The Future of Auditor Reporting is Here

Explore the Future of Auditor Reporting:

To the Point

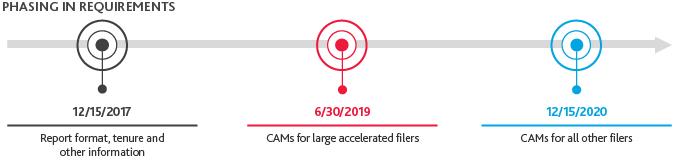

PCAOB Auditing Standard (AS 3101) and related amendments, approved by the SEC in October 2017, introduced new required disclosures relative to Critical Audit Matters, auditor tenure, and a statement on independence, among other changes to the auditor’s report. AS 3101 applies to audits of public companies both large and small with limited exceptions as noted below.

.png)

Which Audits Do and Do Not Require CAM?

CAMs are required to be reported for audits of public companies. However, CAMs are not required for audits of:

- Brokers and dealers;

- Registered investment companies other than business development companies;

- Employee stock purchase, savings, and similar plans; and

- Emerging growth companies.

What is a CAM?

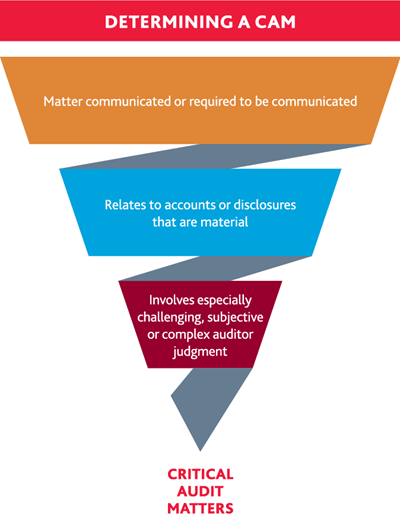

A CAM is any matter arising from the audit of the financial statements that was communicated or required to be communicated to the audit committee and that:

- relates to accounts or disclosures that are material to the financial statements, and

- involves especially challenging, subjective, or complex auditor judgment

While CAMs will result from the nature of communications that are already occurring with the audit committee, the auditor is now required to provide to and discuss with the audit committee a draft of the auditor’s report prior to release.

.png)

How are CAMs Assessed?

CAMs involve “especially challenging, subjective, or complex auditor judgment.” In determining whether those criteria apply, the auditor should take into account, alone or in combination, the following nonexclusive list of factors:

.png)

How Many CAMs and Where Do They Occur?

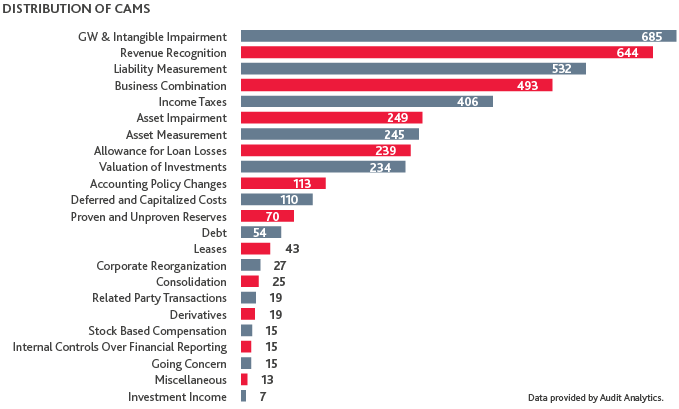

While the number of CAMs will vary for each audit engagement, it is expected that most auditor reports will have at least one CAM. A lengthy list of matters, however, could detract from the intent of communicating CAMs.

It has quickly become clear that there is not a set number of CAMs that exists in a given industry or type or size of a company. The below charts show the number and nature of CAMs identified for all filings through September 30, 2020 (data provided by Audit Analytics).

.png)

.png)

What Will CAMs Look Like?

For each critical audit matter communicated in the auditor’s report the auditor must:

- Identify the critical audit matter;

- Describe the principal considerations that led the auditor to determine that the matter is a critical audit matter;

- Describe how the critical audit matter was addressed in the audit; and

- Refer to the relevant financial statement accounts or disclosures that relate to the critical audit matter.

When describing CAMs in the auditor’s report, the auditor is not expected to provide original information unless it is necessary to describe the principal considerations that led the auditor to determine that a matter is a CAM or how the matter was addressed in the audit.

CAMs for Management and Audit Committees

While CAMs will result from the nature of communications that are already occurring with the audit committee, the auditor is now required to provide and discuss with the audit committee a draft of the auditor’s report prior to release.

What to Expect

As a member of management or audit committee member, you should expect to engage in timely discussions with your auditors about what matters they expect to be CAMs for the current audit cycle as soon as audit planning and throughout interim review and audit fieldwork. Prior to the audit report release, the audit committee and management should expect the opportunity to review the draft of the auditor’s report and carefully evaluate specifics of CAM reporting and a need for enhancement and clarification of financial statements disclosures, as applicable.

Timeline for Calendar Year-end Issuers

.png)

Evolving Resources

| Recommended Resources | Release Date |

| PCAOB Stakeholder Outreach on the Initial Implementation of CAM Requirements | October 2020 |

| PCAOB Econometric Analysis on the Initial Implementation of CAM Requirements | October 2020 |

| PCAOB Critical Audit Matters Spotlight | December 2019 |

| Critical audit matters: What firms are reporting | October 2019 |

| PCAOB New Auditor’s Report Resource Site | Regularly Updated |

| PCAOB Audit Committee Resource: Critical Audit Matters | July 2019 |

| PCAOB Investor Resource: Critical Audit Matter | July 2019 |

| PCAOB Implementation of CAM: A Deeper Dive on the Communication of CAMs | May 2019 |

| PCAOB Webinars on Critical Audit Matters | Spring 2019 |

| CAQ Webinar: The Enhanced Auditor’s Report is Here: Get the Facts on CAMs and More | April 2019 |

| PCAOB Additional CAM Resources for Audit Committees | March 2019 |

| CAQ Critical Audits Matters: Lessons Learned, Questions to Consider, and an Illustrative Example | December 2018 |

| PCAOB Staff Guidance | Updated August 2018 |

Have Questions? Contact Us

SHARE