Tax Risk and Reward: Why Boards Should Consult With Tax Leaders on Strategy

Key Takeaways for Boards from BDO’s 2022 Tax Outlook Survey

Board members recognize that corporate strategies usually bring significant and often complex tax risks and opportunities. Tax risk management oversight requires appropriate tools, resources and, as important, investments in technology to enable companies to comply with various jurisdictional tax requirements. Add to this emerging areas of risk such as broad environmental, social, and governance (ESG) factors and related transparency in reporting.

Tax executives have a unique understanding of how business decisions affect their organization’s tax posture and the investments needed to implement tax strategies and activities successfully and effectively. This perspective makes tax professionals’ viewpoints a valuable addition to boardroom discussions.

The 2022 BDO Tax Outlook Survey polled 150 tax executives about their views on everything from tax planning strategies to technology to ESG and beyond. Three key takeaways surfaced for boards:

- An intentional focus on tax risk is central to broader business strategy

- Adopting advanced technology is critical to managing tax liability and risk

- Tax departments can play a key role in ESG strategy development and transparent reporting.

Managing Tax Risk Is Central to Business Strategy

Tax governance is part of an organization’s enterprise risk management (ERM) and broader business strategy. The oversight of an entity’s tax risk should be customized to balance value, compliance and reputation. Most business decisions have tax implications and involve increasing complexity from rapidly evolving global and domestic tax rules, regulations and guidance; heightened tax authority scrutiny; increased stakeholder demands and continued pressure for the tax department to add value through planning opportunities. Boards should have a forwardlooking view toward evolving risk and intentional evaluation of tax risk as a significant component of overall business strategy. A board-approved tax risk strategy, ideally as part of a tax control framework, can assist in mitigating tax risk by fostering a communication mechanism and clearly defined processes and controls to identify and manage operational tax risk. The vast majority of boards already do assess tax liability as part of risk oversight. BDO’s survey reveals that 94% of tax executives say tax risk is either “highly” or “moderately” included as part of the board’s oversight function.

Improving visibility into tax risk requires tax knowledge at the board level, including a detailed understanding of the business’ total tax liability (TTL), which should include current liabilities and consideration of how planned initiatives could affect future liabilities. Understanding how the company leaders are managing TTL is important to minimizing tax risk and potentially uncovering opportunities for the business and reducing TTL. Boards can equip themselves with this knowledge and a forward-looking view of tax through continuing education, identification of a board-level tax expert or advisor, oversight of processes and controls integrating tax into operations and strategy, and collaboration with and reporting from management teams and tax departments.

At a time when tax risk is becoming an even more important element of business strategy, board directors should have a clear view of how strategic initiatives (e.g., capital improvement projects, new products/services, geographic expansion) affect tax liability. However, while 97% of tax executives say their boards have either a “high” or “moderate” level of understanding of TTL, those with a “high” understanding decreased by seven percentage points from the previous year, which indicates a decline in knowledge on this key issue. The board should stay apprised of evolving tax guidance and its impact on business planning. If not already included as part of a governance skill matrix, boards may consider including an evaluation of directors’ tax knowledge to identify gaps in knowledge and experience that may require further consideration.

Another area for focus is the degree to which management teams consult with tax departments regarding strategy. Just 45% of tax executives say they are “always” included in strategic planning and decision-making, which is a decline of 11 percentage points from our 2021 Tax Outlook Survey. That represents a significant 20% drop-off in just one year, indicating that some companies could have blind spots regarding tax risk as they develop and implement strategy.

Percentage of tax executives who say they are “always” included in strategic planning and decision-making:

Boards should work closely with management teams to ensure the tax function is integrated into both strategy and operations of the business. More than half of tax executives (57%) say they spend more time explaining the tax implications of business decisions now compared to five years ago. While this could imply that boards and management are seeking more input from tax departments, it also points to a knowledge gap in a critical area that should be addressed going forward. Formalizing a company’s approach to tax risk management and integration of tax within strategy and operations through formalized and documented planning, policies and procedures provides better insight of vulnerabilities and can uncover opportunities to improve tax operations and optimize their total tax approach.

The convergence of dynamic changes — such as shifting policy and regulatory guidance, macroeconomic forces, industry-specific issues and more — makes it vital for board directors to understand how those changes impact tax liabilities and may alleviate unexpected surprises.

Using Technology to Manage Tax Liability and Risk

Advanced technology is transforming the tax function and helping businesses manage tax risk more effectively. Boards that understand the value of investing in tax technology can better oversee how the business adapts in a shifting tax landscape.

Technology can unlock new efficiencies and support analytics to simplify areas of evolving complexity. Respondents reported that investments in tax technology have provided a range of benefits that include:

Respondents at thriving tax departments were more likely to report reduced tax risk (44% thriving vs. 31% surviving/struggling), boosts in employee morale (40% vs. 33%) and reduced workforce expenses (27% vs. 17%). It’s no surprise to see that 97% of tax executives expect to invest in tax technology this year. Specifically, more than half plan to invest in data analytics, business intelligence software, tax provision software and tax automation.

As with any technology, success hinges on supporting adoption and enablement among the workforce. Tax executives say their greatest challenge is training their teams to use the tools and processes necessary for tax technology. Consequently, boards have an important opportunity to hold management accountable for training and upskilling key talent as part of the technology transformation. There are also additional options that can help bridge gaps or alleviate resource constraints in these areas. Eighty-six percent of tax executives are currently or are planning to co-source and/or outsource tax technology implementation or optimization.

The use of tax technology by skilled talent can also help businesses achieve greater transparency in reporting, which is a priority area when expanding corporate reporting related to ESG.

Technology can help identify and track key metrics, integrate data sources, and yield insights for reporting and timely decision-making.

The Role of Tax in ESG Strategy and Reporting

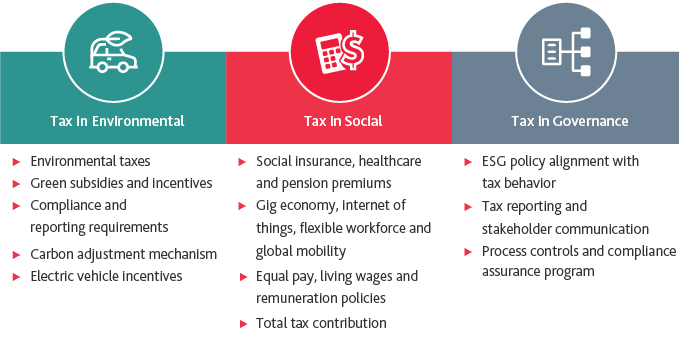

ESG has become a key component of creating broad stakeholder value. A company’s tax strategy is directly linked to its broader ESG strategy, as taxation is increasingly seen as part of a company’s social contributions. Shareholders and stakeholders — as well as ESG rating providers — often view tax transparency as a gauge of a company’s ESG commitments, which can conflict with tax minimization strategies, such as offshoring profits.

Directors are working with management to establish ESG objectives that contribute to long-term value creation and business resilience, while also assessing how relevant ESG factors are linked to company performance and communicated publicly. Sixty-two percent of tax leaders have increased their ESG collaboration with the board and C-suite; and 95% of tax executives say their department has played a role in developing tax transparency reporting programs. Additionally, nearly three-quarters of tax executives (74%) say they have qualitative disclosures in place while 44% indicate they further include quantitative disclosures.

However, fragmented systems and a lack of standardized reporting frameworks for ESG information continue to be a challenge for tax data governance relative to ESG factors. Nearly two-thirds of respondents (62%) said [ESG] data collection and analysis are problematic, pointing to an underlying issue of [a lack of] tax data governance and fragmented systems.

Through prioritization, boards can work with management teams to address tax data governance and support more effective use of technology in the reporting process.

Evaluating how to improve tax transparency can require significant time and resources. While the U.S. does not currently have ESG tax specific transparency requirements, various global reporting standards and frameworks are converging. Additionally, the Organization for Economic Cooperation and Development (OECD) continues to pursue global tax reform in conjunction with governments, and tax transparency is the subject of a standard from the Global Sustainability Standards Board.

As boards have ESG considerations top of mind, tax leaders can be important partners in advancing those objectives. Eighty-six percent of tax executives believe ESG measures have a positive impact on long-term financial performance compared to just 64% of CFOs surveyed in BDO’s 2022 Middle Market CFO Outlook Survey. Tax executives were also much more likely than CFOs to cite improving their company’s ESG rating as one of their main ESG objectives. Companies have an opportunity to demonstrate leadership on ESG by taking a proactive approach to transparent tax reporting.

Looking Ahead

Board oversight of the tax function continues to increase in complexity and importance. As boards continue to evaluate how management approaches tax risk, directors are encouraged to regularly leverage tax executives and subject matter experts in board discussions. Ensuring the entity is making appropriate investments in technology can provide a range of benefits that help achieve strategic and reporting goals. This includes enabling capital allocation and holding management accountable to provide the upskilling necessary to maximize technology benefits. As reporting standards and requirements evolve, collaboration between the board, management and tax department helps align the tax strategy with broader business objectives for sustainable value creation.

SHARE