The Impact of Hurricanes on Florida Insurance Claims: Irma, Michael and Beyond

Insurers experienced dramatic development of claim estimates for 2017’s Hurricane Irma in 2019, 2020 and now 2021. And during the 2018 hurricane season, Hurricane Michael hit Florida with another destructive event. The claim costs that developed from these two storms provide significant insight into the challenges facing the Florida insurance market—especially for those predominantly writing homeowner policies.

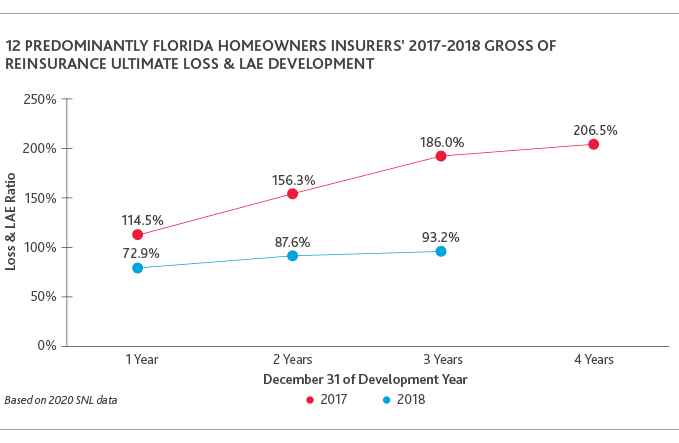

The following graph compares ultimate loss and loss adjustment expense (LAE) ratios for 12 such insurance companies at each year-end evaluation since the accident years for Hurricanes Irma and Michael.

While the ratios are not isolated to claims for Hurricanes Irma and Michael, these catastrophes make up a large portion of the claims in 2017 and 2018, respectively. Although an additional year has passed since Irma, the trajectory of the claims development is much different to date from Michael.

Florida Insurance Market Factors

Before describing specific storms, we review several dominant factors in the development of claims in Florida—specifically, assignment of benefits, public adjusters, demand surge, and various regulations that have historically contributed to a challenging environment for insurers in Florida. Legislative reforms, described in a later section, were passed recently to address abuse related to these market factors.

Assignment of Benefits

An assignment of benefits (AOB) agreement transfers insurance benefits from the policyholder to a third-party assignee, usually a water extraction company, roofer or plumber. AOB relieves the homeowner of responsibility of dealing with the insurance company and allows the experienced third-party to maximize the claim to both the insured and the service company’s benefit. Assignees not acting in good faith, however, may inflate claim costs and charge insurance companies for unnecessary repairs or repairs not performed. Historically, fraud has been difficult to contain with one-way attorney fees deterring insurers from disputing all but the most questionable claims. While AOB has spread, AOB lawsuits are concentrated in the tri-county area of South Florida that includes Miami-Dade, Broward and Palm Beach Counties.

Public Adjusters

Public adjusters often specialize in insurance claims associated with catastrophes. These claims specialists help settle insurance claims on the behalf of policyholders. They advertise their services to provide maximum claim settlements.

Demand Surge and Higher Loss Adjustment Expenses

Demand surge can dramatically increase the cost of repair and replacement of damaged property when one or multiple large-scale disasters lead to shortages of materials and labor. Sometimes only emergency repairs can be completed and as the temporary repairs deteriorate, more repairs are often needed, adding to the ultimate cost. Adjuster resources also become more expensive when demand exceeds supply, resulting in higher loss adjustment expenses.

Regulation

Various Florida regulations require damaged homes to be built to new, higher safety standards. For example, the 25% rule requires that a roof is replaced if more than 25% of tiles are damaged. Historically, these regulations have had an inflationary impact on repair bills.

As part of the 2011 sinkhole reform bill, Florida limits the first notice window to three years for windstorm or hurricane loss and five years for other types of claims. Some suggest that the later reported claims may be more fraudulent.[1] Also, according to HCI Group’s Q1 2021 earnings call, late claims are more likely to become lawsuits, which increases insurer expenses. The company further indicated in the earnings call that the percentage of claims that went into lawsuit increased from 9% if filed in year 1 to 34% of claims filed in year 2. More than 50% of claims filed in year 3 are already in lawsuit.

Hurricane Irma

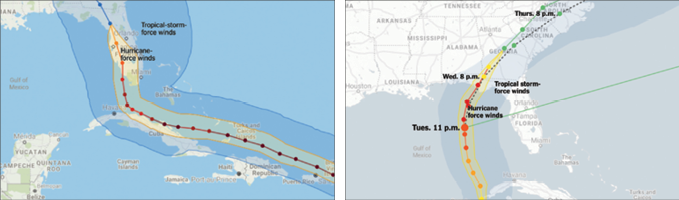

Hurricane Irma hit the Florida Keys on September 10, 2017 as a Category 4 storm and then took on Category 3 status before making landfall again in western Florida. Irma weakened quickly over the mainland, causing widespread but relatively minor damage across most of the state.

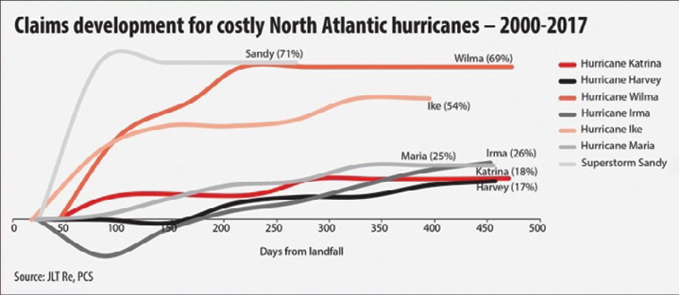

The 2017 hurricane season was the most expensive in U.S. history. Before Irma, Category 4 Hurricane Harvey overwhelmed eastern Texas in late August, and two weeks after Irma, Category 5 Hurricane Maria devastated Puerto Rico. Claims estimates for all three of these hurricanes experienced large amounts of adverse development. Property Claims Services (PCS) figures on U.S. insured losses suggest a 26% loss creep on Hurricane Irma 450 days after landfall (from the lowest estimate in late January 2018), 25% on Maria and 17% on Harvey. PCS’s initial estimates for Hurricane Irma were set at $18 billion ($13.1 billion in Florida), which were cut to $15 billion in late January 2018 and subsequently raised to $19.5 billion in late May 2018.

As shown in the chart above, Irma and Harvey still had a positive slope 450 days after landfall, while the other listed storms had completed much of their development.

Individual insurers continued to experience tremendous development, or “loss creep,” because they were initially less conservative than the modeling firms. This could be seen by multiplying market share percentages to modeled estimates in early 2019.[2] With a majority of the loss development ceded to reinsurers, direct writers may have focused less on gross estimates early on for the 2017 storms.

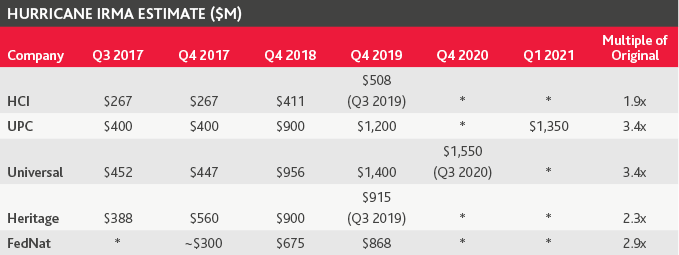

Specific development of gross Irma losses per earnings releases of public insurers includes the following:

*No update provided

With adjustments still being made in late 2020 and into 2021, it is not clear if the adverse development related to Irma has finally leveled off. In BDO’s analysis of client data, an increase in reported claims immediately before Irma’s three-year filing deadline was followed by a significant reduction in new reported claims afterward.

Hurricane Michael

Hurricane Michael struck the Florida Panhandle on October 10, 2018, as a Category 5 hurricane, causing near-total destruction across its path. The flat, swampy terrain did not disrupt the storm’s core, and Michael stayed strong even as it came 50 miles inland. The pressure at landfall was 919 millibars, similar to Hurricane Andrew (1992) at 922 millibars. Hurricane Irma’s pressure at landfall was 931 millibars.

The 2018 hurricane season was above average but not exceptional, experiencing only one other major hurricane (Florence). PCS’s initial estimate for Michael was $7.1 billion. According to reinsurer Guy Carpenter, the estimates developed adversely by approximately 45% through August 2019. Aon raised its estimate from $6 billion to $10 billion initially, and then to $11 billion at Q1 2019.

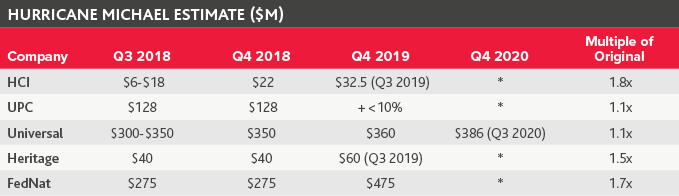

While Michael is still approximately a year less mature than Irma, its development has not been as impactful. Compared to the changes in Irma estimates, the gross estimates per the following public companies’ earnings releases have been far lower.

*No update provided

Damage from Irma Compared to Michael

Hurricane Irma caused many small, inflatable claims, while Michael caused many total losses that were not good candidates for claim inflation. According to November 2020 data from the Florida Office of Insurance Regulation (FLOIR), the average incurred claim size for Michael was $57,441 ($9.1 billion for 159.000 claims), while Irma only averaged $18,368 ($20.7 billion for 1.13 million claims).

Irma was part of the worst hurricane season in U.S. history and could be an exceptional case of demand surge and higher-than-expected loss adjustment expenses. Roof damage has been especially troublesome for Irma claims because of tile shortages. Michael-related claims were reported in only 15 counties in the Florida Panhandle, while Irma impacted the entire state’s 67 counties. The tri-county area—the most impacted by the AOB crisis and making up 27.7% (312,000 out of 1.13 million) of claims for Hurricane Irma—was not hit by Hurricane Michael. While the final claim costs have not yet been tallied, there is reason for optimism that Michael will not see the same levels of late development as Irma.

Source: The New York Times

Looking Ahead

Intending to curb AOB abuse and unnecessary litigation, the Florida legislature passed reforms HB 7065/SB 122 effective July 2019.

In June 2021, SB 76 and SB 1598 became law. SB 76 reduces the filing time for first notices of loss for all claims to two years from the date of loss, which may reduce fraud. It also replaces one-way attorney fees with a statute that makes the recovery of attorney fees and costs contingent on obtaining a judgement for indemnity that exceeds the pre‑suit offer from the insurance company by at least 20%. It also restricts the ability of contractors and public adjusters to provide incentives, for instance a free meal for performing a roof inspection.

SB 1598 requires public adjusters to be licensed by the state of Florida, and they are no longer allowed to be paid by contractors or attorneys.

Lessons learned from Hurricane Irma, Michael and others are encouraging insurers to make efforts to reduce coastal exposure and, thus, exposure to hurricanes. With this in mind, there is cautious optimism that losses stabilize more quickly for future hurricanes in Florida, but insurers will need to act quickly, as the anticipated overactive hurricane season is already underway.

[1] “Hurricane Irma’s ‘Last Gasp’: 3-Year Claims Deadline Put to the Test,” Insurance Journal, September 10, 2020.

[2] “Models to stay the same despite post-Irma creep,” Insurance Insider, March 19, 2019.

SHARE