excess of a highly-compensated employee’s Base Amount:

-

Base Amount – the average of the employee’s earnings for the five years ending prior to the separation of service.

-

Tax – the employer is subject to a 21 percent excise on the difference between the present value of the separation payment and the Base Amount (not three times the base amount). This provision mirrors one used by the IRS in for-profit organizations (280(g)). It is frequently misinterpreted to mean up to three times current compensation with painful consequences. Being off by just $1 can trigger exposure to the full amount over the Base Amount.

-

-

It is possible that compensation plus the present value of a parachute payment could trigger the 21 percent excise tax on both compensation in excess of $1 million, as well as the applicable portion of a separation payment.

All tax-exempt organizations would be well-advised to undertake a thorough examination of compensation arrangements for all highly-compensated employees. This should include even those making less than $1 million who might be impacted under a parachute payment scenario. This examination should include:

-

A review of all includable compensation amounts to identify employees, if any, that may be a covered employee over the $1 million threshold amount in current pay for tax years beginning after Dec. 31, 2017. Any compensation paid to these individuals in excess of $1 million annually will be subject to the 21 percent excise tax going forward.

-

An examination of all compensation arrangements now in effect for all highly-compensated employees. This should focus on all employment agreements, non-qualified retirement arrangements, incentive plans, severance arrangements, and retention plans. Actual or potential payments that might arise under a variety of foreseeable scenarios should be plotted out on a year-by-year basis and studied to identify potential instances where an excise tax scenario may arise.

Most formal compensation arrangements and plans used by tax-exempt organizations are subject to the Employee Retirement Income Security Act (ERISA), IRC 457 and 409A regulations. As a matter of good practice, all of these arrangements should be reviewed by legal counsel to ensure compliance with applicable provisions of these and any other requirements. Errors contained in these documents or administering them may have adverse tax consequences to employees as well as the organization. If not done so recently, now is a crucial time to check all documents.

The complexity of these IRS and ERISA regulations greatly restrict the actions that might be taken to eliminate or minimize potential excise tax exposure identified in the review of present compensation levels or potential parachute payment scenarios. There may be changes that could address issues that are discovered, but they must be carefully explored.

There is not sufficient space in this article to adequately cover the issues involved in changes to any existing arrangements. Qualified legal counsel is essential to ensure that any changes considered do not violate these regulations. Similarly, any new compensation arrangements or plans for highly-compensated employees must also be examined and structured to ensure compliance and minimize unnecessary exposure to the excise taxes on excess compensation.

For more information, contact Michael Conover, managing director, Specialized Tax Services – Global Employer Services, at [email protected].

Return to Table of Contents

Is Your Not-for-Profit Financially Fit?

By Lee Klumpp CPA, CGMA

Being financially fit and stable is critical to any business, including a not-for-profit (NFP). If a NFP has a weak financial position, it may not be able to sustain its operations. While the perception by many in today’s society is that most NFPs are generally financially healthy, this is not always the case. For example, a recently published report noted that 41 percent of charities do not expect to make a profit over the next three years. An NFP’s liquidity is an important story to convey to the users of its financial statements.

To determine the overall financial health of an NFP, you need to understand its financial statements. You should be able to find a copy of the NFP’s financial statement that you are interested in analyzing on the NFP’s website or obtain it by requesting it. Evaluating these documents will provide insight into the NFP’s financial health and the basis on which management makes strategic and financial decisions. To do this evaluation effectively, you need a basic knowledge of NFP accounting methods and the ability to calculate financial ratios such as liquidity. Liquidity has also become a critical metric used by boards and stakeholders to measure the potential sustainability of an NFP.

No amount of long-term investments and capital assets will keep a nonprofit operational if its finances aren’t sufficiently liquid. Having the right amount of liquid and non-liquid resources available is key for an NFP to accomplish its mission. While there is a cost associated with not having enough liquidity, there is also a forgone opportunity cost for having too much liquidity.

LIQUIDITY DEFINED

Liquidity is typically defined as how much cash and/or assets (such as short-term investments) an NFP holds that can be easily converted to cash for use in the immediate or near future. An NFP is thought to be liquid if it has ready access to cash to meet its needs. An NFP may be described as liquid because it holds cash directly or because it holds other liquid assets such as money market accounts, certificates of deposits, or other short-term investments that can readily be converted to cash.

To find out whether an NFP is financially strong, calculate the total value of everything that it could use to raise cash, if necessary. This calculation includes money in the bank, accounts receivable, and inventory on hand that it can sell. If the nonprofit has investments in marketable securities, you can include these, because they are relatively easy to liquidate. Divide the total amount by the NFP’s liabilities to determine what percentage of its value would be left if it had to liquidate and pay off all creditors.

HOW NFPs DISCLOSE LIQUIDITY UNDER NEW GUIDANCE

The Financial Accounting Standards Board’s Accounting Standards Update (ASU) 2016-14, Presentation of Financial Statements of Not-for-Profit Entities addresses how NFP’s should disclose information regarding liquidity.

Specifically, the ASU requires that an NFP disclose both quantitative and qualitative information about the liquidity of assets and near-term demands for cash as of the reporting date, including (1) the amount of financial assets at the end of the period; (2) the amount that, because of restrictions or other limitations on their use, is not available to meet cash needs in the near term; (3) the amount of financial liabilities that require cash in the near term; and (4) information regarding how an NFP manages its liquidity, and any other sources of cash (such as lines of credit). The FASB believes that this information will significantly improve users’ ability to assess a NFP’s liquidity. The ASU is effective for year’s beginning after Dec. 15, 2017.

PRESENTATION OF LIQUIDITY

Qualitative Information, refers to how an NFP manages its liquid resources to meet its operational cash needs within one year of the statement of financial position date. Qualitative information should be included in the footnotes and describe the availability of the NFP’s financial assets.

Financial assets are defined as cash, ownership interest in an entity, or a contract that allows an NFP to receive cash or another financial instrument or to exchange financial instruments on potentially favorable terms. The availability of financial assets can be affected by:

-

The nature of the asset

-

External limitations on the asset that are imposed by donors, grantors, laws and contracts

-

Limits on the asset that are imposed internally, for example, by governing board decisions

Quantitative Information, refers to the amount of financial assets available to meet the NFP’s cash needs within one year of the statement of financial position date. Quantitative information can be included on the face of the statement of financial position or in the footnotes.

EFFECT ON NFPs

These new disclosure requirements will provide clarity to readers of financial statements about the resources that are available to support the NFP’s central and ongoing operations. The disclosures should also make it more apparent when an NFP is in a strained financial situation.

NFPs that already present their statement of financial position in a classified format that shows current and noncurrent assets and liabilities separately may discover their current presentation shows all or part of the required quantitative information required by the ASU. These entities have already determined the assets expected to be realized in cash or available for use within one year of the financial statement date. However, further disaggregation of these amounts may be needed in the footnotes to fully satisfy the requirements of the ASU.

FINANCIAL ASSETS

NFPs will need to assess what their financial assets are and whether the current assets presented in their statement of financial position equate to the financial assets available to support general expenditures within one year from statement of financial position date.

In some instances, an NFP’s current assets may be different from those available to meet cash needs for general expenditures. For example, an NFP may classify pledges to be received within one year as current in its statement of financial position, but these pledges may be restricted by donors for a specified purpose and unavailable for general expenditures—even when the cash is received.

Common types of financial assets include:

-

Cash and cash equivalents

-

Short-term investments

-

Receivables

-

Pledges

RESTRICTIONS

Restrictions that could limit the use of assets are:

-

Donor restrictions for capital expenditures or other expenses beyond the next year

-

Funds designated by the board including assets for self-insurance funding, pension obligations or debt arrangements

-

Assets held as collateral

-

Cash balance limits resulting from contractual agreements with vendors or creditors

-

Cash required to be held in separate accounts or restricted for a specific purpose

-

Loan covenants

NEXT STEPS

Qualitative Disclosure

NFPs will need to develop and implement a policy to comply with qualitative information disclosure requirements for managing liquidity and liquidity risk. If an NFP doesn’t currently have such a policy, the NFP should consider working with its management team and governing board to establish the policy. As with all significant organizational policies, it’s a best practice to document policies in writing and review them on an ongoing basis.

Quantitative Disclosure

NFPs will want to consider creating a draft of the new quantitative disclosure. If an entity is financially strained or has limited available resources, the new quantitative disclosure requirements may result in a very small or even negative amount of financial assets available for use within a year.

This signifies a liquidity risk and may also cause management to doubt the entity’s ability to continue as a going concern, per ASU 2014-15, Presentation of Financial Statements – Going Concern (Subtopic 205-40), which was released in August 2014. ASU 2014-15 provides guidance about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and requires certain related footnote disclosures. This standard was effective for annual periods ending after Dec.15, 2016.

NFPs with High Liquidity Risk

When NFPs implement the new standard, there is likely an opportunity to consider if the organization has a high liquidity risk, which means it has a minimal amount of available liquid assets or possibly a negative amount. If this is the case, management might want to consider discussing the liquidity risk with users of the financial statements—such as grantors, donors, and the bank—or obtaining a line of credit to help with operating needs if liquid resources are unavailable. The board may want to consider setting up and funding an operating reserve to improve its liquidity reserve. For more information on items to consider in setting up an operating reserve visit the Nonprofit Operating Reserve Initiative.

NEXT STEPS FOR IMPLEMENTING ASU 2016-14

As NFPs prepare to implement the new requirements of ASU 2016-14, they should consider the following next steps:

-

Identify financial assets and any possible limits whether by donor restriction or board-designations to these assets.

-

Review the general ledger and financial statement report writer setup and consider whether any changes can be made to enable easier tracking of financial assets.

-

Perform an analysis to determine what limits are imposed on financial assets.

-

Calculate financial assets available to meet cash needs within one year.

-

Consider whether a classified statement of financial position may improve your NFP’s display of liquidity.

The capability of an NFP’s systems to generate information to support providing these new disclosures may require re-working and re-evaluation. Additionally, NFPs may want to institute oversight related to the NFP’s projected liquidity to help reduce the risk of materially misstated disclosures. The benefit of all of this is that senior management and the governing board may appreciate having readily accessible information about the NFP’s resource availability to more easily determine the organization’s financial fitness.

For more information, contact Lee Klumpp, partner, National Assurance, at [email protected].

Return to Table of Contents

The Integration of Data Privacy into a Data Governance Program

By Karen Schuler, CFE, IGP, IGP and Mark Antalik

In the Winter 2017 issue of the Nonprofit Standard, the article entitled “Nonprofits are not Immune to Maintaining Data Privacy” dove into why data privacy considerations are critical for nonprofit organizations.

The article provided a step-by-step guide to bolster your data governance preparedness for a data leakage or breach situation. In this article, we add to that foundation to provide nonprofit organizations with a guide to building privacy into their data governance program. A holistic data governance program considers data access, use, and storage; data classification; data related policies and procedures; employee training; and ongoing monitoring and controls. Let’s examine why data governance is important. Data governance allows an organization to:

-

Improve functionality across the organization;

-

Optimize customer or donor data analytics, trends, and anomalies;

-

Highlight potential vendor fraud;

-

Identify sources of protected data to enhance data security and privacy programs, such as masking or anonymizing sensitive data;

-

Identify business and operational issues; and

-

Improve insight into the organization, such as improved forecasting, higher degree of personalization, and targeted marketing.

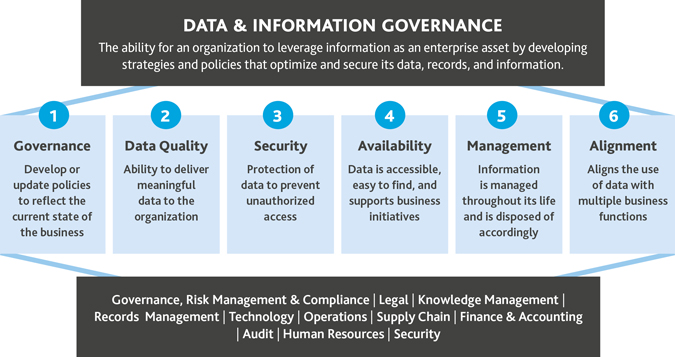

Establishing a general framework that aligns with your business is key to an effective data governance program. Equally important is a data governance committee focused on promoting enterprise information as a core asset to the business. BDO’s Data & Information Governance framework (seen below) focuses on governance, data quality, security, availability, management, and business alignment.

Generally, a highly functioning data governance committee should include the following members focused on tasks aligned with their role in the organization and specific responsibilities within the program. In smaller organizations, individuals may serve in multiple roles.

|

TITLE |

DATA GOVERNANCE COMMITTEE ROLE |

RESPONSIBILITIES |

|---|---|---|

|

Executive / Executive Director |

Executive Champion |

|

|

Executive Leadership Team |

Program Sponsors |

|

|

Director or Senior Manager |

Program Director/Manager or Program Owner |

|

|

Information |

Information Management / Records Management |

|

|

Human Resources (HR) Manager |

HR Constituent |

|

|

Cybersecurity Director or Executive |

Data Privacy and Protection Manager |

|

|

Chief Information Officer |

Technology Representative |

|

|

Legal/Senior Counsel |

Litigation and Discovery Manager |

|

|

Compliance Senior Director |

Regulatory Compliance Manager |

|

|

Marketing & Sales Manager |

Business Unit Manager or Knowledge Manager |

|

|

Site Champions |

Local/Regional Employees |

|

|

Outside Data and Information Governance Providers |

Data and Information Governance, Information Management, Records Management, Training, Security, and Information Technology Experts |

|

When establishing a privacy program, it is important to consider if the organization views privacy as donor- or customer-centric. This will help to determine where data that requires protection resides; its sources, types, and uses; and the applicable laws that govern it.

Effective data privacy programs are aligned with the business, with a clearly defined business case and key stakeholders. Creating a process for the program to interface with the business will help to drive a culture of data privacy and protection.

Within the privacy program framework, consider policies, procedures, standards and guidelines. Other considerations include:

-

Education and awareness – training employees and providing updates on evolving privacy requirements

-

Monitoring regulatory change – regulations applicable to your organization

-

Internal policies and compliance – enforcement of policies

-

Data inventories, data flows, and classifications – locations, use, and protection of sensitive data

-

Risk assessments – assessments required to evaluate vendors or internal products, including formal privacy impact assessments (method of evaluating privacy in information systems and collections)

-

Incident response – response plan to a security incident

-

Remediation – recovery plan from a security incident

-

Ongoing program evaluation and validation – performing regular program audits

Regardless of how your organization structures its privacy program, it is critical to stay current on local, national and international privacy laws. If you operate in more than one state or country, consider an automated process for privacy law alerts to help align your program with applicable laws and regulations. This is a critical function of the program as there are significant penalties for noncompliance. For example, organizations that do not comply with the European Union’s General Data Protection Regulation (GDPR) face fines up to 20 million Euros or four percent of annual global revenue, whichever is greater.

Once your privacy program is implemented, consider mechanisms to demonstrate success of the program. Metrics might include highlighting the program’s return on investment in terms of consistency and operational improvement:

-

Privacy risk indicators

-

Privacy impact assessment metrics

-

Reduced time for responses to data subject inquiries

-

Reduced incident handling – breaches, complaints, inquiries

-

Reduced disclosure to third parties

-

More effective records retention – data reduction by identifying redundant, outdated, or trivial information

-

Number of employees trained

Once the data privacy program has been implemented, the privacy operational life cycle will drive consistency, ongoing maintenance, and continuous improvement. Stay tuned for our Summer issue where we will share insights into the privacy operational life cycle.

For more information, contact Karen Schuler, partner, BDO National Data & Information Governance Practice Leader, at [email protected] or Mark Antalik, managing director, BDO National Data & Information Governance Practice, at [email protected].

Return to Table of Contents

Mission Matters

By Paul Jan Zdunek, MBA, PROSCI® Change Management Certified

A mission statement is more than mere words plastered on a website or at the top of an annual report – it represents everything an organization stands for and all that it can accomplish. It drives the organization and its work.

There is a cyclical ad infinitum relationship between a nonprofit organization’s mission, its impact, and its fundraising efforts.

Developing a powerful mission statement is critical to clarifying:

-

the core purpose for why the organization exists and its goals

-

what makes the organization different than the other 1.5 million nonprofits operating in the U.S., and

-

directional focus, serving as a guidepost for decision-making to keep actions on-point and avoid mission creep

While a powerful mission is critical to a nonprofit’s success, mission alone won’t bring funding to your door.

PROVE YOUR WORTH

How is your organization delivering on its mission? With fewer donors giving to fewer organizations today and donor retention declining, it’s more important than ever to showcase the impact of fundraising contributions. Donors are closely examining ROI— Return on (their) Investment—when deciding where to give. In this new Impact Era 2.0:

-

Successful nonprofits are using rigorous, data-driven evaluation to measure impact

-

Foundations are funding based on a nonprofit’s impact and also providing the tools to measure it

-

Overhead is finally being recognized as critical to an organization’s ability to achieve maximum impact

-

Board governance and executive leadership are being scrutinized for both effectiveness and efficiency

-

Performance-based bonuses are becoming an influential part of the new nonprofit workplace culture

BAKE IMPACT INTO MISSION STATEMENTS

A strong mission statement is more than a description of the organization or a plethora of cleverly constructed words and sentences that sound important. It must have impact and communicate impact. An effective mission statement:

-

Gets to the Point: be clear, clean and crisp about the unique mission and actions of your organization

-

Addresses What the World Needs: if your organization did not exist, would it matter?

-

States the Differentiator: compared to similar organizations in your space

-

Serves as a Guidepost: ensure mission creep, chasing money, never happens

-

Inspires: speak to the heart of your potential investors; where will their dollars go and why are their donations important?

-

Sticks: like an elephant in a tutu, your mission should be hard for stakeholders to forget

ONE ORGANIZATION GETTING IT RIGHT

charity: water is a force to envy in the nonprofit world. Their mission, work and impact are highly transparent, simple and powerful.

Let’s do a quick analysis of charity: water’s mission statement – it’s raison d’être: bringing clean and safe drinking water to people in developing countries:

-

Gets to the Point: 11 carefully-chosen words articulate the organization’s focus without getting mired in details

-

Addresses a Need: giving people access to a fundamental human need

-

Differentiates: “developing countries” indicates the work is in high-need areas that have limited resources

-

Inspires: this gets above politics, infrastructure challenges, and other problems with a simple message that stresses water is a basic human right

-

Sticks: both the name of the organization and its mission are simple and clear

How does this translate to charity: water’s influence and impact? The transparency and clarity used in the mission statement shines through in their website, communications and annual reports. They make it very easy to track how dollars are being put to use. It’s also clear that charity: water isn’t just “talking the talk.” Nearly every dollar donated goes directly to their projects, and founder Scott Harrison even has a separate fundraising initiative to cover organizational overhead.

The result? Donations have continuously increased since 2007.

Getting the mission right and articulating a powerful impact can help organizations elevate their voice above the noise—but will it lead to donations? How you ask for dollars can have a major influence on how many donations come through the door. (See Andrea Wilson’s article entitled, “Survival Tips for the New Era of Fundraising.”)

If your organization finds itself with a need to create or re-write its mission statement, remember the words of the great Martin Luther, “If you want to change the world, pick up your pen and write.”

So, pick up your pen and write an impactful mission statement that will change the world.

For more information, contact Paul Jan Zdunek, managing director, at [email protected].

Return to Table of Contents

Survival Tips for the New Era of Fundraising

By Andrea Wilson

For nonprofits looking to stand out in an increasingly crowded giving landscape, experimenting with new giving models and integrating new technology into your current campaigns could help you stand out from the crowd.If the bulk of your fundraising budget is still directed toward age-old direct mailing campaigns, consider diversifying and exploring a few of the following emerging trends.

MATCH DONOR BEHAVIOR.

What influences someone to donate to an organization? While many Americans make regular contributions to priority causes, successfully converting new donors takes a combination of two elements: (1) A compelling case for why your organization’s work matters, and (2) a clearly articulated value proposition, or the impact of their individual donation.

But a poignant campaign is only half the battle. If your organization relies solely on wire transfers or other slow processes to accept donations, you’re unlikely to see money pouring in. Nonprofits that limit the barriers to giving and update their donation channels to keep pace with consumer behavior are less likely to lose prospective donors midstream. Increasingly, that means optimizing online and mobile giving platforms.

According to Nonprofit Source, nearly half of millennials (47 percent) gave through an organization’s website in 2016. To facilitate painless giving, an omnichannel approach—so donors can give via their preferred means—is often the best solution.

GET YOUR NONPROFIT FRONT-AND-CENTER WHEN IT MATTERS MOST.

A new fundraising tool, Action Button, goes a step further to align with consumer behavior. The interactive technology pairs news stories directly with causes to help nonprofits reach potential donors when they are engaged in an everyday activity—reading the news—at a moment they might be organically inspired to give. A breaking news story on a hurricane’s landfall, for example, could have ‘action buttons’ integrated directly in the article itself that allow readers to donate to a natural disaster relief organization or take a quiz to test their knowledge on the impact of that nonprofit’s humanitarian work.

TAP INTO YOUR ANALYTICS.

Understanding the analytics behind fundraising could be an important differentiator for organizations. A good place to get started is digging into your own data. Are your campaigns driving more giving from women? Baby Boomers? High-net-worth (HNW) philanthropists? Familiarizing yourself with your core contributors can be valuable to identify who your current campaigns resonate with, and perhaps even more valuable, help you determine whether you’re overlooking a potential donor pool.

One step further than analyzing internal data, nonprofits should also explore leveraging publicly available data—posted to Facebook, LinkedIn, Twitter and other social media platforms—to more intentionally target potential donors with specific characteristics. This can be as broad as targeting donors of a certain age or educational background, or as specific as targeting individuals that “liked” or demonstrated support for similar causes or organizations on their personal platforms.

Successful organizations also use social media data to understand what’s going on with real people and forge connections. For example, a cure-based organization might send targeted messages to people that celebrate anniversaries of being cancer-free on social media. When deciding where to make charitable contributions, people often give money to organizations and causes that have personally impacted them or their loved ones.

As you consider how to integrate technology into your nonprofit’s fundraising activities, ask yourself:

-

Who are your target donors?

-

Are you overlooking a potential donor pool like Millennials?

-

Have you considered broadening your target demographic?

-

Do your giving platforms align with your donors’ behaviors and allow for seamless integration into their routines?

-

Are you leveraging publicly available data to forge or strengthen connections with people close to your cause?

Reprinted from the Nonprofit Standard blog and the Philanthropy Journal.

For more information, contact Andrea Wilson, managing partner, Nonprofit & Education Advisory Services, at [email protected].

Return to Table of Contents

How Do You Read and Understand Nonprofit Financial Statements?

By Lee Klumpp, CPA, CGMA

The answer to the question is a complex one, but each individual statement is equally important especially when used in conjunction with the footnotes. However; before we jump into explaining why each statement is important we must first understand why nonprofit (NFP) organizations are different from their for-profit brethren. NFPs are not owned by shareholders nor do they intend to earn profit to distribute back to shareholders. Instead, NFPs seek to earn revenue to support their program activities which are related to their mission. The mission is the key driver for NFPs, not a return of profit to its shareholders. (See the article entitled “Mission Matters.”) Financial statements are key components in revealing the financial health of an organization whether NFP or for-profit. An NFP’s financial information can get quite complicated, but if you understand the basics, you can glean vital information from the financial statements and related disclosures.

Nonprofits use four main financial reporting statements: statement of financial position (balance sheet), statement of activities (income statement), statement of cash flows and statement of functional expenses. Three of these statements are similar to for-profit company statements, with the exception that the statement of functional expenses is unique to NFPs because it is an analysis of expenses by both nature and function. Understanding the elements of these statements and how they relate to one another can help you understand an NFP’s financial position and what resources it has available and how the NFP deploys its resources.

STATEMENT OF FINANCIAL POSITION

The nonprofit balance sheet is also commonly referred to as a statement of financial position or statement of financial condition. This statement is based on the accounting formula, assets equal liabilities plus net assets. This equation is mirrored on a for-profit balance sheet; however, net assets are replaced with owners’ equity. The balance sheet offers the best overall perspective on the nonprofit’s financial health and stability. In particular, readers evaluate the relationship of assets to liabilities. One of the issues that blur NFPs’ financial statements versus for-profit entities’ is the ability to determine liquidity (working capital) because of donor restrictions on net assets.

The assets on a statement of financial position are classified as either current or non-current if the NFP has chosen to present a classified statement of financial position. Current assets are the most liquid, meaning they can easily be converted to cash in a relatively short period. Fixed assets are non-current since the assets are expected to be available for a term longer than 12 months form the measurement date (year-end). Similar to assets, liabilities are also classified as current or long-term based on the closeness to maturity. Current liabilities include money owed to creditors in less than a year. Long-term liabilities are due in one year or later. Net assets (equity) is the total amount of residual assets remaining in the NFP.

STATEMENT OF ACTIVITIES

Often referred to as the income statement since the term is more commonly associated with for-profit companies and earnings, the nonprofit statement of activities follows the basic formula: revenues less expenses equals the change in net assets. In a for-profit this is referred to as earnings. The nonprofit statement of activities shows the funds coming into the organization less the costs of operating the organization.

An NFP’s revenues, gains, expenses and losses are listed on its statement of activities. Revenue is money earned from an NFP’s normal business operations. The expenses on the statement of activities are the costs associated with earning the revenue. When an NFP sells one of its assets, it can experience a capital gain or loss because this activity is not part of its central and ongoing business activity. Revenues less expenses, plus gains less losses, equals the overall change in net assets. The dollar amount of the change in net assets listed on the statement of activities is also found on the cash flow statement under the operating activities section.

STATEMENT OF FUNCTIONAL EXPENSES

The statement of functional expenses is only used by nonprofit organizations based on the importance of monitoring expenditures. In general, this statement breaks down organizational expenses into common categories. This breakdown helps an NFP track how it spends its money. The statement also shows the breakdown of expenses between program services and support services. One of the reasons nonprofits track expenses is to report on the percentage of funds that go toward programs compared to funds spent on administration costs, such as employee salaries and fundraising.

STATEMENT OF CASH FLOWS

The statement of cash flows is similar to the one used by for-profit entities. The statement of cash flows presents operating, investing and financing activities to show the sources and uses of cash.

The cash flow statement can be presented using the direct method (the preferred method) or the indirect method, which is the one that is most commonly used. The direct method shows in the operating activities section the inflows and outflows related to cash flows provided by and used in operating activities. The indirect method starts with the change in net assets, followed by additions to or subtractions related to changes in the statement of financial position to adjust the change in net assets to a cash basis. The statement of cash flows is divided into four sections. The first section of the cash flow statement is cash provided by or used in operating activities, which shows the cash flows in and out of the NFP in relation to its mission-related operation. The second section, cash flows from investing activities, shows cash the NFP received from or spent on its capital investments. The third section, financing activities, shows the inflows and outflows of cash related to the NFP’s borrowing activities, which is also listed on the statement of financial position. The final and last section is the supplemental information which presents cash paid for income taxes and interest and the non-cash transactions.

FOOTNOTES

The footnotes or disclosures are just as important as the individual statements. The information in the footnotes allows the reader to obtain more information so they can truly understand the numbers in the various statements. The footnotes provide the accounting policies utilized in preparing the financial statements as well as information about the components of the numbers presented in the financial statements. The footnotes are critical to understanding the statements and should be read in detail.

For an in-depth look at reading and interpreting nonprofit financial statements and more about the new ASU, Presentation of Financial Statements of Not-for-Profit Entities, refer to the publication “How to Read Nonprofit Financial Statements,” authored by Lee and his colleagues at BDO.

For more information, contact Lee Klumpp, partner, National Assurance, at [email protected].

Return to Table of Contents

Updates to FASB Proposed Guidance for Contributions

By Lee Klumpp, CPA, CGMA

The Financial Accounting Standards Board (FASB) met in February 2018 to re-deliberate on the proposed Accounting Standards Update (ASU), Not-for-Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, which relates to revenue recognition of grants and contracts by not-for-profit (NFP) entities.

The FASB issued an exposure draft on Aug. 3, 2017, with an invitation for comment ending Nov. 11, 2017, receiving 56 comment letters. The proposed ASU clarifies the guidance on how nonprofits determine whether a transfer of assets is a contribution or an exchange transaction and how they distinguish between conditional and unconditional contributions. See the article entitled, “FASB Issues Exposure Draft on Accounting for Contributions Received and Contributions Made,” that outlines the proposed ASU in the Fall 2017 issue of the Nonprofit Standard.

The purpose of the proposed ASU is to address feedback that the FASB received from stakeholders related to the diversity in practice and the difficulties in determining whether grants and similar contracts are exchange transactions or contributions. That distinction is important because it determines whether an entity should follow the guidance for contributions received in Accounting Standards Codification (ASC) 958-605, Not-for-Profit Entities-Revenue.

Additionally, the proposed ASU would help organizations evaluate whether a contribution is conditional or unconditional, which affects the timing of revenue recognition. An unconditional contribution is recognized when received, while a conditional contribution is recognized when the barriers to entitlement are met.

Although the accounting for contributions primarily affects NFP entities, the proposed ASU would apply to all entities (including business entities) that receive or make contributions, including promises to give that are accounted for under ASC 958-605 and contributions made that are accounted for under ASC 720-25, Other Expenses-Contributions Made. The proposal would clarify that all entities should consider the guidance in ASC 958-605 when determining whether a transaction is a contribution or a transaction in the scope of ASC 606, Revenue From Contracts With Customers. However, the proposal would not apply to a business entity’s accounting for transfers of assets from government entities.

In its recent meeting, the FASB made the following decisions:

Conditional Contributions—Indicators to Describe a Barrier

The Board decided to clarify and refine the indicators to describe a barrier, including removing the additional actions indicator in the proposed Update.

Contributions Made by a Resource Provider

The Board affirmed that the guidance for distinguishing between conditional contributions and unconditional contributions should be similar for both a recipient and a resource provider.

Recurring Disclosures by Recipients about Conditional Promises to Give

The Board affirmed the existing disclosure requirements about conditional promises to give.

Simultaneous Release of a Condition and a Restriction

The Board decided that the simultaneous release accounting option for restricted contributions could be elected for conditional restricted contributions separately from unconditional restricted contributions.

Transition

The Board affirmed that the final amendments should be applied on a modified prospective basis following the effective date to agreements that are either (1) incomplete as of the effective date or (2) entered into after the effective date.

Effective Date

The Board affirmed that for recipients, the effective date of the amendments will align with Topic 606, Revenue from Contracts with Customers. The Board decided that for resource providers, the effective date will be delayed by one year.

Early Adoption

The Board affirmed that early adoption will be permitted.

Stay tuned for the final issuance of the ASU which is projected to be in the second quarter of 2018.

For more information, contact Lee Klumpp, partner, National Assurance, at [email protected].

Return to Table of Contents

Shaking Off the Stigma of Indirect Costs

By Andrea Wilson

The “burden” of indirect costs remains one of the top concerns for both nonprofit organizations and their donors. Faced with limitations on indirect cost recovery from private foundations, shrinking federal dollars, and the increasing costs of program oversight, organizations grapple with a number of serious and conflicting concerns in this area. How do organizations adapt to the changing regulatory and market environment in which they operate? While indirect costs are necessary expenses toward the management and viability of the organization, many donors view such costs as a “tax” to their sponsored programs, and most organizations struggle to overcome that preconception.

What are indirect costs and why is there so much discomfort and stigma around cost recovery?

One significant challenge in getting key stakeholders to understand the indirect cost paradigm is that there is no specific list of costs that are required to be indirect. This means that the organization itself defines which costs are designated as direct and indirect, based on its business structure, programs and other factors. While we generally see expenses such as executive wages, home office facilities and general accounting in the indirect cost category, there is no single method of defining which expenses should be included. Further complicating the discussion is multiple pools of costs, such as overhead and general and administrative (G&A) that organizations use to accumulate and allocate costs. The term “overhead” is generally used to describe the costs associated with maintaining the organization while G&A costs are typically those associated with operating and managing the programs. Collectively these make up indirect costs to the organization.

Direct expenses, on the other hand, are all those that can be connected to an ultimate cost objective, i.e., programs. Organizations can count direct and indirect costs differently even if they provide relatively similar services and are of relatively similar size. For example, some organizations treat the costs associated with procurement management as a direct expense while others include such costs as an indirect cost in their general and administrative rate, and some even have a separate “subcontractor and materials handling rate.”

This very simple, yet real, example can have significant consequences on the underlying indirect cost rate of the organization. In the first instance, where procurement is a direct charge to the program, the indirect cost rate goes down, but the total direct charges increase. In scenario two, the reverse is true, direct expenses go down and indirect expenses increase. Yet in the third scenario, when procurement is treated as a separate pool, the overall overhead rate goes down with the inclusion of a marginal subcontractor and material handling rate. These examples illustrate that the same exact cost, in absolute terms, can be treated at least three different ways, each with differing impact to the indirect cost rates of the organization.

There is no doubt that the complexity and diversity in methodologies contributes greatly to the stigma surrounding indirect costs. In budget preparation and presentations to donors inclusive of federal agencies, indirect costs are typically presented as a rate, i.e., percentage of cost. From a donor’s perspective, there is a great deal of scrutiny involved in analyzing the direct expenses of an award, and yet at the end of the budget, there is a percent of cost, sometimes substantial, that has very little to do with the intent of the award. Hence, many donors truly believe that indirect costs are a “tax” to programs.

In the U.S. federal context, many organizations have a cognizant oversight agency that reviews the organization’s indirect cost rate annually. However, the group that manages this rate is different from those that review and award grants and contracts. Organizations with complex federal and non-federal donor mixes are tied to their federal indirect cost rates for the entirety of the organization, thus making oversight by their private donors nearly impossible. Further, very few private foundations have a verification process of indirect cost rates. Worse yet, many donors put caps on indirect cost recovery, or negotiate a rate less than the true indirect recovery rate of the organization, thereby creating a starvation cycle for organizations. If the organization is federally funded, this could also result in a non-compliant application of their indirect cost methodology.

How do organizations overcome the stigma?

-

Implement cost-cutting measures to reduce indirect costs serves the immediate purpose of lower indirect cost rates, often making organizations more competitive on programs.

-

Reconsider your structure. Many sophisticated organizations have several segments with varying rates, or multiple consolidating entities enabling them to have multiple rates to comply with the varying programs’ needs and donor requirements.

-

Consider adding in service center allocations that move costs from your indirect costs to your direct expenses. For example, if an organization adds an IT service center which is allocated based on headcount, the cost of IT is moved out of the indirect costs and is moved to the direct expenses of the programs. The impact reduces the overall indirect cost rate.

-

Look for different methodologies with which to allocate your costs. Some organizations have varying methods for more equitable distribution of indirect expenses, which serves to help donors evaluate indirect costs. For example, instead of allocating indirect expenses based on program expenses, look for a more appropriate driver based on your programs, such as direct beneficiaries, etc.

-

Add additional notes to your budgets and requests for funding. While several donors have ceilings on indirect expenses, many do not. Do not simply apply your rate, but rather explain its composition and application. Let donors know these are real expenses and explain why they are necessary to the organization.

Reprinted from the Nonprofit Standard blog.

For more information, contact Andrea Wilson, managing partner, Nonprofit & Education Advisory Services, at [email protected].

Return to Table of Contents

The Great Act – Transforming How the Government Uses Grant Reporting Data

By Lee Klumpp, CPA, CGMA

The 115th Congress has been busy with tax reform but has managed to introduce a proposed bill H.R. 4887 (“Grant Reporting Efficiency and Agreements Transparency Act of 2018” or “GREAT Act” or the “Act”) on Jan. 29, 2018, by Representatives Foxx (R-N.C.), Gomez (D-Calif.), Issa (R-Calif.), Quigley (D-Ill.), and Kilmer (D-Wash.). Three other members have signed on to the bill since it was introduced. The bill is currently before the House Committee on Oversight and Government Reform.

The sole objective of the Act is to modernize federal grant reporting by standardizing the information recipients submit to agencies. It is believed by its sponsors that the GREAT Act will transform federal grant reporting from disconnected documents into open data by directing the executive branch to adopt a standardized data structure for the information grantees must report to agencies. By replacing outdated documents with open data, the GREAT Act is intended to deliver transparency for grant-making agencies and the public and allow grantees to automate their reporting processes, thereby reducing compliance costs.

The GREAT Act would require the creation of a comprehensive and standardized data structure, or “taxonomy,” covering all data elements reported by recipients of federal awards, including both grant and cooperative agreements.

The sponsors of the Act believe that it can achieve and accomplish the following:

-

Modernize reporting by recipients of federal grants and cooperative agreements by creating and imposing data standards for the information that grants and cooperative agreement recipients must report to the federal government.

-

Implement the recommendation by the Director of the Office of Management and Budget, under Section 5(b)(6) of the Federal Funding Accountability and Transparency Act of 2006 (31 U.S.C. 6101 note), which includes the development of a “comprehensive taxonomy of standard definitions for core data elements required for managing federal financial assistance awards”.

-

Reduce burden and compliance costs of recipients of federal grants and cooperative agreements by enabling technology solutions, existing or yet to be developed, by both the public and private sectors, to better manage data recipients already provide to the federal government.

-

Strengthen oversight and management of federal grants and cooperative agreements by agencies through consolidated collection and display of and access to open data that has been standardized and, where appropriate, transparency to the public.

The proposed legislation tasks the Director of the Office of Management and Budget (OMB) and a leading grant agency, that will be designated when the bill has passed, with implementation. The implementation goals are as follows:

-

Within one year: Establish government-wide data standards for information related to federal awards reported by recipients of federal awards.

-

Within two years: Issue guidance to grant-making agencies on how to leverage new technologies and implement the new data standards into existing reporting practices with minimum disruption.

The bill directs OMB and a leading grant agency to publish grant reporting information, once transformed into open data, on a government-wide website, such as the existing grants.gov portal. It provides exceptions and restrictions, including:

-

No personally identifiable or otherwise sensitive information will be published.

-

Information not subject to disclosure under the Freedom of Information Act (Title 5, Section 552) will not be publicly disclosed.

-

The OMB Director to permit exceptions on a case-by-case basis.

The Act would require each grant-making agency to begin collecting grant reports using the new data standards within three years.

BENEFITS

The sponsors of the GREAT Act believe that the federal government, the funding agencies, recipients and the public will all benefit from the Act’s implementation in the following ways:

-

Reduce recipient compliance costs by automating the compilation and submission of reports to federal agencies.

-

Create a single consolidated data set of post-award reports for federal grant recipient information applicable to all grant-making agencies and programs.

-

Foster increased federal and public oversight and transparency into the distribution of federal funding.

-

Facilitate the adoption of modern technologies for grant reporting.

For more information, contact Lee Klumpp, partner, National Assurance, at [email protected].

Return to Table of Contents

Possible Update to the GAAP Definition of a Collection

The Financial Accounting Standards Board (“FASB” or “the Board”) has decided to add a project to its agenda to address the misalignment of the collections definition between the Accounting Standards Codification (ASC) Master Glossary and the American Alliance of Museums’ (“AAM”) definition. This project would help address the difficulties that museums have been encountering in determining the value of their collections, which include collections, artwork, artifacts and historical treasures in complying with the AAM’s policies in order to receive their accreditations from AAM.

The differences in the two definitions is outlined in the excerpts from the full definitions below:

ASC Master Glossary:

Works of art, historical treasures, or similar assets that are subject to an organizational policy that requires the proceeds of items that are sold to be used to acquire other items for collections.

AAM definition:

Disposal of collections through sale, trade or research activities is solely for the advancement of the museum’s mission. Proceeds from the sale of nonliving collections are to be used consistent with the established standards of the museum’s discipline, but in no event shall they be used for anything other than acquisition or direct care of collections.

The ASC criterion requiring that collection sales proceeds be used to buy other items for the collection, however, does not reflect the AAM’s guideline that the proceeds from a sale of a collection can also be used for the direct care of current collections. As a result, museums have been confused about what is in the AAM’s policy guidelines against the FASB’s definition of a collection under ASC Topic 958.

At the March 28th meeting, the Board completed its deliberations on this topic and decided the following:

1. To add the concept of direct care to the definition of collections in order to align the definitions in the ASC Master Glossary and the American Alliance of Museums’ Code of Ethics for Museums.

2. That the change in definition should be applied on a prospective basis.

The Board then directed the FASB staff to draft a proposed Accounting Standards Update (ASU) for vote by written ballot and decided that the comment period for the proposed ASU will be 45 days. Stay tuned for updates on the proposed ASU.

Return to Table of Contents

SHARE