Voluntary Audit Committee Disclosures Continue to Evolve

Download PDF Version

As evidenced in the fifth annual Audit Committee Transparency Barometer, released by the Center for Audit Quality and Audit Analytics, public companies of all sizes continue to expand voluntary audit committee disclosures within their proxy statements to provide stakeholders with further insight into the oversight responsibilities, particularly with regard to the external auditor and the audit process.

Audit committees have many requirements placed upon them by regulatory bodies and exchanges. BDO’s Audit Committee Requirements Practice Aid summarizes these existing requirements and certain evolving best practices in a user-friendly tool. However, current required public communications through vehicles like the annual proxy statement and the audit committee report contained within, may leave some stakeholders perhaps looking for further insight into audit committee governance activities, particularly with regard to the oversight of the audit. In 2015, the SEC issued a concept release regarding possible revisions to audit committee disclosures which generated a renewed discussion about disclosure but has not resulted in any significant changes to date. Instead, the SEC has taken a monitoring approach to developments in practice with respect to voluntary disclosures being made by public company audit committees. The SEC further continues to emphasize disclosure effectiveness within publicly expressed statements made by SEC leadership and staff.[1] SEC Chief Accountant Wes Bricker and SEC Chairman Jay Clayton both underscored the importance of relevant audit committee disclosures during a session on the vital role of public company auditors and audit committees at the most recent AICPA Conference on Current SEC and PCAOB Developments. During that discussion, Bricker indicated:

“The audit committee report, together with the auditor’s report, will convey and should convey the relevance of both of those groups, adding to the investor’s [knowledge] not only what those groups do but how they do it. That’s important texture for investors to gage the governance and audit quality that’s been built into any given company.”[2]

In its recent Main Street Investors Survey, the Center for Audit Quality (CAQ) reports that 81% of 1,100 U.S. investors surveyed indicate confidence in public company auditors; while a similar 80% indicate confidence in independent audit committees. Both of these confidence indicators have increased significantly from 67% and 63%, respectively, in 2011. This signals an encouraging trend with respect to two critical value providers in the financial reporting chain but also indicates there remains more work to be done to increase confidence in capital markets.

As a means to capture current voluntary audit committee reporting trends, several organizations, including the CAQ and Audit Analytics along with several of the largest accounting and auditing firms, conduct annual analyses and have concluded that increasingly enhanced, voluntary disclosures are being made by audit committees across the board.

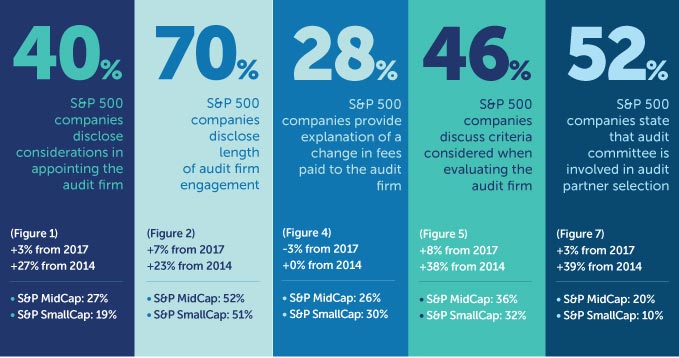

Audit Committee Transparency Barometer and Key Findings

In November 2018, the Center for Audit Quality and Audit Analytics released their fifth annual Audit Committee Transparency Barometer, examining the robustness of audit committee proxy disclosures among the Standard & Poor’s (S&P) Composite 1500 companies. Unlike similar reports that focus on the largest public companies, this report looks at the most current proxy statements filed between July 1, 2017 and June 30, 2018 across small-, mid-, and large-cap companies that compose the S&P 1500. The authors note that they continue to see encouraging year-over-year trends with respect to voluntary, enhanced disclosure around external auditor oversight included within the audit committee report and elsewhere in the proxy statement.

The 2018 Audit Committee Transparency Barometer provides valuable data points for audit committees’ consideration. Categories of disclosure considered within the report include:

-

Audit firm selection and ratification;

-

Length of audit firm engagement;

-

Audit firm compensation;

-

Audit firm evaluation and supervision; and

-

Audit engagement partner selection

Key findings shared:

Source: CAQ 2018 Audit Committee Transparency Barometer

Within each of the areas noted above, the report provides several illustrative disclosures deemed as best practices for audit committee consideration which we encourage you to review. Additionally, the report details the five year data trends for each disclosure category listed above by disclosure question and provides comparatives across the large, the mid, and the small-cap companies in the study.

While the findings generally show more significant increases in robustness of disclosures for the large organizations, increases, some in the double digits, are noticed across all size companies. The CAQ and Audit Analytics do point out some areas of opportunity for improvements in describing how audit committees are executing their oversight responsibilities - particularly in how audit committees are compensating and appointing auditors with regard to audit quality and independence considerations. Additionally, they encourage audit committees to make clear the evaluation process of the auditor and the frequency that is being done to further improve audit quality and enhance the relationship between the audit committee and the external auditor.

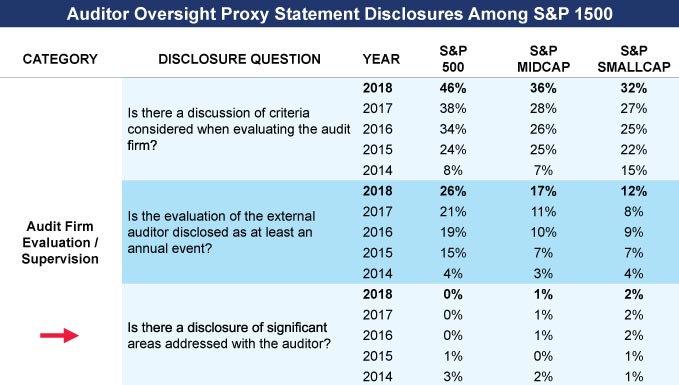

BDO Additional Insight: BDO noted that disclosure of significant areas addressed by the auditor is not currently an area being disclosed voluntarily by the audit committee much, if at all. We anticipate in coming years, with the effectiveness of the new auditor reporting required disclosures of Critical Audit Matters (CAMs) under PCAOB Auditing Standard 3101, audit committees may be more focused on this particular area and the opportunity to increase communications regarding their oversight role with respect to the critical areas addressed within the audit. We encourage our clients to engage in “dry run” discussions and exercises with their engagement teams with respect to the identification and reporting of CAM during the current year audit cycle to better inform the process in preparation for effectiveness of this new requirement beginning in 2019.

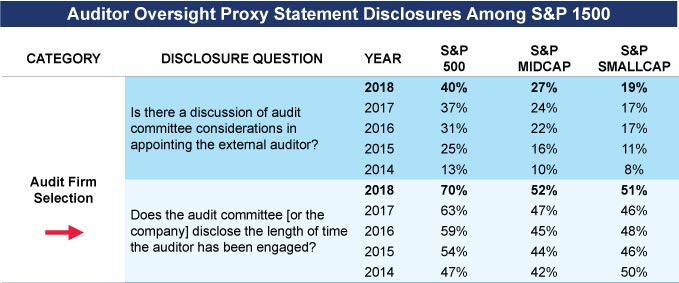

.jpg)

In contrast, we noted that while disclosures by audit committees of large-cap companies with respect to audit tenure have increased significantly from 47% to 70% in five years, this was much less evident with mid-cap companies (42% to 52%) and relatively flat for small-cap companies. (50% to 51%). This was an interesting finding, given that 2018 was the first year in which auditors were required to provide tenure information within the auditor report. BDO notes that within the S&P 500, in looking at 422 companies with market cap greater than $10 billion, approximately 86% and 20% have had the same auditors for more than 10 years or more than 50 years, respectively[3]. Larger companies may have higher motivation to get out in front of auditor’s required disclosures to perhaps acknowledge or describe the benefits of longer auditor relationships. On the flip side are instances that require a change in auditor where proactive audit committees may want to indicate publicly, outside of a required 8-K filing, as to the many reasons as to why a change may occur.

Source: CAQ 2018 Audit Committee Transparency Barometer

PCAOB Auditing Standard (AS) 3101 addresses new disclosure requirements within the auditor report to the audited financial statements. For auditor reports issued in 2018 (e.g., audits of fiscal years ending on or after 12/15/2017), changes to the report itself, disclosures about audit firm tenure and other information were required. Beginning with large accelerated filers for audits of fiscal years ending on or after 6/30/2019, followed by other filers as of 12/15/2020[4], the auditor’s report will provide information on Critical Audit Matters (CAM) that had not previously been provided to investors. In determining what matters would be considered a CAM, auditors shall consider the following:

For more information on the requirements of PCAOB AS 3101 and changes to the auditor report, visit BDO’s Future of Auditor Reporting is Here.

At BDO, we believe transparency and trust are the foundation of every high quality audit. We also recognize that the perceived value of our quality audits in the marketplace is derived from the trust of both those who oversee our work and those who rely on it. As a leader in the audit profession, BDO is committed to providing the same level of transparency to our stakeholders as our clients provide to theirs. It is our intent and commitment to deliver high quality audits and provide our clients with deep insights and value.

For further information, refer to BDO’s own voluntary disclosure: 2018 Delivering on Our Audit Quality Intent

BDO Additional Insight: We continue to believe that complexity, increasing access to and the digitization of information, technological advances, and emerging risks fuel public demand for greater transparency from those charged with governance. Regulators, while potentially trying to reduce an already overwhelming disclosure burden, remain focused on the balance for meaningful investor information and are paying close attention to market communication channels.

Audit committees have the ability to provide thoughtful and insightful information about their oversight responsibilities of the audit and the auditors. Voluntary disclosure within public filings that are timely and relevant can help de-mystify the audit process and support the enhancement of audit quality. Information shared in tools like the Audit Committee Transparency Barometers serve as good bench marks to evaluate the strength of your own organization’s approach to disclosure.

Where to Learn More?

BDO will continue to monitor developments in this area to provide timely guidance and references to our clients and contacts through our Center for Corporate Governance and Financial Reporting.

[1] Refer to SEC Chief Accountant Wes Bricker’s remarks before the University of Tennessee’s C. Warren Neel Corporate Governance Center: “Advancing the Role and Effectiveness of Audit Committees.” Similar remarks were made during the Association of Audit Committee Members, Inc. Annual Meeting held on October 5, 2018.

[3] Computed from Audit Analytics Standard & Poors 500 Company data based on reported Market Cap of greater than $10 billion and disclosed auditor reporting as of 11/5/2018.

SHARE