The Resilience Playbook: From Recession to Recovery & Beyond

The novel coronavirus (COVID-19) caught the entire world unawares. Officially named a global pandemic by the World Health Organization (WHO) on March 11, 2020, the coronavirus outbreak continues to plague the U.S., taking a toll on human lives and shutting down entire sectors of the economy in an effort to contain community spread.

At some point, this will end, the economy will recover, and life will return to some semblance of normal. Many companies will endure and get back to business as usual. But if we are to learn anything from this crisis, it should be that returning to “business as usual” must not be our only objective. We must take steps to ensure we are better prepared to combat the next crisis to come, whatever form it takes. The goal, as we persevere and ultimately emerge from this crisis, should be to get to better than usual. Because after the outbreak abates—whether in three months or in 12—the world will not look the same. The behaviors we adopted in crisis will persist in some shape or form beyond the pandemic. New opportunities and threats will emerge.

In short, business as usual will no longer cut it. It’s the businesses that start thinking now about what the post- COVID-19 landscape will look like—and make plans accordingly—that will be poised to thrive in crisis and beyond.

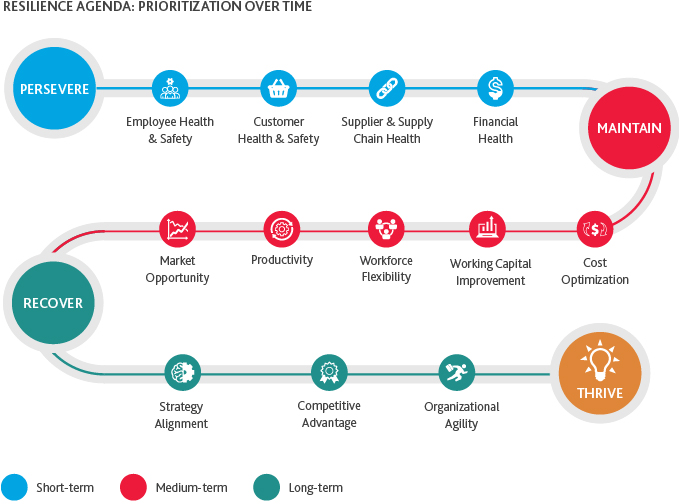

The Resilience Agenda

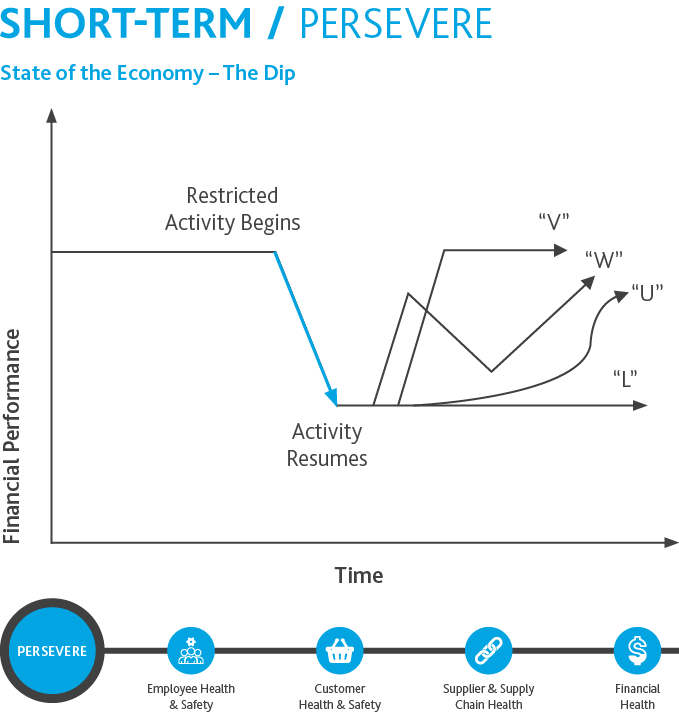

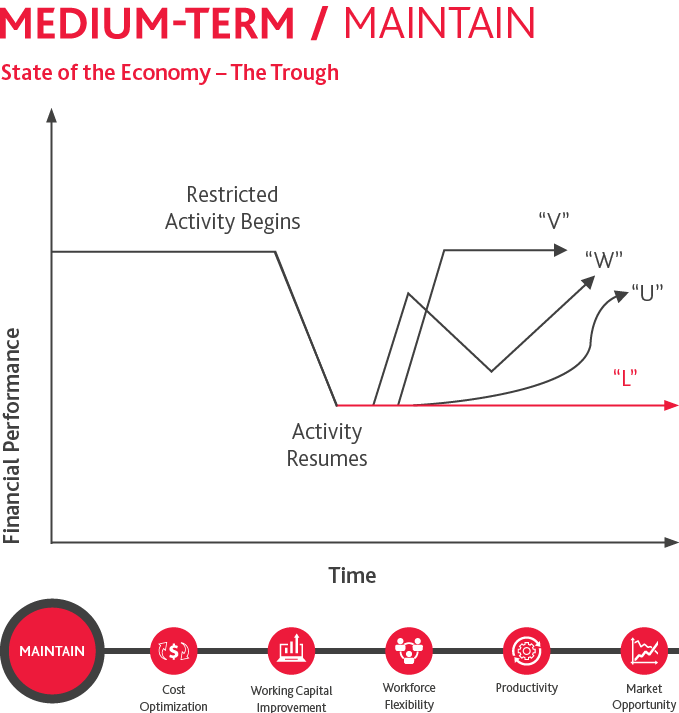

The diagram below outlines a sequenced approach from immediate remediation to recovery to recharged and ready to thrive. While the duration of each phase will vary based on the severity of the financial impact on the company, the course of the virus and the trajectory of the economy, these are the practical levers businesses should consider to expedite recovery and gain competitive advantage over the longer term.

Employee Health

The nature of the virus makes it challenging for companies to provide a safe working environment for their employees while maintaining productivity and efficiency. According to the U.S. Bureau of Labor Statistics, as of 2018, just 29% of the American workforce could perform their jobs from home—so working virtually is relatively new to a large chunk of the population. Moreover, while some companies may be able to equip their employees to work remotely, businesses deemed “essential,” where the nature of work requires in-person operations, can’t offer that flexibility to their entire staff.

Actions to ensure the well-being of your employees include:

|

Evaluate work-from-home arrangements and options for remote meetings and video conferencing. |

||

|

Secure remote access to company systems and data.

Cybersecurity needs to be a heightened priority, as many systems are more vulnerable to potential security issues due to business disruptions, use of remote workspaces, and the learning curve for first-time remote workers. [Read more COVID-19 cybersecurity recommendations.]

|

||

| Follow all public health guidelines from the Centers for Disease Control and Prevention. If employees must continue to come in to work, take every precaution to keep the workplace safe. Provide employees with personal protective equipment (PPE), and consider instituting temperature checks throughout the day. Ensure employees’ workspaces are at least six feet apart, minimize crossing of paths, and put cleaning and disinfection protocols in place. |

||

| (Over) Communicate with clarity, composure and compassion. Expect your employees to be anxious—about their job security and their health, as well as the health of their loved ones. Communicating with them frequently and transparently is critical not only for alleviating confusion, but also for calming fears. While speed is key, don’t forget to show empathy. Every communication is an opportunity to reaffirm your company’s core values and boost morale. |

||

| Account for the impact on employees’ mental health. COVID-19 can take a toll on an individual’s mental health for a variety of reasons: the stress of a new routine for first-time remote workers, anxiety around getting sick and/or infecting others or depression from social isolation. Review the mental health services included in your company’s benefits program, consider investing in supplemental mental health benefits, and ensure employees are aware of the resources available to them. |

Customer Health & Safety

Make sure business practices promote customer safety. If you deliver products and services directly to customers, ensure your delivery workers abide by social distancing guidelines. If you have physical space that needs to remain open to customers, consider imposing limitations on the number of people and meter lines. In some cases, like for healthcare provider organizations, creating separate spaces for coronavirus patients is required.

Implementing these common-sense safety measures is just the bare minimum of what businesses should do. Look for opportunities to go above and beyond for your customers and the communities in which you do business. LinkedIn Learning, for example, has made 16 courses on how to work more effectively remotely temporarily available for free. Approached in the right way—with humanity at the heart of everything you do—these actions can build trust and rapport with customers, which will translate to greater customer stickiness.

In addition, you will need to keep a close eye on your customers’ financial health. The coronavirus has wrought a financial crisis, forcing many business customers to cut their budgets, put long-term investments on hold, or worse, file for bankruptcy protection. Consumer spending is also down significantly and will likely continue to trend downward because of the trifecta of store closures, sweeping job losses and shifts in demand as people acclimate to the “shut-in” economy. Whether you sell to other businesses, consumers, or both, you’ll need to take a hard look at your customer base and identify at-risk customers along with your level of exposure to them. If your ability to safely drive revenue in the next two to four months is in question, you should take preemptive measures to mitigate potential losses.

5 Strategies for Mitigating Revenue Loss

-

Expect some degree of loss; don’t waste resources fighting for every dollar

-

Focus on improving relationships with key customers and those most insulated from novel coronavirus risk

-

Pivot your product or service offerings to those in high demand

-

Identify product or service innovation quick wins

-

Revisit your pricing model to provide more flexible and affordable options

Supplier and Supply Chain Health

Mandated shutdowns, travel restrictions and workforce shortages have caused unprecedented disruption to supply chains. The financial impact of novel coronavirus containment measures may also increase the likelihood of supplier defaults. Evaluate your organization’s exposure to supplier delays or defaults and assess the impact of a potential loss on your business. To insulate critical components from supply chain disruption, triage your inventory investments according to near-term shifts in customer demand and pivot to alternate supply routes, if needed. Looking forward, evaluate the future supply chain footprint, including possible ways to diversify your suppliers, and assess the cost-benefit of maintaining duplicate facilities or routes on an ongoing basis.

6 Supply Chain Strategies to Mitigate Disruption

-

Monitor demand shifts. Maintain a daily pulse of customer demand shifts to obtain an updated view of finished goods and inventory needs.

-

Communicate with key suppliers. Share information frequently to delay, increase or cancel inbound supply orders as needed to align inventory investments with customer demand.

-

Prioritize customers and products. Invest working capital to maximize profitability, avoid loss of critical customers and minimize reputational risk.

-

Mitigate supplier risks. This crisis has uncovered risks of supply disruption in many cases and has surfaced the need to properly diversify the supply base to mitigate supply disruption and increase agility.

-

Re-evaluate your supply chain footprint. Ask yourself these questions: Are my suppliers, manufacturing facilities and warehouses located in the right places? Are there changes I should consider making given the criticality of my products, opportunity for disruption and potential legislative mandates that may occur in some industries?

-

Target high-impact opportunities to increase supply chain transparency and visibility. This crisis has likely tested and revealed gaps in visibility across your global supply chain. Going forward, this is an opportunity to prioritize and address some of these gaps. Emerging digital technologies can be deployed to make practical improvements relatively quickly and affordably.

Financial Health

Liquidity in a crisis is imperative. Companies need to preemptively counteract the impact of slowdowns and unbudgeted costs. A revised cashflow projection is essential for liquidity and business planning and enabling difficult decisions to be made as early as possible. Perform financial forecasting including sensitivity and ratio analyses, examining the overall threat to your organization based on multiple sales decrease scenarios. Identify short-term measures to increase liquidity, such as:

-

Reducing variable costs

-

Halting nonessential purchases

-

Negotiating longer payment terms with suppliers

-

Negotiating a debt service holiday or covenant relief

-

Filing for bankruptcy protection

-

Applying for a low-interest government loan

-

Taking advantage of tax relief provisions

If you’re considering layoffs or furloughs, keep in mind that you may lose eligibility for a loan under the $500 billion economic stabilization plan included in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which is available to midsized and larger businesses. If you apply for a small business loan under the CARES Act, reducing either the number of employees or employee wages by 25% or more will reduce the loan forgiveness available to you.

Before making labor cuts, address other areas of spending. While workforce reduction has historically been an obvious area of focus for lowering costs, it is also a source of competitive advantage for the long-term. According to research from Harvard Business Review, companies that rely primarily on workforce cuts to manage costs have only an 11% chance of “breakaway performance” coming out of a downturn. The same study found organizations that focused on operational efficiencies over layoffs were more likely to experience breakaway performance.

Cost Optimization

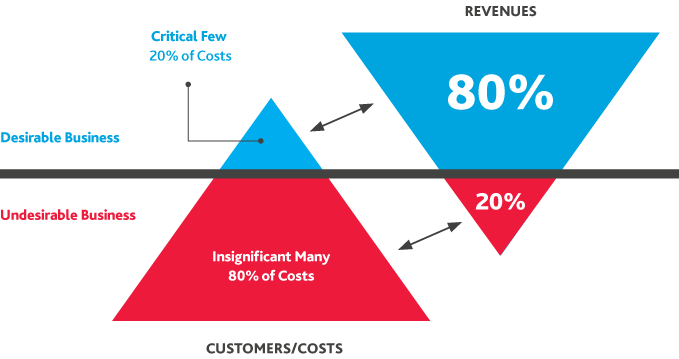

The knee-jerk reaction to an economic downturn tends to be to slash costs across the board. But cutting costs without discrimination or clear segmentation during an economic downturn is not a recipe for success. There’s a reason PE-backed companies outperformed companies not backed by private equity during the recession in 2008: they out-invested their counterparts by 5.9%. The lesson here isn’t that every company should immediately get in bed with private equity; it’s that even in times of financial stress, you have to maintain investment in productivity and innovation. Cost adjustments do need to be made, but the goal should be to strike the right balance between targeted, sustainable cost-reduction initiatives and smart spending to fuel the engine of growth.

Imagine your organization as a living organism. You can trim the extra fat, but if you cut away at a vital organ, performance will start to drop off. Think instead in terms of streamlining and simplifying, and concentrate your dollars on the areas of the business that drive the greatest value and differentiation.

Everything in the budget should be up for reevaluation. Look first to realigning and reducing large cost “rocks” that were previously masked by high levels of revenue growth. Are all those costs necessary and justified? Going forward, spending needs to be hyper-focused on the products and services in highest demand and those driving the most profit, as well as the key customers representing the greatest share of your revenue. Doing so effectively requires intimate knowledge of what customers really want—based on real market data and frequent conversations with your biggest buyers, not guesswork.

Targeted Cost Optimization Strategies:

-

Look for opportunities to negotiate discounts. In a recession, your vendors are more likely to be flexible on pricing.

-

Unlock operational efficiencies by streamlining processes and reconfiguring supply chains.

-

Shift investments in inventories to the items that have the highest impact.

-

Reduce IT infrastructure costs by retiring unsupported applications and consolidating redundant functionalities.

-

Leverage technology to automate certain types of work processes to reduce labor costs.

-

Renew focus on quality in not just products and services, but also information/data.

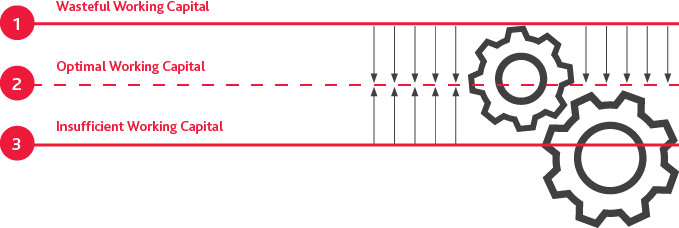

Working Capital Management

Working capital must be optimized at the right level for the business, the market and the economy. What’s “optimal” can vary significantly from business to business. The key is understanding the right level for your organization in the current economic environment and managing to it. Even in recession, more working capital isn’t always better; too much creates waste and an unproductive use of assets. On the other hand, with too little working capital, businesses grind to a halt, unable to serve customer needs or fund the day-to-day needs of company operations and payroll. Without a clear working capital strategy or plan, capital is highly variable and can be wasted.

Two Key Goals:

-

Stabilize and consistently stay on the red line; and/or

-

Effectively lower the working capital to a more optimal level

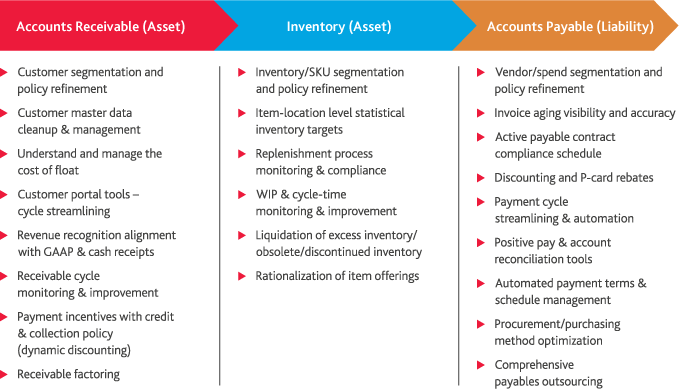

The primary levers for working capital management are accounts receivable, inventory and accounts payable. The table below outlines the actions companies can take to improve working capital efficiency across all three levers.

The goal is to establish formal benchmarks with correlating resources and activities to achieve them to manage working capital at an optimal level, with tolerances for the specific requirements of the business, the industry it operates in, and the current stage of the economic cycle.

Key Metrics for Working Capital Management

Moving the Needle

Workforce Flexibility

During immediate response efforts, companies may have furloughed employees or permanently reduced the size of their workforce. To quickly scale capacity up or down, organizations will need to employ more flexible staffing models, which can take many different forms, such as part-time or short-term hires, on-call workers, and temporaries hired or leased from a staffing agency. Co-sourcing models represent another option, where in-house staff can use their skills and experience to complete certain aspects of a task, while looking outside the business to complete the remaining work. Co-sourcing saves the time and costs of recruiting and hiring someone with the applicable expertise for a limited task, and it gives the business more control over the work at a fixed cost.

Each organization must determine what resourcing strategies work best for them on a case-by-case basis, but the process will be similar: Assess the current staffing landscape, identify needs for business goals, create a staffing projection and maintain a strong workplace culture. The goal is to create a more agile workforce that can complete the tasks of current workflow without adding future obligations for the business.

Productivity

According to research from Stanford and Harvard, productivity typically increases during a recession—the result of job insecurity. However, with a significant chunk of the workforce now working remotely—many for the first time—productivity gains are a toss-up. To improve your workforce productivity, you’ll need to be intentional about it.

A large piece of productivity growth comes down to driving accountability and engagement. One of the biggest hindrances to productivity is the decoupling of responsibility and authority. Decision-making power needs to reside with the individual responsible for the outcome. The more layers in between the responsible individual and the decision-maker, the more information gets diluted and the longer it takes to reach a decision. Look for opportunities to reduce redundancies and streamline your overall organizational structure. Evaluate whether you have the right people in the right roles, or if they can be redeployed elsewhere in the organization to greater effect.

While you should avoid making additional broad-brush layoffs, as the negative repercussions on morale typically outweigh the short-term margin improvements, low performers are an exception to the rule. Sudden drop-offs in performance is to be expected in these uniquely difficult circumstances and deserve some leniency, but employees who have consistently underperformed don’t get carte blanche. Shedding these low performers gives higher potential employees an opportunity to step into roles with greater responsibility and accountability. Teams can also be supplemented with high quality available talent at a reasonable cost—in effect, upgrading the overall competence of the organization.

Digitization and robotics also play an increasingly important role in driving productivity gains, one that even a recession cannot derail. Over the next decade, digital tools and technologies will drive productivity gains in three key ways:

-

Process optimization

-

Labor automation

-

Driving collaboration and innovation

So, although the inclination may be to put digital initiatives on hold until the economy recovers, the loss in prospective productivity gains makes such a proposition untenable. The danger in sitting tight is the widening gap from competitors who capitalize on the changing environment and continue to digitize.

Simply layering technology on top of existing systems and processes won’t do the trick alone, however. Without a concerted effort to upskill employees and break down internal silos, the way work is performed will be suboptimal. And above all else, remember that your employees are humans, not machines. Even after the pandemic reaches its peak, the stress, anger and grief it caused won’t immediately go away. Treat your employees with care and compassion—not only because it’s the right thing to do, but also because the positive impact on morale will be well worth it.

Market Opportunity

In every crisis, there is opportunity. At this point in your recovery, it’s important to take a step back and think beyond tactics to strategy. There may be mid-term opportunities to capitalize on a market shift or change in circumstance. Perhaps your competitors are hurting for cash while you’re on solid financial ground; you can temporarily reduce your pricing—taking a short-term margin hit but winning more market share. Or perhaps you can spot a nascent customer behavior pattern that you’re in a unique position to address.

The companies that will thrive in the tumultuous months ahead are those that move quickly to seize these emerging opportunities. Doing so can feel risky, but the alternative—letting opportunities pass you by—is far riskier.

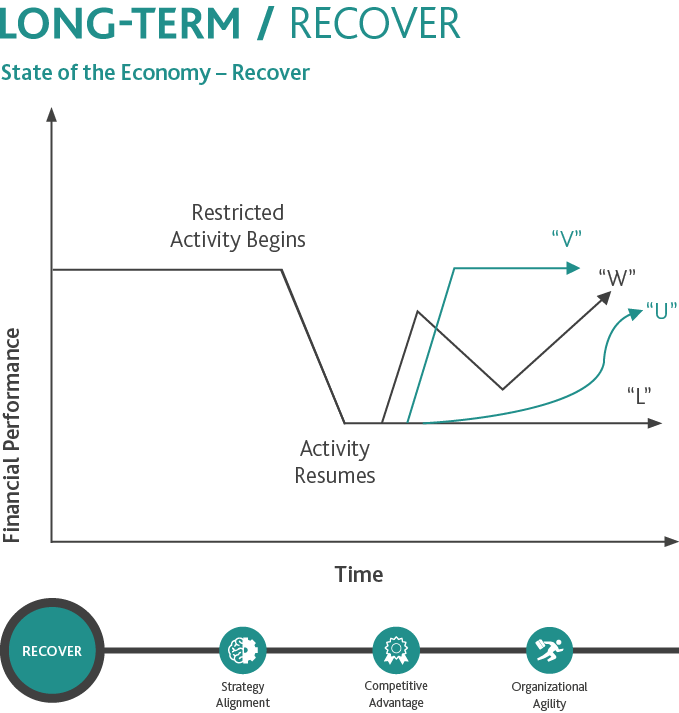

Strategy Alignment

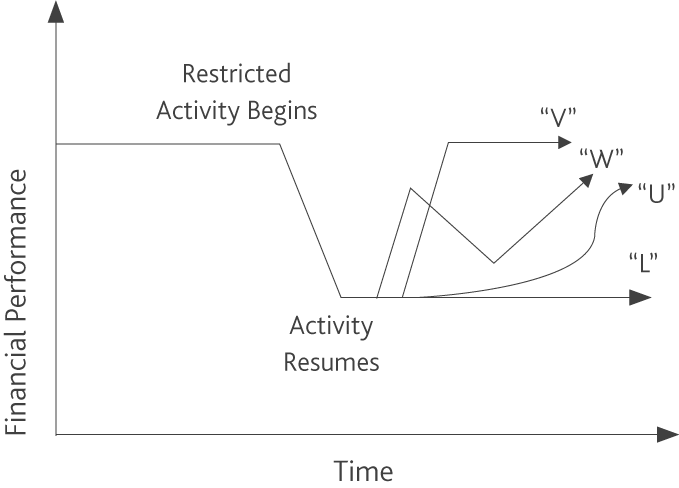

You may have had a plan for long-term transformation before the coronavirus outbreak—and it’s likely no longer applicable to the current environment. Rather than pushing through with an irrelevant strategy, you’ll need to revisit it to incorporate the lasting, large-scale forces of change brought on by the pandemic.

Identifying these forces of change requires foresight: analyzing both past and current trends to forecast future scenarios and draw conclusions on what to do about them. Arguably the most challenging component of foresight— and where creativity and diversity of thinking come into play—is interpreting what these future scenarios mean for your specific business. Foresight must be contextualized with empathy to become actionable. In other words, how will these future trends affect your customers and employees? What will they need, and how can you reposition your business to help?

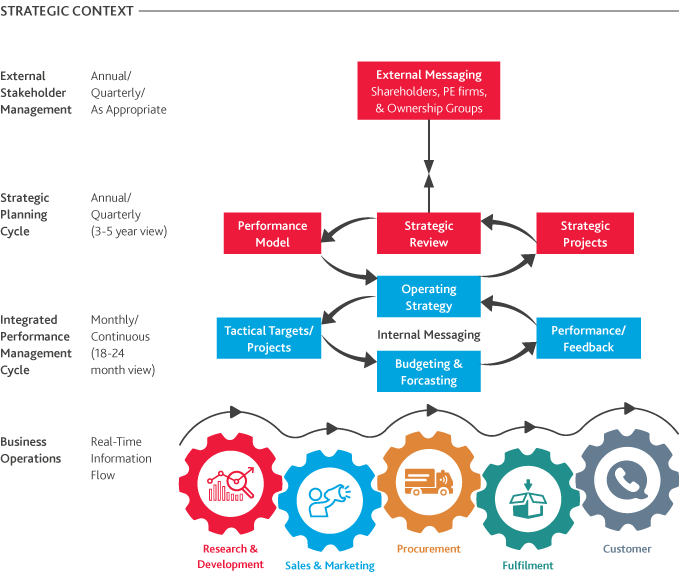

If you didn’t have plans for transformation before COVID-19, building a future-state model is a good place to start. A future-state model synthesizes your strategy into a visual representation of the critical capabilities you will need to execute your strategy and the corresponding impact on operations and people. It is your organization reimagined in detail as it will operate in the post-COVID-19 and post- recession future. Your future-state model should account for cross-functional impacts both within your organization and with external entities. A singular, end-to-end view of your business strategy will help you mitigate the risk of unintended consequences, ensure the right people are engaged and involved, and maximize value. Your future-state model needs to be a living one; continuous strategy refinement is critical.

Competitive Advantage

By evaluating and refining your strategy, you will have set in motion the enablers that will position you to achieve long-term market advantage: greater liquidity through fiscal discipline; higher productivity and workforce flexibility to quickly scale up; and quick-win market opportunities for a competitive edge. The goal now is to translate these early wins into a sustainable lead over the competition. If you previously invested in improvements in salesforce productivity, for example, you can focus on target account identification to attract new high-value customers. Or if you’ve made strides in operational efficiencies, determine whether you can keep prices low—or even drop prices—to garner a greater share of the available market. Maybe you’ve seen early success in upskilling your workforce; if so, can you take a more aggressive approach to digital transformation? With sufficient access to capital, do you have the resources to invest in new ideas and bring them to market first?

7 Ways to Differentiate Your Business

| 1. Superior product or service performance | ||

| 2. Customization | ||

| 3. New features | ||

| 4. New pricing model | ||

| 5. Greater convenience | ||

| 6. Greater reliability | ||

| 7. Better customer service |

Organizational Agility

Adapting to accelerated change and uncertainty requires organizational agility. There’s no getting around the need for speed: speed to insight, speed to decision and speed to action. Pragmatically, a business’s agility—the speed at which it receives, interprets and acts on new information—should be comparable to the average rate of environmental volatility that drives either risk or opportunity. Organizations in industries facing more volatility (e.g., restaurants and retailers) must be more agile than those in industries facing less.

At the crux of agility is data. Data is the engine of faster, smarter decision making. Eventually, every business process, from core operational processes to management processes to support processes, should be driven by data.

A data-driven journey starts with what we call insight-led innovation. The concept is based on the premise that today’s innovations should pave the way for tomorrow’s, and portends a future where business intelligence guides corporate strategy, an essential determinant of risk versus return. Every innovation should enable more informed, data-driven, strategic business decisions down the road, leveraging technology to tighten the business performance management cycle—the efficiency with which strategy is operationalized and critical success factors are achieved. It’s a means of addressing short-term needs while building overall innovation capacity and business intelligence.

Our current fluid business climate, changing on a daily and weekly basis, requires agile business capabilities to rapidly understand and reallocate resources to best mitigate risks and capitalize on emerging opportunities. Those who are slow to act will miss the window of opportunity to leapfrog their competitors and thrive in the upturn.

Agility might start with business intelligence and process reengineering, but it ends in people, requiring in many cases a significant cultural shift and a dedicated effort to remove organizational friction. It’s a delicate dance between stability and flexibility—and hitting the right note is an exercise in leadership. Fear is the enemy of agility. When you allow fear to guide your actions, the tendency is to try to impose control where you should be exerting influence. When facing ambiguous and unpredictable situations, we need to apply a different decision model that relies on narrative techniques and multiple perspectives rather than hard-and-fast rules.

Amid accelerating change and complexity, organizations need leaders who apply problem-solving skills to any situation, under significant pressure and time constraints. Building up the critical thinking capability requires investing in education, and developing deeper and more varied expertise across the organization. Employees need to be taught methods for making sense of disruptive change, interpreting information and gaining additional insight when information is incomplete. They need to be trained to recognize their own unconscious biases and develop strategies to negate them.

4 Tools to Unlock Agility

| Enterprise Data Governance: Focuses on ensuring enterprise data is available, accurate and timely to make informed decisions and catalogued to extract business intelligence. | ||

| Integrated Performance Management: Focuses on shortening the cycle between gaining insight and taking action related to Critical Success Factors and Key Performance Indicators. | ||

| Dynamic Forecasting: Shifts the balance of management’s focus toward a heavier weighting on the future. | ||

| Efficient Performance Reporting: Reinforces alignment by staying focused on the KPIs that really matter. |

Redefining Resilience

Resilience is defined as “the capacity to bounce back.” In business practice, however, resilience efforts have conventionally focused on keeping threats out rather than responding more effectively to them. But convention assumes that every threat can be anticipated, and if not outright blocked, then prepared for. This perpetuates a “wait-for- impact” culture.

Foresight alone will not protect a company’s future, nor is it realistic—or even possible—to plan for every threat scenario. The next black swan event may come without any warning whatsoever. You can’t make a contingency plan for the unpredictable.

The true measure of resilience isn’t resistance to threat; it’s foresight coupled with agility. How fast can we identify potential disruptions or shifts in demand? When we identify a threat or an opportunity, how soon can we respond to it? Which risks can be prevented or mitigated, and which threats require adaptation? Are we culturally flexible enough to alter our plans or pivot entirely when necessary? Can we pinpoint the opportunities in the ensuing uncertainty to innovate? The businesses that come out on top are those that can shift quickly from a defensive posture to an opportunistic one— resilient by design instead of retroactively.

We get it: It’s hard to think about what’s next when you’re still in the middle of a crisis. But if the economy does fall into a protracted recession—and many signs indicate it will—you’ll need to make big moves sooner rather than later. Hope is not a plan. A smart plan, on the other hand, brings hope and an opportunity to thrive.

SHARE