2018 BDO Board Survey

Explore the 2018 BDO Board Survey:

- Tax Reform: High Expectations Meet Reality

- Time to Track Total Tax Liability

- Boards Seek Auditor Review of Non-GAAP Measures and KPIs

- Sustainability Reporting Takes a Back Seat in 2018

- Boards Focus on Diversity and Overboarding

Transformation Moves Boards to Take Fresh Look at Tax, Metrics, Diversity

The world of corporate directors at publicly traded companies is constantly in flux—never more so than in 2018, as boards face regulatory uncertainty, significant tax law changes and greater focus on holistic tax planning, disruptive changes in business models and intense scrutiny of board diversity and composition.

The 2018 BDO Board Survey, conducted annually through the BDO Center for Corporate Governance and Financial Reporting, measures the opinion of public company directors on these issues, as well as other key governance concerns. This year’s survey, conducted in July and August 2018, examines the opinions of 140 corporate directors of public company boards.

“Public company board directors see recent tax law changes as positively impacting their company, but many are taking a ‘wait and see’ approach to launching new business initiatives, as they look to develop a more thorough understanding of their business’ total tax liabilities. Directors remain confident in the use of non-GAAP measures in financial reporting, and believe their boards are on a positive track with regard to addressing board diversity."

AMY ROJIK

AMY ROJIKNational Assurance Partner, Communications and Governance

Tax Reform: High Expectations Meet Reality

2018 has seen the most significant changes to United States tax laws in a generation, and while the full impact of the changes wrought by the Tax Cuts and Jobs Act of 2017 is still being determined, public company board members have an inside look at how their companies have been affected.

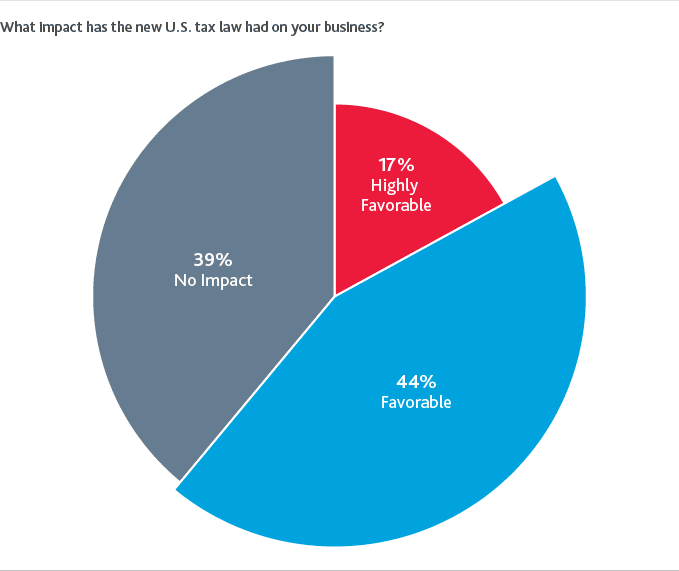

A majority (61 percent) of public company board members note a favorable or highly favorable impact, while 39 percent say the tax law changes had no impact at all on their business. That’s in contrast to the optimism shown last year, when an overwhelming majority (94 percent) of public company board members anticipated changes to tax law would have a favorable impact on their business. More muted optimism among corporate directors now that the tax reform has become reality may reflect the uncertainty that still underlies many aspects of tax reform—especially with a potential second round of tax reforms already on the horizon.

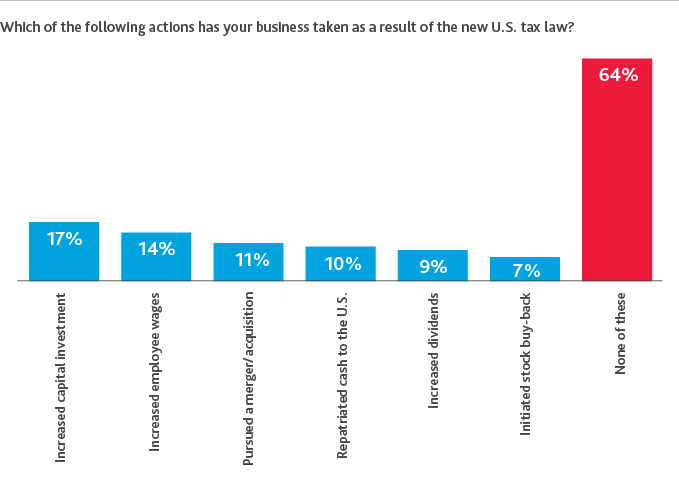

When asked what actions their business has taken as a result of the new U.S. tax law, many public company board members report reinvesting in the business via increasing capital investment (17 percent), increasing employee wages (14 percent) and pursuing a merger or acquisition (11 percent). Smaller percentages focus on returning gains to shareholders through increasing dividends and initiating stock buy-backs. The majority (64 percent) of public company board directors, who report taking no actions to date, may benefit from taking a phased approach to acting on tax reform: determining and addressing any immediate to-dos, navigating key steps to implementing any changes, and finally, ensuring their tax department is equipped to grow and address futures changes.

BDO's Closer Look

Congress and the Trump Administration have already begun consideration of Tax Reform 2.0, including further legislative or regulatory actions to make permanent the short-term provisions of the 2017 tax law changes, among other adjustments to the tax code. BDO regularly produces resources, including this Tax Reform Planning Checklist, designed to keep you informed on the latest developments that may impact your businesses.

To learn more, visit BDO’s Tax Reform hub for a broad range of resources featuring the latest intelligence from BDO tax professionals. Perspectives from tax business leaders on the ground are also captured in BDO’s 2018 BDO Tax Outlook Survey.

Time to Track Total Tax Liability

Given the U.S. tax law changes in 2018 and the growing complexity of global tax regimes, seemingly small changes in corporate strategy can have significant consequences to the business’ total tax liabilities across jurisdictions. For public company board members, understanding the company’s total tax liability and monitoring how well management is mitigating this risk, including all of its various tax dynamics, is critical.

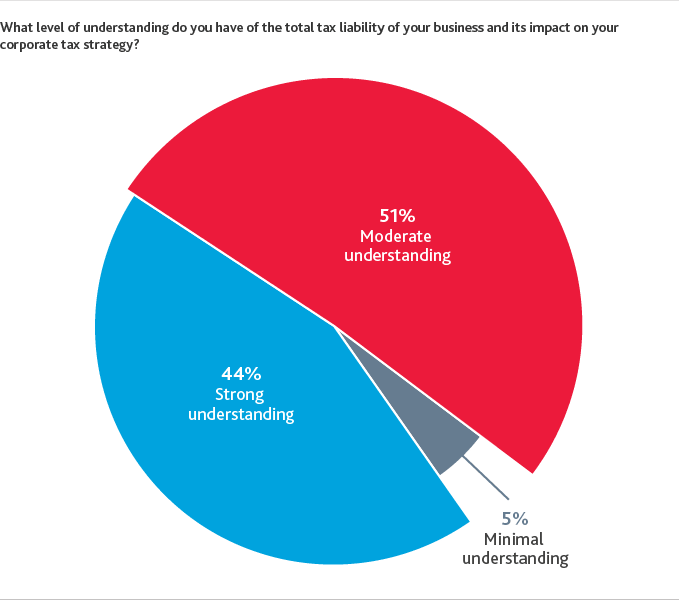

Regardless of whether their company is undertaking changes as a result of the new U.S. tax law, corporate board members must ensure their company has developed a complete picture of its tax liability, factoring in income, property, excise and other taxes, as well as credits, incentives and deductions at the international, federal, state and local levels. Among board members surveyed, only 44 percent have a strong understanding of their organization’s total tax liability and how it impacts the company’s tax strategy.

“While tax reform continues to make headlines in the U.S., it’s just one part of a complex set of tax issues facing businesses across all industries. Getting a grasp on total tax liability is the next great challenge and opportunity for many companies—understanding where tax costs arise across the entire business and developing strategies to minimize the impact on the bottom line. Leading businesses will consider tax from a holistic perspective and use data-driven insights to develop comprehensive tax solutions."

.jpg) MATTHEW BECKER

MATTHEW BECKERNational Tax Managing Partner

As companies look to explore new tax strategies to survive and thrive during this time of intense change, board members can help the business avoid bumps in the road by proactively tackling tax risk and opportunities at the earliest juncture, and by re-evaluating strategies regularly, as the tax landscape continues to shift. As good governance practice, directors are strongly encouraged to reserve time to engage with company management and tax advisors on an ongoing basis.

Boards Seek Auditor Review of Non-GAAP Measures and KPIs

As public company business models shift in response to technological changes, organizations are seeking additional ways to provide insights into operations, financial position and liquidity—beyond what is required by statute. Many companies have turned to non-GAAP financial measures as a way to showcase these results. From measures such as “adjusted EPS” to “community-adjusted EBITDA,” organizations are pressing the case to investors that GAAP metrics don’t necessarily capture the true performance of the business. While these non-GAAP measures are increasingly making an appearance in company financial reports, they also remain an area of focus for regulators and stakeholders.

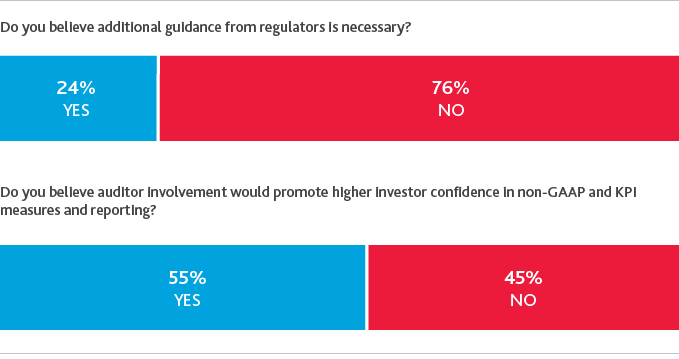

When asked if they believe additional guidance from regulators on non-GAAP and other key performance indicator (KPI) metrics in their financial statements is necessary, more than three-quarters (76 percent) of corporate board directors say no.

When asked if auditor involvement would promote higher investor confidence in non-GAAP measures, however, a majority (55 percent) of public company directors say that it would, suggesting that boards believe a greater level of transparency, consistency and comparability in these measures would be beneficial to investors and others to understand a company’s results of operations, financial position or liquidity.

“Technologies from blockchain to artificial intelligence (AI) are fueling new and evolving business models and driving the emergence of new ways to track and monitor company progress toward strategic goals. Auditors must adapt their approach and analysis to respond to this disruptive trend and provide independent insights on these new metrics that help drive quality and trust."

.jpg) PHILIP AUSTIN

PHILIP AUSTINNational Assurance Managing Partner, Auditing

BDO's Closer Look

The Center for Audit Quality (CAQ) released a new tool, Non-GAAP Measures – A Roadmap for Audit Committees, as a culmination of stakeholder roundtables designed to solicit discussions around the usefulness and challenges of using Non-GAAP financial measures, and to identify opportunities to enhance public trust and confidence in such measures. This tool and others have been designed by the CAQ with significant input from stakeholders and serve as valuable resources to audit committees in the execution of their oversight duties and increasing transparency, consistency and reliability within the financial reporting chain.

BDO continues to report on the use of Non-GAAP measures including within our year-end Audit Committee Round Up: Focal Points, Tools & Resources for use by audit committees and management.

Sustainability Reporting Takes a Back Seat in 2018

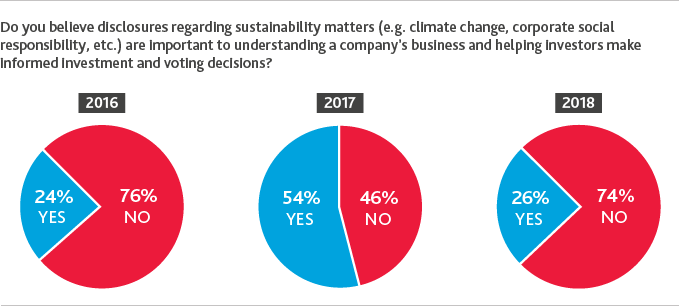

Institutional investors and asset managers serving large and mid-market companies continue to push for greater board accountability and focus on sustainability metrics—as evidenced by Northern Trust’s proxy voting guidelines promoting energy efficiency, Trillium Asset Management’s push in favor of greenhouse gas emissions reporting, and Vanguard’s renewed focus on sustainability. But while sustainability disclosures were a priority for public company board members in our 2017 survey—a stark reversal from 2016—this year’s results show the focus on sustainability has perhaps been put on the back burner…for now. When asked whether disclosures regarding sustainability matters are important to understanding a company’s business and helping investors make informed investment decisions, a majority (74 percent) of public company board directors surveyed say no.

The shift in focus this year may be attributable, at least in part, to a lesser focus, politically speaking. Last year, our survey corresponded with the significant spotlight on President Trump’s 2017 decision to pull the U.S. out of the Paris Climate Accord along with a notable proposal approved by Exxon shareholders requiring Exxon to measure and disclose how regulations to reduce greenhouse gases and new energy technologies could impact the value of its oil assets.

Historically, sustainability reporting has been largely undertaken by large, multinational companies. But as the pace of change and availability of instant data continues to drive toward a more globally conscious economy, companies of all sizes may feel more intense pressures to publicly address what they are doing to promote good environmental, social and corporate governance (ESG) practices within their organizations.

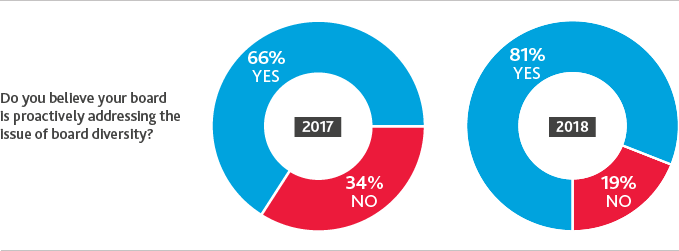

Boards Focus on Diversity and Overboarding

The SEC had begun to look into company disclosures of the ethnic, racial and gender composition of public company boards more than a year ago, considering whether to make such disclosures a mandatory requirement. More recently, BlackRock, the world’s largest money manager, stated that companies in which it invests should have at least two women on their boards. When asked if their board was addressing the issue of board diversity, more than eight-in-10 (81 percent) directors say yes—a marked increase from 2017, when only 66 percent of respondents said the same.

BDO’s Closer Look

Sustainability reporting goes beyond emissions and environmental policies. In BDO’s 2018 Shareholder Meeting alert, we highlight certain significant international regulations and evolving sustainability reporting frameworks that are garnering attention, along with activities being undertaken domestically by the U.S. Sustainability Accounting Standards Boards (SASB) to encourage corporate sustainability disclosures that are material, comparable and decision-useful for investors.

Additionally, in our Shareholder alert, we cited the prominence and growing support of the #MeToo movement in the media and actions being taken by leading companies across multiple industries to stamp out “bad behaviors” and “turning blind eyes to such” by executives and others. One of the tangible results of this focus is the demand by stakeholders for corporate governance accountability and pressuring of the board to demonstrate clear focus on establishing the correct tone and culture at the top of the organization. With these and other examples of ESG concerns on the rise, we would encourage boards to remain vigilant and consider these issues more fully.

Still, nearly one-fifth (19 percent) of directors believe their board has room to grow on this measure, and only 33 percent of directors say their board uses formal diversity reviews to address the topic of board diversity.

With the backdrop of a rapidly evolving business world and competitive disruptors all around us, board composition is becoming increasingly more important to the health of the organization. Board diversity extends beyond consideration of gender and affords board members the opportunity to truly drive board composition with diversity in thought and experience to generate innovative thinking and be proactive to the changing influences on the business. Digital transformation and the broad impact of technology on business models has made it more important than ever to have directors that take seriously their role in helping companies adapt and thrive.

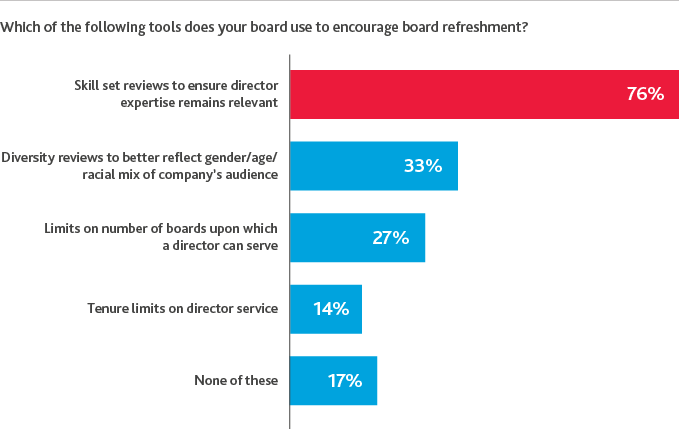

To encourage board refreshment and address the issue of board composition, 76 percent of companies surveyed use skill set reviews to ensure director expertise remains relevant, and one-third (33 percent) use diversity reviews to better reflect the gender, age and racial mix of the company’s audience. A smaller amount (14 percent) may additionally achieve board refreshment through imposing tenure limits on its board members.

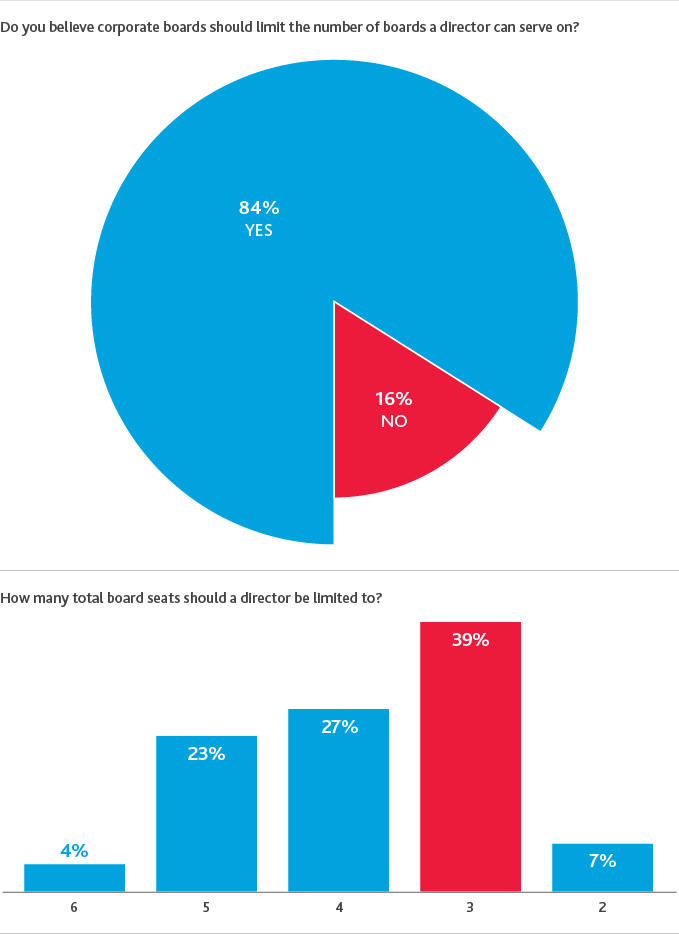

Beyond diversity, boards are also re-evaluating board service limitations. Proxy advisor firms ISS and Glass Lewis have shone a spotlight on the time commitment and focus required to successfully serve on a public company board, with both companies issuing guidance opposing the nomination of non-executive directors with more than five board seats. Just four percent of public company board members surveyed this year feel this figure should be higher, and nearly three-quarters (73 percent) think directors should be limited to four seats or fewer. Yet only 27 percent of directors say their company sets strict limits on the overall number of boards on which a director can serve.

Beyond diversity, boards are also re-evaluating board service limitations. Proxy advisor firms ISS and Glass Lewis have shone a spotlight on the time commitment and focus required to successfully serve on a public company board, with both companies issuing guidance opposing the nomination of non-executive directors with more than five board seats. Just four percent of public company board members surveyed this year feel this figure should be higher, and nearly three-quarters (73 percent) think directors should be limited to four seats or fewer. Yet only 27 percent of directors say their company sets strict limits on the overall number of boards on which a director can serve.

The topic of board diversity and service limits should continue to be a top focus for corporate board directors, as both are likely to become increasingly prominent as changing business landscapes and other disruptive market drivers push company boards to become proactive in addressing these issues.

BDO’s Closer Look

BDO urges directors to review proxy voting guidelines issued by proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis that have specific recommendations on board composition, among other governance matters. We further urge directors to consider expanding their use of board refreshment tools to include robust skill sets reviews reflective of changing business environments, overboarding considerations, tenure limitations, and composition reviews that align diversification in thought and independence requirements to best meet the needs of corporate strategy and stakeholder expectations.

BDO has several available archived programs: Director Diversity – Striking the Right Balance In the Boardroom and Board Leadership: How to Onboard Your Board. These programs examine many of the topics outlined above and provide anecdotes from well respected directors that may resonate with you.

BDO Board Survey

These are just a few of the findings of the 2018 BDO Board Survey, conducted by the Corporate Governance Practice of BDO USA in July and August 2018. A companion report, the 2018 Cyber Governance Survey, explores the board’s role related to cybersecurity, information governance and digital transformation. These two annual surveys examine the opinions of corporate directors of public company boards regarding timely and relevant corporate governance and financial reporting issues.

BDO USA’s Corporate Governance Practice is a valued business advisor to corporate boards. The firm works with a wide variety of clients, ranging from entrepreneurial businesses to multinational Fortune 500 corporations, on myriad accounting, tax, risk management and forensic investigation issues.

SHARE