2020 BDO Biotech Briefing

Table of Contents

Collaboration & R&D Prioritization: Key Industry Focal Points

Sharing is critically important in life sciences this year.

While free-flowing collaboration and focused innovation have long been lofty ideals of biotech and pharma, because of the COVID-19 pandemic, they’re now imperatives to doing business. With new mandates come new funding pressures, a need to get even tougher on pipeline decisions and a heightened risk environment.

The pandemic is far from the only driver of change, however. Public pressure to curb product prices amid mounting R&D costs, looming patent expirations threatening to usher in new competitors, and shifting reimbursement models have weighed on biotech and pharma companies for some time, pushing them to rethink traditional ways of doing business.

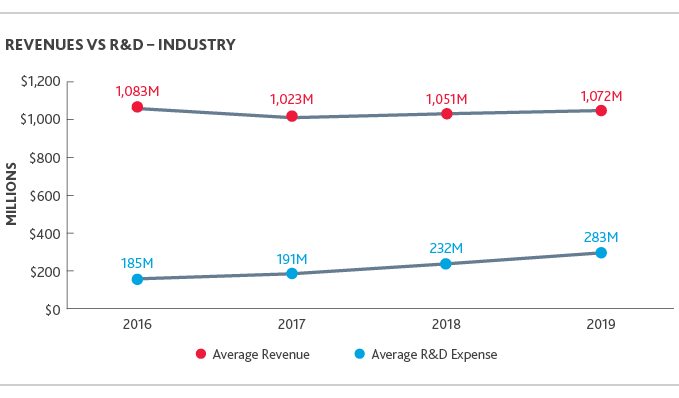

These pressures are showing in the way R&D expenses are either outpacing or increasing at almost the same rate as revenue across the industry.

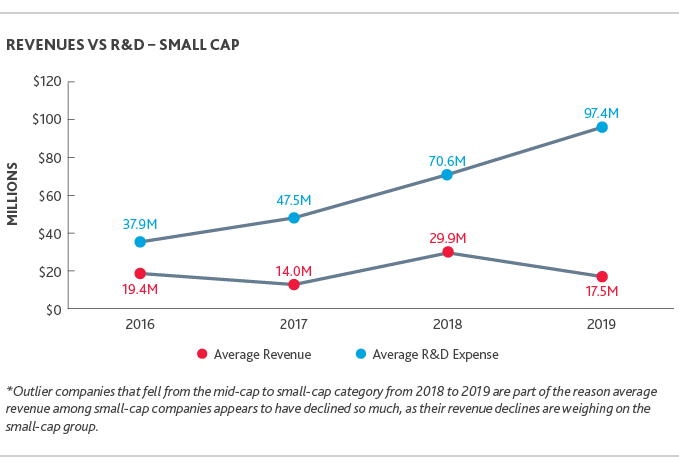

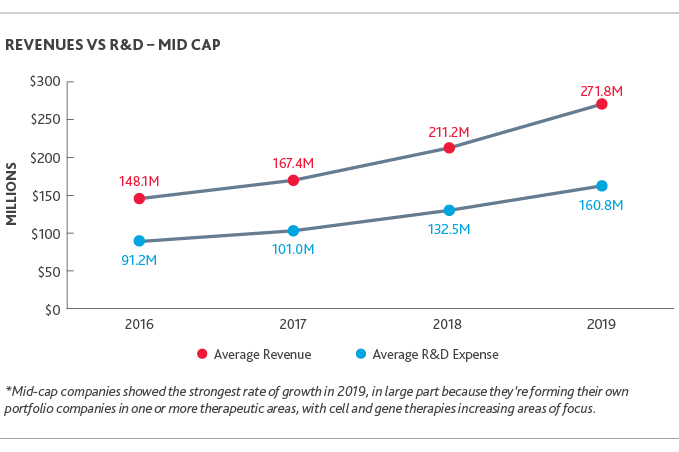

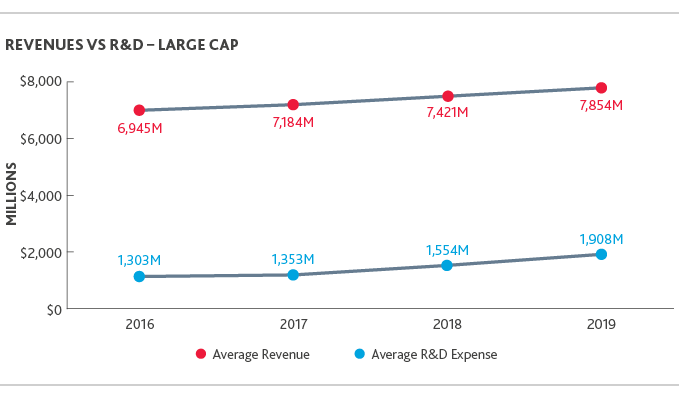

Companies listed on the NASDAQ Biotechnology Index (NBI) saw a modest 2% growth in average revenue to $1.072 billion in 2019 from $1.051 billion in 2018, while average R&D expenses increased almost 22% from $232 million in 2018 to about $283 million in 2019, according to the 2020 BDO Biotech Briefing, which analyzes the latest 10-K SEC filings of NBI companies as a bellwether of the industry. In 2019, small-cap companies saw average R&D expense increase about 38% compared to 2018, while average revenue declined 41%. Mid-cap companies saw an R&D expense increase of about 21% and revenue increase of 29%, while large-cap companies saw an R&D expense increase of about 23% with a revenue increase of about 6%.

Now, amid skyrocketing cost pressures that will only intensify, organizations face new challenges—and opportunities—around innovating collaboratively.

At least 30 countries and numerous institutions around the world have signed up to support the World Health Organization (WHO) and Costa Rica’s COVID-19 Technology Access Pool (C-TAP). C-TAP, centered on five key elements of scientific collaboration, aims to make vaccines, tests, treatments and other technologies that help combat the virus publicly accessible.

C-TAP’s 5 Key Principles

|

|

|

1. Public disclosure of gene sequences and data |

|

|

|

2. Transparency around clinical trial results |

|

|

|

3. Inclusion of clauses in funding agreements between governments and other funders with pharma companies and other innovators addressing equitable distribution, affordability and publication of trial data |

|

|

|

4. Licensing of COVID-19 products to the UN-backed public health body Medicines Patent Pool, working to increase access to and facilitate development of critical medicines for low- and middle-income countries |

|

|

|

5. Promotion of open innovation and technology transfer models that boost local manufacturing and supply capacity |

Live Examples of Collaboration & Innovation in Crisis

Biogen & VirBiogen, which was listed on the NBI in 2019, entered into an agreement in May 2020 with infectious disease company Vir Biotechnology for cell line development, process development and clinical manufacturing. Vir is working to develop a monoclonal antibody which it believes could bind to COVID-19 to prevent or help treat future infections. |

||

Eagle Pharmaceuticals & Hackensack University Medical CenterEagle Pharmaceuticals, also listed on the NBI in 2019, submitted an investigational new drug application to the FDA in April 2020 for a phase 2 clinical trial in partnership with Hackensack University Medical Center to evaluate the efficacy of its product in coronavirus-infected patients. |

||

CLIENT SPOTLIGHT:Nephron PharmaceuticalsInnovation is happening outside of the NBI too. BDO client Nephron Pharmaceuticals is an example of a life sciences company that has repurposed its supply chain to address the most pressing public health issues. The company has stepped up its manufacturing of respiratory medication, increasing production capacity by 20% with FDA approval of a new production line. It has also donated more than 400,000 vials of respiratory products to Americares, a disaster relief nonprofit. |

In January, a team of Chinese and Australian researchers published the first genome of the virus—critical to research in support of a vaccine—making the virus’s genetic map freely available to researchers around the world. As of May 13, according to the WHO, the virus had already been sequenced more than 3,000 times.

Engineers, doctors and computer scientists at MIT have been working to create a low-cost ventilator. A group of Indian engineers took up the ventilator’s open-source design as they worked to build ventilators to help address their own country’s shortage.

The White House Office of Science and Technology Policy, the U.S. Department of Energy and IBM, meanwhile, have launched the COVID-19 High Performance Computing (HPC) Consortium, a private-public effort to provide access to the world’s strongest high-performance computing resources to support COVID-19 research.

Moderna Therapeutics also secured almost $500 million from the U.S. Department of Health and Human Services to accelerate the development of its mRNA vaccine candidate.

Such collaboration and innovation across the entire life sciences sector will continue to be critical to combating COVID-19, particularly as the world prepares for additional waves of the outbreak.

“Sharing information across and beyond traditional boundaries is no longer a nice-to-have. It’s a must-have. In the race to develop a vaccine against the virus and therapeutics to better manage its symptoms, life sciences organizations that break down organizational silos and reprioritize or repurpose products in their R&D pipelines to focus on the most pressing public health needs—while managing new risks the pandemic has created—will come out of this crisis stronger.”

|

TODD BERRY, CPA |

Maximizing Innovation Through Tax Transformation

Because of the urgent need to innovate quickly around COVID-19 amid growing R&D expenses, being able to protect—and stretch—the financial resources that are available by maximizing R&D tax credits and understanding COVID-specific tax relief measures has become critically important.

Capitalizing on R&D Credits

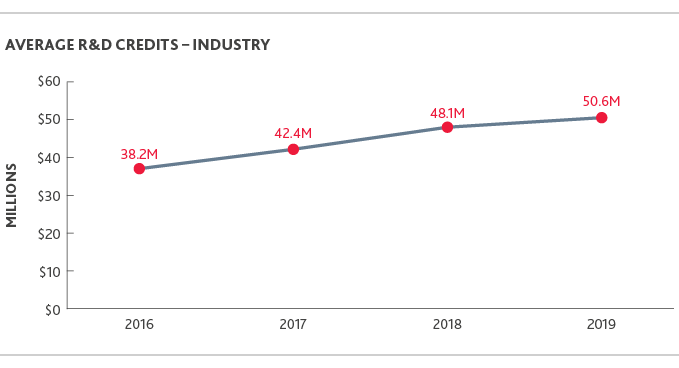

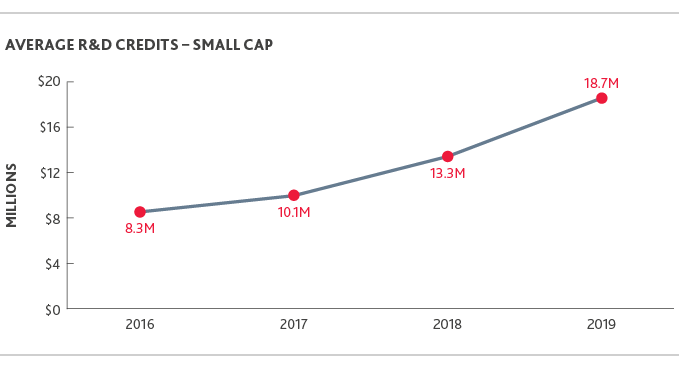

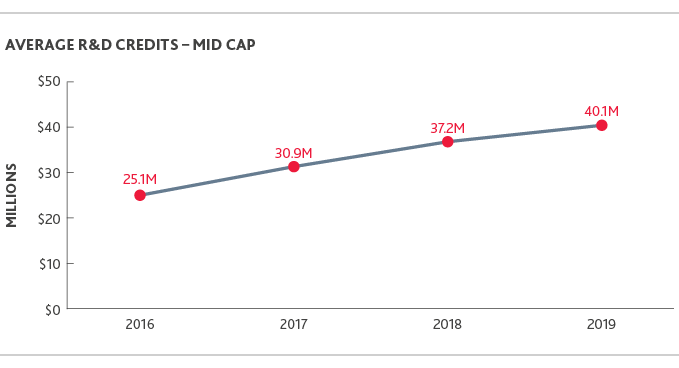

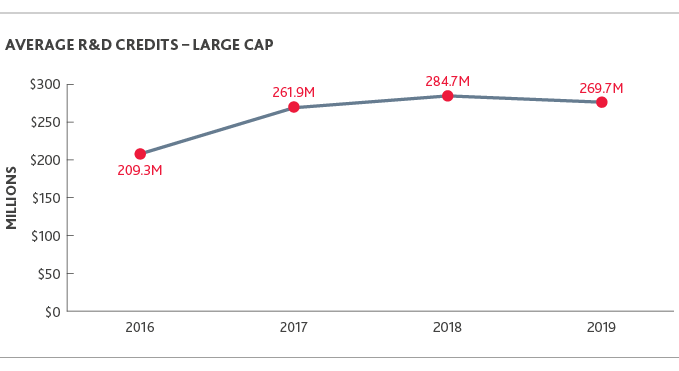

Among companies listed on the NBI, BDO’s analysis shows that biotech claims on R&D tax credits ranged from $500K to $500M, and average R&D credits increased 5% from 2018 to 2019. This underlines the effect of certain changes included within the Tax Cuts and Jobs Act (TCJA).

The law cut the corporate tax rate from 35% to 21%, in effect increasing the research credit’s net benefit by more than 21% from its previous 65% to the law’s 79%. It also requires companies to capitalize and amortize certain R&D expenditures paid or incurred in a tax year beginning after Dec. 31, 2021 over a five-year period, which could translate to companies recording higher income levels and in turn, higher tax liabilities. Small- and mid-cap companies, which must navigate greater levels of financial uncertainty compared to their large-cap counterparts, showed the highest jumps in R&D credits received in 2019, indicating that many may be racing to capitalize on R&D credits before the 2021 change takes effect.

“R&D is often the difference between growing or folding for life sciences—and it’s never been more important. With rising R&D costs amid tightening revenues and an economic downturn, organizations must be able to maximize the financial resources they do have to develop COVID-19 and other products in a financially viable way. Capitalizing on state, local and federal R&D credits is key.”

|

CHRIS BARD, CPA |

Though many businesses are claiming R&D tax credits, each year, billions more go unclaimed at the federal, state and local levels because companies don’t fully understand the credit.

At the federal level alone, however, any organization working to develop new or improve existing products, processes or software is eligible for R&D tax credits, especially if it’s in support of the fight against COVID-19.

Though certain exclusions do apply, activities generally qualify for the federal R&D tax credit if they meet each element of the following criteria:

|

The purpose of the activity is to improve the functionality, performance, reliability or quality of a product, process, software, technique, invention or formula (“component”) that is intended to be used in the taxpayer’s business or held for sale, lease or license. |

|

|

The taxpayer encounters uncertainty regarding whether it can or how it should develop the component, or regarding the component’s appropriate design. |

|

|

|

To eliminate the uncertainty, the activities include evaluating alternatives through modeling, simulation, systematic trial and error, or other methods. |

|

|

The success or failure of the evaluative process is determined by the principles of engineering, physics, chemistry, biology, computer science or similar natural or “hard” sciences, as opposed to principles of sciences like economics, consumer preferences, etc. |

Companies Leverage NOL Carryforwards

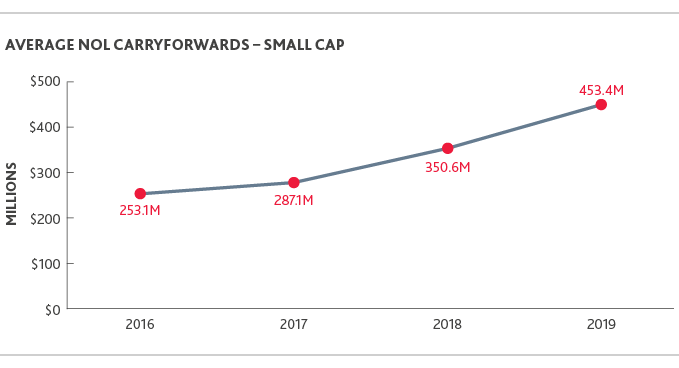

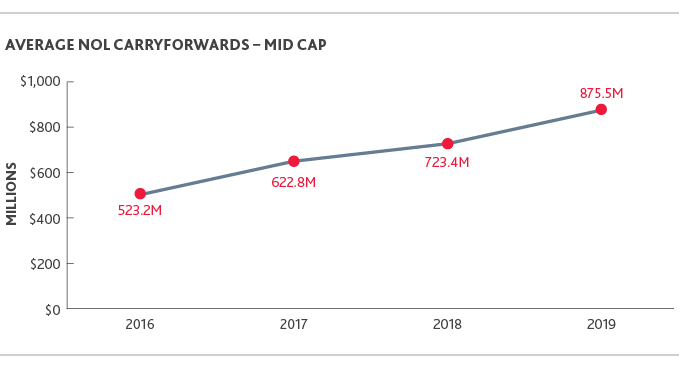

Net operating loss (NOL) carryforwards, which also received an overhaul through the TCJA, showed notable increases across both small- and mid-cap companies. NOL carryforwards among small-cap companies increased 29%, and among mid-cap companies, 21%. Among large-cap companies, which historically had already been leveraging NOL carryforwards, they declined about 10%. For tax years ending after Dec. 31, 2017, the TCJA allows for the indefinite carryforward of NOLs, which can offset taxable income to reduce a company’s total tax liability.

Looking ahead, the number of companies leveraging NOL carryforwards in 2020 and beyond is likely to increase following March 2020 changes from the Coronavirus Aid, Relief and Economic Security Act (CARES Act). While the TCJA limited NOLs to 80% of taxable income in any one tax period, the CARES Act temporarily removes this 80% limit for taxable years beginning before 2021 to allow an NOL carryforward to fully offset an organization’s income.

Additionally, the CARES Act allows NOL carrybacks for tax years beginning in 2018, 2019 or 2020 for up to five years, with the goal of allowing organizations to update prior returns and use losses which can free up new sources of much-needed cash during the downturn.

For life sciences organizations that may be feeling heightened financial impacts during the pandemic or pausing certain R&D projects to instead focus on development of critical COVID-19 products, the NOL carryforward and carryback can be helpful to lowering overall tax liability while supporting liquidity.

“Biotech and pharma companies have an opportunity to capitalize on the changes from the CARES Act. To effectively respond, they must evaluate whether they manufacture a product that could be critical in a public health crisis, what their timeline for an R&D pipeline looks like in light of expedited approval processes, and how they could support new supply chain reporting processes. Those able to successfully pivot innovation pipelines around these questions will realize new opportunity and can capitalize on government funding mechanisms in the process.”

|

LANCE MINOR, MBA |

Refocusing Your R&D Pipeline to Align with Federal Funding Opportunities

To increase chances of capitalizing on R&D credits and maintaining financially viable innovation, biotech and pharma must closely examine their current pipeline and decide where to press pause, where to repurpose and where to increase spending. To make those decisions, they should prioritize projects addressing the most urgent public health needs, using the CARES Act as a guide.

The CARES Act

-

Awarded $80 million to the FDA to overhaul its regulatory process to allow for innovation and improved safety and effectiveness of a category of drugs that includes products like acetaminophen and hand sanitizer—both of which play a critical role in combating the spread and symptoms of the virus.

-

Granted the FDA permission to expedite its review process for animal drugs that have the potential to treat zoonotic diseases (those that can be transferred from animals to humans) that can seriously threaten public health, such as COVID-19.

-

Enacted new reporting requirements for drug manufacturers related to drug shortages, requiring them to implement a risk management plan and prepare annual reports for each drug they produce.

-

Directed the National Academies of Sciences, Engineering and Medicine to carry out a report on the security of the U.S. medical supply chain, which will serve as the basis for recommendations and suggestions to confront and remedy supply chain vulnerabilities that could be detrimental to public health.

-

Allocated $3.5 billion to the Biomedical Advanced Research and Development Authority (BARDA) for necessary expenses of manufacturing, production and procurement of vaccines, therapeutics, diagnostics and small molecule active pharmaceutical ingredients (API). The funds can be used for the development, translation and demonstration at scale of innovations in manufacturing platforms.

-

Distributed $706 million to the NIH’s National Institute of Allergy and Infectious Diseases, including $156 million for the study, construction, demolition, renovation and acquisition of equipment for vaccine and infectious disease research facilities of or used by the NIH.

Moving forward, the FDA in particular has signaled that, to the extent that the innovations and adaptations it has implemented during the pandemic worked and would make sense outside of it, the agency will incorporate them into standard procedures. The agency has also vowed to remove unnecessary barriers identified during the pandemic.

The pandemic and certain specifics of the CARES Act also point to a growing need to develop products that help us better understand, protect against and treat zoonotic diseases. The industry is likely to see greater levels of investment—and a new flurry of M&A activity—around biotech and pharma companies able to develop or contribute to the understanding of new treatments, processes or software that help do this.

Back to Top

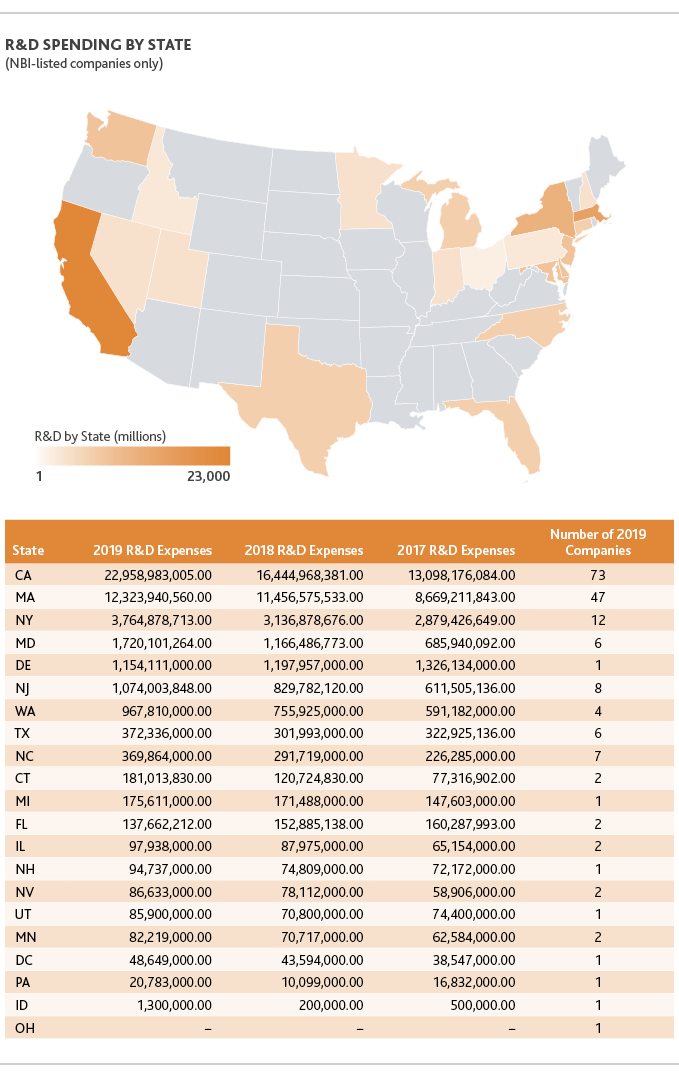

R&D Spending by State

(NBI-listed companies only)

California, Massachusetts and New York are once again the top markets for total R&D investment when reviewing total state-by-state R&D spend based on location of company headquarters. Home to many of the country’s academic research hubs and with tax environments conducive to industry innovation, these states have historically been leaders in the biotech and pharma spaces. They are home to many of the country’s leading academic research hubs, and they have abundant infrastructure in lab facilities, hospitals, incubators, venture capital and National Institutes of Health funding.

Specifically, California is driven in large part by big pharma, which contributed $15 of the $23 billion in 2019 R&D spend including $13.2 billion by Amgen and Gilead, collectively. Gilead’s investment in Galapagos constituted about $4 billion of the $6.5 billion increase in R&D spend from 2018 to 2019.

Looking Ahead

Promising Outlook for Debt & Equity Financing

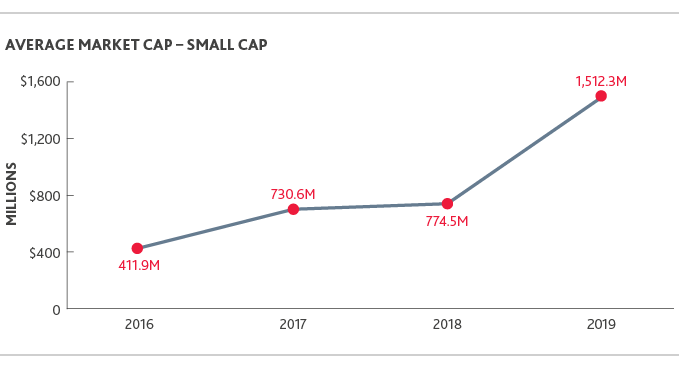

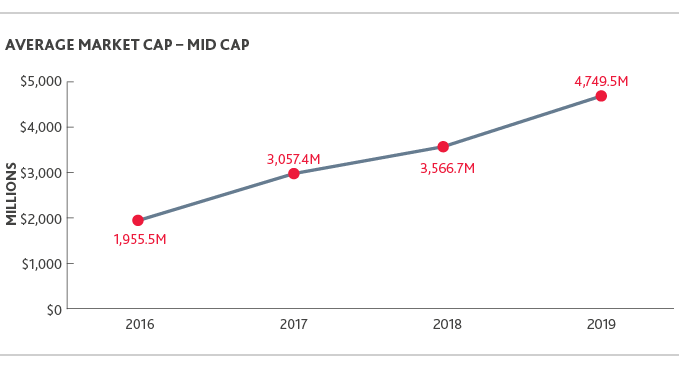

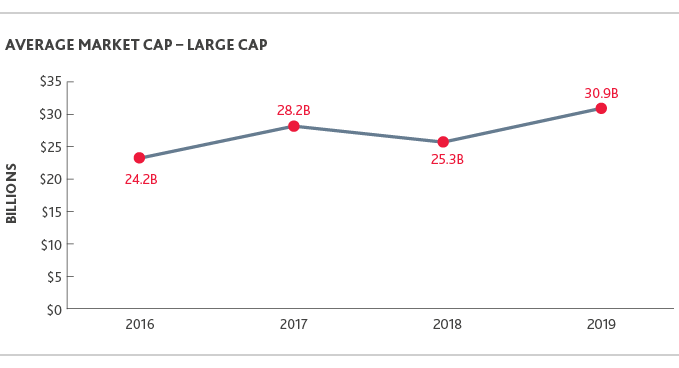

In 2019, companies on the NBI at every size saw their average market cap increase from 2018 levels, with small-cap companies growing the fastest. Compared to 2018, small-cap companies’ average market cap grew about 95%, mid-cap about 33% and large-cap about 22%.

Looking ahead, 2020 looks to be a robust one for both equity and debt financing in biotech and pharma overall, despite the pandemic. As of May 29, the amount of high-grade corporate debt issued this year had reached more than $1 trillion, double the pace of 2019, according to CNBC. On the heels of the Federal Reserve’s March 16 action to cut its target interest rate to near zero, organizations are racing to restructure and pay down existing debts and boost capital to survive the downturn.

The NBI price hit its lowest 2020 point at $2,947.85 in March 2020 when the first reports of outbreaks had reached the United States, according to MarketWatch. On July 9, 2020, however, the index closed at $4,413.06, close to its 52-week high of $4,468.19 and indicating that it had largely recovered.

“With the Fed effectively making debt cheaper, industry debt financing is likely to continue to surge as biotech and pharma companies work to invest heavily in COVID-19 R&D despite financial struggles during a downturn. Equity financing is likely to follow a similar path, as investors flock to stocks of biotech and pharma companies showing promising COVID-19 vaccine progress or other therapeutics and products.”

|

|

BOB SNAPE |

Small-Caps Seek New Opportunities

Though small-cap NBI-listed companies saw the fastest growth in 2019 compared to their mid- and large-cap counterparts, they may face the tough road ahead in the current climate, as their revenues—highly dependent on non-recurring licensing fees and equity financing—continue to be unpredictable in today’s environment.

The pause in clinical trials, the success of which small-cap companies are largely dependent upon, has hampered companies from moving products through development and on to the commercial phase—where revenue is actually generated. The good news is that the equity markets are holding up, IPOs continue to close and venture funding continues to be robust albeit somewhat soft in the early-stage deals. In addition, as smaller companies look for opportunities to survive and larger companies seek new products or technologies in up-and-coming product categories, this trend could spur a new flurry of M&A activity and investment opportunities.

Companies taking advantage of the favorable funding environment by going public include Legend Biotech, which in mid-June raised nearly $424 million from its IPO, with plans to use it to support clinical development and manufacturing of its myeloma cell therapy, according to Xconomy. Lantern Pharma, meanwhile, also went public, raising about $26 million to support its R&D focused on cancer drugs, and Generation IPO raised about $200 million through its IPO, among others.

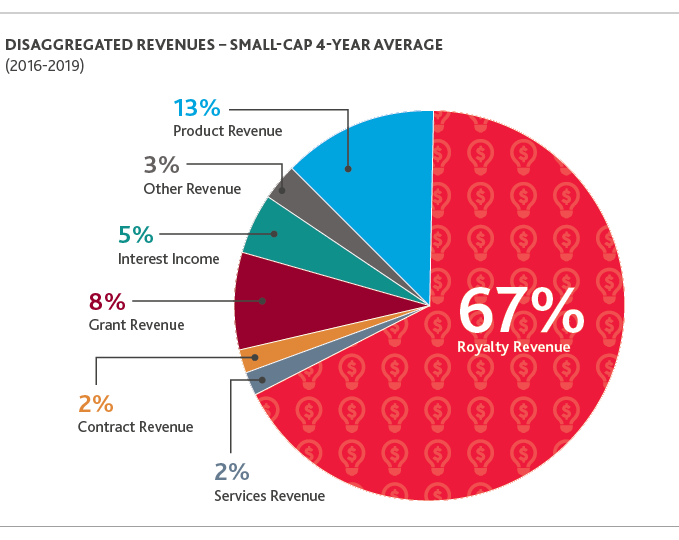

Royalty revenue, including from collaborative licensing agreements, accounted for 67% of NBI small-cap companies’ average revenue from 2016-2019 and the percentage of royalty revenue is likely to increase among small-cap companies. Strapped for cash, a target of larger companies and considering the greater cross-industry collaboration amid COVID-19, well-positioned small-cap companies are likely to engage in a greater number of licensing agreements.

“On the one hand, we expect the pause in clinical trials to cause revenue declines in certain product categories in the coming year, especially areas being deprioritized by the FDA right now. On the other hand, as smaller companies look for opportunities to survive and their larger counterparts seek new products or technologies in up-and-coming product categories, this trend could spur a new flurry of M&A activity and investment opportunities.”

|

PATTI SEYMOUR, MBA, CSCP |

Collaborative Licensing Agreements & Tax Implications

Collaboration agreements often involve smaller biotech or pharma companies teaming with larger entities to develop research into commercially viable products. Such agreements may involve the licensing of products or technology from one party to another in combination with some degree of joint development, and they can have significant tax implications.

“Taxation of collaboration agreements requires consideration of all aspects of the deal, commonly, including up-front, milestone and royalty payments. Facts and circumstances that can impact the ultimate tax treatment of each of these payments for both collaborating parties can vary from deal to deal. Financial reporting complexities that can affect the effective tax rate underscore the importance of risk management in such transactions-an area of increased interest among board members. A 2019 BDO survey as well as new university research finds that board members who play an active role in the risk management of their companies’ tax functions are often rewarded with more favorable effective tax rates and lower tax uncertainty. Proactive tax planning that considers short and long term forecasts and business changes will serve as valuable insight to management and stakeholders.”

|

ELENI LAGOS, CPA |

Leading Out of Crisis

Though the worst of the initial COVID-19 outbreak appears behind us, the world will continue to navigate potential follow-on waves in the coming months. All communities and businesses will need to do their part to flatten the curve and work towards a longer-term solution beyond social distancing measures.

Life sciences must lead the way—both in terms of protecting against this specific virus and other zoonotic diseases likely to come.

Those organizations that enable thoughtful collaboration, prioritized R&D and appropriate risk mitigation will be the guiding lights.

Have Questions? Contact Us

Investment banking products and services within the United States are offered exclusively through BDO Capital Advisors, LLC, a separate legal entity and affiliated company of BDO USA, LLP, a Delaware limited liability partnership and national professional services firm. For more information, visit www.bdocap.com. Certain services may not be available to attest clients under the rules and regulations of public accounting. BDO Capital Advisors, LLC is a FINRA/SIPC Member Firm.

SHARE