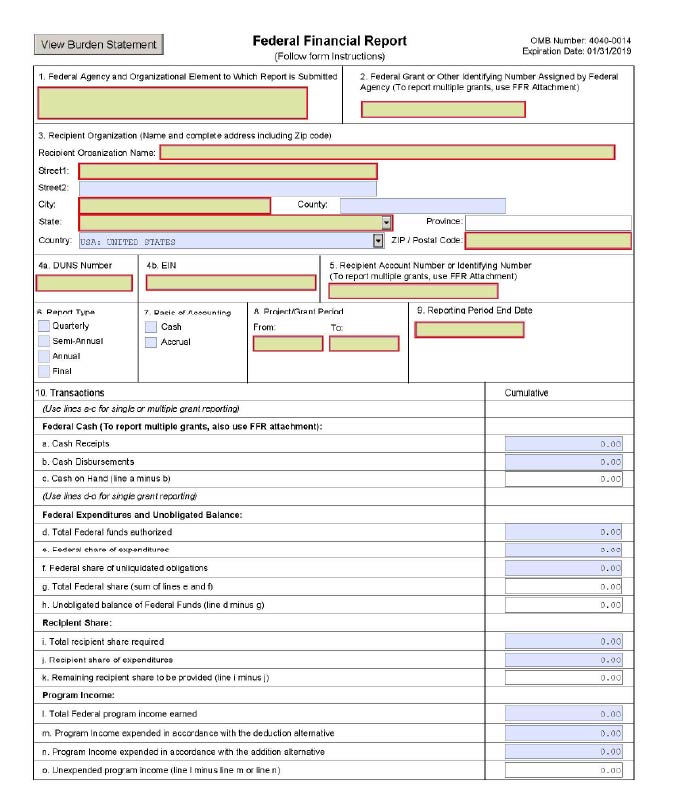

PIH Notice 2025-20 was published by the Department of Housing & Urban Development (HUD) and provides instructions and deadlines for submitting the required Federal Financial Report (FFR) also known as Standard Form 425 (SF-425). The SF-425 is a required Office of Management and Budget (OMB) financial reporting form to track the status of financial data tied to a singular Federal grant award. On October 9, 2008, OMB published the SF-425. Pursuant to the Federal Financial Assistance Management Improvement Act of 1999 (P.L. 106-107), OMB directed agencies, such as HUD, to use the SF-425 to report the financial status of grants and cash transactions using those funds. As of October 1, 2009, all Federal agencies and Federal grant and cooperative agreement recipients were required to use the SF-425 for financial reporting unless OMB approved otherwise. This requirement was moved to 2 CFR 200.328 and HUD must implement this regulatory requirement. HUD now is under pressure by the OMB to implement the reporting on SF-425. The reporting will be effective for CY 2026 Operating Subsidy grants that will start in April 2027.

The reporting on SF-425 is going to begin with calendar year (CY) 2026 operating subsidy, for each Asset Management Project (AMP). The SF-425 will be submitted in the Operating Subsidy Portal, similar to submitting HUD Forms 52722 and 52723 for Operating Subsidy. The Period of Performance (also known as the Grant Period) for each grant year shall be the period beginning with the Public Housing Authority (PHA) initial receipt of grant funds [typically a calendar year regardless of the PHA’s fiscal year] and ending on the date identified in the annual Operating Subsidy Processing Notice, which is currently seven years. For example, the expenditures for Operating Subsidy grant for CY 2026, would be reported in the Operating Subsidy Portal by April 30, 2027. The PHA will be required to report on the expenditures from January 1, 2026 through December 31, 2026, regardless of the PHA’s fiscal year, by April 30, 2027. The PHA will be required to report on grant activity, each year, until the earlier of the PHA submitting a zero balance of unobligated funds, unliquidated obligations, and cash on hand, or the termination of the annual contribution contract (ACC).

- Unobligated Funds represent the balance of Federal funds reported as unobligated by the PHA in their SF-425 submission, [no planned uses of grant funds].

- Unliquidated Obligations can either be on a cash basis where obligations have been incurred but not yet paid, or an accrual basis, where obligations have been incurred but require the expenditure to be recorded.

- Cash on Hand is the cumulative amount of cash drawn down from the Line of Credit Control System (LOCCS), also known as eLOCCS, less the sum of actual cash disbursements for direct charges for goods and services, the amount of indirect expenses charged to the award, and the amount of cash advances and payments made to contractors.

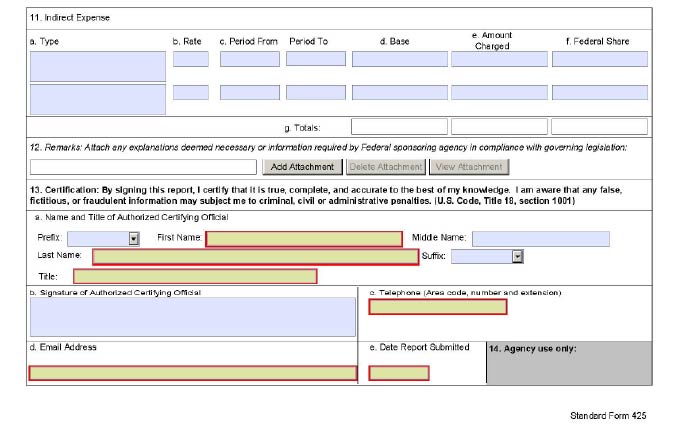

The Notice goes on to explain that PHAs must submit a supplemental response on line 12 of SF-425 any time their Cash on Hand amount is greater than the amount they will disburse within the next three business days from submission. HUD just wants this amount for information purposes only and the PHA will not be penalized. 24 CFR 990.210 allows PHAs to draw 1/12 of their subsidy monthly. PHAs are not permitted to obligate or expend any grant funds after the Period of Performance (currently 7 years).

Any grant funds not obligated by the end of the Period of Performance must be returned to HUD. If the PHA did draw the funds from eLOCCS, but did not spend them in 7 years, the PHA will be required to send the funds back to HUD. If the PHA did not draw the funds from eLOCCS, then the PHA will be locked out from making any draws from eLOCCS.

Any grant funds obligated by the end of the Period of Performance must be liquidated by the following April 30th. The PHA cannot liquidate any obligations after that specified date. Any obligations not liquidated by this date must be returned to HUD. Grants for which there are funds remaining as of April 30th, the year after the end of the Period of Performance will be locked in eLOCCS and the PHA will not be able to draw down any additional grant funds.

Obligated grant funds must be liquidated by April 30th following the end of the Period of Performance (after the seventh year). If a PHA reports unobligated funds, unliquidated obligations, or cash on hand in their SF-425 as of the end of the Period of Performance, the PHA must submit an additional SF-425 to track the status of these unresolved funds. This additional report must cover the period ending April 30th, the liquidation deadline (January 1st to April 30th). The additional SF-425 must be submitted to HUD by August 30th following the end of the Period of Performance. The additional SF-425 makes sure that HUD has the necessary oversight of any unresolved funds after the liquidation deadline. HUD will recapture any funds reported as unobligated, unliquidated obligations or cash on hand for grants in which an SF-425 must be submitted by August 30th following the end of the Period of Performance. Recaptured funds are not reported on the SF-425. The final SF-425 must show all funds obligated, all obligations liquidated and indicate that no cash is on hand. If HUD recaptures funds based upon a PHA’s August 30th submission, the PHA will be required to submit an additional SF-425 covering the period ending December 31, which is required to be made by the following April 30th.

The SF-425 will report program income also. Program income includes rental income, non-rental income from a program asset, interest earned on rental income, and third-party agreements. Program income is not; operating subsidy, capital funds, personal property disposition proceeds, real property disposition proceeds, insurance proceeds, and interest earned on federal grants. Currently, the Notice does not stipulate the program income must be fully expended to stop reporting the SF-425.

PHAs are now required to track the revenue and expenses of grant funds and program income separately to properly report on SF-425. PHAs will have to track grant funds received and spent as well as program income. Program income must be spent first prior to spending any grant funds. At this time HUD did not clarify if program reserves or grant reserves that has accumulated at the PHA prior to CY 2026 will impact the order of expenditures for year 2026 and going forward. We are fairly certain that HUD will clarify their position on the order of operating expenditures and make the reporting prospectively, starting with CY 2026. Operating reserves accumulated prior to CY 2026 are not part of order of operating expenditures requirement and will not be reported on SF-425. Regardless, the PHA needs to create a schedule on how to track these funds. Below is a schedule that can be used that would roll forward each year. The reason to separate Rental Income from Non-Rental income that Non-Rental income can be used for Section 8 purposes per the statute and we expect HUD to clarify this in upcoming guidance (FAQ). This will get challenging for PHAs because it is seven years of tacking that may be required. For example, if a PHA has 3 AMPs and it takes seven years to expend the funds at each AMP, then the PHA can have 21 grants (3 AMPs x 7 years of grants = 21 grants) they have to monitor each AMP’s grant year until the funds are fully expended. This can be an enormous administrative burden that would be required for day-to-day accounting activities as well as reporting the SF-425 in the operating subsidy portal. This will make it more difficult for PHAs that are a fiscal year versus a calendar year. Below is an example that can be used to track this activity to reduce the administrative burden. Another area of concern is tracking submitting interest earned on grant funds. Interest earned over $500 must be returned to HUD annually. The PHA has the flexibility to choose their fiscal year or calendar year to coincide with the annual SF-425 requirements to return interest income.

| AMP1 – CY 2026 | |||

| Rental Income | Non-Rental Income | Operating Subsidy | |

| Rental Income | $ | $ | $ |

| Other Income | |||

| Subsidy | |||

| Interest Income Sub | |||

| Interest Income Other | |||

| Total Income | |||

| Operating Costs | |||

| Fixed Assets | |||

| (Interest Returned HUD) | |||

| Total Expense | |||

| Funds Carried Forward | $ | $ | $ |

In addition to tracking funding, the PHA will also be required to track obligations.

| Obligations – AMP 1 – CY 2026 | |

| Funds Authorized | $ |

| Amount Expended | |

| Amount Obligated | |

| Amount Remaining | $ |

| Obligations – AMP 1 – CY 2027 | |

| Funds Authorized | $ |

| Amount Expended | |

| Amount Obligated | |

| Amount Remaining | $ |

PHAs are responsible for retaining financial records in accordance with 2 CFR 200.302(b)(3) which requires that records sufficiently identify the amount, source, and expenditure of Federal funds for Federal awards. These records must include details necessary to identify Federal awards, such as authorizations, financial obligations, unobligated balances, assets, expenditures, income, and interest. Additionally, all records must be supported by source documentation. HUD requires that beginning with Calendar Year 2025 grants, the record retention period for Operating Fund grants will be the longer of:

- Five fiscal years after the fiscal year in which the PHA receives funds, or

- Three years from the date the PHA submits a final SF-425 showing all funds obligated, drawn down, and liquidated.

If HUD determines that a recipient has failed to comply with its financial accounting, documentation, and reporting responsibilities, HUD will impose additional conditions or sanctions under 2 CFR 200.208 and 200.339, including:

- Requiring the PHA to switch from advance payments to reimbursement for Operating Subsidy disbursements.

- Mandating the PHA to obtain technical or management assistance.

- Requiring prior HUD approval of vouchers.

- Disallowing costs in whole or in part.

- Terminating the recipient’s Federal assistance.

Before taking any enforcement actions, HUD will:

- Notify the PHA of the findings and proposed compliance actions, and

- Provide the PHA with an opportunity, within a prescribed period of time, to respond with arguments, additional facts, or supporting documentation relevant to the findings.

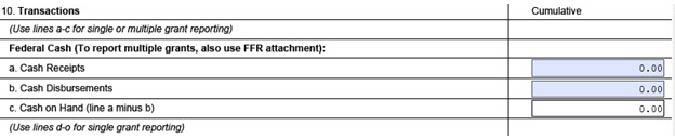

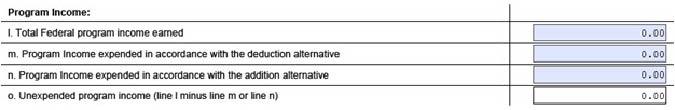

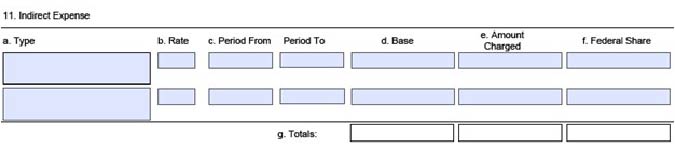

Below is a brief overview of significant fields of SF-425. A form will be completed for each AMP for each grant year

Field 10 a.-c. represents the cumulative cash drawn from eLOCCS less grant cash that was actually expedited

Field 10 d.- h. represents the cumulative amount of grant funds that was expended and other expenditures that were actually incurred or accrued, but not yet paid

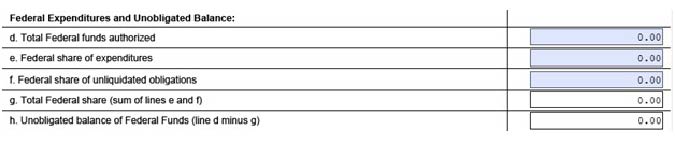

Field 10 i.- j. will likely be removed from the form for operating subsidy reporting purposes or the PHA will report zero

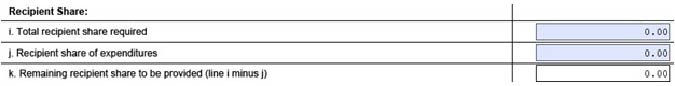

Fields10 l-o represent program income earned with deduction alternative and the additional alternative. The deduction alternative represents rental income and the addition alternative represents non-rental income (other income). Both are considered program income

Field 11 is expected not to be used for operating subsidy reporting.

Contact us today to talk about the Operating Fund Federal Financial Report, SF-425, Order Of Operating Expenditures and how BDO can assist your PHA with instructions and submission deadlines.

BDO’s Public Housing & Affordable Housing practice has served over four hundred housing organizations and is a premier provider of industry education to staff, executives, and HUD employees.

For more information on our service offerings, visit BDO Public Housing & Affordable Housing.