Understanding the Board’s ESG Mandate

Amid a dynamic regulatory landscape and rapidly evolving stakeholder demands, corporate boards face a new mandate: oversight of the organization’s adoption of environmental, social, and governance (ESG) programs. Failure to fulfill this duty can translate into alienating stakeholders, drawing regulatory scrutiny and jeopardizing customer and employee loyalty.

An increasingly hot topic on the boardroom agenda, ESG and sustainability are propelling savvy directors to navigate new ESG-related responsibilities, including:

-

Establishing the board’s oversight role and committee structure

-

Aligning ESG with the company’s corporate purpose, vision and values

-

Integrating sustainability into overall business strategy

-

Prioritizing ESG risks based on materiality to the business

-

Establishing accountability for ESG strategy implementation

-

Overseeing ESG reporting processes and related controls

“The board’s duties of care and loyalty already encompass ESG. As ESG risks and impact become more material to the business, it ultimately falls to the board to ensure that management is acting in the interest of a broader set of stakeholders in ensuring the sustainability of the organization.”

– Amy Rojik, National Partner, BDO Center for Corporate Governance

|

Establish tone from |

Define oversight |

Correctly identify, monitor |

|

Be alert to controls over data quality for more effective |

Establish management |

Ensure communication and |

Bringing the Classroom to the Boardroom

Board directors and management teams rely on continuing education to help them understand industry trends, identify emerging risks, and incorporate new tools and processes. ESG is no different. The more material an ESG risk, the more informed and experienced the board must be to address it.

Boards approach this challenge in differing ways. Some are building ESG competency through formal training. Others have recruited directors with ESG skillsets to augment their current expertise. Some boards have hired advisors or consultants to help implement ESG strategies that consider the organization’s unique material risks. Boards should work closely with management to find the formula that suits the organization best.

Boards must also be able to demonstrate that their directors understand emerging risks to the business and are actively engaged with management to ensure that such risks are being proactively addressed. Engagement with stakeholders is key to a more nuanced understanding of these issues and prioritizing sustainable outcomes.

Addressing Stakeholders’ Expectations of the Board

|

STAKEHOLDER |

EXPECTATIONS OF THE BOARD |

|

Investors |

Oversee the integration of ESG into operations that support sustainable value creation and risk mitigation strategies. |

|

Proxy Advisors |

Disclose the board’s role in overseeing environmental, social and governance issues. |

|

Ratings Agencies |

Ensure management provides up to date information on ESG policies, initiatives and performance. |

|

Regulators |

Ensure the organization discloses its material ESG risks, the impact on the business, how management is mitigating those risks, and the role of the board. |

|

Management Teams |

Oversee the development and direction of the ESG strategy, goals and objectives to address risk and generate value, including oversight of the controls, policies, processes, metrics, incentives and monitoring processes in executing the strategy. |

|

Employees |

Establish clear communication and tone from the top; hold the management team accountable for carrying out the organization’s mission, visions and values while encouraging innovation and ensuring the well-being of all employees. |

|

Customers and Vendors |

Ensure that the organization produces and delivers high quality products and services responsibly and reliably. |

Defining ESG Oversight Structure

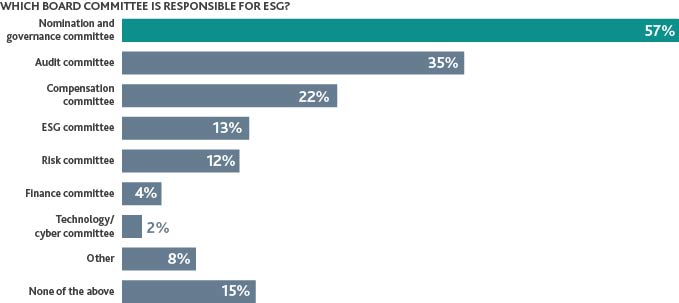

Data from the Fall 2022 Board Pulse Survey

Integrating ESG into corporate strategy begins with establishing sustainability as a company priority. This requires adoption of a conscious approach to leadership that encourages directors to reflect on their management teams, corporate culture and business practices. The board should formalize its ESG oversight roles and responsibilities to demonstrate to stakeholders the commitment to sustainability from the top.

So, how should the board structure ESG governance? It depends. A small, but growing percentage of boards have created dedicated ESG committees, while others have designated oversight to either the full board or to one or more existing board committees. The organization’s material risks, existing governance structures and available resources – including the experience, knowledge and skillsets of directors – should dictate the approach.

Codifying specific roles and responsibilities: Boards that share ESG oversight across multiple committees will need to codify how specific oversight responsibilities will be allocated. For example, assignment of oversight of controls over ESG reporting may be most appropriate for the audit committee, while oversight of the company’s human capital management strategy or aligning compensation with ESG goals and targets may be most appropriate for the compensation committee. Certain oversight responsibilities – such as ESG strategy integration – may make sense to live with the full board rather than at the committee level.

Several key structural considerations:

-

How to ensure all ESG risks are identified and addressed in corporate strategy?

-

How to ensure that ESG roles and responsibilities are formally established and being executed appropriately by directors?

-

Does the board have the appropriate director composition to oversee sustainability matters?

-

How to enable effective communication among the board, committees and management

-

How to achieve accountability for director oversight and management execution

-

How to assure continuing education at the board level (as well as throughout the organization)?

Documenting agreed upon governance approach: Once the oversight structure has been established, the board and committee charters will need to be updated to reflect evolving responsibilities and reviewed to ensure clarity of roles among directors and management teams. If forming a new committee, a charter will need to be drafted, approved and adopted. Additionally, committee members will need to be selected – either from existing directors or potentially via a thoughtful director candidate selection process that takes into account requisite needs for knowledge, skills, experience, perspective and capacity.

Disclosing governance approach: The board will also need to plan communication channels for disclosures included within proxy statements, sustainability reports and other governance communications, as appropriate.

Common Approaches to Board ESG Oversight: Pros and Cons

|

DEDICATED ESG COMMITTEE |

EXISTING COMMITTEE |

MULTIPLE EXISTING COMMITTEES |

FULL BOARD |

|

May include an overarching sustainability committee or more specialized committees (e.g., environmental committee) |

Oversight delegated to one committee, most commonly the Nomination & Governance Committee |

Oversight of ESG matters divided across multiple committees, including:

|

No dedicated committee; all ESG oversight decisions made by the full board |

|

Pros:

|

Pros:

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

Cons:

Material ESG factors may fall through the cracks |

Cons:

|

Connecting Purpose to ESG Metrics & Strategy

Corporate Purpose and ESG are Synergistic

Corporate purpose and ESG must exist in unison. A corporate purpose harmonizes value-creation efforts with the organization’s impact on its stakeholders. Applying a customized ESG framework to manage organization-specific sustainability risk and opportunities helps translate corporate purpose into measurable goals that generate stakeholder value.

Board directors need to ensure that the organization has a strong and identifiable corporate purpose that incorporates diverse stakeholder perspectives and aligns with overall business strategy. Setting related ESG objectives should also be a complimentary exercise; the board must help the management team focus on business performance while balancing competing stakeholder interests. If ESG objectives do not support long-term business growth and sustainability, they may be the wrong objectives.

The board must expect sound project management, supported by processes and controls, metrics and KPIs to drive progress in achieving ESG objectives. Without the means to monitor and quantify progress or gauge risk, board directors cannot evaluate ESG investment decisions, advise on appropriate disclosures or review performance.

In many cases, it may be the Chief Financial Officer or Chief Sustainability Officer, who leads a multi-disciplinary team in developing strategies to achieve ESG objectives. These plans should be vetted with the board. Directors should be sensitive to misalignment between corporate purpose, ESG objectives and business strategy.

|

Compelling vision |

Active, visible leadership from the top |

Policies and procedures |

Training - general and specific - for board, leadership |

Transparency and |

|

Accountability up, down and across |

Incentives, |

Key performance |

Program management |

Monitoring, auditing |

Prioritizing ESG Risks

The universe of ESG risks is vast. A formal materiality assessment is key to identifying the ESG risks and opportunities most relevant to a company. While methodologies vary, a materiality assessment should include:

-

Solicitation of stakeholder input

-

Issues-ranking framework based on materiality

-

Peer benchmarking

The board should review and approve management’s approach to the materiality assessment, paying special attention to stakeholder engagement and the criteria for assessing business risk and impact.

ESG materiality is not static; assessing risk is an ongoing process. The board should work with management to incorporate ESG into existing enterprise risk management (ERM) processes. High-priority issues require clearly defined processes for how and when risk information is elevated to the board.

As part of the board’s risk oversight role, directors must verify that management has implemented appropriate systems, controls, policies and protocols to mitigate ESG risks.

Incentivizing ESG: Carrots & Sticks

While senior management drives daily execution of the sustainability agenda, it is the board’s role to hold management accountable to ensure ESG is appropriately integrated into the overall business strategy. At the board’s disposal are several accountability mechanisms:

Tying Management Pay to ESG Performance

-

Tying specific ESG KPIs to executive compensation is already a best practice in larger organizations

-

Note: Establishing ESG-based incentives may require a level of ESG maturity within the organization

-

-

Benchmarking against peers can help define the appropriate non-financial metrics to incorporate into executive compensation

-

Designing incentives based on each organization’s unique goals and time horizons for achieving them

Incorporating Stakeholder Perspectives

-

Establishing clear ESG directives can help attract and retain employees, customers, lenders, vendors and others

Setting the Communication Cadence

-

Establishing clear reporting lines with management, defining the frequency and format of both internal and external communications

-

Scheduling regular dialogue and internal reporting processes to monitor ESG progress

-

Establishing clear parameters on sharing information with each key stakeholder group

Addressing ESG Lapses

-

Taking an active posture on ESG inaction and failures

-

Monitoring adoption of the ESG agenda is the board’s responsibility; the board must propel efforts to rectify lack of progress in satisfying ESG objectives

Reporting, Data Collection & Assurance

Historically, as part of their fiduciary duty to investors, the board – in particular, the audit committee – has played a supervisory role over management’s corporate financial disclosures. Now that investors and other stakeholders want more transparency on material nonfinancial ESG risks and initiatives, this supervisory role extends to ESG reporting.

Defining ESG Disclosures

Boards must weigh in on management’s proposed approach to public ESG disclosures. Alignment with one or more standardized ESG reporting frameworks may help facilitate the transparency and comparability of information demanded by stakeholders. As with the identification of material ESG risks, the board should work with management and advisors to assess the appropriate frameworks and metrics.

Boards must also continuously monitor regulatory developments–particularly significant proposed ESG disclosure rules and expectations from investors and third-party influencers. Ratings agencies are among the most prominent ESG tastemakers; their influence on the markets and public opinion should not be underestimated. Boards and management teams should evaluate each of these sources to identify the organization’s most material ESG factors and determine how to communicate them – both qualitatively and quantitatively.

Data Collection & Integrity

As part of reporting oversight, boards ensure that management has appropriate policies and internal controls in place for accurate and timely ESG reporting. Enhanced disclosures build stakeholder trust, but if the underlying data is unreliable, transparency efforts can backfire.

Boards should understand the methodology, process and related controls for ESG data collection and reporting, as well as assess the organization’s readiness and need for third-party assurance of ESG disclosures. The internal audit (IA) function (whether in-house or outsourced) can be a valuable resource to leverage as part of overall ESG data collection and integrity considerations.

As regulatory pressures mount to require companies to provide data on emerging ESG matters, boards may need to weigh the value of having such information reviewed or audited by third parties. Absent board experience with greenhouse gas emissions accounting, for example, third-party assurance may be necessary to ensure the integrity of information on which investors and other stakeholders rely. Equipped with accurate and verifiable ESG data, boards can map more actionable paths to address material risks and build stakeholder confidence in execution of corporate strategy.

Refer to BDO’s The Path to ESG Reporting and Attestation Readiness for more information.

Need a cheat sheet? Download our one-page guide to the board’s ESG oversight responsibilities.

The Board’s Quick Guide to Proactive ESG Oversight:

Prioritize ESG risks and opportunities

-

Conduct a materiality assessment to identify ESG risks and opportunities

-

Benchmark against peers and stakeholder interests in prioritizing ESG issues

-

Regularly update ESG risk and opportunity assessments as part of enterprise risk management

Clearly define board oversight

-

Determine governance structure, including full board and committee roles

-

Formalize the division of responsibilities between the board, committees and management

-

Update board charters

-

Publicly share board ESG oversight responsibilities via proxy disclosures and sustainability reporting

Tie strategy to value creation

-

Align corporate purpose to ESG objectives and supporting metrics

-

Embed short- and long-term ESG goals into broader corporate strategy

-

Hold management accountable to ESG progress through incentives, KPIs and tracking capabilities

Design reliable reporting

-

Select applicable frameworks and methodologies based on industry, available data and resources

-

Oversee establishment of reporting systems, data sourcing, controls and testing processes

-

Assess the need for third-party assurance on ESG data integrity and compliance

-

Identify appropriate communication channels – e.g., standalone and/or integrated sustainability reports, corporate websites, etc.

Create an iterative process for improvement

-

Establish a program management approach to re-evaluate and enhance management’s ESG framework

-

Make ESG and sustainability a regular part of board and management discussions

-

Ensure all levels of the organization receive continual education in this evolving area

ESG is the next frontier in risk mitigation and long-term value creation. While ESG introduces high-stakes responsibilities for the board, it rests on the same overriding principles of traditional board governance:

-

Establishing appropriate governance structures

-

Delineating oversight duties

-

Evaluating strategy

-

Driving accountability for all stakeholders

-

Communicating execution of strategy in alignment with corporate purpose, vision and values

Forward-thinking boards will not view this mandate as an added burden but will instead lean into ESG as an opportunity to improve business resilience while contributing to the greater benefit of all stakeholders.

Need help tackling your board’s specific ESG challenges? Check out BDO’s ESG Center of Excellence for more resources, or chat with one of our ESG professionals.

SHARE