M&A Outlook for Insurance Brokers

The COVID-19 pandemic has had a deep and lasting impact on almost every facet of society, changing the way we conduct business and interact with customers. However, despite the significant upheaval and uncertainty the pandemic caused across the business environment, the insurance industry quickly adapted to the new normal.

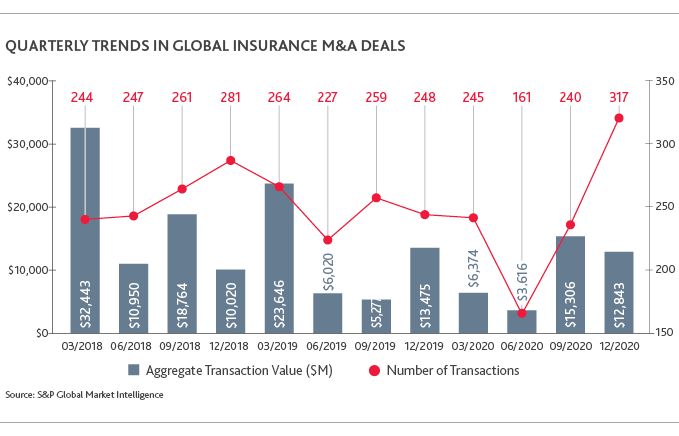

As one might expect, global insurance M&A deal activity was severely disrupted by the pandemic in Q2 20. Perhaps less foreseeable was the way in which volume rebounded in H2 20. According to S&P Global Market Intelligence data in the chart on the next page, transactions plummeted by 34% from Q1 to Q2 20. Surprisingly however, volume rebounded in Q3 to 240 deals before spiking to 317 deals in Q4.

The quick recovery worldwide was mirrored in the U.S. when deals that were held up during Q2 were finally consummated. Favorable Fed policy and easy access to capital, as well as concerns over potential changes in tax policy post-election, provided strong tailwinds.

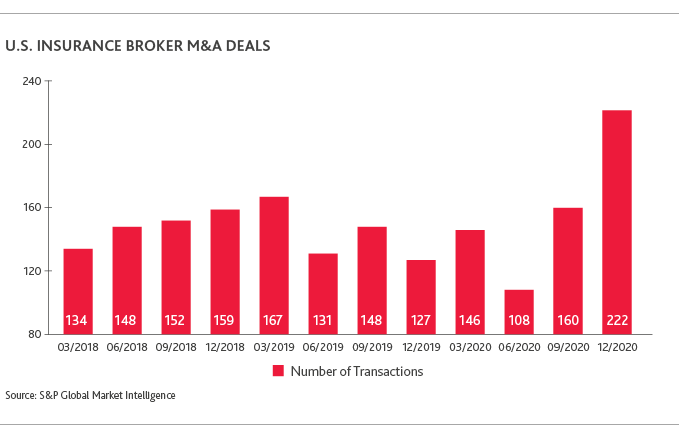

Similarly, within the U.S. insurance brokerage sector, while the pandemic slowed M&A activity significantly in Q2 20, the sector bounced back to finish the year with more than double the number of deals (108 in Q2 20 versus 222 in Q4 20), per the chart below.

The rebound in insurance broker M&A is partly driven by stable economic fundamentals in the industry, but also an abundance of available capital. “Going into the pandemic, private equity firms were already sitting on record levels of capital, allowing them to aggressively pursue M&A opportunities once the capital markets stabilized Q3 20,” said Jonathan Roberts, managing director of Transaction Advisory Services at BDO. “Together with record low interest rates and a fragmented industry ripe for consolidation, insurance brokers and claims administrators continue to be very attractive targets for PE investment.”

In BDO’s inaugural outlook, we look at the factors that are likely to drive 2021 M&A activity in the insurance industry and how brokerages can best position themselves to capitalize on these trends on both the buy- and sell-side.

COVID-19, Climate Change and New Products Will Propel P&C and Life Insurance Demand

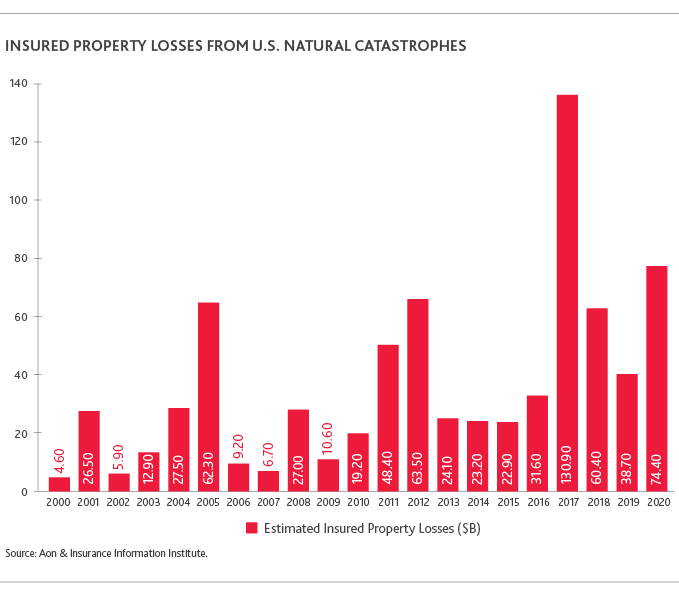

Prior to the pandemic, the property & casualty sector (P&C) was already beset with lower insurance premiums and increased claims due to a different, but equally serious threat—an increase in natural catastrophes due to climate change. According to Aon, natural catastrophe insurance losses in the U.S. rose to $74 billion in 2020, up 88% from 2019 and the highest since 2017, driven in part by losses stemming from Hurricane Laura and the Californian wildfires.

The full impact of COVID-19 on claims is yet to be fully realized, but initial losses were partially offset by reduced claims in personal lines, primarily auto, as remote working and lockdown restrictions reduced claims activity. Further, civil unrest across the U.S. in 2020 resulted in insurance losses in excess of $1 billion. Combined together, 2020 was a significant year for claims activity in the U.S., resulting in the continuing uptick in premium rate increases and a hardening of the market.

For the life insurance sector, sales had been declining for several years. However, in the wake of COVID-19, the sector is seeing steady growth in sales and premiums, as the crisis has highlighted the importance of financial safety nets in an uncertain world.

“The events of 2020 were a stark reminder to businesses and individuals of the need for, and importance of, insurance,” said Imran Makda, national insurance practice leader at BDO. “From life insurance, to property and casualty insurance, to cyber risk insurance, increases in demand should harden rates and drive continued premium increases.”

As a consequence of events in 2020, insurers are also expected to roll out new products designed to address risks uncovered during the pandemic. The move to remote working and the continuing digitization of our everyday life has made cyber threats, and insurance against such threats, a critical market. The ability for insurance brokers to work new product offerings through its existing networks will position them for continued growth in 2021.

Top Acquisition Targets Will Have Robust Digital Transformation Strategies

As was the case before the pandemic, technology and digital transformation will continue to play important roles in the evolution of the insurance industry landscape and the M&A market. A robust digital transformation strategy should greatly enhance a broker’s negotiating position, as they can leverage their advanced technology strategy into becoming the platform for roll-up acquisitions—making them more attractive to potential suitors.

High on the list of acquisition targets will be those brokerages that support a technology strategy that leverages data analytics to enhance customers’ digital experience and engagement throughout the life of their policy. Leaders at insurance brokerages should be looking to increase customer retention and develop new sources of revenue through digital channels, by leveraging AI and data analytics to facilitate cross-selling and up-selling.

How do brokerages build up their digital transformation capabilities when technology is not their core competency? For much of the past decade, the emergence of insurtech was seen as a threat to both brokers and carriers. More recently, however, brokers and insurtech startups have sought to partner. Many insurtechs are formed to improve or enhance specific elements of brokerage services, not to provide those services themselves. At the same time, brokerages can use the opportunity to expand solutions like machine learning and AI-driven customer service without the related time and cost of building those capabilities in-house.

Industry Fragmentation Presents Opportunities for Consolidation and Economies of Scale

One impetus behind the expected uptick in insurance industry M&A activity in 2021 is the continued consolidation of companies in what is still a fragmented business. As of 2018, there were 36,500 independent insurance agencies in the U.S., according to the Independent Insurance Agents and Brokers of America’s (IIABA) 2018 Agency Universe Study. Many smaller insurers may seek out acquisitions by larger companies.

This fragmentation, along with the healthy outlook for the industry, is expected to draw more attention from PE investors, still flush with record levels of excess capital, or “dry powder.” The biggest acquirers in the sector are PE backed, including Assured Partners, Acrisure and Hub, with PE funding 70% of all U.S. broker transactions in FY20, according to OPTIS. This growing appetite from PE in the insurance services market will continue to drive competition for assets and increase deal prices.

SPACs Emerge as a New Source Of Buyers

Market fragmentation is also one factor of interest from special purpose acquisition companies (SPACs). SPACs are publicly-traded companies established to raise money in order to buy another company. Andrew Poole, a high-profile SPAC sponsor, told an audience at a recent symposium that increasing premiums, hard commercial lines pricing, low interest rates and pressures caused by the pandemic, in addition to fragmentation, make insurance one of the “most exciting sectors” for SPAC transactions.

Monetary Policy and the Political Environment: A Mixed Bag

Interest rates that had been on the rise throughout 2019 were driven back down to zero as part of economic stimulus efforts. While higher interest rates benefit insurance providers that rely on fixed-income investments for passive income, a low interest debt environment is a boon for M&A.

On the political front, M&A activity in Q3 20 and Q4 20 may have been partly driven by potential changes in long-term capital gains tax policy, driving some family-owned businesses to consider selling before the end of the year. However, the effect appears far less significant than in 2012, when similar changes that went into effect on January 1, 2013, resulted in a large volume of M&A activity prior to that date.

Recent changes in political leadership could lead to the rollback of the corporate tax cuts passed in 2017, and any changes in tax policy would likely affect M&A activity in the months and years ahead.

The impact of COVID-19 on insurance broker M&A activity barely registered as a flash crash. However, savvy insurance brokerage leaders can find themselves well-positioned to take advantage of new opportunities and circumstances left in the wake of the pandemic’s upheaval and will be in a strong position to benefit from M&A activity going forward.

SHARE