The BDO 600 - 2018 Study of Board Compensation Practices

Now in its twelfth year, the BDO 600 examines board compensation practices of 600 mid-market public companies and tracks trends in director compensation within eight different industry segments including: energy, financial services - banking, financial services - nonbanking, healthcare, manufacturing, real estate, retail, and technology. This unique study focuses specifically on mid-market companies and enables a year-over-year comparison of board of director pay.

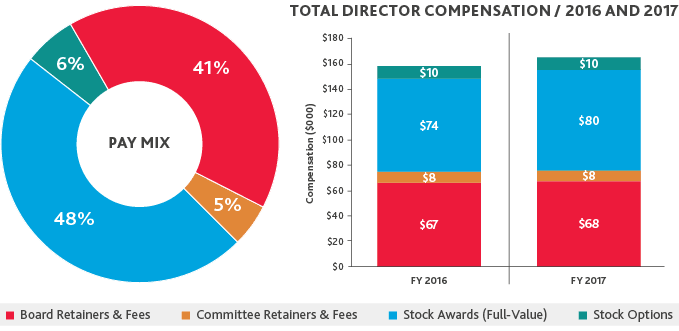

BENCHMARK YOURSELF AGAINST TOP INDUSTRY PEERS AND SEE WHAT GOES INTO A BOARD DIRECTOR'S AVERAGE COMPENSATION MIX, INCLUDING:

- A breakdown of compensation by industry and company size

- The proportions of compensation in equity versus cash

- Board compensation and trends related to: board structure, total board fees, compensation ratio analysis, stock ownership guidelines, board term limits, and representation of women on boards

Read the Study

SHARE