Governance & Reporting, Redefined

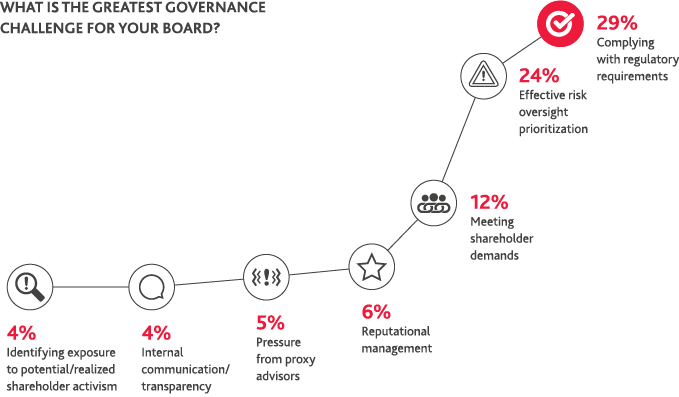

As board directors struggle to balance competing demands for their time, expertise and focus, they point to regulatory compliance and effective risk oversight prioritization as two of the top challenges for their board. In addition to core responsibilities like regulation and risk, companies of all sizes will need to give more weight to how they are perceived broadly as corporate governance continues to be re-defined by those inside and outside the organization.

With stakeholders and shareholders increasingly focused on transparency, boards are likely to become even more involved in communications and reputational management. While required financial reporting remains critical, companies are also looking for new ways to share company performance, metrics and mission with their stakeholders. Overall, organizations that best demonstrate how they are integrating the varying needs of broad stakeholders into their business strategies, while creating long-term sustainable value, hold the keys to success.

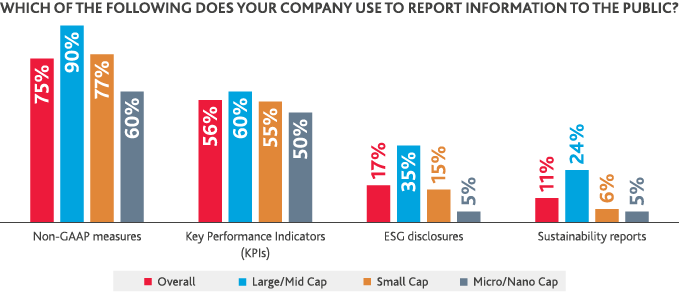

Three-quarters of directors say their companies use non-GAAP metrics and 56% say they report key performance indicators to help convey value. Looking deeper, significantly more large companies are using non-GAAP metrics, ESG disclosures and sustainability reports compared to smaller organizations.

Non-GAAP metrics like “community-adjusted EBITDA” have made headlines in the past several years as digital transformation has helped bring in new business models and opportunities that some companies believe are not fully captured by traditional, required metrics. Home-exercise company Peloton recently introduced an “average net monthly connected fitness churn” metric as a part of their IPO preparations to attempt to describe their success with customer retention. While non-GAAP metrics can assist with sharing potential value and opportunity, they are far from replacing GAAP metrics as the standard, and board directors should ensure financial reporting priorities and oversight are aligned.

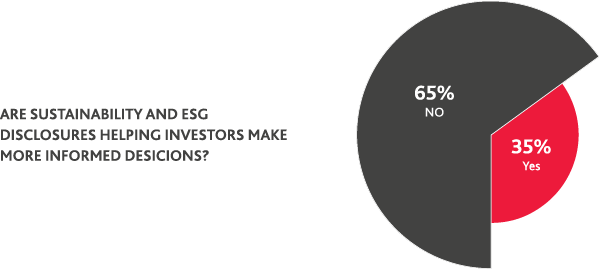

Our survey indicates that companies appear to be less active when it comes to disclosing environmental, social and governance (ESG) measures and publishing sustainability reports. Almost two-thirds (65%) of directors say that sustainability and ESG disclosures do not help investors make more informed decisions. However, with international and increasing domestic cultural and generational pressures, we anticipate these reports may become both more prevalent and more important to company performance. Larger companies are further along in this regard, with 47% of large/mid cap company board directors seeing the value in ESG and sustainability disclosures compared to 32% of small cap and 27% of micro/nano cap company board members.

Another significant disclosure that companies are contending with for the first time is around critical audit matters. Beginning in 2019 with large accelerated public company filers, the PCAOB is requiring auditors to disclose critical audit matters (CAM) in the annual auditor’s report. The PCAOB’s goal is to increase transparency into the audit by communicating issues discussed with the audit committee about matters that could be material to the financial statements, particularly those that require especially challenging, subjective or complex auditor judgment. Ultimately, these added disclosures are intended to help grow confidence in the capital markets and demystify the audit process.

The majority of board directors (76%) across all sized companies say that their audit committees have been working with their auditors to understand the potential impact of CAM on financial reporting. This is good news, as the audit committees will want and need to understand the matters the auditor will determine to be CAM as well as how they will be reported within the auditor’s report to the financial statements.

Many companies have conducted dry run assessments of disclosures, ahead of the reporting deadlines, to understand the issues and better prepare. Not surprising, within reports for the early filers, common CAM include complex revenue recognition, taxes, goodwill, valuation of investments and lease accounting.

“New CAM disclosures provide rich information for investors and provide another layer of transparency for trust in the markets. Auditors and audit committees have been actively preparing for the change by engaging in a dry run process in the year before implementation. Audit committees should continue to actively engage with their auditors to understand CAM identification during the audit process.”

PHILIP AUSTIN

PHILIP AUSTINBDO USA’s National Assurance Managing Partner - Auditing

SHARE