SASB Issues Sustainability Reporting Standards – Why Boards Should Take Notice

At a time of increasing interest in enhanced nonfinancial disclosures, the Sustainability Accounting Standards Board issued codified accounting and reporting standards applicable to 77 identified industries as a market-driven response to satisfy the need for sustainability information focused on financially material issues that are decision-useful for investors and key stakeholders and cost-effective for public companies. Corporate boards are encouraged to consider the potential benefits that come with providing more complete public information about a company’s risks and opportunities.

In November 2018, the Sustainability Accounting Standards Boards (SASB) issued codified sustainability standards applicable across 77 industries following six years of development, leveraging evidence-based research and broad stakeholder input. While the SASB is not an authoritative standard setting body and use of such standards is not required, SASB standards are intended as a guide for voluntary reporting use by public companies in making disclosures on material sustainability factors in Forms 10-K, 20-F, and 40-F as required by existing U.S. regulation. SASB standards may also be applicable to the disclosure of material sustainability information by other types of organizations including privately held corporations and foreign corporations publicly listed in other jurisdictions.

The SASB defines “sustainability” as corporate activities that maintain or enhance the ability of the company to create value over the short, medium, and long term. Sustainability accounting reflects the governance and management of a company’s environmental and social impacts arising from production of goods and services, as well as its governance and management of the environment and social capitals necessary to create value over time. Additionally, the SABS refers to sustainability as “ESG” (environmental, social, and governance), though traditional corporate governance issues such as board composition are not included within the scope of the SASB’s standard-setting activities. The SASB contends that “investors want to better understand not only how companies impact the environment, but also how climate change and other factors will impact companies – and which companies are taking smart steps to reduce risk and increase returns.”[1]

The creation of such standards represent a market-driven response to the need for sustainability information that is decision-useful for investors and interested stakeholders and cost-effective for issuers that revolves around identified financially material issues that are reasonably likely to impact the financial condition or operating performance of a company. Based upon its nonfinancial nature, sustainability information is typically not subject to generally accepted accounting standards and thus, does not fall under U.S. generally accepted auditing standards, procedures, and judgments and is not subject to the rigor of internal controls that are considered in the construct of financial statements[2].

What are the SASB standards?

The industry-specific standards, which span 11 industry sectors, include:

- Disclosure topics – A minimum set of industry-specific disclosure topics reasonably likely to constitute material information, and a brief description of how management or mismanagement of each topic may affect value creation.

- Accounting metrics – A set of quantitative and/or qualitative accounting metrics intended to measure performance on each topic.

- Technical protocols – Each accounting metric is accompanied by a technical protocol that provides guidance on definitions, scope, implementation, compilation, and presentation, all of which are intended to constitute suitable criteria for third-party assurance.

- Activity metrics – A set of metrics that quantify the scale of a company’s business and is intended for use in conjunction with accounting metrics to normalize data and facilitate comparison.

SASB Industry Sectors

The SASB has categorized its 77 standards pursuant to its Sustainable Industry Classification System across the following sectors:

- Consumer Goods

- Extractives & Mineral Processing

- Financials

- Food & Beverage

- Health Care

- Infrastructure

- Renewable Resources & Alternative Energy

- Resource Transformation

- Services

- Technology & Communications

- Transportation

Additionally, the SASB standards are organized around five broad sustainability dimensions that comprise the universe of sustainability issues: (1) environment; (2) social capital; (3) human capital; (4) business model and innovation; and (5) leadership and governance.

Companies may choose to utilize the SASB standards most relevant to the company’s industry or industries in preparing its sustainability reporting. The format for such reporting may vary greatly and includes sustainability reports, integrated reporting, websites, or components within annual reports to shareholders.

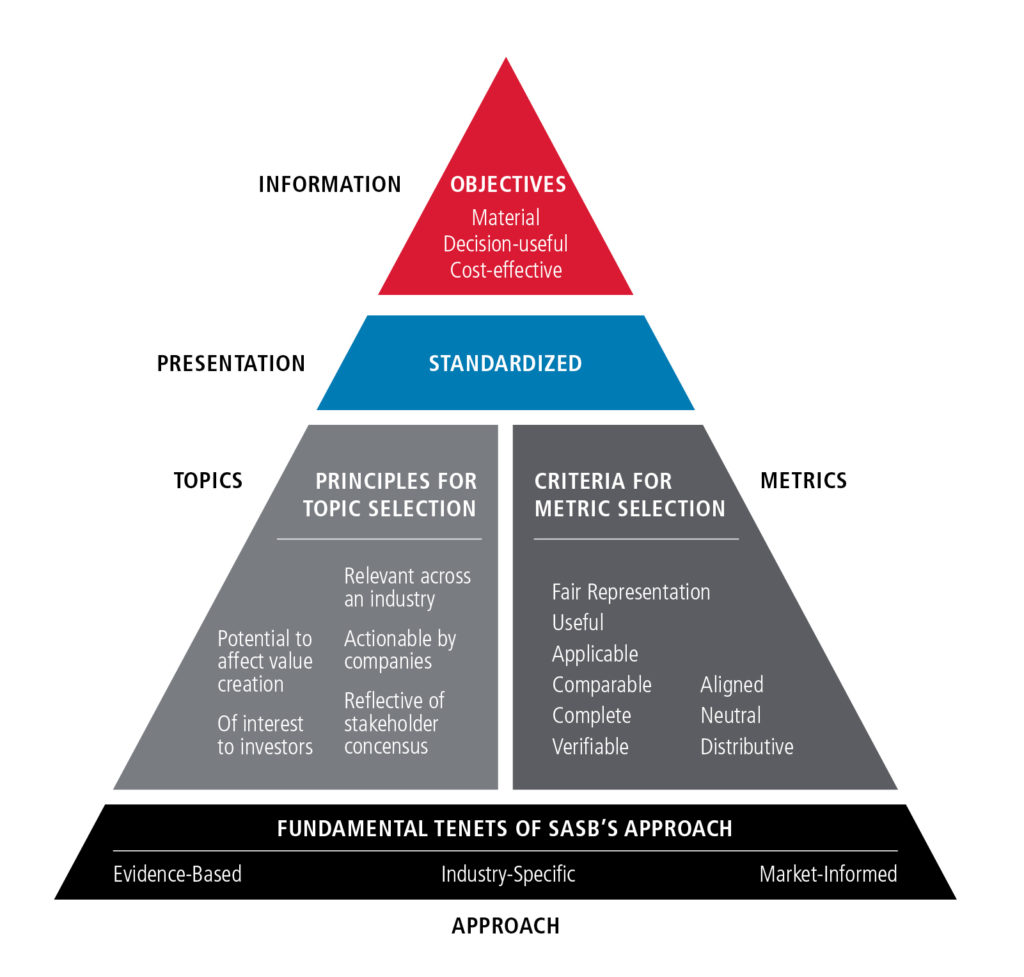

The SASB Standards have been designed and developed based upon the SASB’s Conceptual Framework that sets out the basic concepts, principles, definitions, and objectives that guide its approach to setting standards. As a core principle, the SASB seeks to align its standards and metrics with existing accounting and reporting frameworks and other reporting mechanisms and protocols, such as regulatory filings or industry-developed best practices.

Source: The SASB Conceptual Framework

What is the SASB?

The SASB is an independent, nonprofit standard-setting organization, established in 2011 to develop and disseminate cost-effective sustainability reporting standards to facilitate communication by companies to investors of decision-useful information on sustainability matters. The independent arm of the SASB sets sustainability disclosure standards that are industry-specific and tied to the SEC concept of materiality to investors. The standards are intended to capture sustainability matters that are financially material – reasonably likely to have a material impact on financial performance or consideration. They also provide a tool by which companies may measure their performance against their peers and to take steps to address vulnerabilities and opportunities and move toward more efficient, stable, and resilient markets.

The SASB follows a regular cycle of updating the standards to ensure responsiveness to changing market needs. The development of the SASB Standards was not done in a vacuum and the SASB has indicated that these standards can also be used alongside other sustainability frameworks (see discussion below) and align with recommendations from the Task Force on Climate-related Financial Disclosures and the Global Reporting Initiative.

The SASB Board is composed of a representative stakeholder group that includes former lead regulators from both the SEC and the FASB, attorneys, politicians, business and operational executives, institutional and individual investors, and auditors.

The SASB receives it funding from a range of sources, including contributions from philanthropies, companies, and individuals, as well as through the sale and licensing of publications, educational materials, and other products. The SASB does not receive government financing nor is it affiliated with any governmental body, the FASB, the IASB, or any other financial accounting standards-setting body.

What is the purpose of sustainability reporting?

Traditional financial statements only go so far in capturing all factors that contribute to a company’s ability to create value over time. Sustainability reporting, along with other types of similar reporting known as triple bottom line reporting and/or corporate social responsibility (CSR) reporting, has evolved out of the perceived need to provide additional information about how companies manage environmental, social and human capitals, as well as corporate governance to enhance a decision maker’s understanding of all of the company’s material risks and opportunities. Providing such information, over time, may provide investors and key stakeholders with a more complete view of the ability of a company to manage risks and sustain value creation. Additionally, with a goal of broad disclosure across an industry, investors and key stakeholders may be better able to more fully understand the interrelated nature between financial and nonfinancial factors and risks that impact a company’s future financial position and how sustainability issues are managed across the supply chain. This better enables comparison and the ability to distinguish companies based on their strategies and operations with respect to these types of issues.

What’s in a name?

Various formats of nonfinancial reporting continue to evolve over time – similar perhaps but each with slightly different objectives. For example, sustainability reporting may be viewed as providing information focused on the future, forward thinking plans to sustain a business and improve targets – for instance, waste reduction and innovative brand development. CSR Reporting tends to capture projects and activities that have been done in the past to support community projects. CSR also tends to have much more of a compliance objective and focuses mainly on social aspects. Sustainability reporting may be thought of an umbrella for all key business aspects and activities that envelopes the financial, social, environmental, governance, cultural issues. In short, sustainability reporting is a forward-looking approach acting as an umbrella for all critical business inputs (limited resources) functions (operations), investment (money, time) and impacts (positive and negative) of which CSR Reporting may represents certain underlying elements.

How is sustainability reporting viewed in the U.S. versus elsewhere in the world?

Globally, there has been significant attention and focus from a broad variety of stakeholders – investors, regulators, corporations, activists, and many others – to include corporate sustainability issues within investment analysis and decision-making processes. Regulation, such as the EU Non Financial Reporting Directive, along with foreign exchange listing requirements, including the Sustainable Stock Exchanges Initiative, are further drivers of sustainability initiatives. There has also been an evolution of numerous reporting organizations with competing sustainability frameworks that are in use globally, including the Global Reporting Initiative (GRI), the Organisation for Economic Co-operation and Development (OECD), the United Nations Global Compact, the International Organization for Standardization, the International Integrated Reporting Council (IIRC) and the SASB. Additionally, there has been the increase in ratings organizations such as Carbon Disclosure Project (CDP), the Dow Jones Sustainability Index (DJSI) and the Global Initiative for Sustainability Ratings (GISR) in the attempt to measure how companies who report on sustainability stack up. Due to this broad variability in both how companies report and the basis on how such reporting is evaluated, there is currently not a uniform means to compare sustainability reporting internationally.

Is sustainability reporting required in the U.S.?

Sustainability reporting is not necessarily required in the U.S. However, under SEC Regulation S-K, certain sustainability-related information is required to be disclosed by public companies. Regulation S-K sets forth the specific disclosure requirements associated with Form 10-K and other SEC-required filings and, among other things, requires that companies describe known trends, events, and uncertainties that are reasonably likely to have material impacts on their financial condition or operating performance in the Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) section of Form 10-K or 20-F. Within the MD&A section, companies must “provide investors and other users with material information that is necessary to [form] an understanding of the company’s financial condition and operating performance, as well as its prospects for the future.” Also, under Item 503(c) of Regulation S-K, companies are required to disclose risk factors—factors that may affect a company’s business, operations, industry or financial position, or its future financial performance.

In 2016, the SEC issued a Concept Release on modernizing Regulation S-K disclosure requirements which generated significant public feedback on specifically improving sustainability-related disclosure information in SEC filings. To address the growing interest in ensuring reliability and comparability in sustainability reporting, in July 2017, the AICPA issued Attestation Engagements on Sustainability Information (Including Greenhouse Gas Emissions Information), as a guide to auditors engaged to perform an exam or review pertaining to sustainability information.

Use of the SASB standards provide a materiality focus that is consistent with the SEC’s definition of materiality – issues that are reasonably likely to impact the financial condition or operation performance of a company and therefore are most important to investors.

Who is providing sustainability reporting in the U.S.?

Despite certain required public company reporting, the evolution of voluntary sustainability disclosure currently remains heavily with large companies. The Governance & Accountability Institute study found that 85% of the S&P 500 published sustainability or corporate responsibility reports in 2017, which was up significantly from 20% in 2011.

Increasingly, however, institutional investors and asset managers serving large and mid-market companies are pushing for greater board accountability and focus on sustainability metrics—as evidenced by Northern Trust’s proxy voting guidelines promoting energy efficiency, Trillium Asset Management’s push in favor of greenhouse gas emissions reporting, and Vanguard’s renewed focus on sustainability. In his January 2018 annual letter to CEOs, Larry Fink, CEO of Black Rock, focused on the board’s engagement in developing a company’s long-term strategy and value creation. He went on to highlight “a company’s ability to manage environmental, social, and governance matters demonstrates the leadership and good governance that is so essential to sustainable growth, which is why we [Blackrock] are increasingly integrating these issues into our investment process.”

Where Do U.S. corporate directors stand on sustainability reporting?

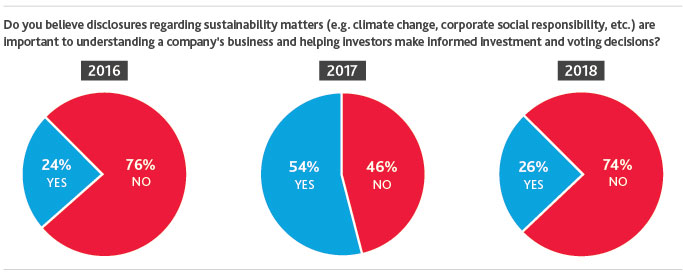

Interestingly, BDO’s findings from our most recent annual survey of public company board directors, seemed to indicate that sustainability reporting has taken a back burner and may not be a high priority on the board’s agenda.

Perhaps sustainability is still thought of by directors as something that is primarily for large, international corporations the likes of Coca Cola, Allergan, and Merck. Perhaps these findings are attributable to a lesser media focus than in the prior year which featured the US exit from the Paris Climate Accord or Exxon’s notable proposal approved by its shareholders requiring measurement and disclosure as to how regulations to reduce greenhouse gases and new energy technologies could impact the value of its oil assets. Whatever the reason, we believe that as the pace of change and availability of instant data continues to drive all companies toward a more globally conscious economy, companies of all sizes may feel more intense pressure to publicly address what they are doing to promote good environmental, social and corporate governance (ESG) practices within their organizations.

Why may Small Cap companies want to consider sustainability reporting?

While our survey compiled opinions shared with us in July and August, BDO more recently designed and sponsored a session during the Small Cap Symposium at the NACD’s Global Board Leaders’ Summit held in Washington, D.C. in early October. Our moderated panel featured D’Anne Hurd, a seasoned director of Pax World Funds, and Veena Ramani, the leader of Capital Market Systems from Ceres, who shared persuasive thoughts and real company examples on the value in developing and communicating a sustainable strategy in a small cap company. Over 150 corporate directors engaged in significant discussion and observations with our panel on how smaller companies and their stakeholders stand to benefit from sustainability reporting.

A few of the key discussion points from the conference included:

- Realization: Tangible returns being realized in adoption of sustainable practices

- Competitive differentiator: Use of voluntary disclosure as opportunity to tell unique stories to the marketplace which can serve as competitive differentiators

- Capitalizing on investment trends: Cultivation and incorporation of evolving investing practices in companies that can demonstrate long term value creation initiatives

- Demonstration of connected corporate strategy: Strengthening corporate strategy with forward-thinking, sustainable practices

- Engagement of shareholders: Getting out in front of threat of increasing shareholder proposals focused on ESG

- Protect reputation and improve public relations: Communicating fulfillment of a deemed duty by the market as a “good corporate citizen”

- Attraction and retention of talent: A potential further differentiator in war for attracting and retaining good talent

Next steps?

With the release of these anticipated industry-specific standards, the SASB has helped pave the way for companies to have a more uniform approach to reporting on sustainability information to enhance and expand financial reporting.

For your further consideration related to the topics outlined above, we have compiled the additional recommended resources:

| Recommended Resources | |

| BDO | 2018 BDO Board Survey Findings |

| BDO | Webinar: What’s on the Minds of Boards – BDO Board Survey 2018 |

| Ceres | Leader from the Top: Building Sustainability Competence on Corporate Boards |

| Ceres | Getting Climate Smart: A Primer for Corporate Directors in a Changing Environment |

| Ceres | Systems Rule: How Board Governance Can Drive Sustainability Performance |

| Global Reporting Institute | Making the case for SME Sustainability Reporting |

| Institute of Management Accountants | Leveraging the COSO Internal Control – Integrated Framework to Improve Confidence in Sustainability Performance Data |

| NACD | Oversight of Corporate Sustainability Activities Handbook |

| Pax World Funds | The Financial Performance of Sustainability: ESG and Risk |

We will continue to highlight these and other activities, trends, and relevant discussion points to our client audit committees and management teams through our Center for Corporate Governance and Financial Reporting.

SHARE