Tax Executives’ 2021 Tax Technology Priorities

2020 was a year of disruption. Time and again, events proved that change is the only constant in the tax world. BDO’s annual Tax Outlook Survey has been capturing U.S. tax executive sentiment since 2015, and the inaugural BDO Global Tax Outlook Survey, published in October 2020, polled tax executives across the globe, revealing five recurring themes:

- Continued change in the global tax landscape is anticipated, contributing to a high degree of uncertainty.

- Tax compliance and complexity is accelerating and dominating tax agendas and boards of directors’ time.

- The tax function is evolving, driven by the changing nature of compliance and the need for technology.

- Tax functions are investing in tax technologies to automate the compliance burden and address increasing complexity.

- Total tax liability (the sum of all taxes owed) is anticipated to increase, and adoption of the concept of a total tax mindset is increasing.

Tax Department’s Role Grows

The COVID-19 pandemic turned the global economy upside down and upended the way businesses operate. The way we work has shifted, and the role technology plays within tax and business as a whole continues to become more important.

Matt Becker, National Managing Partner of Tax“The events of 2020 proved that involving the tax department in business strategy is a key factor in increasing resilience and agility. From conserving cash to helping businesses avoid new liabilities, the importance and value of the tax function has never been clearer.”

According to the 2021 BDO Tax Outlook Survey, 55% of tax executives say the pandemic accelerated the digital transformation of the tax function. While this may have fast-tracked plans that were already underway, fully leveraging tax technology continues to be a struggle. In fact, 91% of executives surveyed claim technology and process limitations affected their ability to keep pace with changes in tax regulation.

It’s not just tax executives who are keeping these issues top of mind. The 2021 BDO CFO Outlook Survey found that understanding total tax liability and transforming the tax function for greater efficiency and better insights are CFO’s top tax challenges, confirming the need for more focus on the topic across leadership teams. Although 47% of tax execs in the 2021 Tax Outlook Survey rate their boards as having a high understanding of total tax liability, this still leaves more than half indicating that more education is needed on how total tax liability impacts overall business strategy.

To continue expanding upon this concept of total tax liability, tax departments should focus first on gaining visibility into the necessary data across the enterprise, which requires a close partnership with finance and IT functions. Next, evaluating, optimizing and/or implementing new technologies to gain more insight into data allows tax professionals to spend more time synthesizing information and communicating it in a value-added manner, in real time, to executive decision-makers.

Build Your Tax Performance Roadmap

While companies may recognize that technology is key for a resilient tax department, knowing where to start is another story. Before you can begin your transformation journey, you should first chart your course by understanding your tax department’s maturity level. Developing and documenting your Tax Performance Roadmap is a key step. While in the past this may have been something tax executives did every three to five years, the rate at which tax technology is changing requires that this exercise be undertaken more frequently. As you make improvements, your current state may fluctuate. Tackling smaller projects to make incremental enhancements can help make the end goal less daunting.

More Than Technology

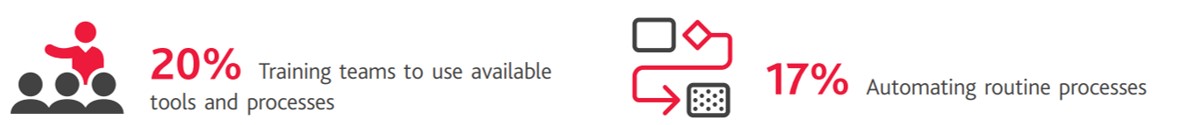

Technology is needed to better understand and model total tax liability, but technology is only as good as the data and processes behind it. It’s important to have teams in place and processes established to fully leverage the technology. According to the 2021 Tax Outlook Survey, after managing essential tax work (34%), the biggest challenges for the tax department are:

Scott Hice, Tax Performance Engineering Managing Partner and National Practice Leader"Like most journeys, digital transformation isn’t an overnight venture—it’s a steady drumbeat of improvements aimed at optimizing technology, data and tax processes. Tax executives hoping to gain greater efficiencies and insights in 2021 should look first to the areas that will provide near-term ROI and should prioritize not just investing in the technology itself, but also in ensuring their people can leverage it effectively.”

Tax executives face a diverse range of challenges in optimizing their companies’ processes and technology, many of which arise from the adoption of legacy capabilities and getting tax professionals up to speed on new tools. As an organization grows, standard processes become even more important. There is a rising need for a role within the tax department focused on IT and technology skills. This is someone who isn’t doing technical tax work but is instead devoted to the technology, data, process and people side of things. A Tax Technology Leader helps to:

- Capture the full power of technology

- Adapt to disruption

- Increase operational efficiencies

- Improve risk management effectiveness

- Ease the administrative burden of technology

After the last several years, tax executives have become familiar with the rapid pace of change. With more shifts anticipated this year, now is the time to focus on getting the right processes, data, technology and people in place so you can be prepared to approach what lies ahead strategically.

SHARE